Materialise Strong Execution Remains On Cruise Control As Q3 Growth Accelerates - STRONG BUY

Key Takeaways: Materialise MTLS 0.00%↑ reported robust Q3 results with revenues and profits exceeding consensus expectations. Most impressively the company reported an acceleration in growth with revenues growing 14.6% Y/Y, which was led by 24.5% Y/Y growth in Materialise Medical segment. Furthermore, driven by impressive margin expansion in the company’s Medical segment and strong cost controls in the quarter, adjusted EBIT grew 89.1% Y/Y. Materialise also highlighted the fundamentals across all 3 segments remains strong and “conservatively” reiterated 2024 guidance.

We are extremely impressed with Materialise’s Q3 performance, which also exceeded our higher than consensus estimates. Above all, the most impressive story of the quarter is the robust performance in Medical, which set a quarterly revenue record. We believe the company’s new US medical plant that is currently serving trauma applications is a large driver to this outperformance, but as Management indicated they are not even scratching the service yet. We believe there is significant room to run in the Medical business, and now the question lies on what do adjusted EBITDA margins look like longer term at this higher run rate. Furthermore, we are upbeat on the company’s ability to growth their other two segments (Software and Manufacturing) despite operating in a challenging industrial environment. We expect these segments to show higher growth as the macro improves. "POUNDING TABLE” We believe another flawless quarter of execution proves Materialise is one of the most compelling stock opportunities in our universe. Materialise is currently trading at an all-time low valuation despite their ability to accelerate growth in a tough macro environment. The company is currently trading at ~6x EV/EBITDA multiple based on 2025 consensus estimates, which compares to the 5-year average of 40x. Furthermore, we believe Materialise is well on their way to coming in at the high-end of their guidance range. Investors are going to pleased with the accelerating growth and robust performance in the Medical segment, and in-turn shares are trading up 10%+ post 3Q24 results. That said, we believe Materialise shares have over 170%+ upside and remain STRONG buyers.

View detailed historical results in our full 5-Year financial model here.

