No Surprise, Pricing Analysis Predicts Robust Xometry 3Q24 Results, But Lack of Q/Q Gross Margin Expansion Concerning For LT Profitability Targets

Key Takeaways: Xometry XMTR 0.00%↑ announced strong 3Q24 results with revenues and adjusted EBITDA that exceeded both Management and consensus expectations. Furthermore, the company surprised by reporting a positive Non-GAAP net income for the first time as a public company. In addition, 4Q24 revenue and adjusted EBITDA guidance came in-line with expectations. What also likely excited investors is Management indicated they expect to grow their marketplace revenues 20%+ in 2025, and be full year adjusted EBITDA profitable. Given the strong 3Q24 execution in a soft manufacturing environment, better than expected profitability and the upbeat 2025 outlook shares traded up 15%+ on these results.

We are not surprised by these results given the robust price acceleration we saw on Xometry’s Marketplace in our 3Q24 Pricing Analysis that has also continued through the month of November. Given the macro headwinds, we applaud Xometry for these strong results and being able to grow 19% in a challenging manufacturing environment is quite impressive. Xometry Marketplace continues to flourish and is likely taking share in the low-end prototyping market domestically and internationally. While we were also impressed with Management’s opex cost controls, which drove the surprised positive net income in the quarter, we believe the limited Marketplace gross margin expansion is concerning given the robust sequential revenue growth. We view gross margin expansion as critical to meeting their 20%+ adjusted EBITDA target, which we believe is a pipe dream. Furthermore, Xometry provided upbeat 2025 financial targets, but spending multiple years in Investor Relations, we believe this sets an unnecessary high bar for when the company provides 2025 guidance in 4 - 5 months. We doubt the company has strong visibility that far out and a lot can change for a company during that time. In turn, we remain cautious on the company’s long term revenue and profitability outlook, as we believe the emergence of Protolabs Network business to put pressure on growth and the company will struggle to expand revenue per active buyer, which declined again Y/Y in 3Q24. We expect these strong results will excite investors, but likely once again inflate profitability expectations. Our bearish thesis remains intact as we believe the company’s inability to increase revenue per active buyer will force the company to continue to accelerate spend to grow and underwhelm investors profitability expectations.

View detailed historical results in our full downloadable financial excel model here.

