Extended Timelines and Supply Chain Delays Continue To Disrupt 2Q24 Results, But Ondas Autonomous Gaining Global Traction

Key Takeaways: Ondas ONDS 0.00%↑ reported mixed 2Q24 results as extended timelines related to the Class 1 railroad network upgrade and supply chain disruption in their Autonomous business impacted sales in the quarter. However, strong cost controls drove a modestly lower than expected adjusted EBITDA loss. Management was disappointed with their 1st half performance, and highlighted visibility into additional Network purchase orders and deployment plans remains limited for 2024, which does not surprise us. However, the Company sounded very upbeat on their outlook and growth accelerating in 2H24 driven by their Autonomous segment. Ondas has not provided quantitative 2024 guidance, but continues to expect to generate significant revenue growth for the full year. Shares traded down ~10%+ on these results given the likelihood aggressive 2024 and 2025 estimates will need to be reduced.

While discouraged with Ondas results, as we highlighted in our preview we expected these large network upgrades and drone deployments will take time and anticipate revenues can be lumpy quarter-to-quarter. That said, we were specifically encouraged with the traction the Company is already seeing with their newly launched counter drone products. Although our biggest concern around additional capital needs remains present, our positive outlook on Ondas long term remains unchanged. We believe Ondas Networks and Ondas Autonomous are strongly positioned in two robust secular tech trends that are both still in the early innings of adoption. Although the company will need to raise cash, which could include spinning out the Autonomous business, we believe the stock accretion opportunity significantly outweighs future dilution. The Company announced an investor day that will take place in September, and will be focused on the Autonomous business. We expect to hear long term funding plans at this event. That said, we remain buyers of Ondas with a 3 - 5 year horizon.

View detailed historical results in our full downloadable financial excel model here.

