CPO, Three Letters That Could Disrupt The Optical Networking Space in 2025 & Who Will Benefit

We believe the optical networking industry is poised for significant growth over the next 1 - 2 years due to a surge in AI technologies and applications, and believe there are several compelling investment and trading opportunities, which we highlighted in our industry deep dive, The Backbone of AI: Optical Networking Deep Dive and Investment Opportunities In The Datacenter Gold Rush.

However, as disclosed in our deep dive the optical component sector faces significant risks from evolving technology trends that threatens the traditional pluggable transceiver market as data rates have scaled to 800G, 1.6T, and beyond. One of these evolving technologies is CPOs or formally called co-packaged optics. While we and many across the industry did not anticipate CPOs to play a critical role in the optical space for several years, TSMC's TSM 0.00%↑ recent announcement may signal a faster-than-expected adoption timeline. This potentially could materially disrupt revenue streams for the leading optical component players such as Lumentum LITE 0.00%↑, Coherent COHR 0.00%↑, Applied Optoelectronics AAOI 0.00%↑ and Fabrinet FN 0.00%↑ overtime, and should be closely monitored by investors.

What are CPOs?

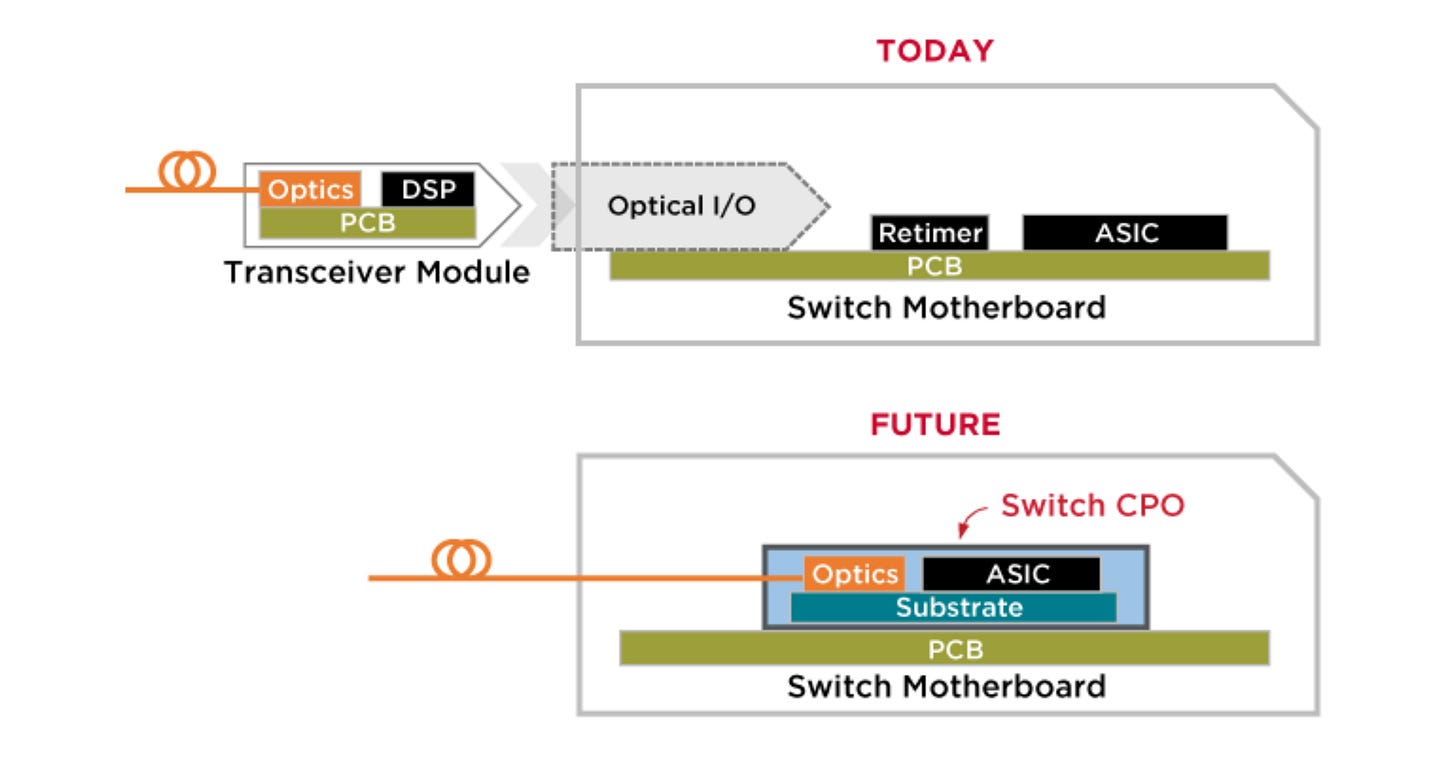

Traditional pluggable transceivers and co-packaged optics (CPOs) represent two distinct approaches to optical data transmission in high-speed networks.

