AutoStore Order Growth Remains Strong, But Deployment Timing Causes Q1 Miss Creating A Buying Opportunity

AutoStore reported mixed Q1 results on Thursday, April 25th with revenues and adjusted EBITDA falling short of expectations, but demand for their solution remains strong as order growth exceeded analyst estimates. Unfortunately, the revenue and profit shortfall weighed on shares with the stock trading down 15% on these results, but shares rebounded the falling day on two analyst upgrades.

We believe the Q1 revenue shortfall is purely driven by a timing issue, and not an indication of slowing demand as orders grew 11% Y/Y in Q1. Given the size of these deployments, we believe it is a normal course of business for sales to be pushed out due to timing that will create buying opportunities for long-term focused investors. That said, we remain very upbeat on AutoStore’s long term opportunity as a leader in the quickly emerging warehouse automation space and remain BUYERS.

Key Results vs Consensus Expectations

1Q24 Results

Revenue $138.1M MISS consensus $162.7M

Adj. EBITDA $63.2M MISS consensus $73.7M

Orders $183.0M BEAT consensus $170.4M

Backlog $491.6M BEAT consensus $456.3M

Key 1Q24 Earnings Takeaways

AutoStore Q1 revenues of $138.1M were down ~7% Y/Y, and came in below analyst expectations ($162.7M). While the revenue decline was attributed to timing of deployments, new orders were up ~11% Y/Y to $183M, which exceeded consensus expectations ($170.4M). This drove a ~10% Q/Q growth in backlog, exiting the quarter at $490M. AutoStore highlighted order growth was driven by positive development in high throughput and micro fulfillment centers, specifically from consumer and third party logistic customers. The company also highlighted that demand from new customers remains strong, which accounted for ~50% of sales in the quarter.

Despite the revenue shortfall, the company saw gross margins expand 590 basis points Y/Y to 72.8%. Gross margin expansion was driven by favorable software product mix, price optimization and favorable sourcing of raw materials. Combining their strong gross margins with their lean operating model, the company reported adjusted EBITDA of $63.2M in Q1. Although adjusted EBITDA missed analyst expectations as a result of lower revenues, we believe adjusted EBITDA margins of 45.8% at this scale is unbelievable. The company is also generating strong free cash flow, which was $66.5M in Q1. We expect strong free cash flow generation to continue, which will allow them to further fund the business and additional R&D efforts to sustain their leadership position.

The company did not provide formal 2024 guidance, but provided upbeat comments on expectations for growth in 2024. Upbeat growth expectations is underpinned by the anticipation the majority of the current backlog will be fulfilled in 2024, with an accelerated portion beginning in Q2.

