Key Takeaways: Protolabs PRLB 0.00%↑ reported mixed 2Q24 results with revenues slightly missing expectations, but strong cost controls allowed the company to beat analyst earnings estimates. However, driven by a worsening macro economic outlook Protolabs provided 3Q24 revenue and EPS guidance that missed consensus expectations. Shares traded down ~15% on the poor outlook, but we were also impacted by the broader market sell off.

We were impressed with Protolabs ability to grow Y/Y in a challenging operating environment, and were not surprised by the more cautionary demand commentary given our 2Q24 Pricing Analysis indicated price deterioration toward the end of Q2. This aligns perfectly with Management remarks, where they highlighted orders declined through the month of June. That said, we believe Protolabs demand challenges are purely driven by a weakening manufacturing environment and not company specific. For example the ISM Manufacturing PMI hit a 8 month low in July. Although we expect growth to be challenged throughout 2024, we remain bullish on Protolabs long-term and believe when growth returns the company will be in a robust position to see strong revenue growth return and translate into stronger earnings growth. We believe the combination of Protolabs Factory and Network business positions the company as a clear leader in the digital manufacturing space. We expect the combination will allow Protolabs to acquire new customers, and more importantly grow wallet share per customer given the company’s internal manufacturing capabilities. Although shares are likely to be pressured in the near term, we are reiterating our Buy rating as we see 100%+ upside for investors who can wait out the current macro challenges.

View detailed historical results in our full financial model here.

