1Q25 3D Printing Reseller Report - OEMs Setting Up for a Surprise? Q1 3D Printing Trends Point to Mixed Results

Link to our research disclaimer.

The primary go-to-market strategy among the largest public 3D printing players relies on independent reseller networks to drive sales and customer adoption. These resellers act as regional distribution partners, providing sales, service, and support for systems. We conduct quarterly channel checks with these partners and gather critical demand insights, which historically has been strongly correlated with quarterly earnings reports. We recently surveyed 26 3D printing resellers across North America and EMEA. Of the respondents, 62% were based in EMEA, while 38% were from the North America, offering a balanced view of market conditions across both regions.

These resellers represent leading brands, including Stratasys SSYS 0.00%↑, 3D Systems DDD 0.00%↑, Desktop Metal DM 0.00%↑, Markforged MKFG 0.00%↑, HP HPQ 0.00%↑ and Formlabs (private), providing a broad perspective on industry trends, customer demand and competitive dynamics.

Key Takeaways From 1Q25 Reseller Survey

System demand remains weak across legacy OEMs. Reseller feedback for Stratasys, 3D Systems, Desktop Metal and Markforged continues to indicate printer sales fell below plan in 1Q25.

Low-cost providers like Formlabs are outperforming. Unlike the broader group, Formlabs saw another quarter of above-plan results, supporting the view that affordable, easy-to-use systems are taking share in a cautious capital spending environment.

Consumables outperformed, potentially boosting Q1 earnings. High-margin material sales were notably better than expected across many OEMs, especially Stratasys, where materials account for 44% of total revenue. We believe much of this strength was driven by pull-forward demand ahead of potential tariffs, rather than sustained utilization increases. Nonetheless, this surge in consumables could set up upside surprises during Q1 earnings season despite weak system sales.

2025 growth expectations have broadly declined. Across nearly every OEM, both printer and material growth expectations were revised lower from 4Q24 to 1Q25. This highlights a more tempered demand outlook despite some Q1 upside in consumables.

Q1 expectations are very low across the board. Sentiment heading into Q1 earnings appears extremely depressed creating potential for short-term stock rallies if results clear the lowered bar, which we expect to be driven by higher than expected material sales.

Structural issues still plague legacy players. Despite possible near-term relief, we remain concerned about long-term competitiveness for Stratasys and 3D Systems, as their legacy platforms face pricing pressure and material leakage to third-party suppliers.

1Q25 3D Printing Demand Trends

In the following section, we break down 1Q25 system and material demand trends for the boarder industry, including 1Q25 Y/Y growth rates and expectations for system and material growth in the coming year.

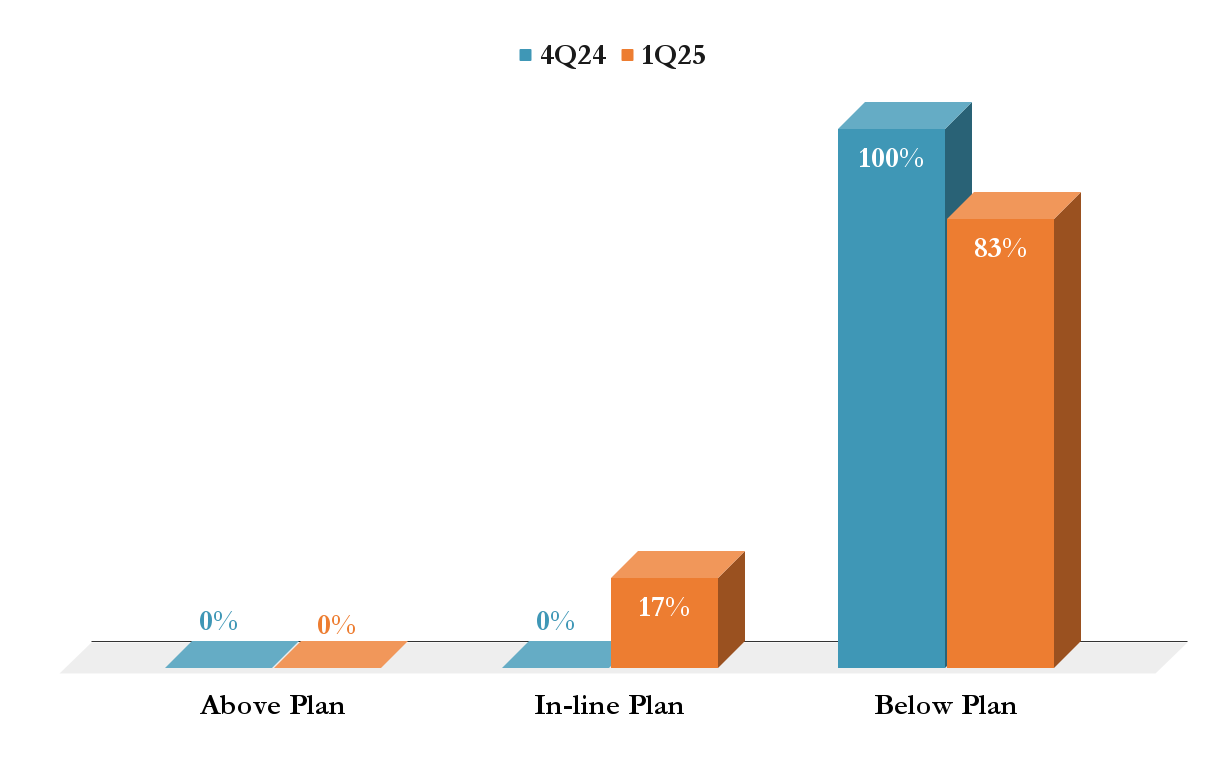

How were printer sales vs plan in 1Q25?

