Impinj Positively Surprises With IP Settlement Award That Helps Crush Q2 Expectations, Moving To Hold On Lower Profitability Concerns

Impinj reported solid 1Q24 results, which came in above Managements and Street expectations. However, as a result of the positive settlement related to the NXP patent lawsuit, Impinj provided significantly better 2Q24 guidance. Strong Q1 results and guidance had shares up 10%+ after-earnings and we expect shares to trade even higher in the near term with improving profitability expectations.

As a result of this newly announced ongoing IP fee, faster than expected demand recovery for endpoint ICs and strong cost controls, our concern about Impinj’s lofty profitability expectations has dwindled. In turn, we see limited downside given the positive catalysts that will be taken from the Q1 earnings call, but feel shares are fully valued and move to a HOLD rating. In the event of a meaningful pullback we would use the opportunity to consider building a position given Impinj’s long term growth opportunity.

Key Results vs Consensus Expectations

1Q24 Results

Revenue $76.8M BEAT consensus $73.6M

Adjusted EBITDA $6.7M BEAT consensus $3.5M

2Q24 Guidance

Revenue $96.0 - 99.0M BEAT consensus $79.0M

Adjusted EBITDA $23.9 - 25.4M BEAT consensus $6.4M

Key 1Q24 Earnings Takeaways

Impinj generated $76.8M in revenues in Q1, which was down 10.6% Y/Y but came in above the high-end of Managements guidance ($72 - 75M) and consensus estimates ($73.6M). Endpoint IC revenues were $61.5M in Q1, down 8.3% Y/Y, as elevated inventory levels at key retail customers remain a headwind to growth. That said, Management acknowledged that they are seeing an improvement in restocking behavior, and are cautiously optimistic about a more meaningful retail recovery in 2H24. Impinj did highlight they are seeing strong success in verticals outside of retail, where they called out strong traction with a 2nd logistics company. In addition, progress with food applications is moving faster than expected, presenting potential for a meaningful incremental driver for the endpoint IC business. Impinj’s System revenue was $15.3M, down 18.7% Y/Y.

The surprise of the quarter was the significantly better Q2 revenue and adjusted EBITDA guidance. Impinj expects 2Q24 revenues to be $96 - 99M (consensus $79M), and adjusted EBITDA in the range of $23.9 - 25.4M (consensus $6.4M). However, the upside is purely driven by the positive settlement awarded to Impinj from the patent lawsuit with NXP. As part of the settlement, NXP made a one time cash payment to Impinj in 1Q24 of $45M. However, starting in Q2 NXP is required to pay Impinj $15M annually for the next 10 years, as long as they continue to use specific IP owned by Impinj. This $15M has 100% gross margin. When backing out the $15M, which will fall into IC Endpoint revenue, we believe Impinj is expected to generate ~$81 - 84M in Q2 revenues. This would imply revenues being down mid-single digits Y/Y on an organic basis. Furthermore, when adjusting for the $15M IP fee, we believe Impinj would generate $6.7 - $8.2M in adjusted EBITDA in Q2. Management mentioned on the call, they intend to further monetize their IP, which we believe could be a meaningful profitable growth driver if proven successful.