Pluggable transceivers, the industry standard for decades, are external optical transceivers that connect to network switches or servers via standard ports, which we highlight below. (See deep dive on transceivers here.) These modules are designed for flexibility and modularity, allowing for easy upgrades or replacements as network demands evolve. However, as data rates have scaled to 800G and beyond, the physical limitations of pluggable optics have become more pronounced. The need for long electrical traces between the switch ASIC and the optical transceiver leads to increased power consumption, higher latency, and signal degradation, creating challenges for high-performance data center applications.

Co-packaged optics (CPOs), on the other hand, aim to address these limitations by integrating the optical transceivers directly with the switch ASIC on the same substrate or within the same package. Switches are a critical networking technology where their primary role is to receive data from one device and route it to the appropriate destinations. By dramatically reducing the distance that electrical signals must travel, CPOs minimize signal loss, reduce power consumption, and enable greater bandwidth density. This tighter integration is critical for the next generation of data center architectures, where higher speeds and energy efficiency are paramount. While CPOs offer significant advantages in performance, they come with trade-offs in terms of complexity, cost, and repairability. Unlike pluggable optics, which can be easily swapped out, CPOs require more sophisticated design and manufacturing processes, as well as new approaches to maintenance and scalability. Despite these challenges, CPOs are increasingly viewed as a necessary evolution to meet the demands of the ever-growing data economy.

Source: Broadcom

TSMC Accelerating the Adoption of CPOs

On one of the last days of 2024, TSMC revealed they have made significant progress in its silicon photonics strategy and plans to produce CPOs, with Nvidia NVDA 0.00%↑ and Broadcom AVGO 0.00%↑ expected to be the initial customers, marking a significant step forward for this emerging technology. While we believe CPOs remain years away from becoming mainstream, TSMC roadmap indicates accelerated progress, with sample deliveries planned for the 1H25 and full production beginning in the 2H25. We believe Broadcom (AVGO) and Nvidia (NVDA) are pushing to accelerate the adoption of CPOs as the industry faces mounting thermal and bandwidth challenges with traditional pluggable transceivers, especially with the transition to 1.6T modules. For example, there have been various reports of NVDA's Blackwell GB200 having thermal challenges, disrupting production. In turn, reports speculate Nvida (NVDA) plans to implement 1.6T CPO with GB300 (successor to GB200), which is planned to be released in 2H25.