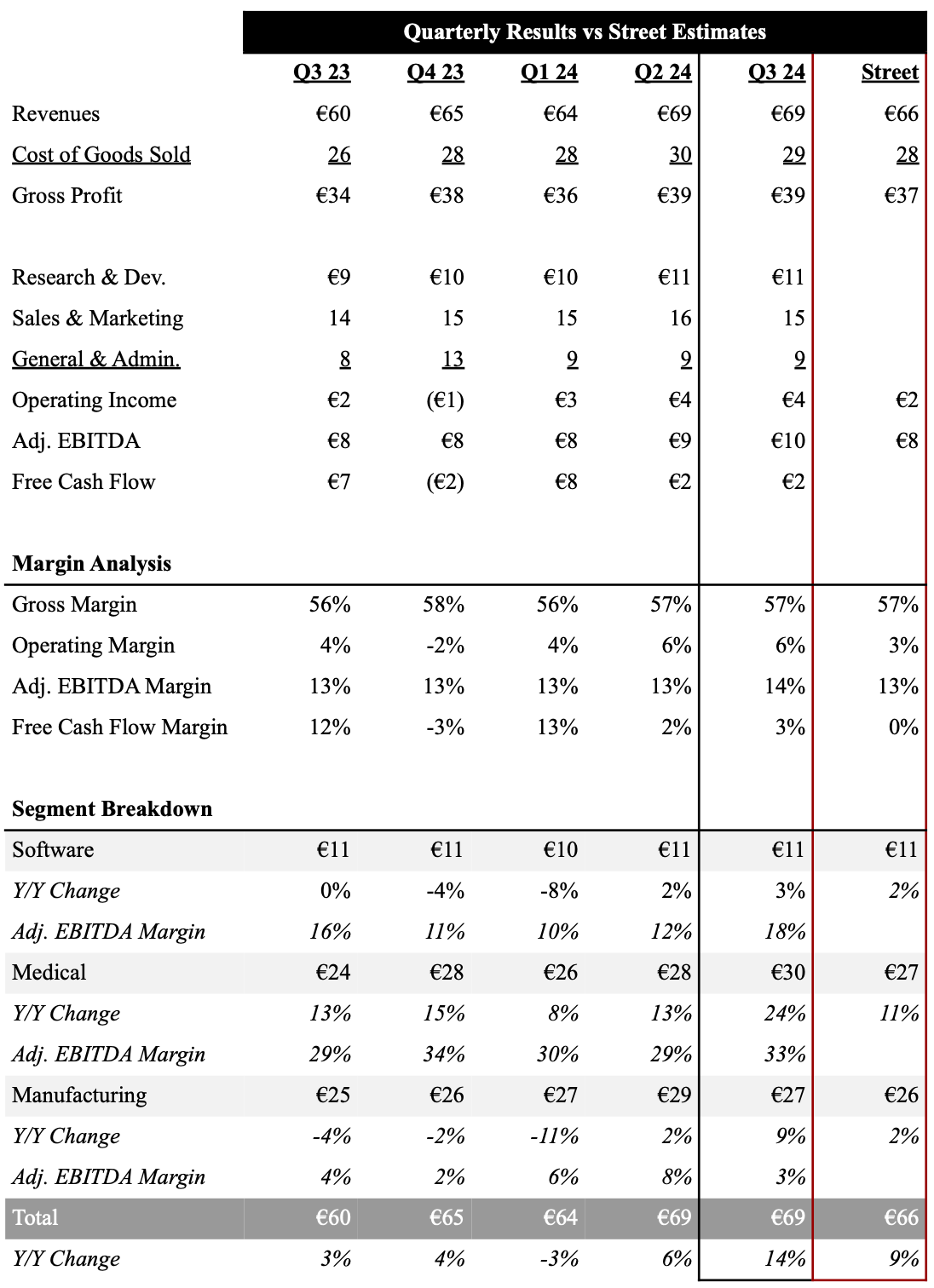

Source: Company Filings, FactSet; Data In Millions

Investor Gifts

Looking to become a better investor or need to find that perfect gift for your finance friend? Check out these products from our partner Investor Gifts like their 2025 Investor Calendar.

Key 3Q24 Earnings Takeaways

Materialise reported 3Q24 revenues of €68.7M, which was up 14.2% Y/Y and came in better than consensus expectations (€65.5M). Growth in the quarter was driven by the company’s Medical segment with revenues accelerating for a second consecutive quarter to 24.5% Y/Y to €30.2M. Medical device and software sales were up ~28% and ~16% Y/Y, respectively. We believe growth from their new US medical plant that is currently focused on trauma applications drove the outperformance. We expect further capacity expansion in the US, as well as expansion into new applications to be a robust long-term catalyst. Manufacturing revenues were up 9.1% Y/Y to €27.3M. Strong demand for certified production parts drove growth in the quarter, while sluggish prototyping demand due to the challenging macro, continues to impact sales. We are encouraged with the Y/Y growth as we believe the European manufacturing landscape continues to be challenging. In addition, the company’s second ACTech plant, which is focused on automotive, is now live and operational. Although we expect the company needs a few quarters to ramp up production, this second facility should help aid revenue growth in 2025. Furthermore, the Software segment was up 2.8% Y/Y driven by recurring software sales that were up ~9% Y/Y as they continue to shift to their recurring CO-AM cloud offering.

Materialise gross margin in 3Q24 was up 120 bps Y/Y to 57.2%. Due to strong performance in Medical, as well as strong cost controls Materialise produced adjusted EBIT of €4.4M, which was better than consensus expectations of €1.7M. Adjusted EBITDA in the quarter was €9.9M, up 25.9% Y/Y. From a segment perspective, Medical adjusted EBITDA margins remain VERY strong at 32.8% in the quarter. Software adjusted EBITDA margins of 17.8%, were up from 16.5% in 3Q23 as a result of continued elevated investments into their CO-AM platform. Meanwhile, Manufacturing adjusted EBITDA margins of 2.6% were down from 4.3% in 3Q23. We admit Manufacturing margins were low, and believe the rise of on-demand marketplace players Xometry and Protolabs is putting pressure on their prototyping business. That said, we expect growth in their certified parts business will help drive margin expansion over time. The company generated €6.9M in cash from operations. Driven by expected accelerated capex investments in Q3 that is related to ACTech expansion, free cash flow in the quarter was €1.8M. These investments are expected to begin to decline in the coming quarters.

Materialise reiterated full year 2024 guidance and expects revenue to be in the range of €265 - 275M, which implies 5.4% Y/Y growth at the midpoint. Materialise expects 2024 adjusted EBIT in the range of €11-14M, which is up 26.4% Y/Y at the midpoint. Management acknowledged the EBIT guidance implies elevated investments related to their FEob acquisition. Given the strong execution to-date, we believe Materialise is well on their way to coming in at the high-end of their guidance range.

