Massive Opportunity In Two Growth Markets, Industrial IoT and Drones

View all Ondas Holdings reports and link to our research disclaimer.

Company Overview

Ondas Holdings ONDS 0.00%↑ is a leading provider of mission critical private wireless connectivity and commercial drone solutions through its wholly owned subsidiaries Ondas Networks and Ondas Autonomous. Ondas Networks designs, develops and manufactures FullMAX, their patented, Software Defined Radio (SDR) platform for a wide range of mission critical IoT applications, which require secure, real-time connectivity with the ability to process large amounts of data at the edge of large industrial networks. FullMAX is addressing a growing number of mission critical applications that require more processing power in many critical infrastructure markets, such as rail, electric grids, drones, oil and gas, and public safety, homeland security and government. The Ondas Autonomous System segment designs, develops, and markets automated, AI-powered commercial drone solutions and counter-drone systems. Their FAA type certified commercial drone solution, Optimus System, provides aerial data to enterprise and government customers. Primary use cases include public safety, security and smart city deployments where automated emergency response, mapping, surveying, and inspection services are highly valued, in addition to industrial aerial data services in a growing number of commercial sectors. Their commercial drone platforms are typically provided to customers under a Data-as-a-Service (DaaS) business model, while some customers will choose to purchase an entire solution. Their counter-drone systems, Iron Drone, are utilized by government and enterprise customers to protect critical assets and people from the threat of hostile drones. Ondas Holdings is traded on the NYSE under the ticker ONDS, and is headquartered in Waltham, Massachusetts.

Below we present our updated core investment thesis on Ondas Holdings profitability outlook. We include access to our downloadable 5-year financial model and our latest price target assessment.

Investment Thesis (BUY)

We believe Ondas Networks and Ondas Autonomous are strongly positioned in two robust secular tech trends that are still in the early innings of adoption. First, Class 1 North American rail operators are at the beginning of a major network upgrade cycle, and we believe Ondas Network’s FullMAX platform presents a compelling solution to drive more intelligence to the edge for rail operators. This positions the company to capture a meaningful share of the estimated $1.3B upgrade opportunity. Second, we believe the commercial and defense drone industry is evolving into a multi-billion-dollar annual market, driven by advancements in automation and AI that are accelerating adoption across a growing number of verticals. Ondas Autonomous' Optimus System, which has been awarded airworthiness Type Certification, establishes the company as an early leader in the fast-growing commercial drone space. Furthermore, we are increasingly bullish on Ondas’ Iron Drone counter-drone system, which is experiencing strong global demand as security and defense agencies prioritize counter-UAS solutions. Additionally, our bullish view is reinforced by Ondas’ status as a U.S.-based drone company, which we believe will benefit from new legislation favoring domestic drone manufacturers over foreign competitors. As U.S. government agencies and defense customers seek to reduce reliance on Chinese-made drones, Ondas stands to gain from policy tailwinds supporting domestic drone procurement. We anticipate the combination of a robust railroad upgrade cycle, accelerating commercial drone deployments, growing counter-drone adoption, and favorable regulatory support for U.S.-based drone companies can drive significant revenue growth over the next five years. While we recognize that deployment timing and demand trends may be lumpy, we believe this will create buying opportunities for patient investors who can take advantage of periods of volatility as the business scales. Our strong outlook reinforces our bullish stance on Ondas shares, and our $1.50 price target reflects the company’s long-term growth potential.

$1B+ Railroad Network Upgrade Cycle: Ondas Networks is currently targeting the North American freight rail operators for the initial adoption of their FullMAX platform driven by an estimated $1.3B upgrade opportunity. In August 2020 Class 1 rail systems in the U.S. were awarded new nationwide wideband radio spectrum by the FCC. As part of the award, the rail operators are required to vacate a series of legacy Advanced Train Control System (ATCS) networks by 3Q25 and upgrade these networks by Spring 2026. This is projected to generate a major network upgrade cycle for the rail industry. Many rail operators currently operate 20 year old legacy communication systems. These systems have limited data capacity and are unable to support increased data throughput and intelligent management systems. We believe the company’s FullMAX platform will enable the rail operators to drive more intelligence to the edge of their operating environments. Ondas estimates the North American Rail Network consists of 200,000 highway crossings, with ~65,000 of the crossings equipped with electronic systems. The Class I railroads currently operate four separate private wireless networks in support of train operations, which include 160 MHz, 220 MHz, 450 MHz and 900 MHz bands. Ondas estimates the addressable market to upgrade these four private networks is approximately $1.3B. We expect the 900 MHz network will be the first network upgraded, which is an estimated ~$450M market opportunity alone. Ondas and their strategic go-to-market partner on this opportunity, Siemens, is in late stages of integrating the enhanced ATCS with multiple railroads, paving the way for anticipated commercial volume orders. Siemens is marketing their dual mode proprietary ATCS under the brand name Airlink. That said, ramping of deployments is taking longer than expected, but given the FCC requirements to upgrade we believe this is a matter of when not if demand accelerates. Below we highlight where Ondas’ solution can be implemented across a rail ecosystem.

