European Challenges Create Headwinds, But Materialise Sell-Off Overdone Creating Buying Opportunity

View all MTLS reports and link to our research disclaimer.

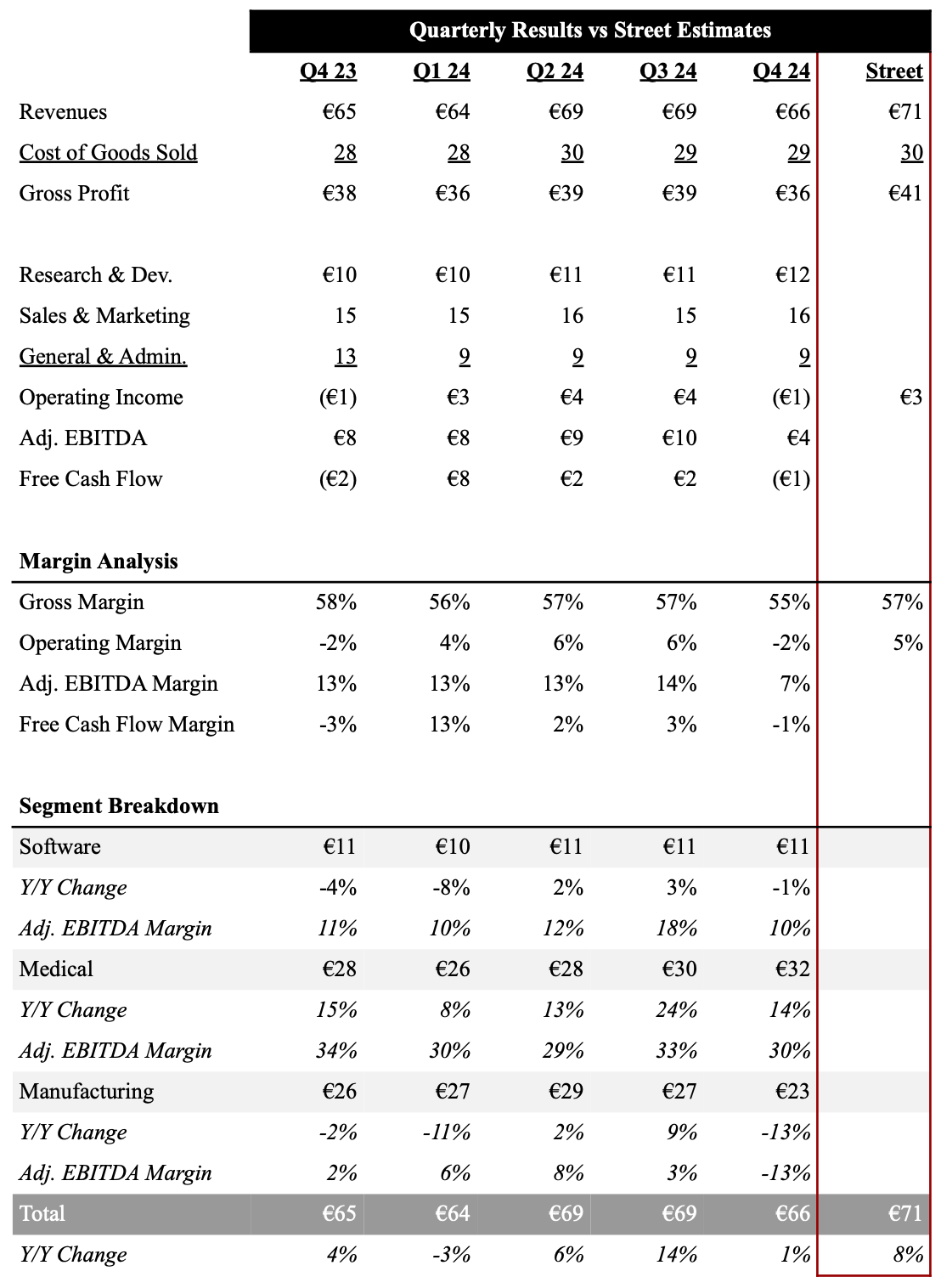

Key Takeaways: Materialise MTLS 0.00%↑ reported Q4 revenue of €66M, a modest ~1% increase Y/Y, but falling short of analyst expectations of €71M. While the Medical segment achieved record-high revenues, growing 14% Y/Y to €32M, the revenue miss was primarily driven by ongoing challenges in the European industrial sector, which weighed on the Manufacturing division. Looking ahead, the company provided a cautious revenue outlook, noting that macroeconomic headwinds in Europe are expected to continue pressuring the Manufacturing division throughout 2025. As a result of the Q4 miss and the downbeat guidance, shares of Materialise traded down 30%+.