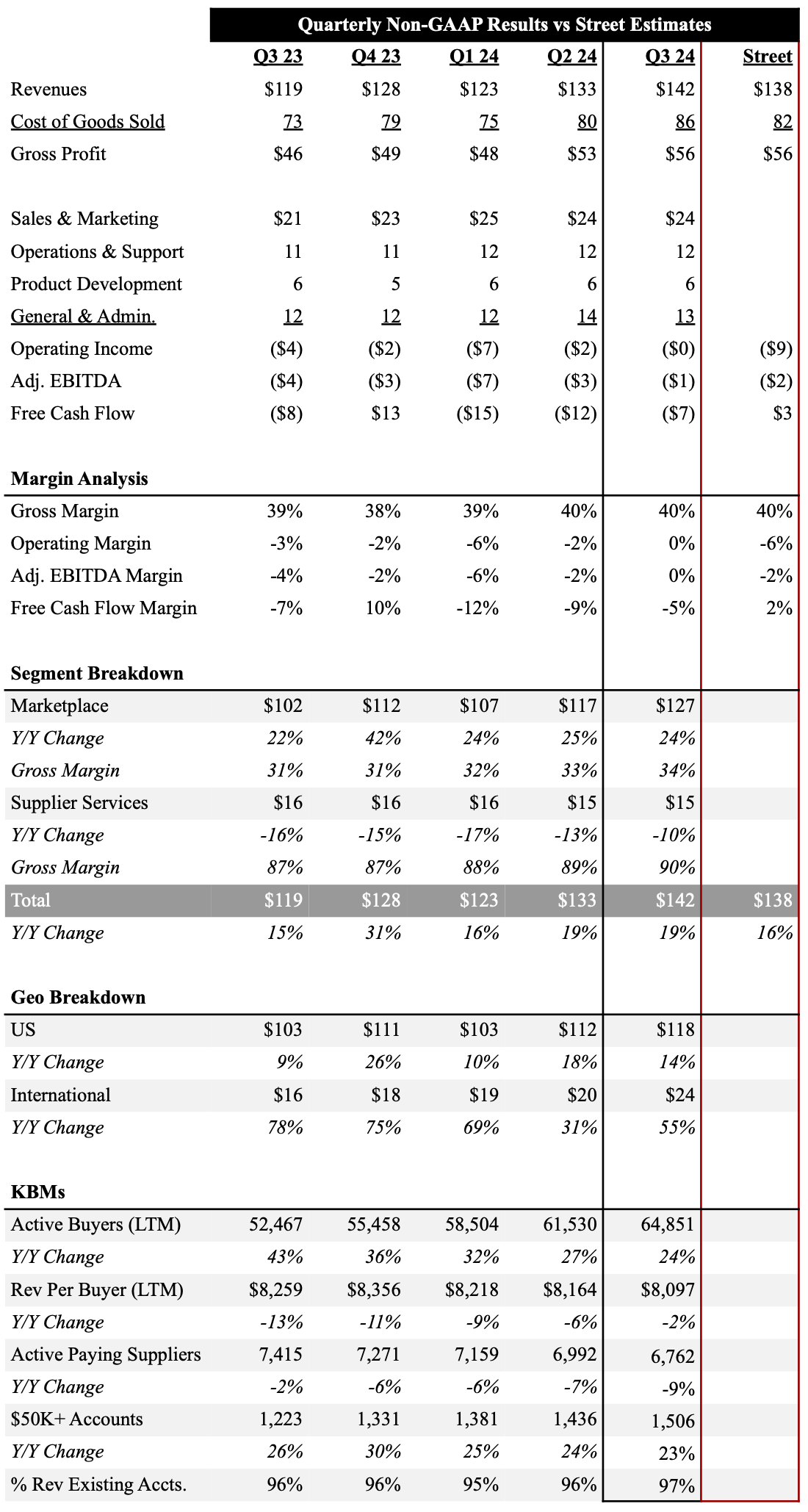

Source: Company Filings, FactSet; Data In Millions

Investor Gifts

Looking to become a better investor or need to find that perfect gift for your finance friend? Check out these products from our partner Investor Gifts like their 2025 Investor Calendar.

✓ US Economic Release Dates

✓ Option Expiration Dates

✓ Market Holidays

✓ Historical Market Returns

SAVE 20% with our exclusive promo SAVE20 at checkout!

3Q24 Earnings Summary

Xometry reported 3Q24 revenues growing 19.1% Y/Y to $141.7M, which was above the Company’s prior guidance ($136 - 138M) and consensus expectations ($137.9M). Revenue in the quarter was driven by Marketplace revenues growing 23.9% Y/Y to $127.0M. Meanwhile, Supplier and Services revenue declined 10.5% Y/Y to $14.7M. Revenues in the US were up 13.7% Y/Y to $117.6M. Sales Internationally were up 55.1% Y/Y to $24.1M, which did reaccelerate for the first time in 5 quarters. While Xometry saw LTM Active Buyers grow 23.6% Y/Y to 64,851 and added 3,321 new buyers Q/Q, we believe Revenue per Active Buyer declined 2.0% Y/Y to $8,097 marking a 6th consecutive quarter of Y/Y declines.

Gross margins were up 60 bps Y/Y to 39.5% as the company’s AI-powered marketplace continues to improve operational efficiencies. Marketplace gross margins were up 250 bps Y/Y to 33.6%, while Supplier Services gross margins were up 240 bps Y/Y as the Company focuses on higher-margin business segments. We do believe the lack of gross margin expansion in the Marketplace business Q/Q is something that is going a bit unnoticed given the company indicated on the 2Q24 earnings call they sees gross margins expanding to 35% by the end of the year. With the expectation revenue growth is expected to decelerate sequentially, we do not see how this is possible. Fortuntely, the company showed strong cost controls in the quarter with opex up less than $1M Q/Q. We are cautious this lack of spend is sustainable as competition intensifies with the emergence of new marketplace players like Protolabs. Driven by higher revenues and lower opex, Xometry reported 2Q24 adjusted EBITDA loss of $0.6M, which was better than Management expectations ($1.5-3.5M) and analyst expectations of a loss of $2,3M.

Xometry is expecting 3Q24 revenues to be between the range of $145 - 147M, which assumes 13.9% Y/Y growth at the midpoint and in-line with analyst expectations ($145.9M). They expect fiscal 2024 Marketplace revenue growth of 22-23% Y/Y, which is up from their prior estimate of 20% and expect Supplier Services revenue to be down approximately 10% Y/Y in Q4 driven by the wind down of non-core services. Driven by expected margin expansion and strong cost controls, Xometry guided 4Q24 adjusted EBITDA to be “slightly profitable” which was mostly in-line with analyst expectations of a loss of $0.3M. However, the company provided color on 2025 as well. They believe Marketplace growth can continue to grow 20% and expects Y/Y growth to accelerate in 2025. The company also expects to be adjusted EBITDA positive for the full year.

