The primary go-to-market strategy among the largest public 3D printing players relies on independent reseller networks to drive sales and customer adoption. These resellers act as regional distribution partners, providing sales, service, and support for systems. One unique advantage of our research is our deep industry experience has allowed us to develop strong relationships with these key resellers. These relationships enable us to conduct robust channel checks and gather critical demand insights, which historically has been strongly correlated with quarterly earnings reports.

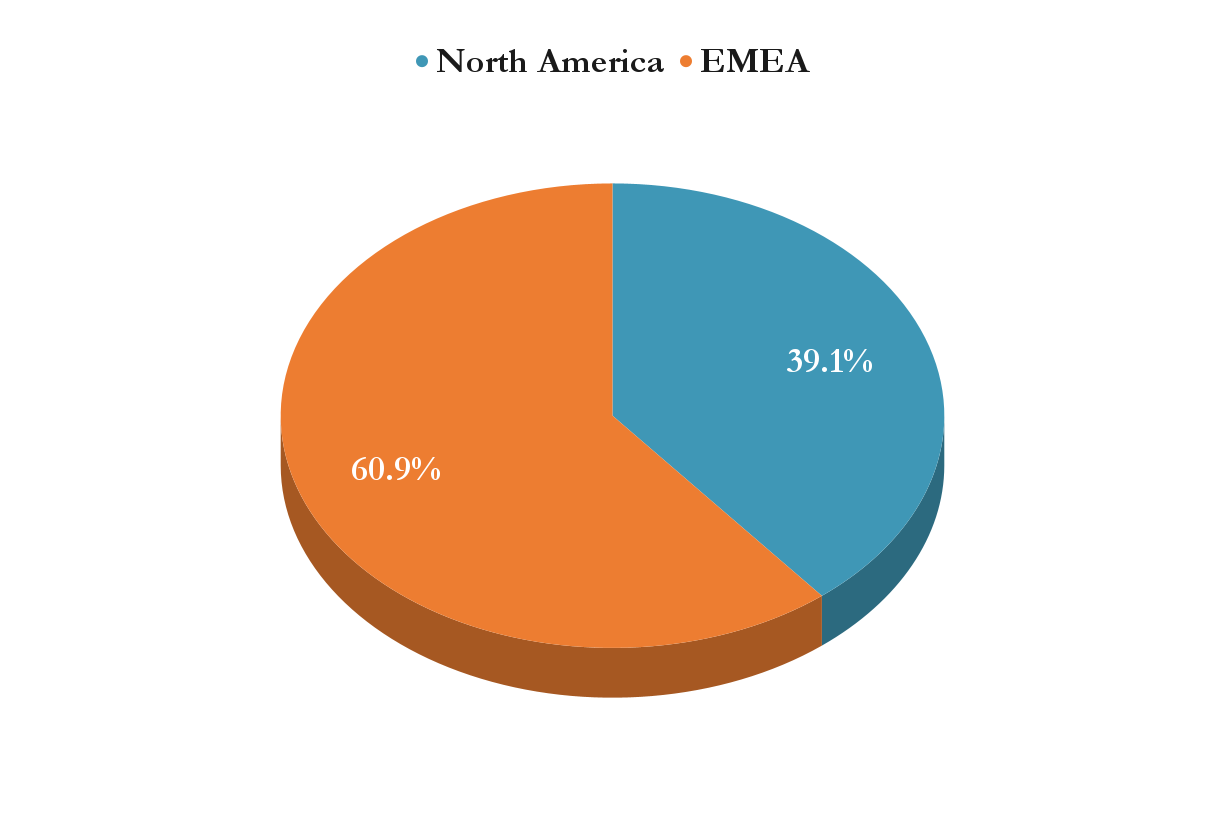

We recently surveyed 25 3D printing resellers across North America and EMEA. Of the respondents, 61% were based in EMEA, while 39% were from the North America, offering a balanced view of market conditions across both regions.