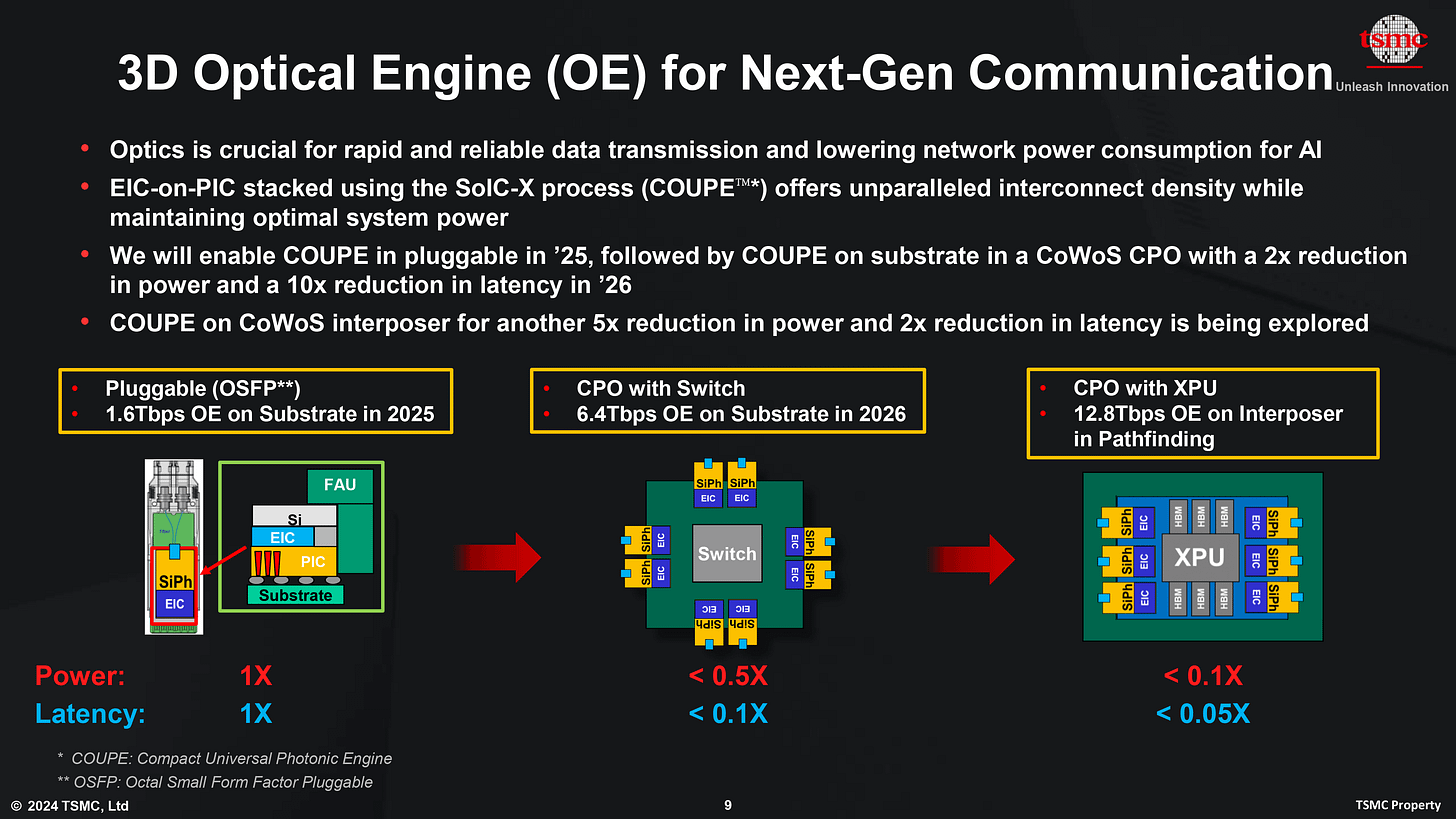

Until now, TSMC, as a semiconductor manufacturer, hasn’t been involved in the silicon photonics market. That’s changing with the launch of COUPE (Compact Universal Photonic Engine), their first 3D optical engine designed for high-speed data applications. The slide below highlights TSMC's advancements in its 3D Optical Engine (OE) technology. At the core of COUPE's design are two key components: the Electrical Integrated Circuit (EIC) and the Photonic Integrated Circuit (PIC). The EIC handles electronic signal processing, while the PIC is responsible for optical signal transmission and modulation. These components are stacked using TSMC's SoIC-X process (System-on-Integrated-Chips), enabling seamless integration of electrical and photonic technologies to achieve unparalleled performance.

Starting in 2025, TSMC plans to deploy COUPE in pluggable optics with 1.6T bandwidth on a substrate, followed by CPO integrated with switches in 2026. CPO promises a 2x reduction in power consumption and a 10x decrease in latency compared to traditional pluggable transceivers. Looking further ahead, TSMC is exploring COUPE integration on CoWoS interposers (Chip-on-Wafer-on-Substrate) with advanced processors, targeting even greater performance improvements.

Source: TSMC

Why CPOs Threaten Traditional Optical Vendors?

The rise of CPOs is poised to disrupt traditional pluggable optical transceiver vendors, as demand for their primary revenue source, transceivers, could decline significantly over time. Today, pluggable transceivers, such as 800G modules, are sold at premium prices ranging from $400 - 500 per module, and the industry purchases hundreds of thousands, if not millions of these modules annually to support rapidly growing data center and network infrastructure. This has been a critical revenue driver for companies specializing in pluggable optics such Lumentum (LITE), Applied Optoelectronics (AAOI), Coherent (COHR) and Fabrinet (FN). However, as CPO technology matures, the integration of optical components directly with switch ASICs will likely reduce the need for standalone transceivers in many high-performance applications, thereby cutting into this lucrative market.

