BOOM! - Tekna Delivers BIG 4Q23 Earnings And Announces A 2nd Large Consumer Electronics Win; Stock Soars

Tekna ($100M Market Cap) is one of our top stock picks over the next 2 - 3 years, and is a world-leading provider of advanced materials and plasma systems. Tekna has developed an IP-protected plasma technology that can transform metal materials such as titanium, aluminum, nickel and silicon into extremely fine powders, which are used in mega secular growth applications, such as 3D printing, consumer electronics, medical implants and aerospace.

Tekna reported Q4 results on Thursday, Feb 8th with revenues growing 66% Y/Y, and saw a significant improvement in EBITDA margins. The company is expecting growth and profitability to continue in 2024. The stock was up 8% on the results.

Key 4Q23 Takeaways:

Tekna reported 4Q23 revenues of $11.4M, which was up 66% Y/Y. Sales were driven by strong demand for materials and systems, which were up 40% and 126% Y/Y, respectively. Due to strong cost controls and production efficiencies, gross margins were 42.9%, up from 28.7% in 4Q22. This helped drive almost adjusted EBITDA breakeven in the quarter for the first time in the company’s history.

As we highlighted in our initiation report here, we are very bullish on the company’s opportunity to supply Apple with titanium for next gen iPhones and iWatch cases and intricate parts. However, we were very encouraged to hear that Tekna has secured a second win with another mega consumer electronics OEM, which we believe is Samsung. Samsung announced late last year that their Galaxy S24 Series will be using a frame case made out of titanium. Driven by this new win, Tekna expects to see new orders in 1H24 from consumer electronic customers. More importantly, the company expects materials to gain better margins in 2H24 as the consumer electronic opportunity ramps.

While not fully baked into our initial bullish report on Tekna, we may have underestimated the revenue potential for direct plasma system sales. The company highlighted on the call a renewed interest in demand for PlasmaSonic systems in hypersonic, space tourism, satellite internet & networks & strategic defense industries. This interest is likely driven by leading Space players such as SpaceX, Blue Origin and NASA, who are all listed as customers in their investor presentation. Plasma system sales were $15.2M, up 90% Y/Y in 2023, and they exited the year with a backlog of $9.4M. We don’t assume this business can sustain this growth rate, but given the upbeat demand comments from Management we expect sales can continue to grow 30%+ in 2024. This will help drive profitability given this segment has gross margins of ~60%.

2024 Outlook: The company did not provide quantitative 2024 guidance, but expects growth to continue and profitability to improve beyond 2023 levels. We believe the material business will continue to grow 35%+ in 2023, driven by strength from key consumer electronic customers, and OEMs for 3D printing applications. Coupled with 30% growth in system sales, we expect the company to report revenues of $54.8M in 2024, up 33% Y/Y. However, we expect production efficiencies and cost controls will now drive gross margins up 130 bps in 2024 to 45.9%. This will translate into the company reporting an adjusted EBITDA profit for the year of $2.0M. That said, we are only in the early innings of this consumer electronic opportunity and believe these estimates could end up being conservative based on how fast this opportunity ramps.

Updated model here.

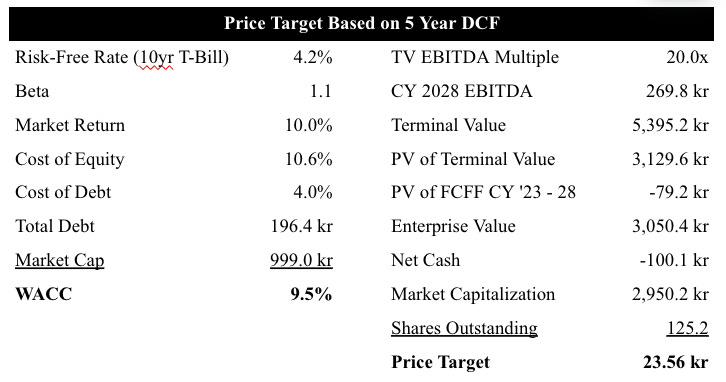

Investment Thesis: We believe Tekna is in the early innings of a multi-year super cycle as demand for their advanced metal materials grow across applications in 3D printing, consumer electronics, aerospace, automotive and medical. However, what makes us extremely bullish on Tekna is the key win they received with Apple in 2023 to supply the leading smartphone provider with titanium for the casing of next gen iPhones and smartwatches. We expect Apple and now others to adopt titanium into an increasing number of smartphones and other devices in the coming years, which could drive demand for 2,500 tons of titanium or $200M in sales alone. Coupled with growing demand in other emerging verticals, we expect Tekna to see 25%+ annual revenue growth over the next 5 years with EBITDA margins approaching 20%. These robust catalysts drive our bullish stance on Tekna shares and higher price target of 23.56 NOK, which equates to ~195% upside. Price target calculation below.

Research Disclaimer: We actively write about companies in which we invest or may invest. From time to time, we may write about companies that are in our portfolio. Content on this site including opinions on specific themes and companies in technology, market estimates, and estimates and commentary regarding publicly traded or private companies is not intended for use in making any investment decisions and provided solely for informational purposes. We hold no obligation to update any of our projections and the content on this site should not be relied upon. We express no warranties about any estimates or opinions we make.