5-Year Financial Outlook

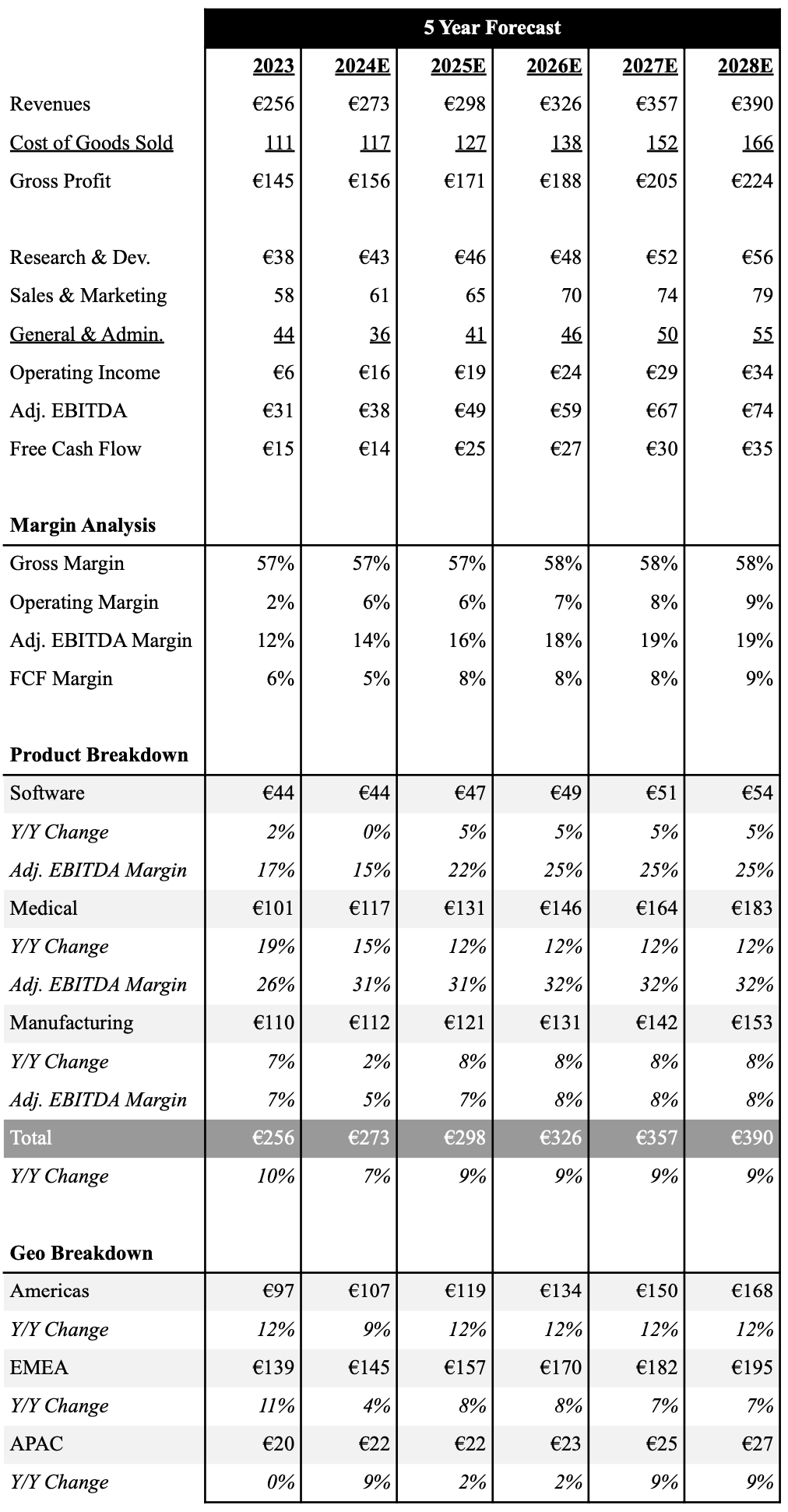

Following another flawless quarter, we have left our financial forecasts mostly unchanged. As we highlight below, we are expecting revenues to grow to €273.3M implying 6.7% Y/Y growth. We expect strong execution to allow gross margins to expand in 2024, and operational efficiencies will increase operating margins by 360 bps to 5.8% for the year. Looking beyond 2025, we continue to expect Materialise can conservatively grow ~10% Y/Y as macro conditions improve, but given the traction in the medical business we think mid-teen growth is becoming more likely. Coupled with sustained operating leverage, we forecast the Company growing EBIT 20%+ annually and generating mid-teen adjusted EBITDA margins by 2028. That said, we would not be surprised to see adjusted EBITDA approach ~20% if the company can further scale Medical adjusted EBITDA margins toward 35%. We are currently taking a conservative approach in our forecast, but believe it is possible.