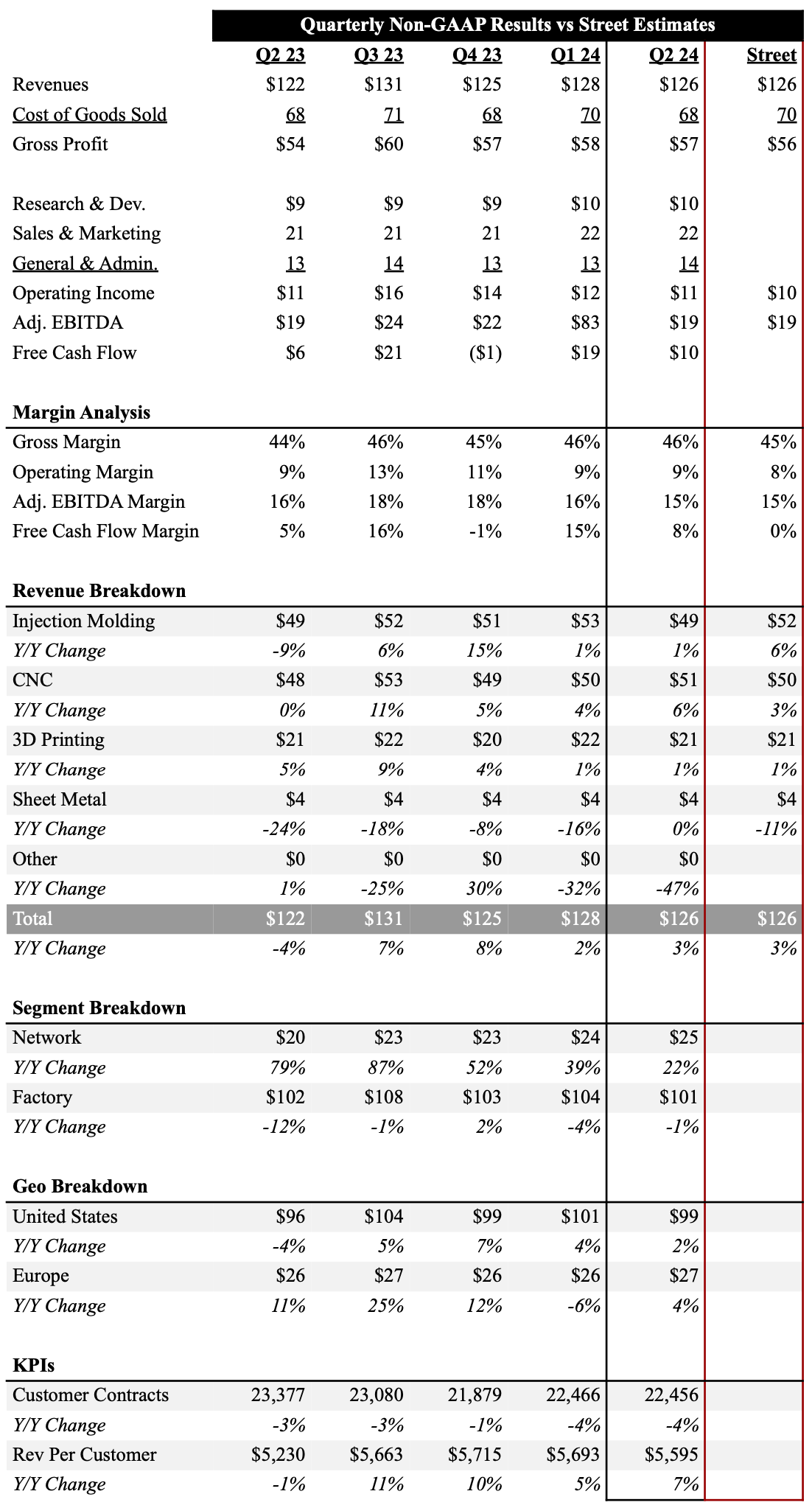

Source: Company Filings, FactSet, Data In Millions

2Q24 Earnings Summary

Protolabs saw 2Q24 revenues grow 2.8% Y/Y $125.6M, which was in-line with Management guidance ($122 - 130M) but slightly below consensus expectations ($126.2M). Revenues in the quarter were driven by growth across Injection Molding (up 0.5% Y/Y), CNC (up 6.1% Y/Y) and 3D Printing (up 1.3% Y/Y) service offerings. While the company’s Network business saw revenues grow 22% Y/Y to $24.7M, the company’s Factory business was down 1.1% Y/Y as low demand for prototypes continues to hamper growth. From a geographic perspective, United States sales grew 2.3% Y/Y, while Europe sales were up 4.4%. A bit concerning was, Customer Contracts in the quarter was down 3.9% Y/Y to 22,456, which accelerated compared to the last 5 quarters. With the growth of the Network business we would be expecting Customer Contracts to be growing as well, and is something we do need to monitor. However, we were pleased with revenue per customer contracts growing 7.0% Y/Y. We are expecting the combination of Protolabs Network and Factory business will allow them to acquire new customers and grow wallet share per customer overtime.

Despite revenues being down Q/Q, Protolabs showed strong gross margin performance, with Non-GAAP gross margins expanding 10 basis points Q/Q and 160 bps Y/Y to 45.7%. Driven by lower revenues and opex that was essentially flat Q/Q, adjusted EBITDA margins were down 30 bps Y/Y to 15.4%, but $19.3M in adjusted EBITDA was still able to beat analyst expectations ($18.7M). However, Management announced a cost reorganization initiative to streamline sales operations and improve efficiencies. Cash flow from operations was $14.4M and free cash flow was $10.2M in the quarter.

Driven by a worsening manufacturing environment, Protolabs guided 3Q24 revenues in the range of $117 - 125M, which implies 3.7% Q/Q and 7.4% Y/Y decline at the midpoint, and missed analyst estimates ($129.6M). Management highlighted that they saw order softness throughout June, and into July. Management guidance implies demand improving in August and September, but given the worsening US Manufacturing PMI Index, this guidance may be challenging if demand continues to worsen. While Protolabs does not give formal gross margin guidance, they expect gross margins to be down modestly Q/Q. However, the company expects opex to be down sequentially as they look to streamline operations and improve efficinces. This resulted in Non-GAAP EPS guidance in the range of $0.29 - 0.37, which was lower than consensus expectations of $0.41.

