Broad Based RAIN RFID Industry Adoption Drives Another Impinj Beat and Raise, But Stock Priced For Flawless Execution... Buyers Beware!

Key Takeaways: Impinj PI 0.00%↑ reported another solid quarter with 3Q24 results coming in above Managements and Street expectations. Furthermore, Impinj provided better than expected 4Q24 revenue, EPS and adjusted EBITDA guidance. Strong Q3 results and outlook had shares up 2%+ in after market trading.

We are impressed with Impinj’s Q3 performance as they report another beat and raise quarter, which includes revenues growing 46.4% Y/Y as RAIN RFID deployments accelerate across a broad set of industries. Given Management’s upbeat tone, this momentum is not expected to stop in the near term. That said, while we expect estimates to go up modestly following Q3 results, Impinj shares are up ~160% YTD and were trading at ~70x EV/EBITDA based on 2025 estimates heading into the quarter. Although we believe Impinj’s growth and improving profitably deserves a rich multiple and another solid quarter will likely push shares higher through year-end, we view any hiccup to be catastrophic for the stock at this valuation. In turn, we believe shares are fully valued and reiterate our HOLD rating. In the event of a “meaningful” pullback we would use the opportunity to consider building a position given Impinj’s long term growth opportunity.

Full financial results and 5 year downloadable model here.