Below is an overview of our 5 year outlook with a full downloadable financial model here.

Source: Industrial Tech Analyst, Data In Millions

Investment Thesis

We are extremely impressed with Materialise’s 2024 performance thus far. Above all, the most impressive story of the quarter is the robust performance in Medical. Demand for 3D printing patient specific surgical tools and implants continues to rise. Driven by further expansion into the US, as well as new applications we expect the Medical business to continue to see double digit growth for the next several years. Furthermore, the Manufacturing segment has positioned itself as a leading service provider of 3D printed production parts, which we expect to drive high-single digit growth once macro conditions improve. We also expect profitability to continue to improve under the company's new CEO. That said, Materialise is currently trading at an all-time low valuation despite their ability to continue to grow in a tough macro environment. While weakness in the stock performance has been largely attributed to poor sentiment across the entire additive manufacturing sector, we believe shares have been significantly oversold. Materialise is currently trading at ~6x EV/EBITDA multiple based on 2025 consensus estimates, which compares to the 5-year average of 40x. Our upbeat growth outlook and improving profitability support our bullish stance, as well as expectation for multiple expansion.

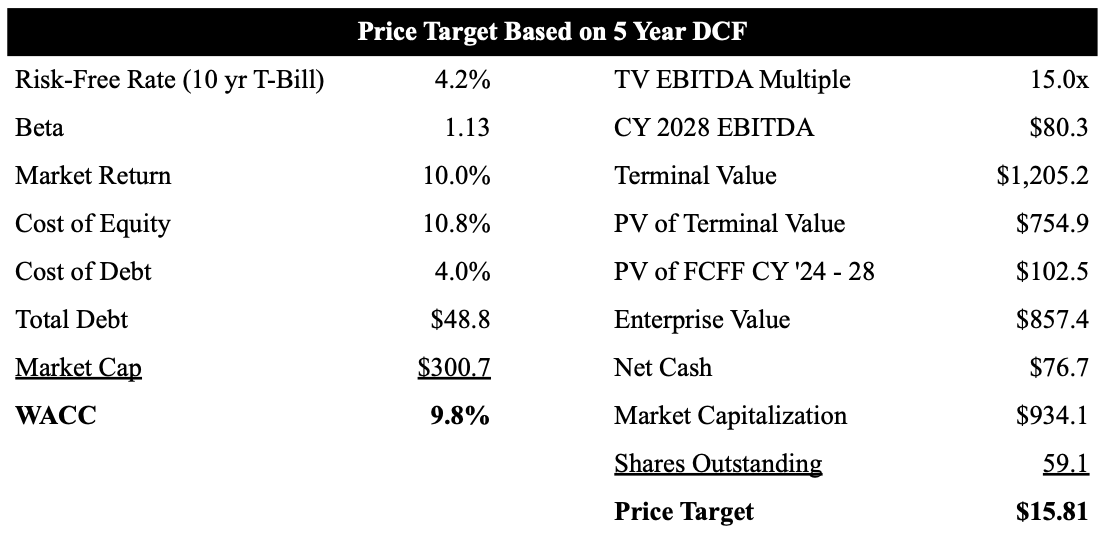

As shown below, we use a 5 year DCF model to value MTLS shares. Based on our current forecast, which we convert into US dollars, and terminal EBITDA multiple of 15x, we value MTLS at $15.81 per share. We raised our price target from ~$15.15 as a result of modestly higher margin estimates.

Source: Industrial Tech Analyst, Data In Millions Except Price Target

Research Disclaimer: We actively write about companies in which we invest or may invest. From time to time, we may write about companies that are in our portfolio. Content on this site including opinions on specific themes and companies in technology, market estimates, and estimates and commentary regarding publicly traded or private companies is not intended for use in making any investment decisions and provided solely for informational purposes. We hold no obligation to update any of our projections and the content on this site should not be relied upon. We express no warranties about any estimates or opinions we make.