5-Year Financial Outlook

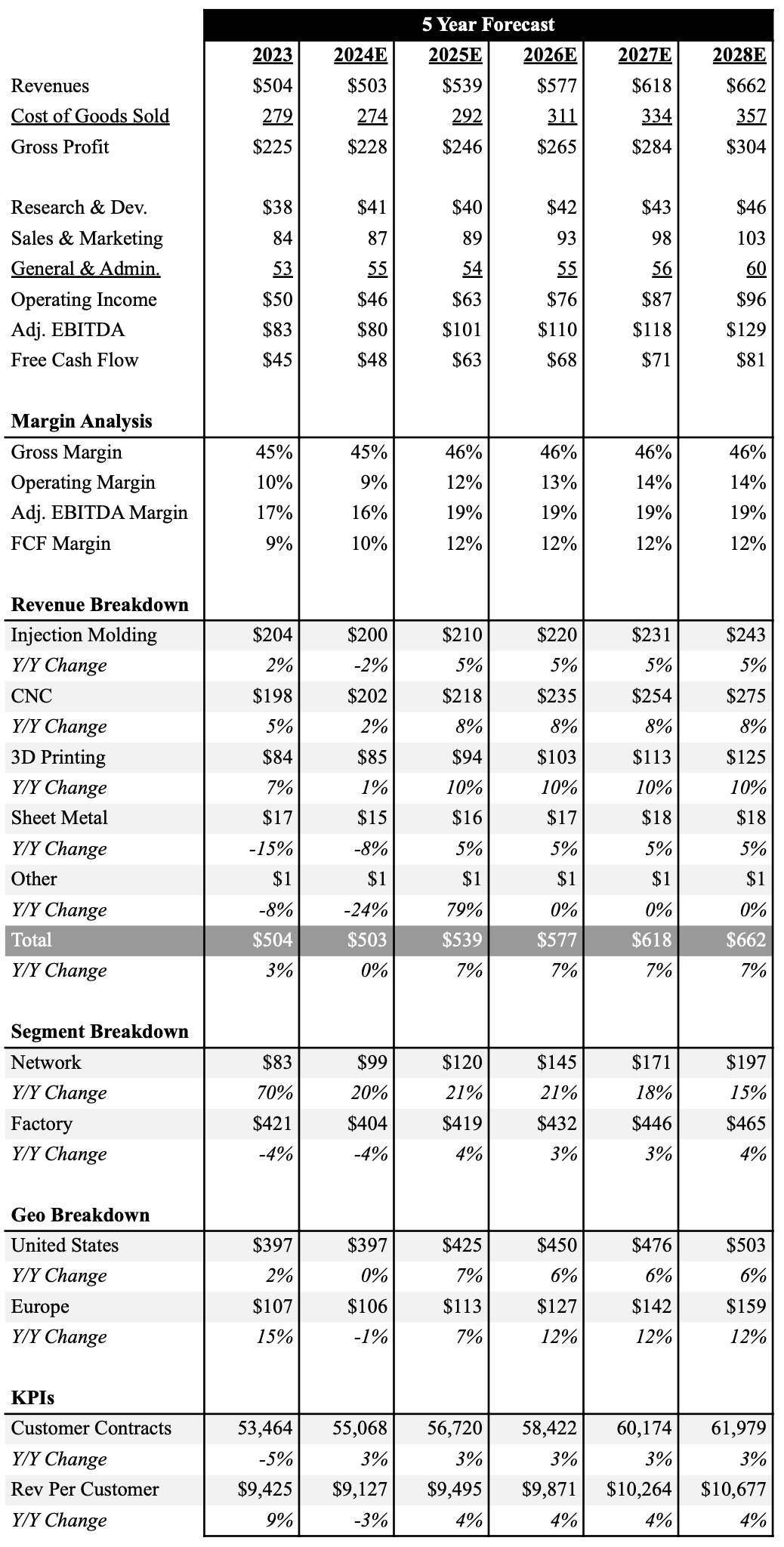

Driven by the Company’s Q3 outlook and a more challenging manufacturing environment than previously expected, we have lowered our revenue forecasts. We expect Protolabs revenue to now be $502.6M, which implies essentially zero growth in 2024. Looking beyond 2024, we are cautiously optimistic that the manufacturing environment improves and expect the Company can sustain ~7% annual revenue growth through 2028, which is in-line with the on-demand manufacturing industry. However, we believe Protolabs Factory and Network offering puts them in position to take market share. Coupled with the expectation the overall manufacturing environment should improve, we believe these estimates could end up being conservative.