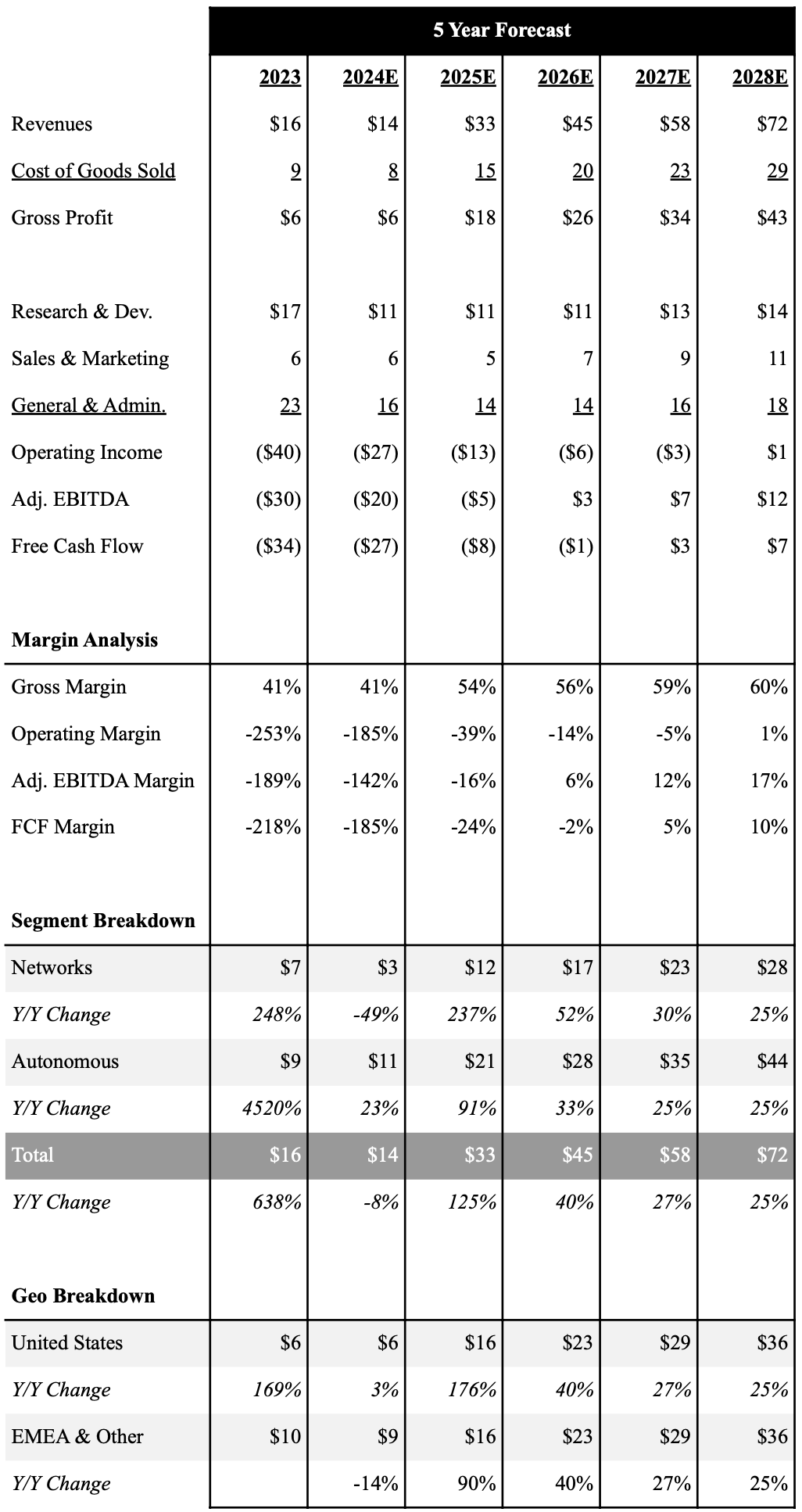

Source: Company Filings, FactSet; Data In Millions

2Q24 Earnings Summary

Ondas reported 2Q24 revenues of $1.0M, which were down 82.5% Y/Y and came in slightly below consensus expectations ($1.2M). Ondas Network revenues were $0.7M, down 56.6% Y/Y. The decrease in Network revenue was primarily a result of extended timelines related to 900 MHz activity with the Class I railroads. While discouraged with the delay, Ondas still met meaningful milestones in the quarter. They progressed field activity in the 900 MHz network which has led to an initial orders by their distribution partner on behalf of a commuter railroad in the Southwest. Although uncertainty around high-volume orders remains, we continue to believe the Network upgrade of the Class 1 North American rail network remains a multi-billion TAM. Deadlines for railroads to move off the legacy network is September 2025, with a buildout requirement deadline of April 2026. This gives us confidence that if delays continue throughout 2024, the company will be in position for a material ramp in 2025.

Ondas Autonomous business generated $0.3M in sales, which was down 92.4%. Supply chain disruptions connected to the Gaza War, was the primary driver to the sales decline. That said, Ondas secured a key contract with the United States Coast Guard (USCG) for maritime emissions monitoring to support Environmental Protection Agency (EPA) Clean Port initiatives at the Ports of Los Angeles and Long Beach. The operational contract positions the Company as a prime vendor for a U.S. federal agency and presents an opportunity for a potential program of record. Furthermore, Ondas received an initial order from a major government military customer in July 2024 to provide the first Iron Drone Raider counter drone systems for operational deployment. An expansion of the order was already received in August 2024 with potential for additional volume orders expected in the second half of 2024 based on combat success in operational conditions. They expect growth to resume in the second half as Optimus System inventory availability improves and Iron Drone production accelerates. Ondas remains upbeat about the Autonomous seeing strong growth on a Y/Y basis in 2H24.

Due to the revenue shortfall and high fixed costs, Ondas reported gross margins of -19.9%. However, inlight of the revenue decline, the Company managed to control opex costs and reported an adjusted EBITDA loss of $6.7M, which was slightly better than consensus expectations ($6.9M). Given near term deployment delays, the Company is expected to keep tight control on costs. However, Ondas ended the quarter with ~$5M in cash. Ondas is currently evaluating their options to raise additional capital, and we believe we will get more detail about this at their Investor Day in 3Q24.

Ondas does not provide formal 2024 guidance, but continues to expect to generate significant revenue growth in 2H24 driven by growing customer activity increasing in the Autonomous business. Revenue visibility is expected to remain challenging in the Networks business in 2024, but we expect an improvement in 2025 given deployment rollout deadlines.

5-Year Financial Outlook

Following 2Q24 results, we lowered our revenue estimates largely due to timing delays in the Network business. We now forecast 2024 sales declining 8.1% Y/Y to $14.4M, which is down from our original estimate of $20.0M. The decline is driven by reducing our 2024 Network revenues from $7.2M to $3.4M, while our 2024 Autonomous revenues are modestly lowered to $11.0M from $12.9M. Looking into 2025, we expect pent up demand for new railroad deployments and accelerating commercial and defense drone shipments to drive at least 125%+ revenue growth. We expect this momentum to continue with growth exceeding 25%+ annually through 2028, exceeding ~$72M in revenues at that time. However, we believe revenues on a quarterly basis will be lumpy given there is some uncertainty around the timing of these large railroad and commercial drone deployments. We do want to highlight consensus estimates heading into 2Q24 earnings implied revenues growing ~350% Y/Y to $72.1M in 2025, which we believe was a bit aggressive. Although the TAM Ondas addresses in both markets is massive, we expect 2025 estimates will be reduced significantly.