In our latest survey of 26 of the largest 3D printing resellers, 50% of respondents reported printer sales coming in below plan during 1Q25, a slight improvement from 52% in 4Q24. However, only 15% saw results above plan, down from 20% the prior quarter. We believe this data underscores that overall demand for new 3D printer systems remains challenged, weighed down by ongoing macroeconomic uncertainty and high interest rates. Notably, the weakest results came from high-end OEMs including Stratasys, 3D Systems, Markforged and Desktop Metal, where capital equipment spending remains under pressure. In contrast, lower-cost providers such as Formlabs and Bambu Lab reported another strong quarter, reinforcing our believe that the low-end desktop providers are increasingly taking share from legacy industrial players.

Source: AM Executive Reseller Survey; 4Q24 R=25, 1Q25 R=26

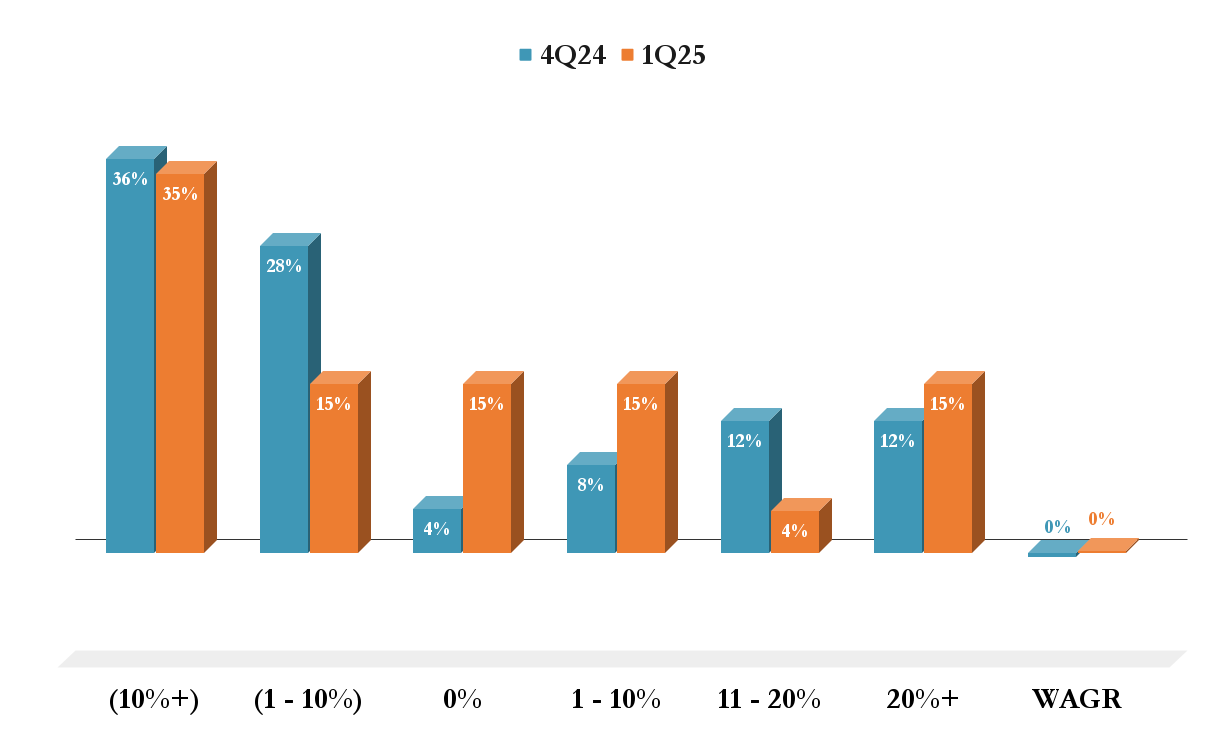

What was Y/Y printer sales growth in 1Q25?

While the weighted average growth rate (WAGR) remains flat, consistent with our 4Q24 survey, we observed a minor shift in expectations toward lower full-year growth. In our latest 1Q25 results, fewer resellers are projecting double digit-growth. At the same time, a greater share of respondents now expect either flat or declining sales for the year, with 35% of resellers anticipating a 10%+ decline—broadly in line with 36% in 4Q24. This suggests a more cautious tone among resellers, reflecting growing concerns around macroeconomic headwinds and tightening customer budgets heading into the remainder of 2025.

Source: AM Executive Reseller Survey; 4Q24 R=25, 1Q25 R=26

How were material sales vs plan in 1Q25?

Notably, 46% of respondents reported material sales coming in above plan—up significantly from just 28% in 4Q24—while only 19% came in below plan. We believe this strength was partly driven by customer behavior ahead of potential new tariffs, as buyers sought to secure materials in advance of expected price increases or import restrictions. While system sales remain challenged, the strong outperformance in materials is encouraging, especially considering the high-margin nature of consumables. As a result, we see potential upside for OEMs with large installed bases and robust materials businesses. However, it is important to keep in mind that if consumables outperformed due to pull-forward demand, this may not reflect higher utilization rates—meaning future quarters could see a corresponding decline.