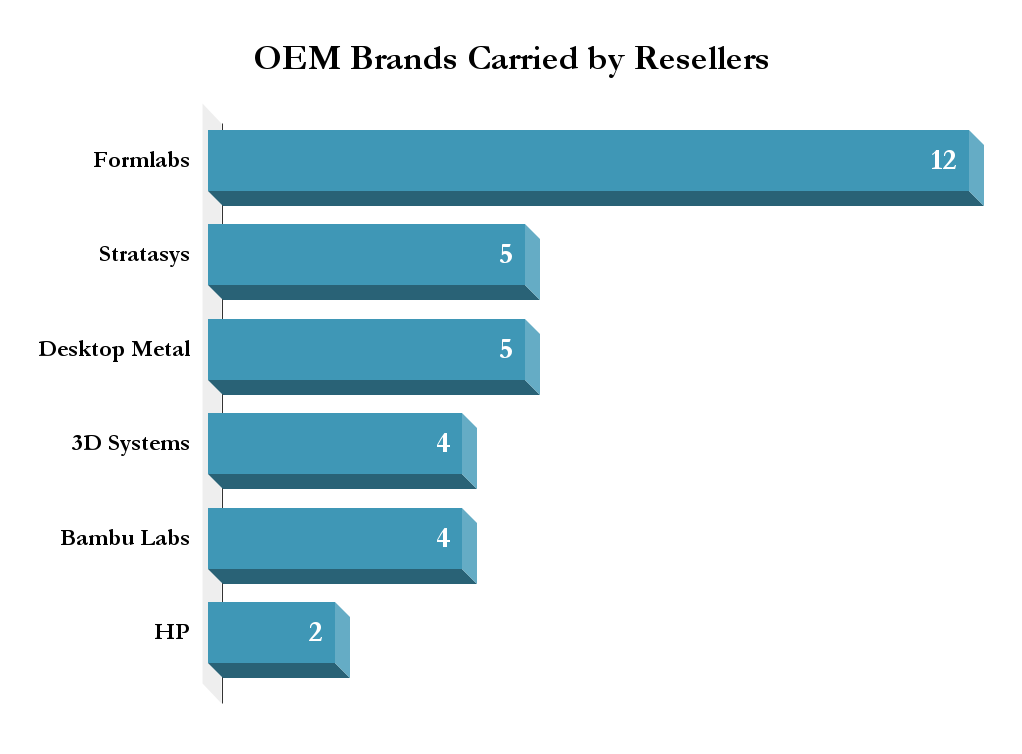

These resellers represent leading brands, including Stratasys SSYS 0.00%↑, 3D Systems DDD 0.00%↑, Desktop Metal DM 0.00%↑, HP HPQ 0.00%↑ and Formlabs (private), providing a broad perspective on industry trends, customer demand and competitive dynamics.

In the sections below, we break down 4Q24 system and material demand, Y/Y growth rates, and expectations for growth in the coming year. Additionally, we provide insights into trends for Stratasys (SSYS), 3D Systems (DDD), Desktop Metal (DM) and Formlabs (Private) offering a timely perspective ahead of 4Q24 earnings season that kicks off in March for the majority of 3D printing OEMs.

Key Takeaways From 4Q24 Reseller Survey

Demand remains weak across the industry. The majority of resellers reported system sales below plan in 4Q24, reinforcing continued macroeconomic headwinds and cautious capital spending.

Consumable sales remain healthy despite weak system demand. Material sales were generally stronger than system sales, reflecting continued usage of installed printers and the recurring revenue potential of consumables.

Resellers are more optimistic about 2025. While 2024 was challenging, most expect system and material sales to improve in 2025, suggesting potential upside if macro conditions stabilize.

Not all OEMs are performing equally. Formlabs stood out as the strongest performer, with majority of resellers reporting better-than-expected sales and the only double-digit growth forecast for 2025. Meanwhile, Desktop Metal is in the worst shape. It was the only OEM where resellers expect negative growth in 2025, reinforcing concerns about its financial health if the Nano Dimension acquisition falls through.

Stratasys, 3D Systems, and Desktop Metal likely missed expectations in 4Q24. All three appear to be under pressure, with revenue declines expected, making 2025 guidance a key focus for investors.

4Q24 3D Printing Demand Trends

In the following section, we break down 4Q24 system and material demand trends for the boarder industry, including 4Q24 Y/Y growth rates and expectations for system and material growth in the coming year.

How were system sales vs plan in 4Q24?

Our survey results highlight ongoing challenges in the 3D printing market, with 52% of resellers reporting that system sales came in below plan for 4Q24. Only 20% exceeded expectations, while 28% were in line with their forecasts, suggesting that overall demand remains weak. We believe the high-interest rate environment and broader macroeconomic uncertainty continue to be significant headwinds to 3D printer sales. While we break down OEM-specific performance in the sections below, one standout finding is that Formlabs delivered the strongest results among the brands we surveyed, while Desktop Metal had the weakest performance.

Source: 4Q24 AM Executive Survey, R=25

What was Y/Y printer sales growth in 4Q24?