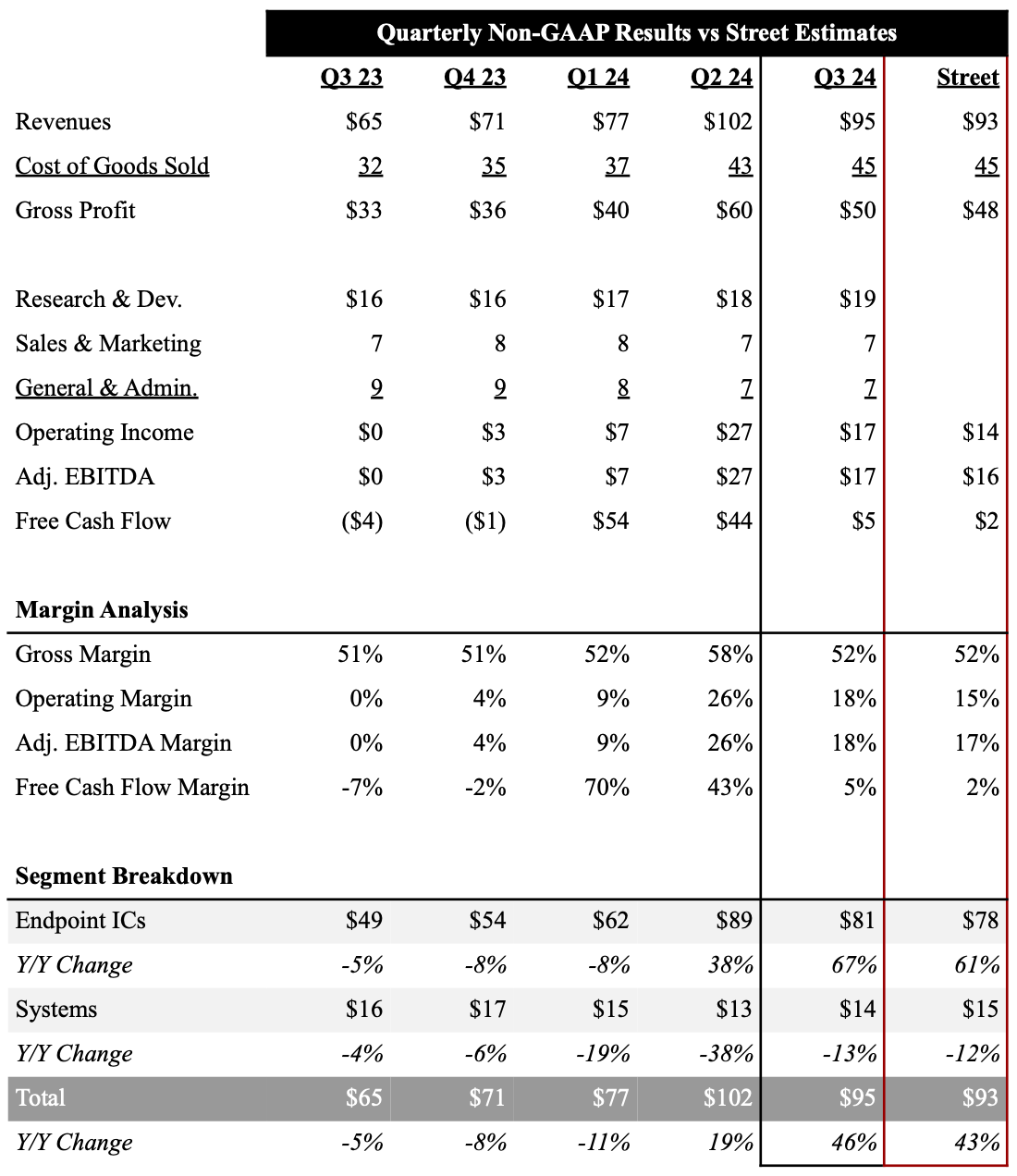

Source: Company Filings, FactSet

Investor Gifts

Looking to become a better investor or need to find that perfect gift for your finance friend? Check out these products from our partner Investor Gifts like their 2025 Investor Calendar.

Key 3Q24 Earnings Takeaways

Impinj generated $95.2M in revenues in Q3, which was up 46.4% Y/Y and came in above the high-end of Managements guidance ($91 - 94M), as well as consensus estimates ($92.7M). Endpoint IC revenues were $81.0M in Q3, up 66.6% Y/Y. Strength in supply chain and logistics, steady growth in retail general merchandise and continued secular growth in both apparel and long-tail applications drove robust IC demand in the quarter. Management specifically called out increasing traction among their key end-customers. For example, at their large North American retailer (Walmart), IC volumes continue ramping, driven by expanding general merchandise tagging. In addition, the second largest North American supply chain and logistics end user (UPS) is increasing label consumption this year and next. Lastly, Management continues to be very excited about growing adoption within Food & Beverage. It is worth noting, Impinj’s biggest IC Endpoint customer Avery Dennison reportws results in the morning, and highlighted a big expansion win with Kroger to begin deploying RFID in the bakery department across 2,800 stores over the next six quarters. We believe this is the first big grocery store win, and could likely drive adoption among Krogers peers in the coming years. System revenues were $14.2M in the quarter, down 13.3% Y/Y.

Non-GAAP gross margins in Q3 were 52.4%, which were up 190 bps Y/Y. Better than expected revenues and strong cost controls drove adjusted EBITDA of $17.3M, which was above the high-end of Managements previous range ($13.8 - $15.3M) and consensus estimates ($15,6M). Driven by normalized working capital levels, Impinj reported $10.1M in cash from operations and $4.7M in free cash flow in the quarter.

Looking ahead, Impinj provided upbeat Q4 guidance, which includes revenues in the range of $91 - 94M. This implies 30.9% Y/Y growth at the midpoint, which came in above consensus estimates ($90.1M). We believe strength across multiple industries such as apparel, retail, logistics and new markets is driving the upside in the guidance. Impinj does not formally guide to Non-GAAP gross margins, but they expect them to be up Q/Q to ~53%. Higher than expected revenues will also result in better than expected profitability, with Impinj guiding adjusted EBITDA in the range of $13.6 - 15.1M (consensus $12.0M).