Source: AM Executive Reseller Survey; 4Q24 R=25, 1Q25 R=26

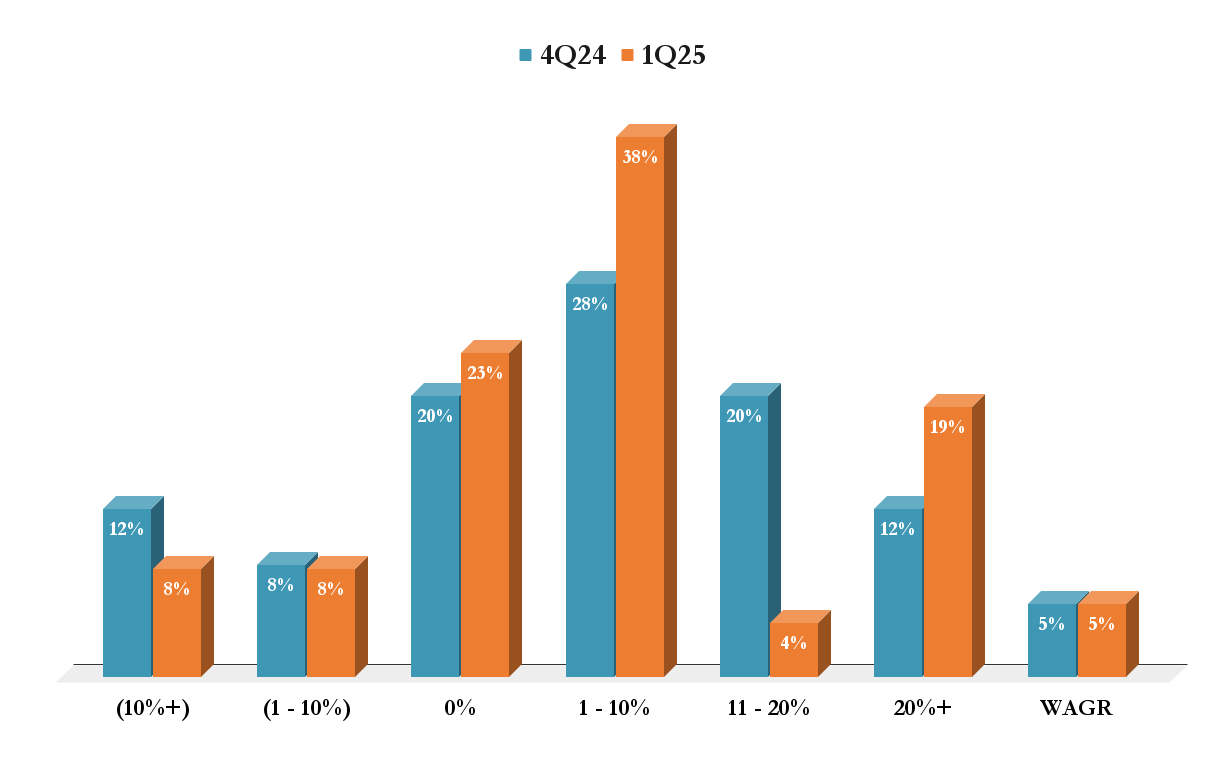

What was Y/Y material sales growth in 1Q25?

Overall, sales expectations remained largely consistent with 4Q24, as reflected by the flat weighted average growth rate (WAGR) of 5%. However, we observed a shift in the distribution of growth responses, with a higher percentage of resellers now reporting growth above 20%—rising to 19% in 1Q25 from just 12% in the prior quarter. This increase appears to come at the expense of the 11–20% range, which dropped from 20% to only 4%. We believe this shift is likely linked to the surge in material demand during the quarter, potentially driven by customers accelerating purchases ahead of expected tariff changes. While encouraging, it’s worth noting that this elevated growth may reflect short-term pull-forward activity rather than sustained increases in usage.

Source: AM Executive Reseller Survey; 4Q24 R=25, 1Q25 R=26

Which end-market drove sales in 1Q25?

The results were largely consistent with our 4Q24 survey, with manufacturing continuing to lead by a wide margin at 29%, followed by education at 13%. Medical, defense, and aerospace each accounted for 11% of sales, reflecting a relatively balanced contribution from key industrial and regulated sectors. However, one notable shift occurred in the automotive sector, which dropped from the second-highest category in 4Q24 at 15% to just 9% in 1Q25, now ranking sixth. We believe this decline may be linked to elevated tariff concerns tied to the automotive industry, which could have caused delays in procurement or investment decisions.

Source: AM Executive Reseller Survey; 4Q24 R=45, 1Q25 R=55

How much do you expect your printer business to grow in 2025?

The most notable shift was a sharp increase in the number of resellers expecting flat or declining growth. Specifically, 19% of respondents now expect 0% growth, up from 12% in 4Q24. Additionally, the share of resellers expecting declines of 1–10% and 10%+ rose to 15% and 8%, respectively—both higher than in the prior quarter. Despite these headwinds, the weighted average growth rate (WAGR) only edged slightly lower from 6% to 5%. These results suggest a more cautious tone has set in across the channel, reflecting a tougher-than-expected start to the year and growing concern over macro and policy-related uncertainty.