Our survey results indicate a stagnant growth environment for 3D printer sales in 4Q24, with our weighted-average growth rate (WAGR) implying 0% Y/Y growth. However, the vast majority (64% of resellers) reported a decline in system sales compared to the prior year, with 36% experiencing a drop of 10%+. Meanwhile, only 32% of respondents reported positive growth, with just 24% seeing double-digit gains.

Source: 4Q24 AM Executive Survey, R=25

How were material sales vs plan in 4Q24?

Unlike system sales, which largely missed expectations, material sales performed significantly better, highlighting solid utilization rates among the existing additive manufacturing install base. According to our survey, 28% of resellers reported material sales above plan, while 48% were in line with expectations, and only 24% fell below plan. These results suggest that while new system demand remains sluggish, customers continue to actively use their existing 3D printers, driving steady material consumption.

Source: 4Q24 AM Executive Survey, R=25

What was Y/Y material sales growth in 4Q24?

Despite a challenging macroeconomic environment, material sales continued to show resilience, with our weighted-average growth rate (WAGR) implying 5% Y/Y growth in 4Q24. This contrasts sharply with system sales, which remained flat, reinforcing that the existing additive manufacturing install base continues to drive recurring material consumption. Among resellers surveyed, 60% reported Y/Y growth in material sales, with 32% reporting double-digit growth in the quarter.

Source: 4Q24 AM Executive Survey, R=25

Which end-market drove sales in 4Q24?

Our survey results show that manufacturing remained the dominant end-market for 3D printing sales in 4Q24, accounting for 31% of demand. This reinforces the ongoing shift toward additive manufacturing for industrial production applications, particularly in tooling, prototyping, and low-volume manufacturing. Automotive was the second-largest driver of sales at 16%, reflecting continued adoption of 3D printing for prototyping, custom parts, and lightweighting initiatives. Meanwhile, medical, defense, and education each contributed 11% of sales, indicating steady demand across these sectors.

Source: 4Q24 AM Executive Survey, R=45

How has demand expectations changed in 2025 compared to 2024?

Our survey results indicate a more bullish outlook for 2025, with 52% of resellers expecting demand to increase compared to 2024. This shift in sentiment suggests that improving macroeconomic conditions may provide a tailwind for system sales, helping to revive growth in the additive manufacturing market.