We were very surprised and disappointed by Materialise’s Q4 results. While our preview accurately predicted robust demand for Medical sales, and we acknowledged that European macroeconomic challenges could weigh on the Manufacturing business, we did not anticipate this level of deceleration in the segment. The weaker-than-expected revenue, combined with higher opex spending, led to profit estimates falling short of our expectations. While we were concerned that elevated R&D expenses could pressure margins, we believe that a majority of the operating expense increases were tied to ACTech startup costs and FEops (3Q24 acquisition) integration, which are largely one-time in nature. As a result, we could see operating expense growth become more controlled in the coming quarters. Despite the disappointing top-line performance, cash from operations increased 56% Y/Y to €31M in 2024, reflecting the company’s ability to generate strong cash flow. While we expect investors to react negatively to the results and the softer 2025 outlook, we view this as a macro-driven issue rather than a structural problem. We continue to believe Materialise is well-positioned to flourish across all three business segments, with Medical maintaining mid-teen growth and Manufacturing poised to recover once macro headwinds subside. Although we were wrong on Materialise’s 2025 growth outlook, we view this as an incredible buying opportunity for long term oriented investors.

View detailed historical results in our downloadable financial model.

Source: Company Filings, FactSet; Data In Millions

Investor Gifts

Looking to become a better investor or need to find that perfect gift for your finance friend? Check out these products from our partner Investor Gifts like their 2025 Investor Calendar.

Key 4Q24 Earnings Takeaways

Materialise reported 4Q24 revenues of €66M, which was up ~1% Y/Y but came in below consensus expectations (€71M). The Medical segment led growth with a ~14% Y/Y increase to €32M, driven by a 15% rise in medical device sales and a ~14% uptick in medical software sales. The Manufacturing segment faced challenges, with revenue decreasing by ~13% to €23 million, primarily due to European industrial sector headwinds that impacted prototyping sales. The Software segment experienced a ~1% decline to €11M, impacted by a ~35% decrease in non-recurring software sales, despite a ~19% growth in CO-AM software sales.

Materialise gross margin in 4Q24 was down 210 bps Y/Y to ~55%, which was driven by lack of scale efficiencies. Adjusted EBITDA in the quarter was €4M, down 49% Y/Y, which was driven by lower revenues and higher opex in R&D, FEops integration and startup costs for their new ACTech division. However, ~€2M of these expenses were one-time in nature. From a segment perspective, Medical adjusted EBITDA margins remain were ~30% in the quarter, but down from 34% Y/Y. Software adjusted EBITDA margins of ~10%, were down from ~11% Y/Y as a result of continued elevated investments into their CO-AM platform. Meanwhile, Manufacturing adjusted EBITDA margins of -13% were down materially as a result of lower revenues and higher-spend into ACTech startup costs. However, the company generated €6M in cash from operations in Q4, and €32M for the full year, which as up ~56% Y/Y. Driven by expected accelerated capex investments in Q4 that is related to ACTech expansion, free cash flow in the quarter broke even. These investments are expected to begin to decline in the coming quarters.

Looking ahead to 2025, Materialise anticipates consolidated revenues between €270 - 285M, reflecting ~4% Y/Y growth rate at the midpoint, but came in well below consensus of €305M. They anticipate the strongest revenue growth to come from our the Medical segment. Materialise Software will continue its transition towards a cloud-based subscription business model, which will impact its revenue growth potential. Furthermore, they anticipate the difficult macroeconomic environment will persist throughout 2025, specifically in the European industrial sector, which will impact the performance of theManufacturing segment. The company will continue investing in their Materialise Medical and Software segments while keeping a strong focus on cost control and optimization in particular in our Materialise Manufacturing segment in 2025. In turn, they anticipate Adjusted EBIT will be in the range of €6 - 10M, which also missed consensus mid-teen adusted EBIT target. That said, we view this guidance as conservative as we expect Management taking a cautious approach given the industrial manufacturing uncertainty, as well as potential implications on European tariffs from the Trump Administration.

Below we dive deeper into our updated 5-year outlook, investment thesis and price target.