Source: AM Executive Reseller Survey; 4Q24 R=25, 1Q25 R=26

How much do you expect your material business to grow in 2025?

In contrast to the downward revisions seen in printer sales expectations, sentiment around materials has improved meaningfully. The percentage of respondents forecasting growth of 20% or more rose to 19% in 1Q25 from 12% in 4Q24, while those expecting 11–20% growth increased to 19% from 16%. As a result, the weighted average growth rate (WAGR) increased from 6% to 8%. While this optimism is encouraging, it remains to be seen whether this reflects sustainable increases in utilization or if, as suspected, it’s largely driven by one-time pull-forward demand ahead of anticipated tariff impacts.

Source: AM Executive Reseller Survey; 4Q24 R=25, 1Q25 R=26

Stratasys (SSYS) Resellers

How were Stratasys system sales vs plan in 1Q25?

While results remain deeply challenged, there was a slight improvement compared to 4Q24, with one reseller reporting in-line performance versus a clean 100% below-plan result last quarter. Overall, however, demand for Stratasys systems continues to struggle. We attribute this to a combination of persistent macroeconomic headwinds and intensifying competition—particularly from low-end entrants like Bambu Labs, which is rapidly gaining share in the prototyping market. Additionally, the proportion of sales derived from systems has continued to fall, reaching a new low of ~25% in 2024. While these dynamics make it difficult to envision near-term system growth, we note that the improvement in Stratasys material sales—covered in more detail below—could help offset weakness in hardware and potentially set the stage for upside surprises in overall performance.

Source: AM Executive Reseller Survey; 4Q24 R=5, 1Q25 R=6

How were Stratasys material sales vs plan in 1Q25?

In contrast to system sales, Stratasys reseller feedback on material sales in 1Q25 tells a much more positive story. According to our survey, 33% of resellers reported material sales above plan, while another 50% came in in-line—marking a dramatic improvement from 4Q24 when 80% reported results below plan. We believe this surge in material demand is largely tied to tariff-related pull-forward activity, which helped temporarily boost order volumes. Given that ~44% of Stratasys revenue is derived from consumables, this could provide a modest upside offset to weaker system sales in the near term. However, it's worth noting that material sales declined 7% Y/Y in 4Q24—Stratasys' first annual drop in this segment in years—and sales declined sequentially throughout 2024. Based on our survey, a major factor may be customers increasingly adopting third-party materials. In fact, ~67% of resellers told us they’ve seen more customers using non-Stratasys consumables in printers that Stratasys is not capturing any revenue from. While the 1Q25 rebound is encouraging, this trend poses a long-term threat to the company’s highest-margin and largest revenue segment.

Source: AM Executive Reseller Survey; 4Q24 R=5, 1Q25 R=6

How much do you expect your Stratasys printer business to grow in 2025?

Reseller expectations for Stratasys printer growth in 2025, and the results show a clear deterioration in sentiment. In our latest 1Q25 survey, 33% of resellers now expect printer sales to decline by more than 10%, which is a stark increase from 0% in the prior quarter. Additionally, the share expecting any growth (1–10%, 11–20%, or higher) has evaporated, while the percentage anticipating flat sales has surged to 50%, up from 20%. As a result, the weighted average growth rate (WAGR) dropped from +4% in 4Q24 to –3% in 1Q25. These results confirm that resellers are bracing for a challenging year ahead in Stratasys system sales, likely due to macro uncertainty and intensifying competition from low-cost providers.

Source: AM Executive Reseller Survey; 4Q24 R=5, 1Q25 R=6

How much do you expect your Stratasys material business to grow in 2025?

Despite the notable upside in material demand seen during 1Q25, which we believe is largely driven by potential tariff pull-forward, this has not translated into stronger full-year material growth expectations. In fact, the weighted average growth rate (WAGR) declined from 6% in 4Q24 to just 1% in 1Q25. The percentage of respondents expecting 1–10% growth in materials dropped meaningfully from 60% to 33%, while those anticipating flat growth jumped from 20% to 50%. No resellers expect growth above 10%, and 17% now expect only modest 1–10% growth, which didn’t register at all in the prior quarter. This suggests that while material sales spiked in the short term, resellers remain cautious about sustained demand, possibly reflecting underlying utilization weakness or continued third-party material substitution.

Source: AM Executive Reseller Survey; 4Q24 R=5, 1Q25 R=6

3D Systems (DDD) Resellers

How were 3D Systems printer sales vs plan in 1Q25?

While 50% of respondents still reported results below plan, which is unchanged from 4Q24, there was a clear improvement at the top end, with 17% of resellers indicating sales came in above plan, compared to 0% last quarter. Meanwhile, the portion reporting in-line results dropped from 50% to 33%. Although macro headwinds and competition from low-cost alternatives remain industry-wide challenges, 3D Systems appears to be holding up better than some peers—especially Stratasys. We believe this relative outperformance is partly due to 3D Systems’ heavier reliance on direct sales rather than channel resellers, which can lead to more stable execution. Notably, the company’s 4Q24 results showed industrial revenue growing 11% Y/Y, and total revenue would have shown positive growth if not for a one-time recognition delay in its medical division. These modestly better-than-expected reseller results could support a constructive setup heading into 3D Systems’ 1Q25 earnings report.