Source: 4Q24 AM Executive Survey, R=45

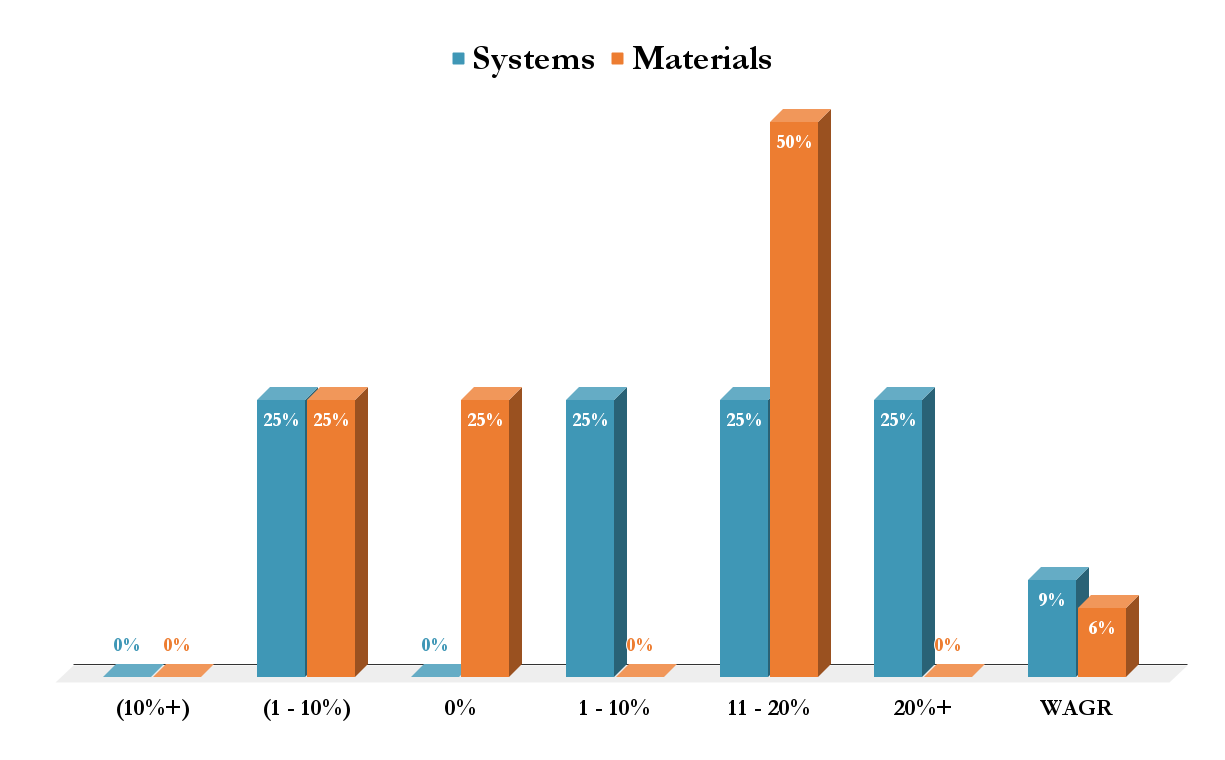

How much do you expect your printer and material business to grow in 2025?

Resellers expect a stronger year in 2025, with projected growth for both systems and materials averaging 6% year-over-year based on our weighted-average growth rate (WAGR). This suggests that resellers anticipate a rebound in capital spending on new 3D printing equipment alongside continued material demand. The majority of respondents (48%) expect system and material sales to grow between 1-10%, signaling broad but moderate expansion.

Source: 4Q24 AM Executive Survey, R=45

Stratasys (SSYS) Resellers

How were Stratasys system and material sales vs plan in 4Q24?

Our survey results align closely with Stratasys’ (SSYS) preannounced 4Q24 earnings, where the company reported revenues of $150.1–150.5M, down ~4% Y/Y and landing at the low end of its full-year guidance range. Among the 5 Stratasys resellers surveyed, 100% reported system sales below plan, reinforcing the company’s struggles with macroeconomic headwinds, and we believe increased competition from low-end FDM OEMd, specficially Bambu Labs. Meanwhile, 80% of resellers saw material sales come in below expectations, though 20% reported in-line performance. This aligns with Stratasys' own commentary that while system sales improved sequentially in Q4, consumables declined Q/Q. The Q/Q consumable decline, which also implies consumable sales being down Y/Y for the first time in 8+ quarters is very concerning. We believe this will be a huge focus when the company reports on March 5th, since consumables accounts for ~45% of sales.

Source: 4Q24 AM Executive Survey, R=5

How much do you expect your Stratasys printer and material business to grow in 2025?

Our survey of Stratasys resellers suggests moderate growth expectations for 2025, with a weighted-average growth rate (WAGR) of 4% for systems and 6% for materials. This aligns with the broader market view, as current consensus estimates project $590M in 2025 revenue, implying 3% Y/Y growth. Among respondents, 40% anticipate system sales growth of 1-10%. Meanwhile, 60% of resellers expect material sales to grow 1-10%. While we anticipate persistent headwinds in 1H25, it’s worth noting that Stratasys, like many industry players, tends to issue more bullish outlooks early in the year. If macro conditions improve, the company may see upside to expectations, but for now, growth forecasts suggest a gradual recovery rather than a sharp rebound.

Source: 4Q24 AM Executive Survey, R=5

3D Systems (DDD) Resellers

How were 3D Systems system and material sales vs plan in 4Q24?

Our survey results suggest that 3D Systems’ (DDD) performance in 4Q24 was somewhat better than Stratasys but still reflected a weak demand environment. Among 4 resellers surveyed, 50% reported system sales in line with expectations, while 50% fell below plan. Similarly, material sales were evenly split, with half of respondents seeing sales meet expectations and the other half missing forecasts. While these results indicate a slightly more stable performance compared to Stratasys, we believe overall demand remains soft, likely due to ongoing macroeconomic headwinds. However, it's important to note that over 20% of 3D Systems’ business is tied to Align Technology (maker of Invisalign), which is sold directly and not captured in this survey. The company secured a $250M, five-year materials supply agreement with Align last year, which we believe remains a solid and stable growth driver for its business.

Source: 4Q24 AM Executive Survey, R=4

How much do you expect your 3D System printer and material business to grow in 2025?

Our survey of 3D Systems resellers indicates expectations for growth in both system and material sales in 2025, with a weighted-average growth rate (WAGR) of 9% for systems and 6% for materials. This suggests a more optimistic outlook compared to the weaker trends seen in 2024. Despite this optimism, current 2025 consensus estimates for 3D Systems call for 3% revenue growth. If macroeconomic conditions improve, these estimates may prove beatable; however, our survey data has yet to show a clear inflection point that would support significant upside.

Source: 4Q24 AM Executive Survey, R=4

Desktop Metal (DM) Resellers

How were Desktop Metal system and material sales vs plan in 4Q24?

