Delays Continue, But Ondas Q3 Robust Order Growth Provides Strong Visibility into Q4 / 2025 Ramp

Key Takeaways: Ondas ONDS 0.00%↑ reported mixed 3Q24 results as revenues came in slightly below expectations, which were led by extended timelines related to the Class 1 railroad network upgrade. However, the company secured $14.4M in purchase orders for their Optimus drone solution and new counter unmanned aerial system (C-UAS) Iron Drone in Q3, which almost all of it is expected to be fulfilled in Q4 / Q1 of next year. Given the robust growth in backlog, the Company sounded very upbeat on their outlook and growth accelerating in 2025 driven by their Autonomous segment. Shares traded slightly down ~1%+ on these results, but the overall market was down and we suspect investors are likely encouraged given the robust backlog and visiblity.

Despite minimal Q3 revenues, we were encouraged with the robust order growth in the Autonomous division, and do believe the company is seeing greenshots in the Network business. Although our biggest concern around additional capital needs remains present, our positive outlook on Ondas long term remains unchanged. We believe Ondas Networks and Ondas Autonomous are strongly positioned in two robust secular tech trends that are both still in the early innings of adoption. Furthermore, we are incrementally more upbeat on the company’s outlook under a new Trump Administration who we suspect will invest significantly in the military and boarder security, as well as put an emphasis on sourcing domestically. Although investors need to be patient as we expect sales will be lumpy over the next couple of years, we suspect patient investors will be rewarded with a 3-5 year horizon. In turn, we remain buyers.

View detailed historical results in our full downloadable financial excel model here.