Although not a near term concern, Xometry’s convertible debt note of ~$280M is coming due in 2026 and the Company continues to burn cash bringing their net cash position to a negative $49.1M.

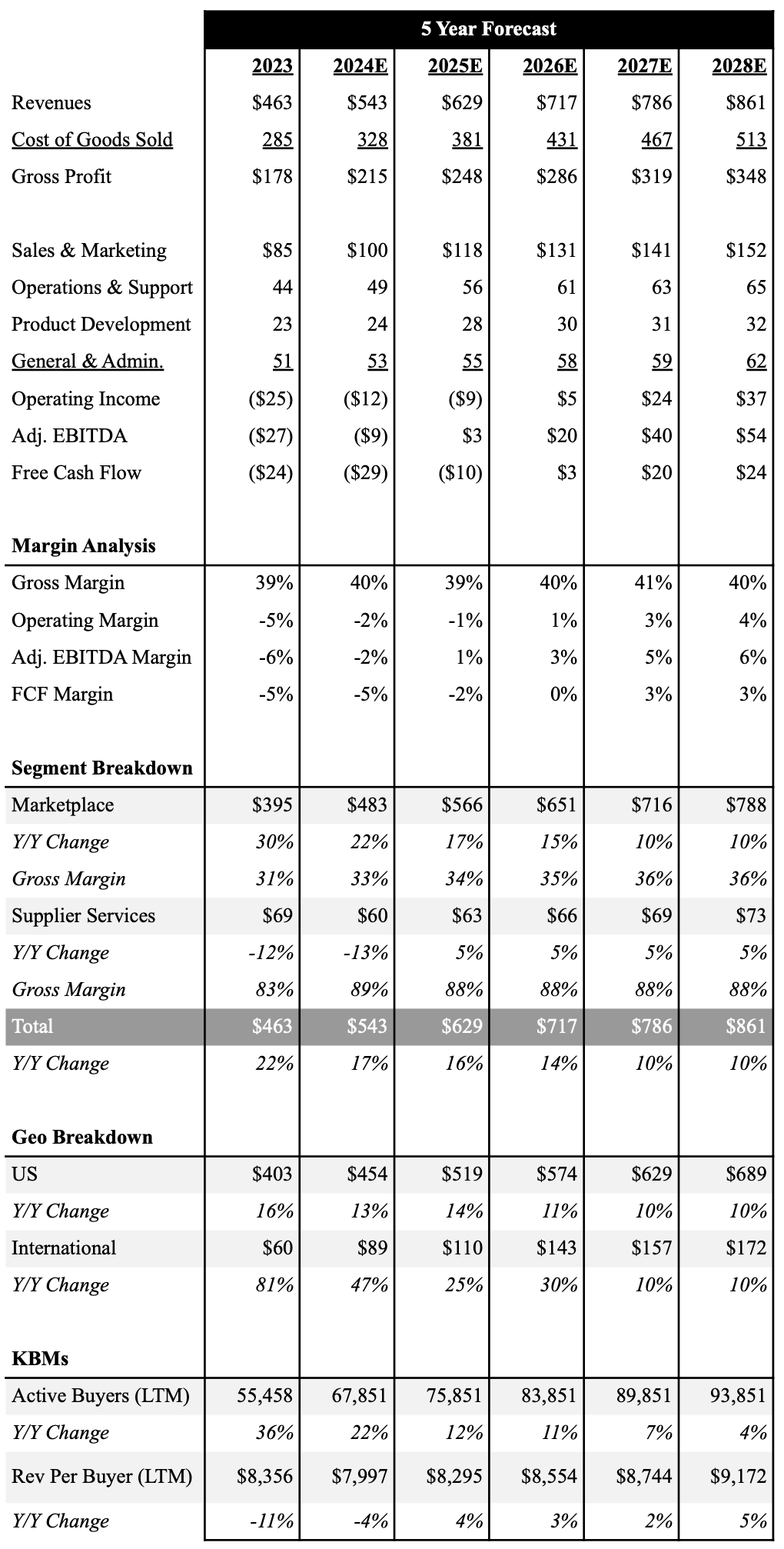

5-Year Financial Outlook

Following 3Q24 results, we have raised our 2024 revenue estimates mdoestly and expect the company to grow revenues 17.1% Y/Y to $542.6M in 2024. Although we believe Xometry can sustain mid-teen revenue growth through 2026, we believe increased competition from the likes of Protolabs will put pressure on Xometry as conditions normalize. In addition, we believe revenues per active buyer is continuing to decline and prove out our core thesis and fundamental flaw in the manufacturing marketplace business. When customers need prototypes and low-volume part orders, Xometry is an efficient solution. However, as customers need to go from low to high production part orders it will not make financial sense to pay the 30-40% markup (XMTR gross margin) Xometry charges on their marketplace and rather go directly to the manufacturer. Driven by these growing concerns, coupled with the law of large numbers, we have taken down our 2027 and 2028 revenue growth projections from 15%+ to 10%.