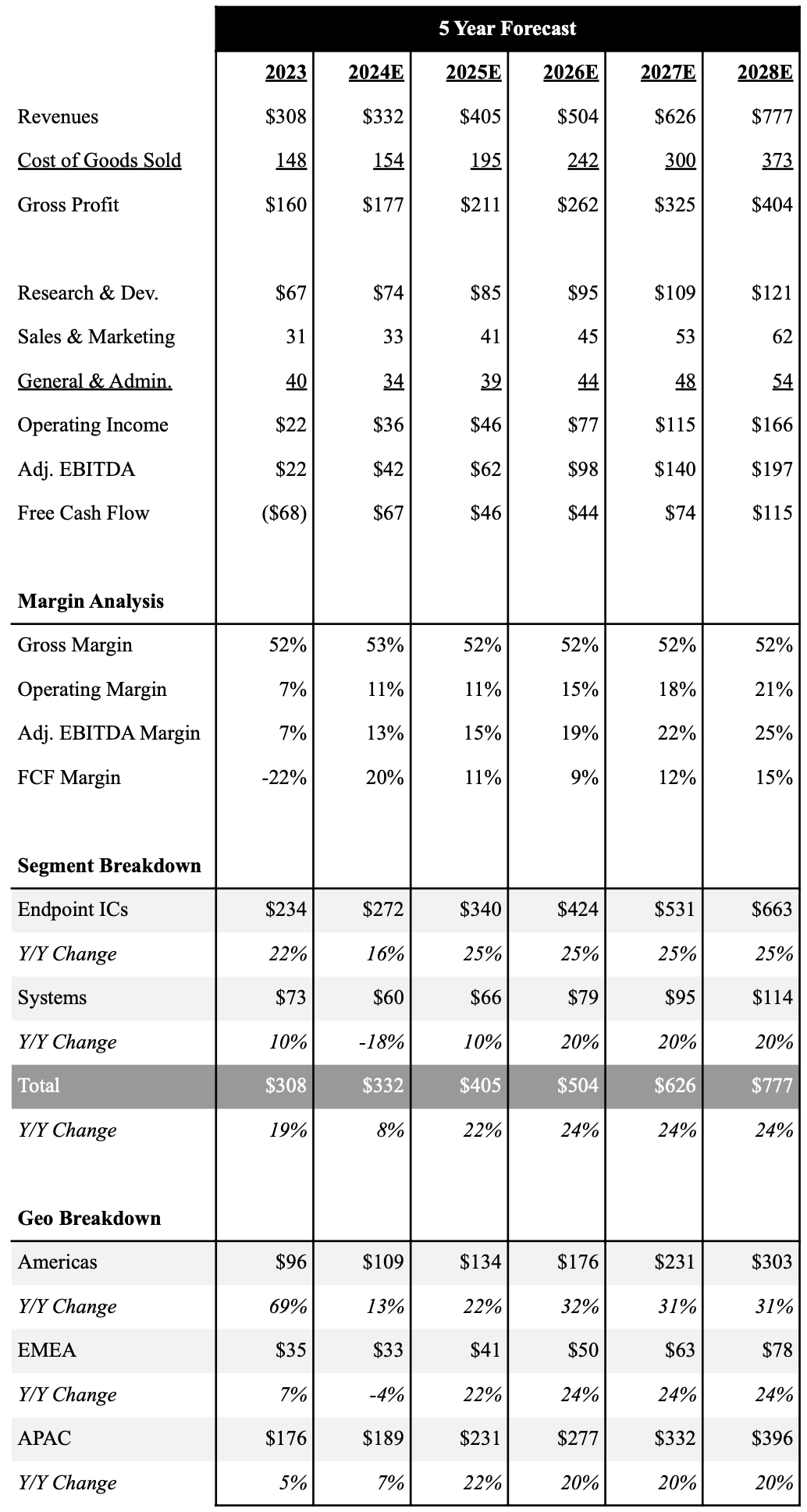

5-Year Financial Outlook

Following the better 1Q24 results and announced IP award, we have increased our financial estimates. Although inventory levels remain elevated, the company continues to see positive greenshots in retail and robust traction in other emerging verticals. Although cautiously optimistic the operating environment improves in 2H24, we do believe the company can grow ~8% Y/Y with the help of the $15M IP fee. As we enter 2025 and inventory levels normalize, we believe Impinj can sustain 20%+ revenue growth for the next several years as RAIN RFID becomes increasingly adopted in several industries.

We do believe the company has a scalable operating model, but Impinj will need to continue to invest in R&D to maintain its leadership in the RAIN market. Although we do not expect meaningful revenue growth in 2024, we expect Impinj to improve operational efficiencies and see modest operating margin expansion that will result in $41.9M in adjusted EBITDA in 2024. Assuming the company can grow in-line with the overall industry, we foresee the company hitting ~25% adjusted EBITDA margins in 2028. We expect the company to generate $100M+ in free cash flow per year by 2028. Our higher profitability and cash flow estimates are driven by the assumption that the $15M annual fee continues through 2028.