Source: AM Executive Reseller Survey; 4Q24 R=4, 1Q25 R=6

How were 3D Systems material sales vs plan in 1Q25?

In line with broader industry trends, results showed an improvement from the prior quarter. Notably, 33% of resellers reported material sales above plan—up from 0% in 4Q24—while only 17% reported in-line performance, down from 50%. That said, 50% of respondents still indicated sales came in below plan, highlighting ongoing headwinds. We believe this mixed picture is partly due to 3D Systems shifting a higher proportion of materials through direct sales rather than the channel, which may be limiting visibility or opportunities for resellers. We believe this improvement could further support additional upside when the company reports 1Q24 results.

Source: AM Executive Reseller Survey; 4Q24 R=4, 1Q25 R=6

How much do you expect your 3D System printer business to grow in 2025?

While there was a modest shift lower in the distribution—particularly in the 1–10% and 20%+ buckets—resellers remain broadly optimistic, with the majority expecting high-single-digit to low-double-digit growth. Specifically, 33% of respondents now expect 11–20% growth, up from 25% in 4Q24, while another 33% project sales to decline 1–10% range. The weighted average growth rate (WAGR) declined slightly from 9% to 8%, but remains far above the negative or flat expectations seen among Stratasys resellers. This bullish outlook stands in contrast to 3D Systems’ own guidance for flat to modest organic growth in 2025. If reseller trends hold, it could position the company to outperform conservative expectations—particularly if industrial and materials sales continue to show resilience.

Source: AM Executive Reseller Survey; 4Q24 R=4, 1Q25 R=6

How much do you expect your 3D System material business to grow in 2025?

While there was a modest downward shift in sentiment, expectations remain broadly in line with the prior quarter. The percentage of respondents forecasting 11–20% growth declined from 50% to 33%, while those expecting more moderate growth of 1–10% rose from 0% to 17%. Additionally, the share of resellers projecting flat sales increased from 25% to 33%. Despite these movements, the weighted average growth rate (WAGR) dipped only slightly—from 6% to 5%—suggesting that expectations have normalized but remain healthy overall.

Source: AM Executive Reseller Survey; 4Q24 R=4, 1Q25 R=6

Desktop Metal (DM-Acquired By Nano Dimension) Resellers

How were Desktop Metal printer sales vs plan in 1Q25?

Desktop Metal survey results were even weaker than in the prior quarter with 100% of respondents reported sales below plan, worsening from 83% in 4Q24. We believe this deterioration reflects a combination of ongoing macroeconomic pressures, heightened competition—especially from lower-cost and more established providers—and uncertainty surrounding the now-completed acquisition by Nano Dimension. That acquisition, which was initially contested, was ultimately mandated by a court ruling at the end of 1Q25 and has since closed. While the transaction brings scale and potential financial runway, we continue to view Desktop Metal’s product portfolio as subpar relative to peers, particularly in terms of reliability and market fit. Looking ahead, we believe Nano Dimension may look to discontinue or divest certain product lines, which could further impact reseller confidence and execution in the near term.

Source: AM Executive Reseller Survey; 4Q24 R=6, 1Q25 R=5

How were Desktop Metal material sales vs plan in 1Q25?

Similar to printer sales, 100% of respondents reported material sales below plan, worsening from 83% in the prior quarter and in stark contrast to the broader industry, where most OEMs saw material demand improve. Desktop Metal stands out as the only major player in our survey that showed no signs of rebound in materials, which are typically more resilient and higher margin. We view this as a clear signal of deepening structural issues across the Desktop Metal portfolio and a broader lack of confidence in ongoing platform adoption.

Source: AM Executive Reseller Survey; 4Q24 R=6, 1Q25 R=5

How much do you expect your Desktop Metal printer business to grow in 2025?

Desktop Metal resellers outlook has also worsened notably with 60% of respondents now expect printer sales to decline by more than 10%, up from 50% in 4Q24. Additionally, 40% anticipate flat growth, while no resellers expect even modest (1–10%) growth, down from 17% last quarter. As a result, the weighted average growth rate (WAGR) declined from –4% to –6%, making Desktop Metal the only OEM in our survey with both worsening results and deeper contraction forecasts. These expectations reinforce the view that Desktop Metal faces an uphill battle post-merger, as weak demand, portfolio complexity and competitive disadvantages continue to weigh on forward sentiment.

Source: AM Executive Reseller Survey; 4Q24 R=6, 1Q25 R=5

How much do you expect your Desktop Metal material business to grow in 2025?

Much like the company’s outlook for systems, material sentiment has continued to deteriorate with 60% of resellers now expect material sales to decline by more than 10%, up from 50% in the prior quarter. Meanwhile, none expect any growth, and those forecasting flat sales rose to 40% from 33%. As a result, the weighted average growth rate (WAGR) dropped further, from –3% to –6%. We believe the lack of optimism even on consumables suggests structural issues with Desktop Metal’s installed base and customer engagement.

Source: AM Executive Reseller Survey; 4Q24 R=6, 1Q25 R=5

Markforged (MKFG) Resellers

How were Markforged printer sales vs plan in 1Q25?

