After a robust year for equities with the NASDAQ, S&P500 and Russel 2000 up 33%, 28%, and 18%, respectively YTD, we believe the momentum will carry forward into 2025, driven by a strong economic backdrop and continued innovation led by robust AI investments. However, we anticipate the market rally will broaden, extending beyond the mega-cap / momentum names, and would not be surprised to see small-cap stocks outperform in 2025 as a result of easing financial conditions and lower interest rates.

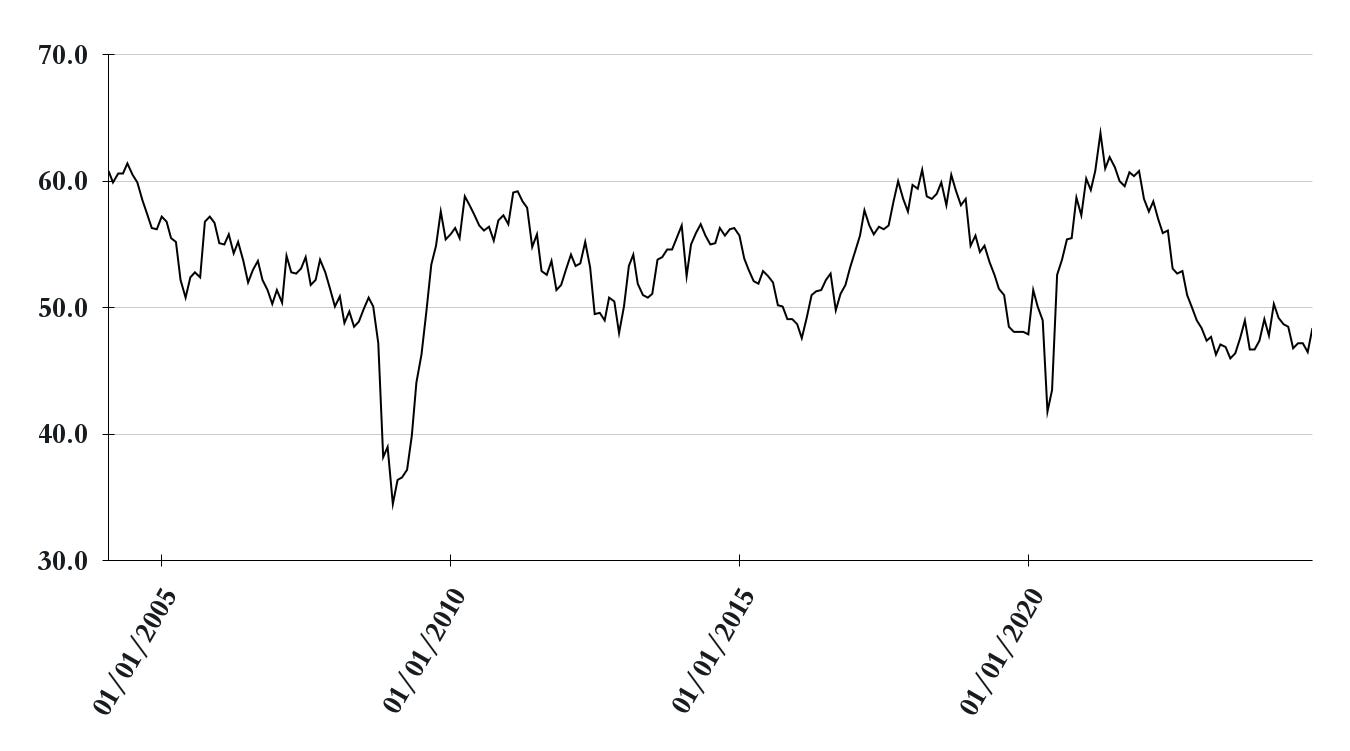

Despite the robust performance in the stock market, the manufacturing environment remained challenging both in the U.S. and internationally, which was largely driven by a high interest rate environment. As shown in the chart below, we highlight the ISM manufacturing index has been in contracting territory since Oct 2022 all but one month. That said, we believe the manufacturing sector is poised to return to expansion territory in 2025, supported by an anticipated shift toward lower interest rates. These more accommodative financial conditions should drive renewed investment in industrial technology. Coupled with a more favorable environment for small-cap stocks, we believe these dynamics bode particularly well for several companies within our coverage universe, which are positioned to benefit from a resurgence in manufacturing activity and increased adoption of transformative technologies.

ISM Manufacturing Index (>50 = Expansion & <50 = Contraction)

Source: FactSet

Below we highlight the two names in our coverage universe we are most upbeat about, and believe can outperform market returns in 2025.