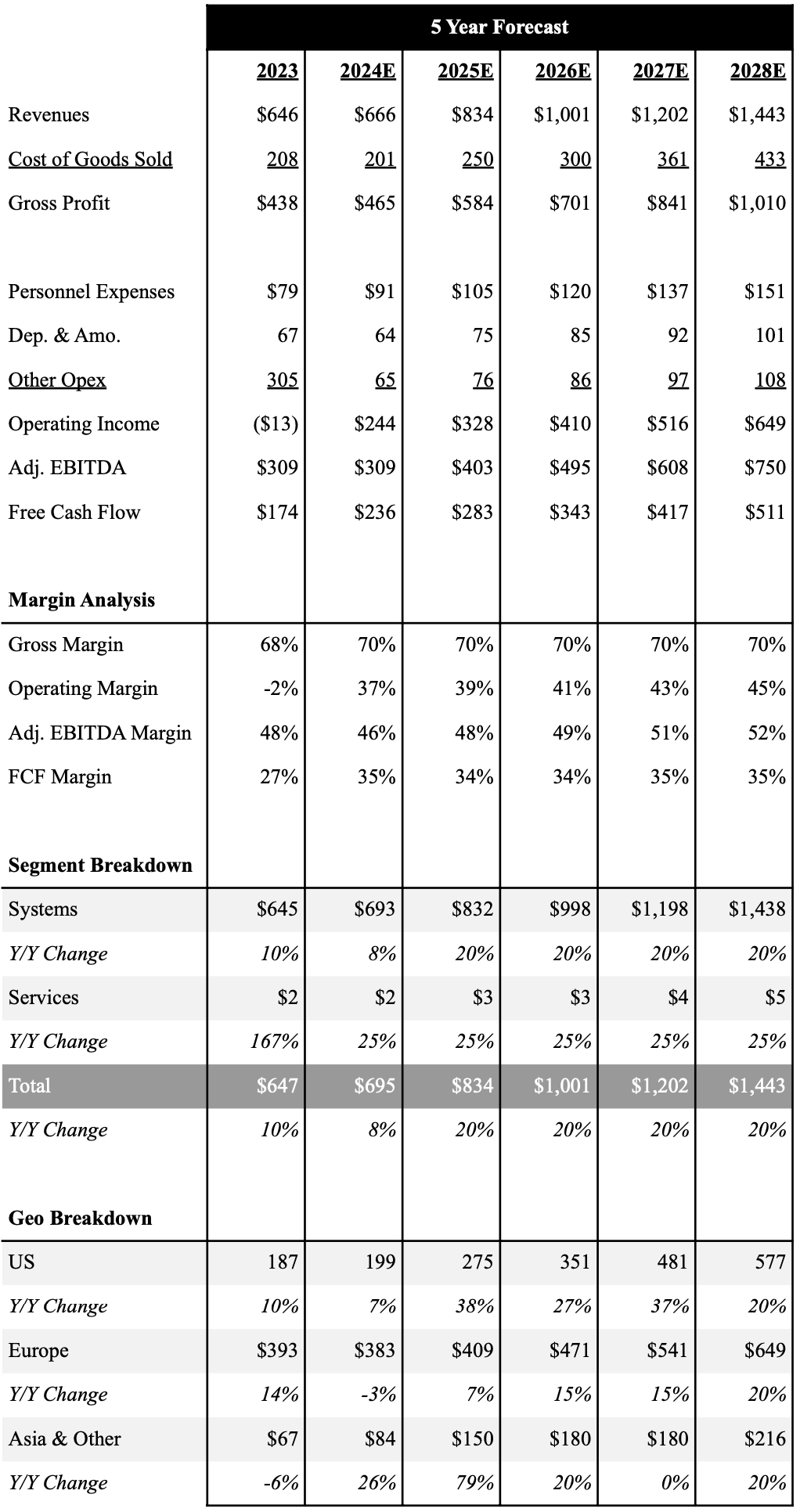

5-Year Financial Outlook

While macro uncertainty as a result of the high interest rate environment, slowed sales and bookings growth in 2023, the company continues to see interest grow. We expect revenue growth to be muted through most of 2024, but our cautiously optimistic macro improves in 2H24 with the expectation interest rates will start to come down. As a result of the lower Q1 revenues we did take down our 2024 revenue estimate by ~$30M, and now expect revenues to grow ~3% Y/Y to $665.6M. As we look into 2025 and assuming the macro improves, we expect revenues to accelerate and sustain 20%+ growth through 2028. That said, AutoStore saw revenue growth of ~80% in 2021 and 2022. Given the strong macro tailwinds driving companies to automated solutions, we would not be surprised to see our estimates end up being very conservative when we return to a normalized environment. Furthermore, even in a challenging operating environment we expect the company to sustain ~70% gross margins. We do expect opex to grow with revenues, but anticipate operational efficiencies will allow the company to see adjusted EBITDA margins reach 50%+ by 2028. This would imply $750M in adjusted EBITDA based on our $1.4B revenue estimate.

Below is an overview of our 5 year outlook with a full financial model here.