5-Year Financial Outlook

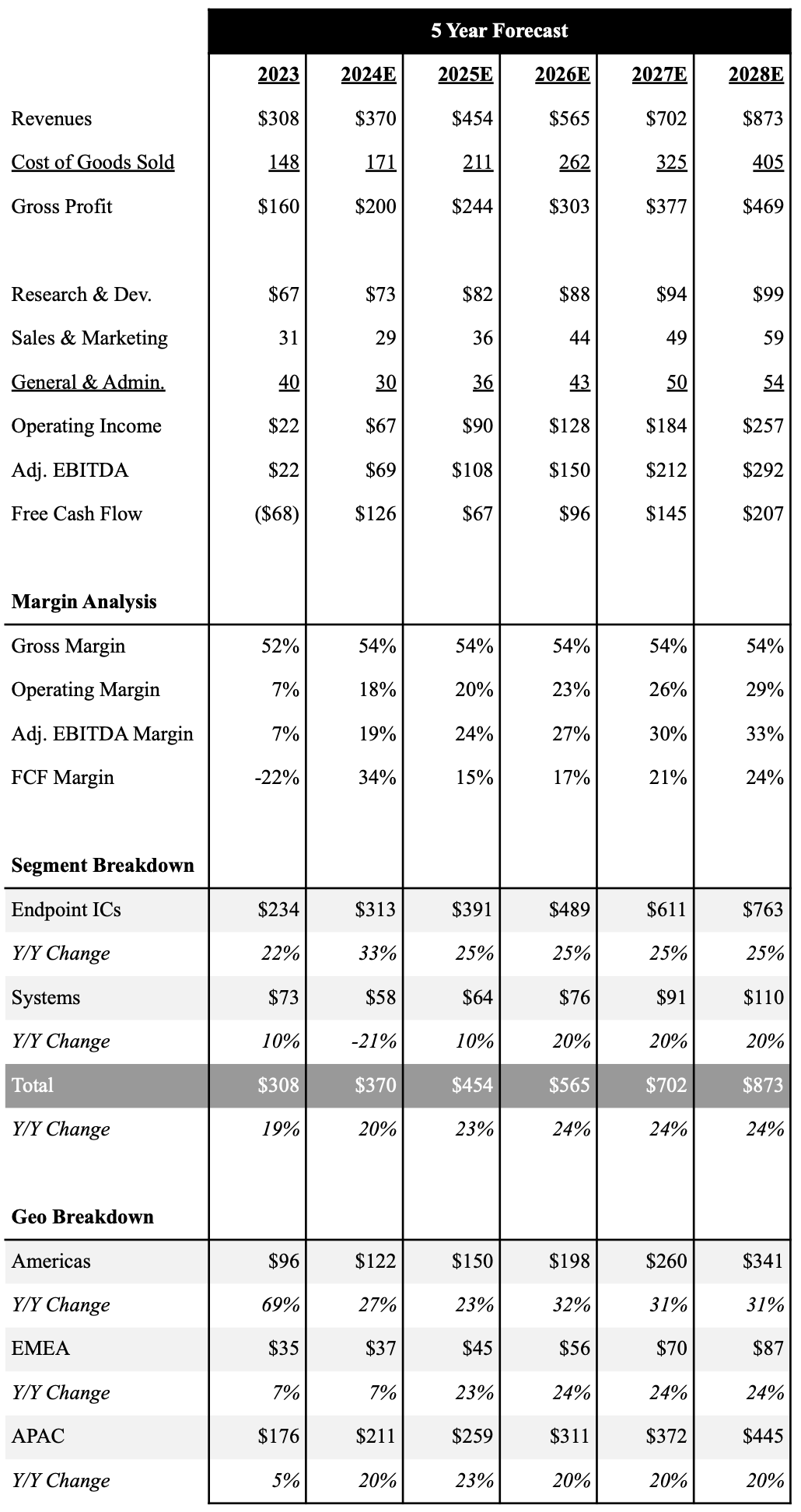

Following the better 3Q24 results and Q4 outlook, we have increased our financial estimates modestly. We believe the company will still grow ~20% Y/Y. As we enter 2025, we believe Impinj can sustain 20%+ revenue growth for the next several years as RAIN RFID becomes increasingly adopted in several industries.

We do believe the company has a scalable operating model, and are impressed with the company’s strong cost controls throughout 2024. While we believe Impinj will need to continue to invest in R&D to maintain its leadership in the RAIN market, we do believe overall operating expenditures could be much lower as a percentage of revenues in the coming years. As a result, we expect Impinj to show even stronger operational efficiencies and see robust operating margin expansion. Assuming the company can grow in-line with the overall industry, we foresee the company hitting ~30%+ adjusted EBITDA margins in 2028. We expect the company to generate $200M+ in free cash flow per year by 2028.

