Challenges Persist, But Tekna’s Long-Term Potential Remains Strong with a Massive Near-Term PlasmicSonic Order on the Horizon

View all Tekna reports and link to our research disclaimer.

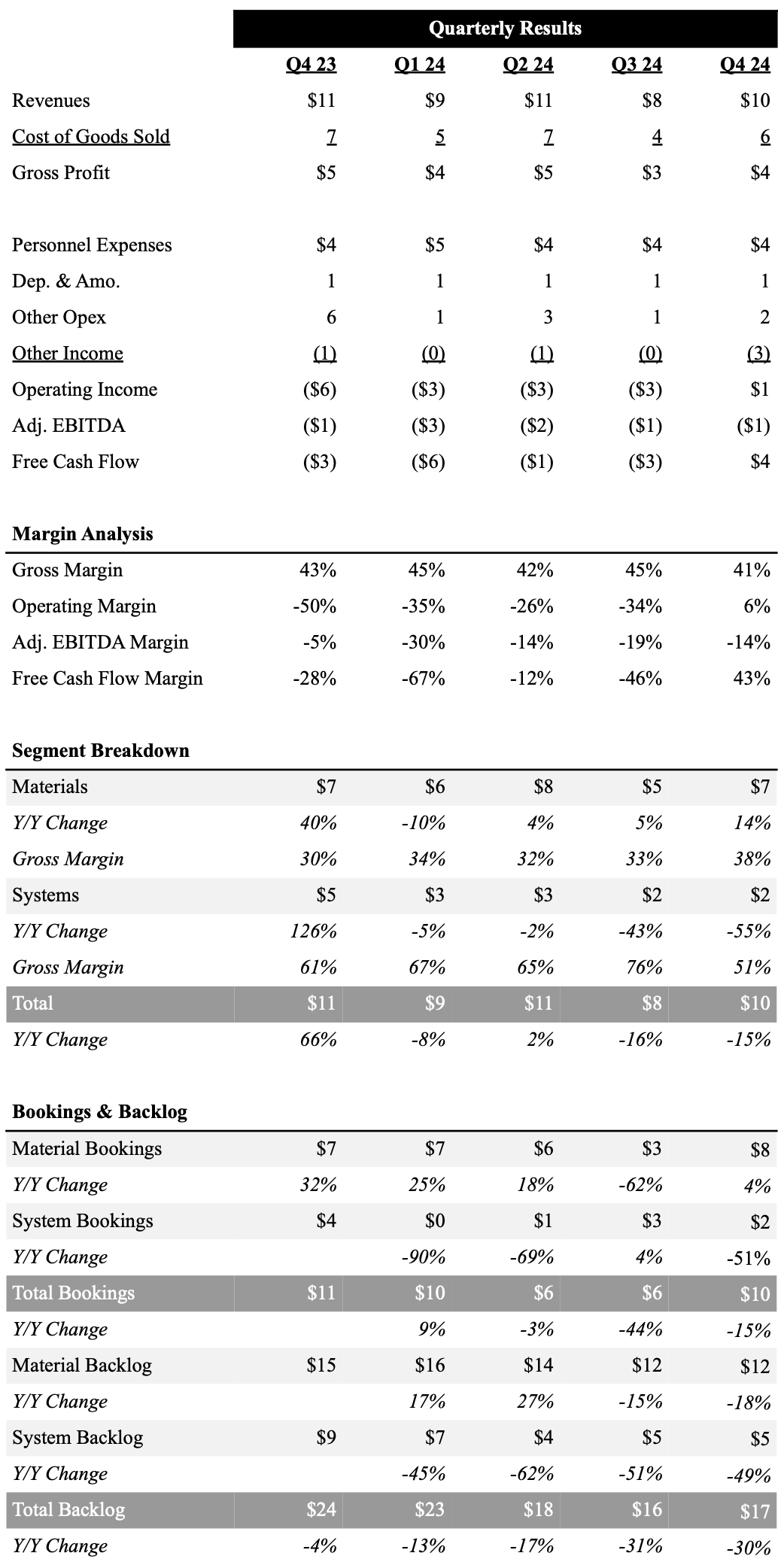

Key Takeaways: Tekna reported what we view as mixed 4Q24 results. Tekna reported a solid performance in its Advanced Materials segment, with Q4 sales growing ~14% Y/Y and ~37% Q/Q, driven by strong demand from the aerospace and medical sectors. However, this growth was partially offset by continued weak sales to 3D printing OEMs, as high interest rates continue to impact system sales. Material bookings saw a remarkable 160%+ Q/Q increase, demonstrating strengthening momentum in material sales. However, the company faced continued headwinds in its Plasma Systems segment, where Q4 sales declined 55% Y/Y to $2.2M, reflecting continued delays in order intake. That said, cost-saving initiatives, disciplined working capital management and $2.9M litigation cost compensation contributed to an improved cash position, helping Tekna strengthen its financial footing. We believe improving material sales, as well cash position were viewed positive as shares traded up ~3% on these results.

We are encouraged by the double-digit growth in material sales and the sharp recovery in bookings, which signals improving demand across key customer segments. While Plasma System sales remain under pressure, we believe the long-term opportunity for Tekna’s PlasmaSonic systems is substantial, given their ~$10M ASP and four promising leads in the pipeline, particularly driven by applications in space exploration. Management remains upbeat that they could close one of these PlasmaSonic opportunities early in 2025, which would be a material win given the company’s total 2024 revenue of ~$39M. However, we remain cautious about potential headwinds, particularly the impact of tariffs on Canadian exports, which could pose a challenge for Tekna’s competitive positioning in the U.S. market (~45% of sales in 2024). While the long-term growth thesis remains intact, we will closely monitor these evolving macroeconomic factors.