Our survey results indicate that Desktop Metal had one of the worst performances among the OEMs we tracked, with a significant portion of resellers struggling to meet expectations. Of the 6 Desktop Metal resellers we surveyed, 83% of respondents reported both system and material sales below plan, while the remaining 17% said sales were merely in line with expectations. Not a single reseller saw sales exceed forecasts, underscoring severe demand weakness for the company.

We believe uncertainty surrounding the closing of Nano Dimension’s NNDM 0.00%↑ acquisition of Desktop Metal is weighing heavily on sales. The two companies are currently engaged in legal disputes, with Desktop Metal suing Nano Dimension for breach of contract. An expedited trial is set for late February, adding further uncertainty to the company’s near-term outlook. If Nano Dimension successfully exits the deal, we see a real risk of bankruptcy for Desktop Metal. The company ended 3Q24 with just $30M in cash on its balance sheet but has been burning approximately $20M per quarter. Without a near-term capital infusion or a resolution to the acquisition uncertainty, Desktop Metal’s financial position appears increasingly precarious.

Source: 4Q24 AM Executive Survey, R=6

How much do you expect your Desktop Metal printer and material business to grow in 2025?

Our survey results show that Desktop Metal is the only OEM vendor in our survey expecting negative growth for both system and material sales in 2025. The weighted-average growth rate (WAGR) for system sales is -4%, while material sales are projected at -3%. This stands in stark contrast to other 3D printing companies, all of which anticipate at least modest growth in the coming year. Among resellers surveyed, 50% expect system and material sales to decline by more than 10%. With ongoing uncertainty around the Nano Dimension acquisition, legal disputes, and a shrinking cash balance, Desktop Metal’s path forward appears increasingly uncertain.

Source: 4Q24 AM Executive Survey, R=6

Formlabs (Private) Resellers

How were Formlabs system and material sales vs plan in 4Q24?

Despite the broader weakness across the 3D printing industry, Formlabs resellers reported some of the strongest results in our survey, with demand for both systems and materials outperforming expectations. Among respondents, 33% saw system sales above plan, while 50% were in line with expectations. On the materials side, 45% reported sales above plan, and 55% were in line with expectations, with no resellers reporting below-plan performance. Although Formlabs is a private company, we believe it is one of the largest players in the space, and its relative strength stands out given that most OEMs in our survey reported softer demand trends. We attribute this outperformance to the company’s lower price point systems, which are likely better positioned in a macroeconomic environment where capital expenditures are under greater scrutiny.

4Q24 AM Executive Survey, R=12

How much do you expect your Formlabs printer and material business to grow in 2025?

Formlabs resellers provided the most optimistic growth outlook among all OEMs surveyed, making it the only vendor expecting double-digit growth for both system and material sales in 2025. Most impressive, 50% of resellers expect system sales to grow 20%+ in 2025. Similarly, material sales expectations are just as strong, with 75% of respondents projecting double-digit growth in 2025. Unlike other OEMs that saw mixed or negative outlooks, less than 10% of Formlabs resellers expect flat or declining sales, making the company an outlier in an otherwise cautious industry.

4Q24 AM Executive Survey, R=12

Bottom Line: Challenging Demand Persists, But 2025 Optimism Offers Potential Upside

Our survey results confirm that demand remains challenging with Stratasys (SSYS), 3D Systems (DDD) and Desktop Metal (DM) struggling to meet expectations in 4Q24. However, resellers are more optimistic about 2025 than 2024, and when compared to current consensus estimates, an improvement in macroeconomic conditions could make these forecasts beatable. That said, not all OEMs are in the same position. Desktop Metal appears to be in significantly worse shape than its peers, with resellers expecting continued declines, raising concerns about its financial stability if it is not acquired. In contrast, Formlabs (private) stands out as an outlier, reporting one of the strongest performances in our survey and being the only vendor expecting double-digit growth in 2025. Meanwhile, based on our results we expect Stratasys, 3D Systems, and Desktop Metal are all likely to report revenue declines and miss consensus revenue expectations for 4Q24, keeping investor focus on 2025 guidance. Given the positive sentiment from resellers looking ahead, there may be upside to 2025 estimates, but this will largely depend on macro conditions improving.

Research Disclaimer: We actively write about companies in which we invest or may invest. From time to time, we may write about companies that are in our portfolio. Content on this site including opinions on specific themes and companies in technology, market estimates, and estimates and commentary regarding publicly traded or private companies is not intended for use in making any investment decisions and provided solely for informational purposes. We hold no obligation to update any of our projections and the content on this site should not be relied upon. We express no warranties about any estimates or opinions we make.