Due to the tough Q1 we now expect gross margins to improve 80 bps in 2024 to 41.5% driven by scale efficiencies in 2H. We continue to believe the company will benefit from further scale efficiencies in the years to come as the business scales, and exceed gross margins of 60% by 2028. We expect Ondas to report adjusted EBITDA loss of $20.5M in 2024. As revenues scale up in the following years, we believe Ondas can exceed 15% adjusted EBITDA margins or $12.2M in adjusted EBITDA by 2028. Improving profitability will also translate into improving free cash flow, but we do expect the company needs ~$30M in additional capital to fund our current growth trajectory.

Below is an overview of our 5 year outlook with a full downloadable financial excel model here.

Source: Industrial Tech Analyst; Data In Millions

Investment Thesis

We believe Ondas Networks and Ondas Autonomous are strongly positioned in two robust secular tech trends that are both still in the early innings of adoption. First, Class 1 North American rail operators are in the beginning of a major network upgrade cycle. We believe Ondas Network’s FullMAX platform will be an attractive solution to drive more intelligence to the edge for rail operators, and allow the company to capture a meaningful portion of this estimated $1.3B upgrade opportunity. Second, we believe the commercial and defense drone industry is growing into a multi-billion dollar annual market opportunity as significant advancements in automation and AI are driving adoption across a growing number of verticals. We believe Ondas Autonomous recently awarded airworthiness Type Certification for their Optimus System makes them an early leader in the quickly emerging commercial drone industry. We anticipate the combination of a robust railroad upgrade cycle and accelerated commercial drone deployments can drive 25%+ annual revenue growth over the next 5 years. Although Ondas will likely need to raise additional capital to fund this aggressive growth, we believe the stock accretion opportunity over the next 3 - 5 years outweighs the possibility of future dilution. Our robust outlook drives our bullish stance on Ondas shares and price target of $1.66, which equates to ~160% upside at current levels.

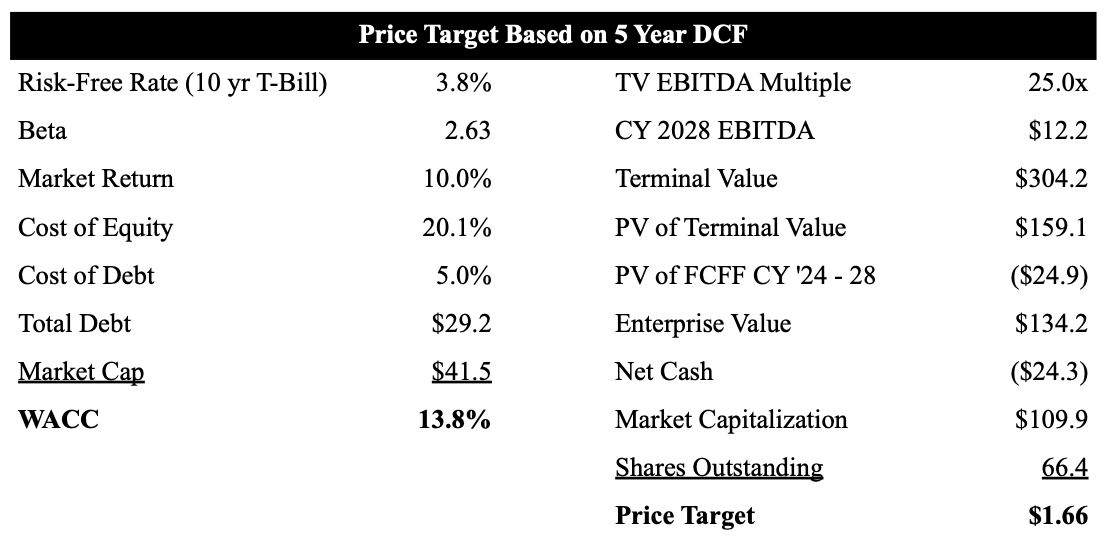

As shown in our table below we use a 5 year DCF model to value Ondas shares. Our price target is driven by a terminal EBITDA multiple of 25x, which is in-line with our high growth industrial tech comp group. We lowered our price target to $1.66 from $2.91, due to higher share count, lower net cash balance and lower estimates.

Source: Industrial Tech Analyst, Data In Millions Except Price Target

Looking to become a better investor or need to find that perfect gift for your finance friend?

Check out these products from our partner Trading Roadmap.

Research Disclaimer: We actively write about companies in which we invest or may invest. From time to time, we may write about companies that are in our portfolio. Content on this site including opinions on specific themes and companies in technology, market estimates, and estimates and commentary regarding publicly traded or private companies is not intended for use in making any investment decisions and provided solely for informational purposes. We hold no obligation to update any of our projections and the content on this site should not be relied upon. We express no warranties about any estimates or opinions we make.