View detailed historical results in our full financial model here.

Source: Company Filings, FactSet; Data In Millions

Investor Gifts

Looking to become a better investor or need to find that perfect gift for your finance friend? Check out these products from our partner Investor Gifts like their 2025 Investor Calendar.

4Q24 Earnings Summary

Tekna reported Q4 2024 revenue of $9.6M, a ~15% Y/Y decline, reflecting continued softness in Plasma Systems sales. The Advanced Materials segment, however, posted solid growth, with revenue increasing ~14% Y/Y to $7.5M, supported by strong demand in the aerospace and medical markets. This was partially offset by weakness in sales to 3D printing OEMs due to the impact of high interest rates on capital spending. Plasma Systems revenue fell ~55% Y/Y to $2.2M, as order delays and lower new bookings weighed on performance. The company’s overall backlog declined ~30% Y/Y to $16.7M, primarily due to reduced orders in Plasma Systems. Despite this, the Advanced Materials segment saw a ~164% Q/Q increase in bookings, signaling improving demand trends heading into 2025.

Gross margins showed mixed trends across segments. Advanced Materials saw an 8.1 percentage point Y/Y expansion in gross margin, reaching 37.6% in 4Q24, driven by a more favorable sales mix and continued productivity improvements. Plasma Systems, however, saw a 10 percentage point decline in gross margin to 51.0%, reflecting weaker revenue recognition from lower-margin activities. Operating costs declined as a result of restructuring efforts, with indirect personnel expenses down $0.7M Y/Y. Adjusted EBITDA came in at a loss of $1.4M, compared to a loss of $0.5M in the prior-year quarter, reflecting the ongoing revenue headwinds in Plasma Systems. Tekna’s cash position improved to $12.4M, up $4.8M from the previous quarter, aided by the $2.9M litigation settlement and disciplined working capital management. We believey this strengthened cash position provides greater financial flexibility as macroeconomic uncertainty eases.

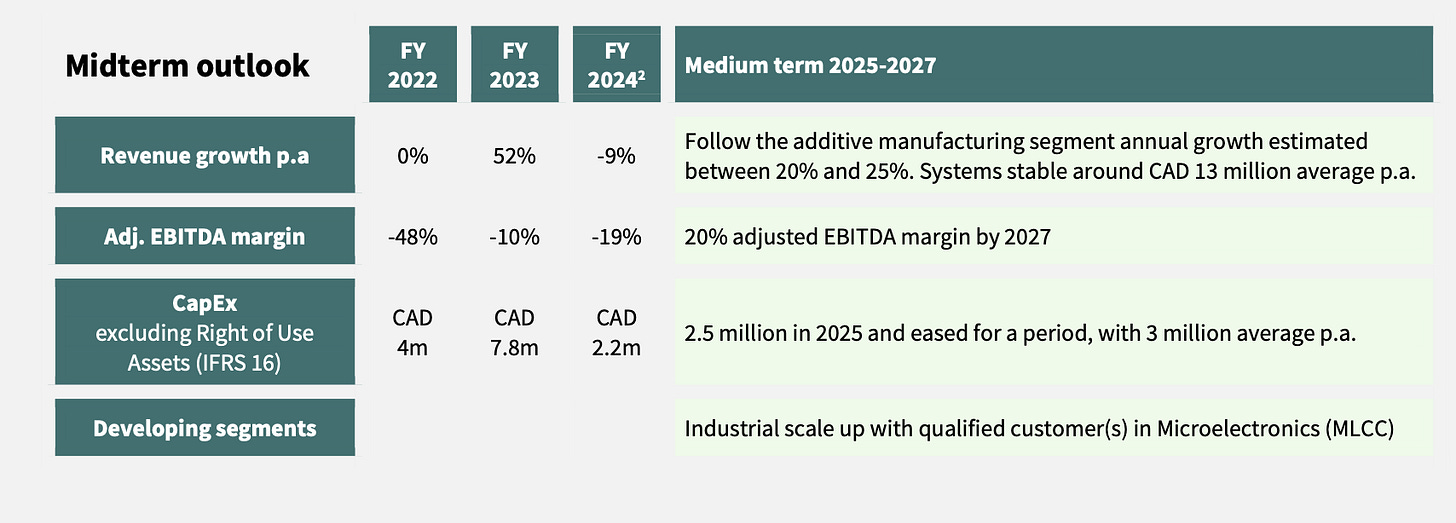

Looking ahead to 2025, the company did not provide quantitative guidance but on the earnings call they are expecting revenues to grow in 2025 and see another year of improving adjusted EBITDA. Tekna remains focused on strengthening profitability and capital discipline while advancing its key growth initiatives. In Advanced Materials, the company anticipates continued demand strength in aerospace and medical applications, while the 3D printing market remains a near-term challenge. Plasma Systems faces headwinds due to delayed customer purchases, but management expects a gradual recovery, supported by a maturing sales pipeline. Notably, Tekna is tracking four active PlasmaSonic opportunities, each with a $10M average selling price (ASP), driven by growing applications in hypersonic flight and space exploration. However, the potential imposition of U.S. tariffs on Canadian imports remains an area of caution, as it could impact Tekna’s cost competitiveness in the key U.S. market (~45% of sales in 2024). Despite these challenges, the company remains confident in its long-term growth trajectory and its ability to navigate near-term volatility. The company did provide these longer-term targets.

Source: Tekna 4Q24 Earnings Presentation

Below we dive deeper into our updated five-year outlook, investment thesis and price target.