While the overall picture remains challenged, there was a mild improvement compared to 4Q24 with 25% of resellers reported in-line performance (up from 17%), and the percentage of resellers below plan fell to 75% from 83%. We believe Markforged's softer results reflect a combination of macroeconomic headwinds, rising competition—particularly from Bambu Labs—and uncertainty surrounding its pending merger with Nano Dimension. That said, with Desktop Metal's deal now closed following a court order, we believe the Markforged-Nano merger is also likely to close in the near term. Importantly, we view Markforged’s position more favorably than Desktop Metal's, given its focus on end-use manufacturing applications and differentiated technology stack. While the company still faces an uphill climb in today’s cost-conscious, increasingly crowded market, access to Nano’s capital could provide a critical growth catalyst once integration is complete.

Source: AM Executive Reseller Survey; 4Q24 R=6, 1Q25 R=8

How were Markforged material sales vs plan in 1Q25?

Results showed modest improvement Q/Q, with 75% of respondents reporting in-line results—up from 67%—and the percentage below plan dropping to 25% from 33%. Similar to trends seen across the broader industry, this suggests steady demand for consumables. However, much like Stratasys’ FDM platform, we believe Markforged may be starting to lose share of material sales to third-party providers. If this trend accelerates, it could pose a meaningful risk to what has historically been a high-margin, recurring revenue stream, particularly as customers look for lower-cost alternatives amid tighter budgets.

Source: AM Executive Reseller Survey; 4Q24 R=6, 1Q25 R=8

How much do you expect your Markforged printer business to grow in 2025?

While resellers still expect growth in printer sales, sentiment has clearly softened since 4Q24. The share of respondents forecasting 1–10% growth dropped sharply from 50% to 25%, while those expecting flat sales rose to 38% from 0%. At the same time, 25% respondents are projecting sales decline 1 - 10% in 2025, compared to 0% in the previous quarter. The weighted average growth rate (WAGR) declined from 7% to 3%, reflecting a more cautious outlook amid competitive and macroeconomic pressures. While expectations remain more constructive than those for Desktop Metal or even Stratasys, the step-down in sentiment underscores the mounting challenge Markforged faces in defending share and driving new system sales, particularly with Bambu Labs rapidly gaining traction in the mid-range prototyping and production market.

Source: AM Executive Reseller Survey; 4Q24 R=6, 1Q25 R=8

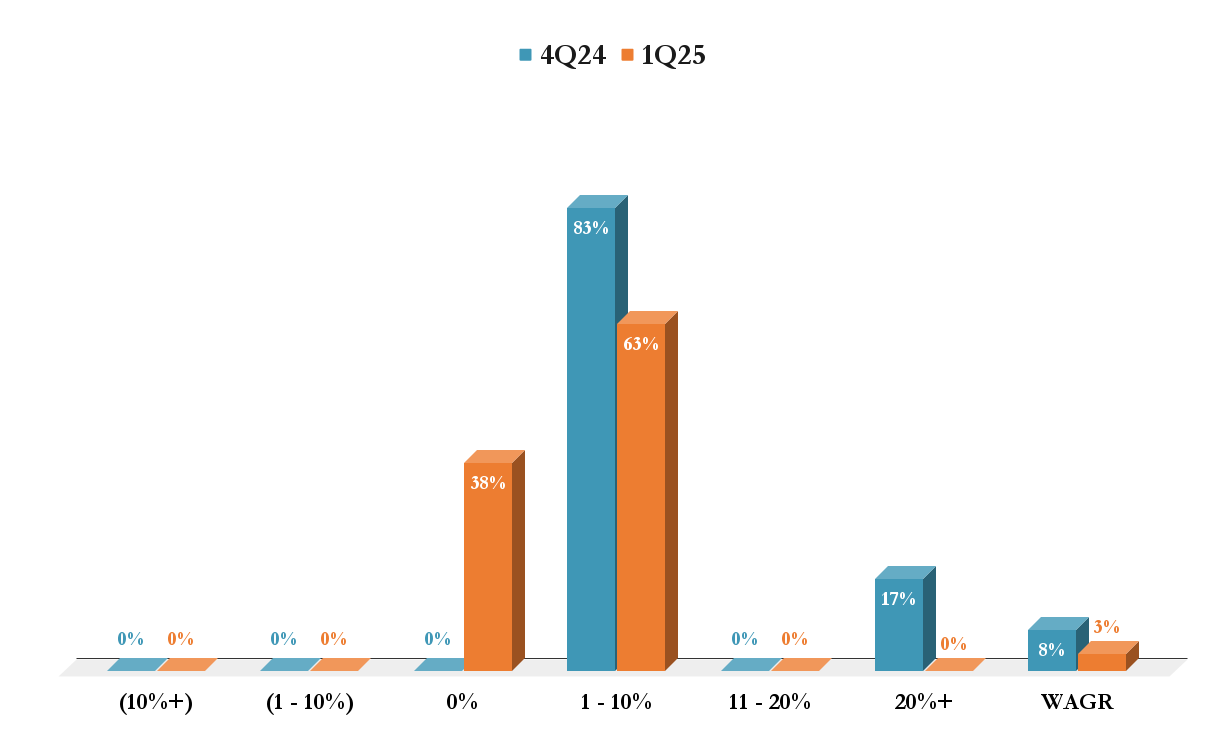

How much do you expect your Markforged material business to grow in 2025?