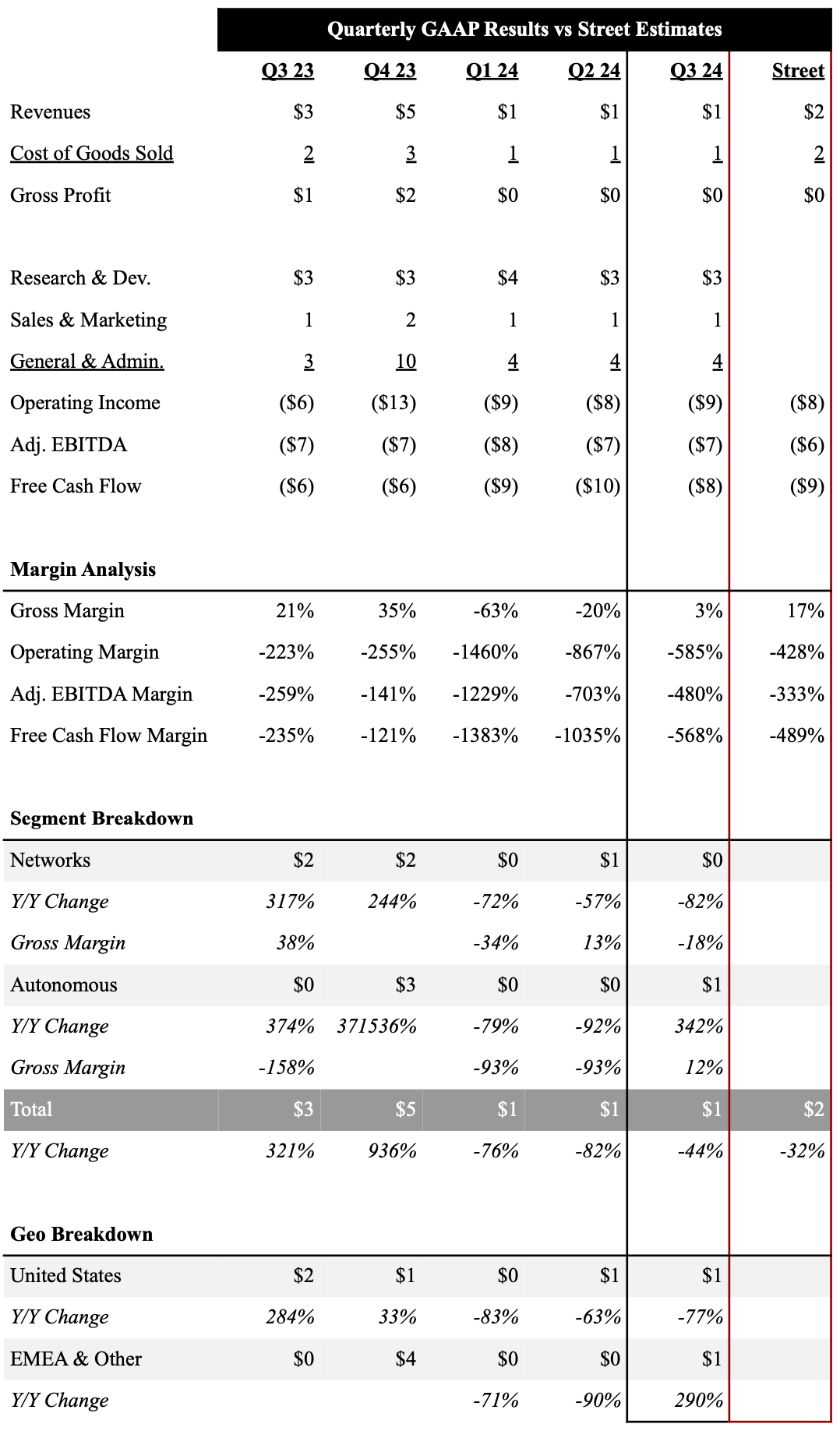

Source: Company Filings, FactSet; Data In Millions

Investor Gifts

Looking to become a better investor or need to find that perfect gift for your finance friend? Check out these products from our partner Investor Gifts like their 2025 Investor Calendar.

✓ US Economic Release Dates

✓ Option Expiration Dates

✓ Market Holidays

✓ Historical Market Returns

SAVE 20% with our exclusive promo SAVE20 at checkout!

3Q24 Earnings Summary

Ondas reported 3Q24 revenues of $1.5M, which were down ~44% Y/Y and came in slightly below consensus expectations ($1.8M). Ondas Network revenues were $0.4M, down ~82% Y/Y. The decrease in Network revenue was primarily a result of extended timelines related to 900 MHz activity with the Class I railroads. While discouraged with the delay, Ondas still met meaningful milestones in the quarter and we believe the company is progressing toward a significant ramp in 2025. Ondas highlighted their visibility from railroad customers is improving with respect to plans for the new 900 MHZ network. This is highlighted by the order received by Siemens from Metra for a planned system-wide 900 MHz upgrade to support their passenger operations in Chicago. The Metra order was followed by the expansion of a 900 MHz network for a Class I railroad, also in Chicago, that has been in live operation for nearly a year. Although uncertainty around high-volume orders remains, we continue to believe the Network upgrade of the Class 1 North American rail network remains a multi-billion TAM. Deadlines for railroads to move off the legacy network is September 2025, with a buildout requirement deadline of April 2026. This gives us confidence that if delays continue throughout 2024, the company will be in position for a material ramp in 2025.

Ondas Autonomous business generated $1.0M in sales, which was up ~342%. In addition, the company generated $14.4M in new orders from what we believe is the Israeli Military, which included $9.0M for their new Iron Drone C-UAS system and $5.4M in Optimus systems with deployments intended to support the protection of critical assets at military bases and borders under challenging environmental conditions. Ondas also is making meaningful strides with US and international government agencies for a variety of inspection and security applications. The company expects significant growth to return in Q4 as they begin to deliver on this backlog over the next two quarters.

Due to the Q3 revenue shortfall Ondas reported gross margins of 3.2%. However, in-light of the revenue decline, the company reported an adjusted EBITDA loss of $7.1M, which was higher than consensus expectations ($6.0M). Given near term deployment delays, the company is expected to keep tight control on costs. However, Ondas ended the quarter with ~$2.9M in cash. The Company expects to fund its operations from the cash on hand, proceeds from financing activities, gross profits generated from revenue growth, potential prepayments from customers for purchase orders, potential proceeds from warrants issued and outstanding, and additional funds that the Company may seek through equity or debt offerings and/or borrowings under additional notes payable, lines of credit or other sources.