Capitalizing on the Expanding Commercial and Defense Drone Opportunity: We believe the commercial drone industry is growing into a multi-billion-dollar annual market, as advancements in automation and AI drive adoption across a growing number of verticals. While many may view the drone industry as highly competitive and fragmented, we believe Ondas' recent airworthiness Type Certification for its Optimus System establishes it as an early leader in the emerging commercial drone market. This was the first-of-its-kind certification for a non-air carrier drone, achieved after a four-year intensive FAA review process. Drones with an airworthiness certificate significantly simplify the waiver process for operating over people and beyond visual line of sight (BVLOS), a key differentiator in enabling scaled commercial operations. The Optimus System is already operating regularly in urban environments in the United Arab Emirates, and the company plans to leverage its type-certificated vehicle to conduct similar operations in urban environments across the U.S. Beyond the commercial drone opportunity, we are increasingly bullish on the company’s Iron Drone counter-drone technology, as the need for defensive drone solutions grows globally. As drone-based threats continue to escalate, particularly in military and critical infrastructure security, we believe Iron Drone is well-positioned to capitalize on rising demand from both U.S. defense agencies and international military customers. Additionally, we believe Ondas’ status as a U.S.-based drone company provides it with a strategic advantage, particularly in a Trump administration, which is expected to favor domestic drone manufacturers over foreign competitors. As U.S. government agencies and defense customers seek to reduce reliance on Chinese-made drones, Ondas stands to benefit from policy tailwinds supporting domestic drone procurement. We expect domestic and international drone deployments for Smart City applications, industrial aerial data services, and counter-drone technology to drive strong revenue growth over the next five years as Ondas expands its global footprint.

Optimus System overview video.

Iron Drone Overview video.

Recent Performance

Below we present a snapshot of Ondas Holdings’ recent financial performance, as well as other key performance indicators. Additionally, access our financial model below, which provides more historical results for a deeper analysis.

Source: Ondas Holdings; Data In Millions

5-Year Financial Outlook

Following 4Q24 results and the company’s updated 2025 guidance, we have raised our 2025 revenue estimate to $22M, representing ~205% Y/Y growth. However, this remains below the company’s $25M guidance, as we are taking a more cautious approach until we gain further confidence in the revenue ramp. Beyond 2025, we continue to expect over 25%+ annual growth through 2029, driven by the scaling of both the Ondas Autonomous and Networks business. That said, we recognize our estimates could be conservative if deployments accelerate meaningfully.

We have also lowered our gross margin forecast to 37% in 2025 from our prior 52% estimate, reflecting a more measured ramp in high-margin product sales. Over time, we forecast gross margins to scale to 45% by 2029, as the business gains operating efficiencies. While management has guided for margins to reach 50% by the end of 2025, we view this as aggressive given the 21% gross margin reported in Q4 2024. We will need to see sustained execution before raising our estimate. Additionally, while we anticipate the company will realize operating efficiencies, we also believe Ondas will need to continue investing to maintain its competitive positioning. As such, we expect opex to grow on an absolute basis by $5–10M each year through 2029, which will continue to drive adjusted EBITDA losses through 2029. Given this trajectory, we believe that unless Ondas can sustain 100%+ revenue growth for multiple years or undergo a significant restructuring, the company will likely need to raise $20–30M annually to support its growth initiatives based on our projected revenue run rate.

Below is an overview of our 5-year outlook and a link to our downloadable financial model.

Source: Ondas Holdings, Industrial Tech Analyst; Data In Millions

Valuation

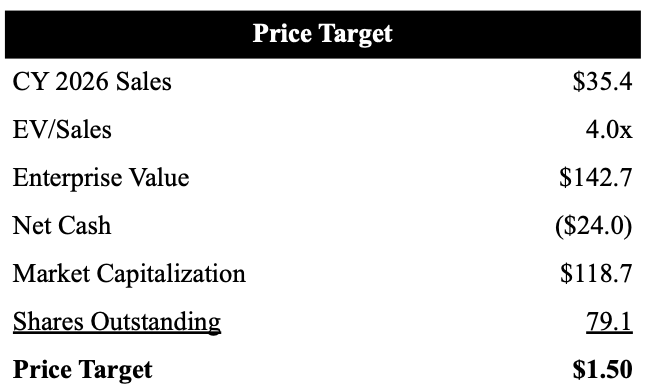

As shown below, based on our 2026 calendar year revenue estimate of $27.6M and a 4x EV/Sales multiple, we arrive at our updated $1.50 price target. We have lowered our price target from $1.60, reflecting the higher share count and lower net cash position following the recent capital raise. Our 4x EV/Sales multiple is slightly below the drone group comp average (4.5x), reflecting Ondas’ ongoing operating losses.

Source: Ondas Holdings, Industrial Tech Analyst, Data In Millions Except Price Target

Research Disclaimer: We actively write about companies in which we invest or may invest. From time to time, we may write about companies that are in our portfolio. Content on this site including opinions on specific themes and companies in technology, market estimates, and estimates and commentary regarding publicly traded or private companies is not intended for use in making any investment decisions and provided solely for informational purposes. We hold no obligation to update any of our projections and the content on this site should not be relied upon. We express no warranties about any estimates or opinions we make.