Like system growth expectation, sentiment has cooled notably for materials. While the majority of respondents still expect modest growth, the percentage projecting 1–10% growth dropped from 83% in 4Q24 to 63% in 1Q25. At the same time, 38% of resellers now expect flat growth, up from 0%, and no respondents expect double-digit growth—a sharp reversal from the prior quarter when 17% expected growth of 20% or more. As a result, the weighted average growth rate (WAGR) declined from 8% to just 3%. This softening outlook likely reflects not just macro uncertainty and competitive pressures, but also increasing penetration of third-party materials, which may be starting to erode Markforged’s high-margin consumables stream.

Source: AM Executive Reseller Survey; 4Q24 R=6, 1Q25 R=8

Formlabs (Private) Resellers

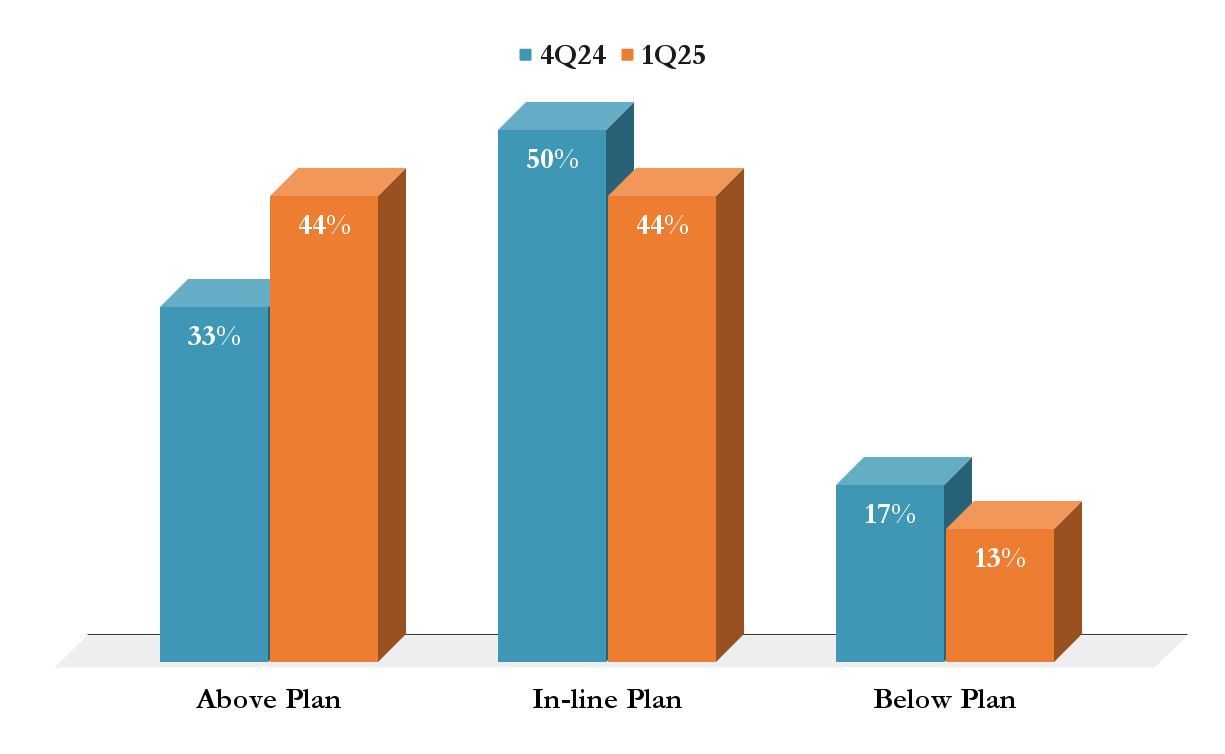

How were Formlabs system sales vs plan in 1Q25?

Once again, Formlabs stands out as a notable outperformer relative to the broader industry. Not only did Formlabs outperform peers, but it also improved sequentially with 44% of resellers reported sales above plan (up from 33% in 4Q24), while only 13% came in below plan. These results further reinforce our belief that low-cost providers are gaining share, especially in a market increasingly sensitive to pricing and ROI. In a challenging macro environment where many OEMs are seeing demand fall short, Formlabs continues to demonstrate solid execution. If the company were public, we’d expect them to deliver a strong earnings print this quarter based on these underlying trends.

Source: AM Executive Reseller Survey; 4Q24 R=12, 1Q25 R=16

How were Formlabs material sales vs plan in 1Q25?

Formlabs remained very strong and consistent with last quarter. A commanding 94% of resellers reported sales at or above plan, with 38% coming in above plan and 56% in line—nearly identical to the prior quarter. Although there was a slight dip in the “above plan” category (from 45% to 38%), the overall strength in consumables demand underscores the stickiness of Formlabs' installed base and the recurring nature of its business model. With only 6% of resellers reporting below-plan results, Formlabs continues to lead the industry in channel consistency.