We were a bit surprised the company did not acknowledge / reiterate the near and longer term revenue targets Ondas provided at their investor day in September. Revenues were projected as is: 2024 = $7.6-8.6M, 2025 = $15-18M and 2026 = $35-38M. Rather the company indicated, they expect a recovery in revenue growth in Q4 driven primarily by the OAS business unit as the company fulfills backlog, while revenue expectations for Ondas Networks are modest in Q4.

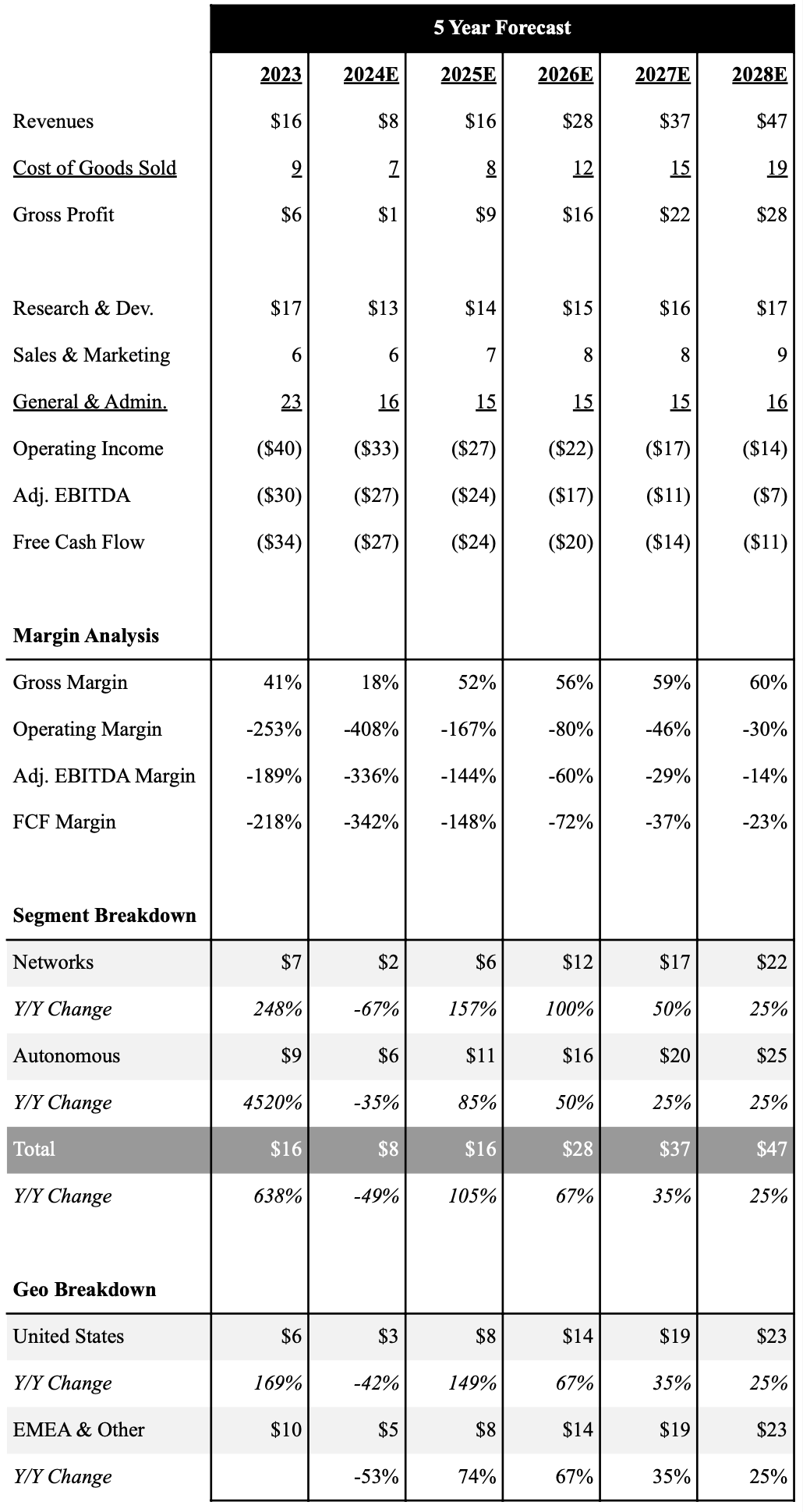

5-Year Financial Outlook

Following 3Q24 results, which also factors in the company’s updated guidance at their investor day, we lowered our financial estimates. We now forecast 2024 sales declining ~49% Y/Y to $8.0M. The decline is driven by reducing our 2024 Network revenues from $3.4M to $2.2M, while our 2024 Autonomous revenues are lowered to $5.8M from $11.0M. Looking into 2025, we expect pent up demand for new railroad deployments and accelerating commercial and defense drone shipments to drive revenues to $16.5M, which is in-line with the company’s previous guidance ($15-18M). We expect this momentum to continue with growth exceeding 25%+ annually through 2028, exceeding ~$46M in revenues at that time. However, we believe revenues on a quarterly basis will be lumpy given there is some uncertainty around the timing of these large railroad and commercial drone deployments.

We continue to believe the company will benefit from scale efficiencies in the years to come as the business scales, and exceed gross margins of 60% by 2028. We also believe Ondas will see solid operating leverage, but we do believe the company will need to either significantly cut opex or do a meaningful capital raise to get to profitability. Our model expects the company needs ~$70M in additional capital to fund our current growth trajectory throw 2028. This rational is why we believe the company should spin out the Autonomous segment into a separate entity.

Below is an overview of our 5 year outlook with a full downloadable financial excel model here.

Source: Industrial Tech Analyst; Data In Millions

Investment Thesis

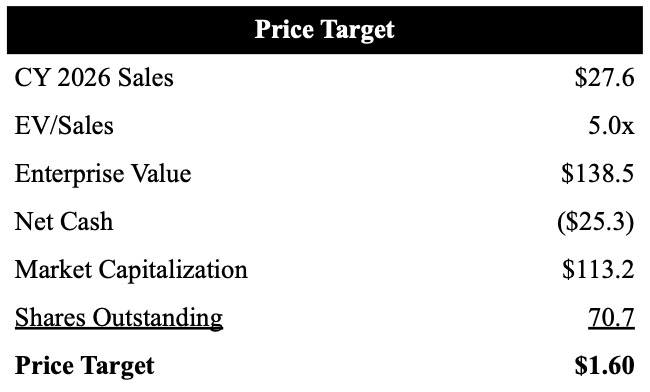