Source: Industrial Tech Analyst

Investment Thesis

We view AutoStore as a clear market winner within the fast emerging automated storage and retrieval market as secular trends of e-commerce, labor shortages and rising labor costs have made their solution increasingly attractive in fulfillment centers across a growing number of industries. AutoStore has a history of strong growth but macro uncertainty as a result of the high interest rate environment, slowed sales and bookings growth. However, the company continues to see interest grow from thousands of customers globally and is entering 2024 with a robust backlog. We view the slowdown in demand as an opportunity for investors, as we believe the company will return to 25%+ growth as macro conditions improve. Furthermore, the company has been able to grow profitably. Driven by ~70% gross margins and lean partner driven operating model, the company is consistently reporting adjusted EBITDA margins north of 45%. AutoStore is currently trading at 16x EV/EBITDA based on 2025 estimates, which is below our industrial tech comp group (~25x) and their closest public peer Symbotic (~57x). We believe as macro conditions improve, current estimates will end up being conservative and likely drive multiple expansion. Our robust outlook drives our bullish stance on AutoStore shares.

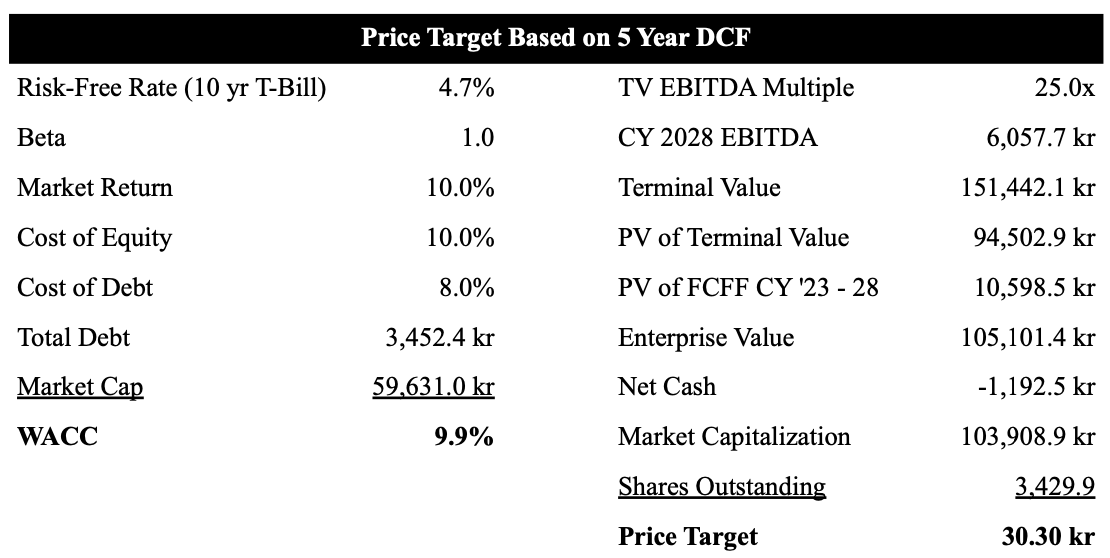

As shown in our table below we use a 5 year DCF model to value AutoStore shares. We also value shares in Norwegian Krone (NOK) given they are sold on the Oslo Exchange. Based on our current forecast we value AutoStore at 30.30 NOK, which equates to ~80%+ upside at current levels.

Source: Industrial Tech Analyst

Looking to become a better investor or need to find that perfect gift for your finance friend?

Check out these products from our partner Trading Roadmap.

Research Disclaimer: We actively write about companies in which we invest or may invest. From time to time, we may write about companies that are in our portfolio. Content on this site including opinions on specific themes and companies in technology, market estimates, and estimates and commentary regarding publicly traded or private companies is not intended for use in making any investment decisions and provided solely for informational purposes. We hold no obligation to update any of our projections and the content on this site should not be relied upon. We express no warranties about any estimates or opinions we make.