Source: AM Executive Reseller Survey; 4Q24 R=11, 1Q25 R=16

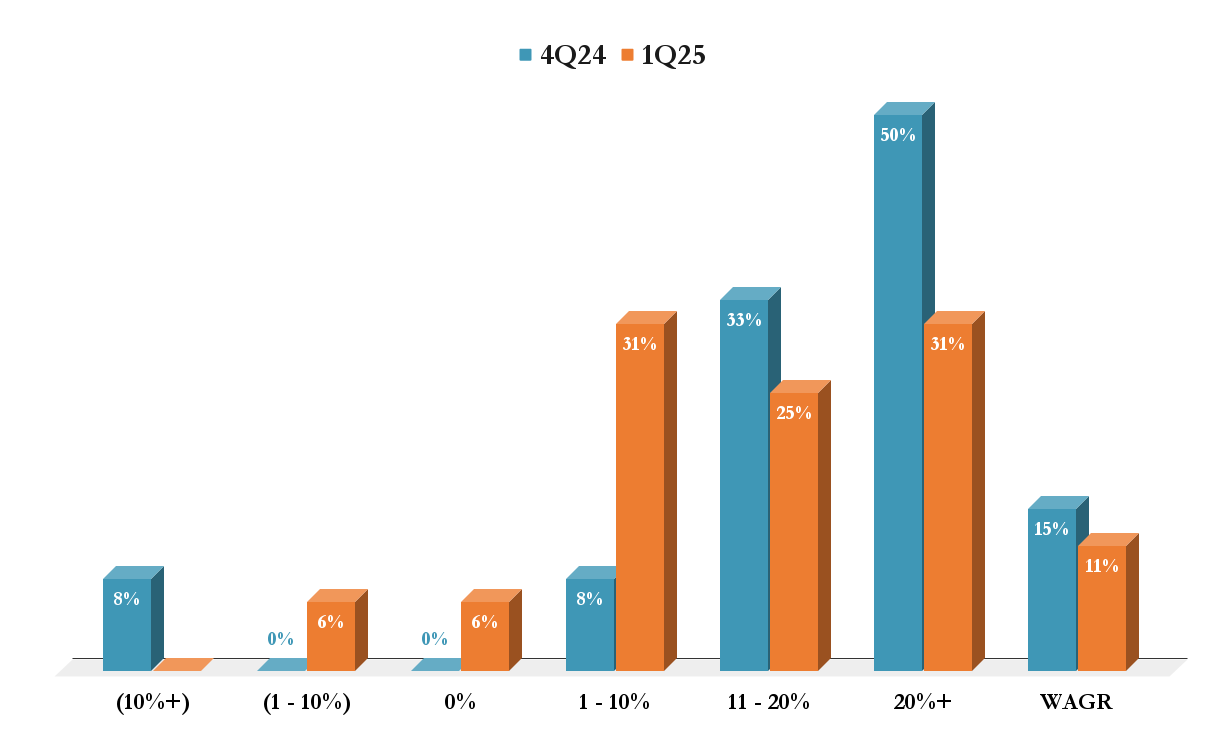

How much do you expect your Formlabs printer business to grow in 2025?

Formlabs’ 2025 printer growth expectations, which despite a modest step down from last quarter, remain among the strongest in the industry. While the percentage of resellers expecting 20%+ growth dropped from 50% in 4Q24 to 31% in 1Q25, the overall outlook remains highly encouraging. The weighted average growth rate (WAGR) dipped from 15% to 11%, but still reflects robust demand momentum. These results support the view that Formlabs continues to outperform the broader 3D printing sector, particularly as low-cost, high-utility systems remain attractive in a constrained macro environment.

Source: AM Executive Reseller Survey; 4Q24 R=12, 1Q25 R=16

How much do you expect your Formlabs material business to grow in 2025?

Formlabs resellers’ 2025 material growth expectations, which despite a modest decline Q/Q, remain strong and aligned with healthy system sales trends. While the percentage of resellers expecting 20%+ growth edged down slightly from 33% in 4Q24 to 31% in 1Q25, the overall sentiment remains robust. A combined 56% of respondents still anticipate double-digit material growth, and the weighted average growth rate (WAGR) remains elevated at 11%, down just 2 points from 13% last quarter.

Source: AM Executive Reseller Survey; 4Q24 R=12, 1Q25 R=16

Bottom Line: 1Q25 Earnings Could Surprise To The Upside, But Structural Headwinds Remain

Following our 1Q25 survey, we believe system demand remains challenged across much of the industry, particularly for legacy players like Stratasys, 3D Systems, Desktop Metal and Markforged, as low-cost providers such as Formlabs and Bambu Labs continue to flourish. That said, from a stock perspective, expectations appear extremely low heading into Q1 earnings season. With high-margin consumables likely outperforming—particularly for companies like Stratasys, where materials account for 44% of revenue—we believe there is potential for near-term earnings surprises. However, structurally, we see fundamental issues with the legacy platforms. While Nano may emerge as the next major revenue player post-merger, we remain skeptical of the Desktop Metal business and believe Markforged faces mounting pressure as Bambu Labs gains momentum. We would highlight Formlabs as a standout, but unfortunately, the company remains private, at least for now. In short, while we could see a near term bounce in some of these names, we remain cautiously optimistic on the long-term outlook for most players in the space.

Research Disclaimer: We actively write about companies in which we invest or may invest. From time to time, we may write about companies that are in our portfolio. Content on this site including opinions on specific themes and companies in technology, market estimates, and estimates and commentary regarding publicly traded or private companies is not intended for use in making any investment decisions and provided solely for informational purposes. We hold no obligation to update any of our projections and the content on this site should not be relied upon. We express no warranties about any estimates or opinions we make.