Below is an overview of our 5 year outlook with a full financial model here.

Source: Industrial Tech Analyst

Investment Thesis

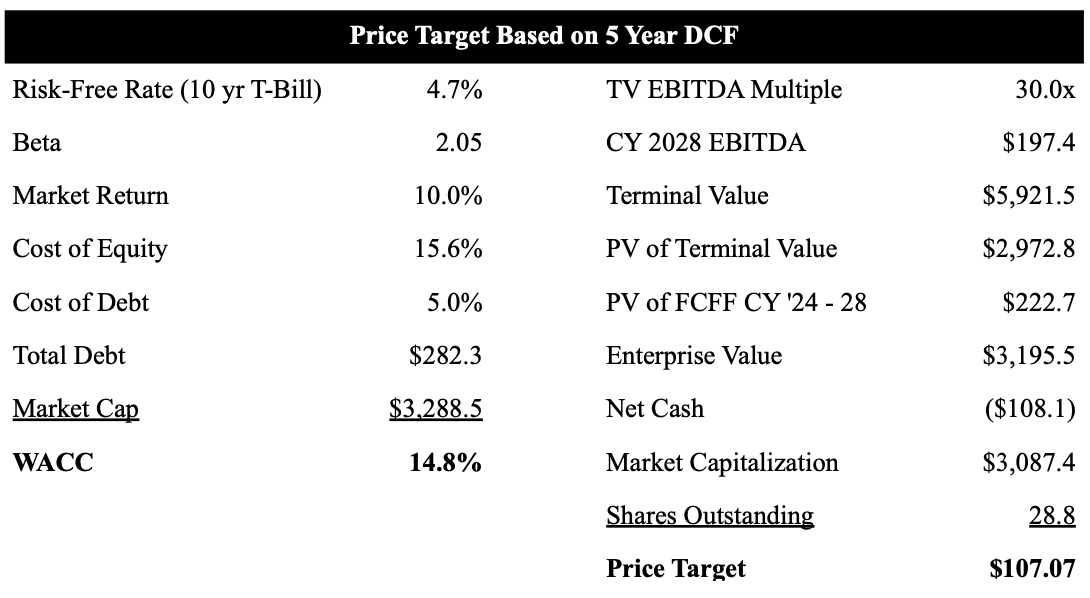

We believe Impinj is a clear leader in the fast emerging RAIN RFID industry, which we anticipate will be one of the fastest growing tech markets over the next 5 years. We believe expansion across Impinj core markets, retail and logistics, and new verticals will enable the company to see 20%+ growth return. Heading into 2024, elevated inventory levels remain a headwind, and we are cautiously optimistic of a stronger recovery in 2H24. However, as a result of this newly announced annual IP fee, faster than expected demand recovery for endpoint ICs and strong cost controls, our concern about Impinj’s lofty profitability expectations has dwindled. In turn, we see limited downside given the positive catalysts that will be taken from the Q1 earnings call, but feel shares are fully valued and move to a HOLD rating. That said, expectations still remain high and in the event of a meaningful pullback we would use the opportunity to consider building a position given Impinj’s long term growth opportunity. As shown in our table below we use a 5 year DCF model to value Imping shares. Based on our current forecast we value Impinj shares at $107.07. We increased our price target as a result of the annual IP fee and lower assumed costs.

Source: Industrial Tech Analyst

Looking to become a better investor or need to find that perfect gift for your finance friend?

Check out these products from our partner Trading Roadmap.

Research Disclaimer: We actively write about companies in which we invest or may invest. From time to time, we may write about companies that are in our portfolio. Content on this site including opinions on specific themes and companies in technology, market estimates, and estimates and commentary regarding publicly traded or private companies is not intended for use in making any investment decisions and provided solely for informational purposes. We hold no obligation to update any of our projections and the content on this site should not be relied upon. We express no warranties about any estimates or opinions we make.