However, we are impressed with the continued, but modest gross margin expansion and believe as macro conditions improve they should see some scale efficiencies. That said, we expect the lack of revenue growth per active buyer will pressure profitability, and show the Company’s 20% adjusted EBITDA margin target is a pipe dream. Without a meaningful restructure, we believe mid-single digit EBITDA margins are more likely in 2028.

Below is an overview of our 5 year outlook with a full downloadable financial excel model here.

Source: Industrial Tech Analyst; Data In Millions

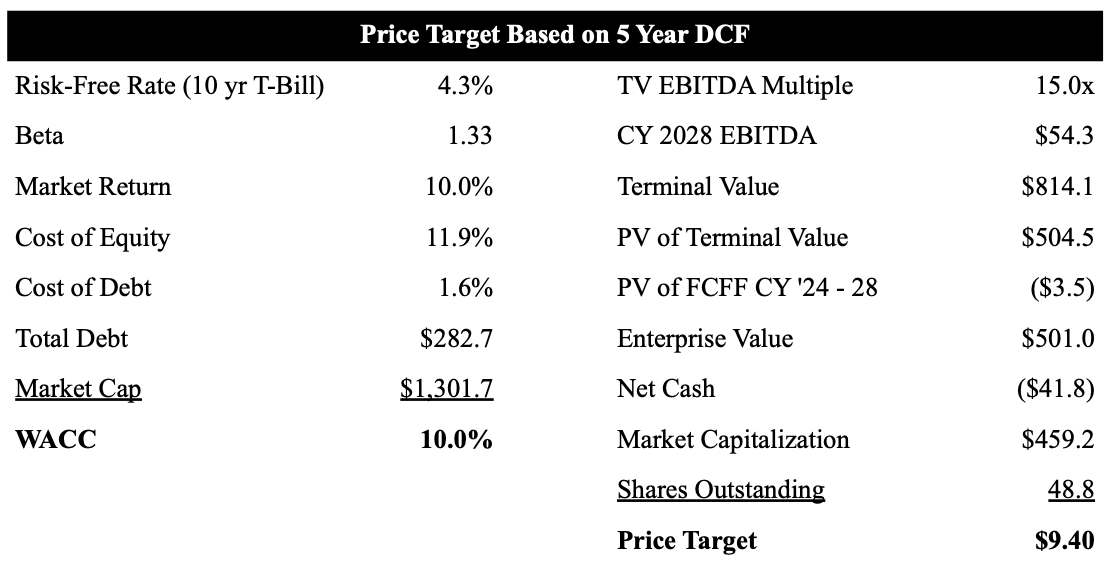

Investment Thesis

We can not deny that Xometry has been a true disrupter to the digital manufacturing space as their Marketplace revenues have grown from ~$80M in 2019 to ~$500M+ run rate in 2024, and proven the ability to continue to grow double-digits in a tough manufacturing environment. We do believe Xometry will continue to grow, but are cautious on the Company’s revenue and profitability outlook with the quick emergence of new marketplace players such as Protolabs and continued challenging macro environment. Furthermore, while we believe Xometry is a great tool to secure prototypes and low-volume production parts, we believe Xometry will struggle to increase wallet share among customers. This coupled with higher opex spend to support new buyer growth, we believe the company will continue to underwhelm investors profitability expectations. These all support our bearish stance and $9.40 price target.

As shown in our table below we use a 5 year DCF model to value Xometry shares. Based on our current forecast that includes a 15x EBITDA multiple to our terminal value, we value Xometry shares at $9.40.

Source: Industrial Tech Analyst, Data In Millions Except Price Target

Research Disclaimer: We actively write about companies in which we invest or may invest. From time to time, we may write about companies that are in our portfolio. Content on this site including opinions on specific themes and companies in technology, market estimates, and estimates and commentary regarding publicly traded or private companies is not intended for use in making any investment decisions and provided solely for informational purposes. We hold no obligation to update any of our projections and the content on this site should not be relied upon. We express no warranties about any estimates or opinions we make.