We expect Protolabs Network business to continue to grow 20%+ over the next several years. Given this business has gross margins below the company average (~30%), we expect Protolabs to see limited gross margin expansion as the Network business accounts for a higher percentage of overall sales. However, we are impressed with the Company’s ability to grow gross margins in a challenging macro environment and have modestly raised our long term gross margin target from 45% to 46%. Furthermore, we expect strong revenue growth and prudent cost management, will drive operating and adjust EBITDA margin expansion. Our current forecast expects the company to generate $79.8M in adjusted EBITDA in 2024. By 2028, we expect the company will be generating $129M in adjusted EBITDA. We expect strong adjusted EBITDA will translate into robust free cash flow (FCF) generation, reaching $80M by 2028. However, as we stated before, our estimates imply ~7% annual growth, which could be conservative and see the potential for upward revisions to our adjusted EBITDA and FCF estimates in a better manufacturing environment.

Below is an overview of our 5 year outlook with a full downloadable financial model here.

Source: Industrial Tech Analyst, Data In Millions

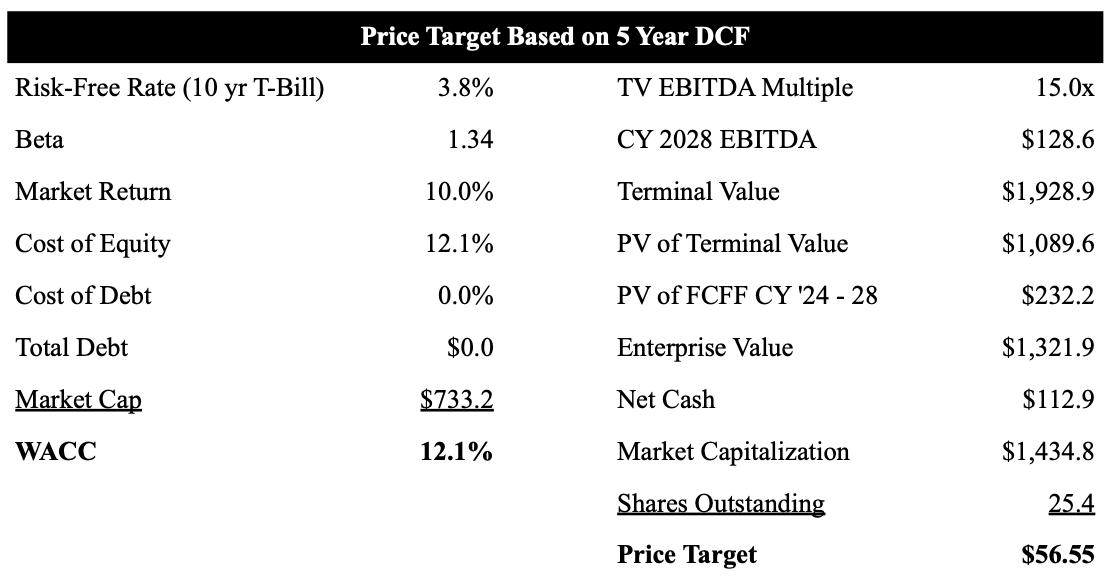

Investment Thesis

We believe the combination of Protolabs Factory and Network business positions the company as a clear leader in the digital manufacturing space. We expect the combination will allow Protolabs to acquire new customers, and more importantly grow wallet share per customer given the company’s internal manufacturing capabilities. While we believe gross margins could be lumpy as the Network business ramps, we believe Protolabs will continue to grow and produce strong free cash flow. Protolabs is currently trading at ~8x EV/EBITDA based on 2025 estimates, which is well below the company’s 5-year average of ~20x. We believe as the manufacturing environment improves, stronger growth coupled with improving margins will drive multiple expansion back towards historical levels. These all support our bullish stance, which drives our price target of $56.55.

As shown in our table below we use a 5 year DCF model to value Protolabs shares. Based on our current forecast that includes a below average 15x EBITDA multiple to our terminal value, we value Protolabs shares at $56.55.

Source: Industrial Tech Analyst

Looking to become a better investor or need to find that perfect gift for your finance friend?

Check out these products from our partner Trading Roadmap.

Research Disclaimer: We actively write about companies in which we invest or may invest. From time to time, we may write about companies that are in our portfolio. Content on this site including opinions on specific themes and companies in technology, market estimates, and estimates and commentary regarding publicly traded or private companies is not intended for use in making any investment decisions and provided solely for informational purposes. We hold no obligation to update any of our projections and the content on this site should not be relied upon. We express no warranties about any estimates or opinions we make.