While traditional vendors will still provide discrete optical components, such as lasers, modulators, and photodetectors for CPOs, these products command much lower prices. For example, lasers typically sell for less than $5-$10 per chip. This stark price disparity highlights the potential revenue compression traditional vendors may face as CPO adoption grows. The transition to CPOs will force optical component makers to adapt their strategies, potentially focusing on high-volume, low-margin manufacturing or finding ways to add value through advanced packaging and integration technologies to remain competitive in this evolving market.

Who Will Benefit Most From CPOs?

We believe the transition to CPOs will benefit switch chip providers greatly. Broadcom (AVG) and Nvidia (NVDA), which currently controls ~70% of the switch chip market, are well-positioned to capitalize on this shift, with Marvell MRVL 0.00%↑ serving as a smaller third-market player. Industry reports suggest that CPO switch chips could cost up to 2x more than traditional switch chips designed for use with pluggable optics, reflecting the significant revenue opportunities for leading switch chip vendors.

We also believe switch box vendors, which provide fully assembled hardware units that include a chassis, power supplies, cooling systems, and integrated switch chips are in position to benefit from the transition to CPOs as data centers and enterprise networks need to upgrade their infrastructure to 1.6T and beyond bandwidth speeds. We believe companies such Arista Networks ANET 0.00%↑, Cisco CSCO 0.00%↑, Juniper Networks JNPR 0.00%↑, as well as Nvidia’s networking division (formerly Mellanox) are best positioned suppliers of switch boxes for hyperscalers and enterprises.

CPOs Will Take Time And Massive Pluggable Opportunity Remains

While CPOs seem to be advancing rapidly, particularly with TSMC's recent announcement, several hurdles remain before widespread adoption can occur. Signal compatibility and troubleshooting are significant challenges, as CPO systems lack the modularity of pluggable transceivers, which can be easily replaced or upgraded in case of failure. We also believe companies will adopt a hybrid approach, using a mix of pluggable transceivers and CPOs to balance performance, scalability, and operational flexibility.