We believe Ondas Networks and Ondas Autonomous are strongly positioned in two robust secular tech trends that are both still in the early innings of adoption. First, Class 1 North American rail operators are in the beginning of a major network upgrade cycle. We believe Ondas Network’s FullMAX platform will be an attractive solution to drive more intelligence to the edge for rail operators, and allow the company to capture a meaningful portion of this estimated $1.3B upgrade opportunity. Second, we believe the commercial and defense drone industry is growing into a multi-billion dollar annual market opportunity as significant advancements in automation and AI are driving adoption across a growing number of verticals. We believe Ondas Autonomous recently awarded airworthiness Type Certification for their Optimus System makes them an early leader in the quickly emerging commercial drone industry. We anticipate the combination of a robust railroad upgrade cycle and accelerated commercial drone deployments can drive 25%+ annual revenue growth over the next 5 years. Although Ondas will need to raise additional capital to fund this aggressive growth, we believe there is meaningful upside given the market opportunity infront of the company. Our robust outlook drives our bullish stance on Ondas shares and price target of $1.60.

As shown below, based on our 2026 calendar year revenue estimate of $27.6M and 5x EV/Sales multiple, we value Ondas shares at $1.60.

Source: Industrial Tech Analyst, Data In Millions Except Price Target

Research Disclaimer: We actively write about companies in which we invest or may invest. From time to time, we may write about companies that are in our portfolio. Content on this site including opinions on specific themes and companies in technology, market estimates, and estimates and commentary regarding publicly traded or private companies is not intended for use in making any investment decisions and provided solely for informational purposes. We hold no obligation to update any of our projections and the content on this site should not be relied upon. We express no warranties about any estimates or opinions we make.