Below is an overview of our 5 year outlook with a full financial model here.

Source: Industrial Tech Analyst

Investment Thesis

We believe Impinj is a clear leader in the fast emerging RAIN RFID industry, which we anticipate will be one of the fastest growing tech markets over the next 5 years. We believe expansion across Impinj core markets, retail and logistics, and new verticals like food and consumer electronics will enable the company to sustain 20%+ growth. That said, Impinj shares are up ~160% YTD and were trading at ~70x EV/EBITDA based on 2025 estimates heading into the quarter. Although we believe Impinj’s growth and improving profitably deserves a rich multiple and another solid quarter will likely push shares higher through year-end, we view any hiccup to be catastrophic for the stock at this valuation. In turn, we believe shares are fully valued and reiterate our HOLD rating. In the event of a “meaningful” pullback we would use the opportunity to consider building a position given Impinj’s long term growth opportunity.

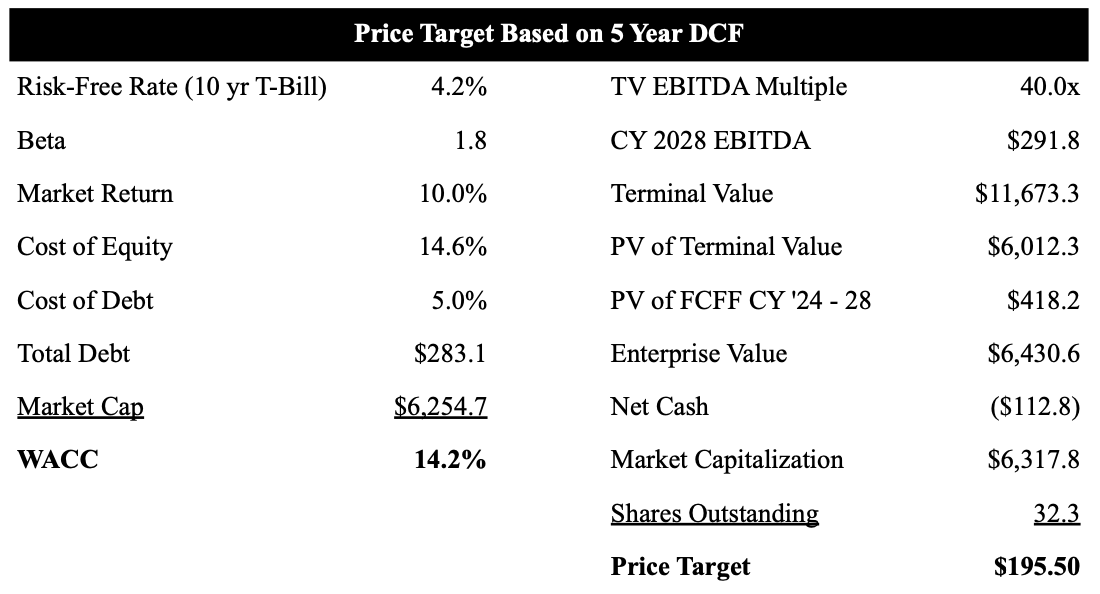

As shown in our table below we use a 5 year DCF model to value Impinj shares. Based on our current forecast we value Impinj shares at $195.50. We increased our price target from $146.84 as a result of higher revenues, lower assumed costs, as well as higher terminal multiple that aligns with our higher 5-year average earnings growth rate.

Source: Industrial Tech Analyst

Research Disclaimer: We actively write about companies in which we invest or may invest. From time to time, we may write about companies that are in our portfolio. Content on this site including opinions on specific themes and companies in technology, market estimates, and estimates and commentary regarding publicly traded or private companies is not intended for use in making any investment decisions and provided solely for informational purposes. We hold no obligation to update any of our projections and the content on this site should not be relied upon. We express no warranties about any estimates or opinions we make.