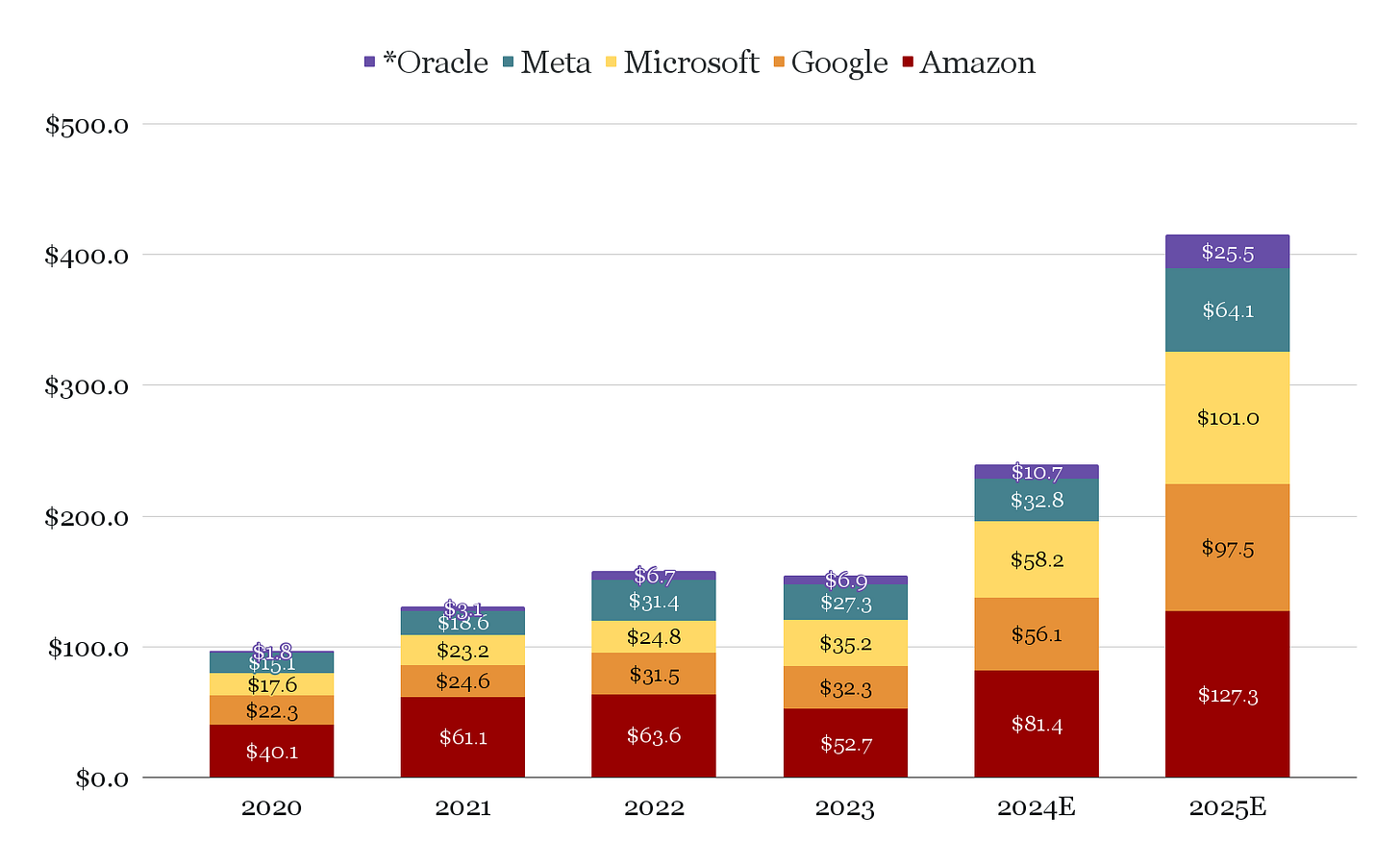

In turn, we believe the traditional optical pluggable market is still poised for massive growth over the coming years driven by the robust adoption of AI technologies and applications, and presents substantial opportunities for optical component suppliers. Hyperscalers are aggressively planning datacenter capex expansions in 2025, including tech giants like Microsoft MSFT 0.00%↑ and META 0.00%↑ who have already announced they are doubling their capex runrate in 2025 to support the exponential growth of AI applications and data-intensive workloads. Below we highlight hyperscalers historical capex trends, as well as our latest 2025 capex estimates. This unprecedented investment in next-generation data center infrastructure will drive significant demand for optical components. Furthermore, the Stargate project launched under the Trump administration, which is a $500B joint venture between OpenAI, SoftBank, Oracle, and MGX to build advanced AI computing infrastructure in the U.S. adds further momentum to this trend. Together, we believe these factors position optical vendors to benefit immensely from the scaling of AI and advanced communication systems in the coming years.

Hyperscalers Capex Spend

Source: Company Filings, Industrial Tech Stock Analyst

While we believe optical component suppliers have significant growth potential in the near term, we strongly advise investors to closely monitor the evolution of CPOs. To mitigate this risk, investors could focus on more diversified suppliers such as Lumentum (LITE), Coherent (COHR), and Fabrinet (FN), which not only have exposure to the pluggable market but also offer a broader range of optical components and services to a variety of industries. These companies maybe better positioned to adapt to market shifts and capitalize on opportunities across multiple segments, providing a more balanced approach to navigating the rapidly evolving optical ecosystem.

Research Disclaimer: We actively write about companies in which we invest or may invest. From time to time, we may write about companies that are in our portfolio. Content on this site including opinions on specific themes and companies in technology, market estimates, and estimates and commentary regarding publicly traded or private companies is not intended for use in making any investment decisions and provided solely for informational purposes. We hold no obligation to update any of our projections and the content on this site should not be relied upon. We express no warranties about any estimates or opinions we make.

Thanks for the article. CPO supply chain should look a lot like SiPh's. Could SOI (silicon-on-insulator) and even InP (indium phosphide epi) providers become hidden gems in the CPO race? If not mistaken, most SiPh uses SOI (Soitec), and Intel uses large areas of InP epi wafer (IQE, Landmark Opto) for their pluggable SiPh to replace various discrete components. Compound on Si from Aeluma may be quite interesting as well? Testing providers like Chroma and Aehr will likely do really well too.

The biggest losers are probably the discrete optical component companies?