Pure-Play U.S. Drone Leader Uniquely Positioned For Emerging Supercycle

View all Red Cat reports and link to our research disclaimer.

Company Overview

Red Cat Holdings RCAT 0.00%↑ is a U.S.-based technology company that designs, develops, and delivers cutting-edge drone solutions in defense applications. Red Cat flagship product, the Blackwidow drone, is a military-grade unmanned aerial system designed for short-range reconnaissance missions. The Blackwidow is equipped with advanced features like night vision capabilities and secure communications, making it ideal for military and tactical operations. Red Cat also provides Edge 130 Blue through its acquisition of Flightwave, which is a Hybrid vertical takeoff and landing (VTOL) system, for long range reconnaissance missions with up to 2 hours of flight time. Lastly, their FANG solution is a first person view (FPV) drone with a flight time of 10 minutes with lethal surgical strike capabilities. The company is part of the U.S. Department of Defense's Blue sUAS program, which provides secure, American-made drones for defense use. Red Cat is also expanding its presence in global markets with their advanced drone technologies. The company is traded on the NASDAQ exchange under the ticker RCAT, and is headquartered in San Juan, Puerto Rico with a manufacturing facility in Utah.

Below we present our updated core investment thesis on Red Cat reflecting our latest analysis of the company's growth trajectory and overall profitability outlook. We include access to our downloadable 5-year financial model and our latest price target assessment.

Investment Thesis (BUY)

Red Cat is uniquely positioned to capitalize on what we believe is a global defense drone supercycle, driven by increasing geopolitical tensions and growing demand for advanced unmanned systems. As a U.S.-based manufacturer and a key participant in the U.S. Department of Defense's Blue sUAS program, Red Cat is well-positioned to benefit from favorable U.S. legislation supporting domestic drone production. The company’s long-term opportunity has been further bolstered by its massive SRR contract award, a milestone that not only enhances Red Cat’s credibility but also increases the likelihood of securing additional contracts from the Air Force, Navy, Marine Corps, public service agencies, and allied defense organizations like NATO. Furthermore, Red Cat’s partnership with Palantir to integrate AI-driven navigation and advanced autonomous capabilities into its drones will strengthen its leadership position in the market. By leveraging Palantir’s AI expertise, Red Cat is making its drones more competitive in high-stakes defense applications. Additionally, we believe a potential Trump administration defense policy could prioritize building the largest drone army in history, a move that would strongly favor U.S.-based drone manufacturers like Red Cat. These factors position Red Cat to capture substantial growth in the defense sector, reinforcing our bullish outlook on the stock and our $14 price target.

Emerging Leader In Global Defense Drone Space - The drone industry is experiencing rapid growth across sectors like defense, infrastructure inspection, agriculture and logistics. Red Cat is well-positioned to benefit from this expanding demand, with a strategic focus on defense. As one of the few companies approved by the U.S. Department of Defense under the Blue sUAS certification, which are drones that have passed the Defense Innovation Unit evaluation, we believe Red Cat holds a competitive advantage in securing military contracts as defense budgets are increasingly prioritizing unmanned systems. Additionally, Red Cat’s growing credibility as a leading US drone company is helping expand into global markets, specifically NATO countries. We believe this further enhances its ability to capture market share in defense sectors worldwide.

Transformative SRR2 Contract: Red Cat’s position as a leading drone player has significantly strengthened following its SRR Tranche 2 (SRR2) contract award, a major milestone that could be worth over $350M over the next five years, with the U.S. military expected to procure 12,000+ drones. Limited-rate production is expected to beginning in March 2025 and full-rate production targeted for September 2025. Importantly, $25M in SRR funding is already secured for 2025, though additional funding timelines remain uncertain. Encouragingly, Red Cat is actively advocating for $120M in annual SRR funding for the next three years, which would enable full production scaling and position the company for future defense contracts. While SRR revenue will be substantial, we expect demand to be lumpy, creating attractive buying opportunities for long-term investors.

Favorable Legislation To Benefit US Drone Companies - The American Security Drones Act and the Countering CCP Drones Act significantly benefit Red Cat by creating a regulatory environment that favors U.S.-based drone manufacturers over foreign competitors, particularly low-cost Chinese companies such as industry leader DJI. The American Security Drones Act, which was passed and included in the 2024 National Defense Authorization Act eliminates the use of drones by government agencies made by many foreign companies, including DJI. Furthermore, the Countering CCP Drones Act, which we believe will be signed into law as part of NDAA 2025, will regulate airwaves to ban foreign drones from using US controlled frequencies. This would essentially destroy foreign drones in US airspaces.

Recent Performance

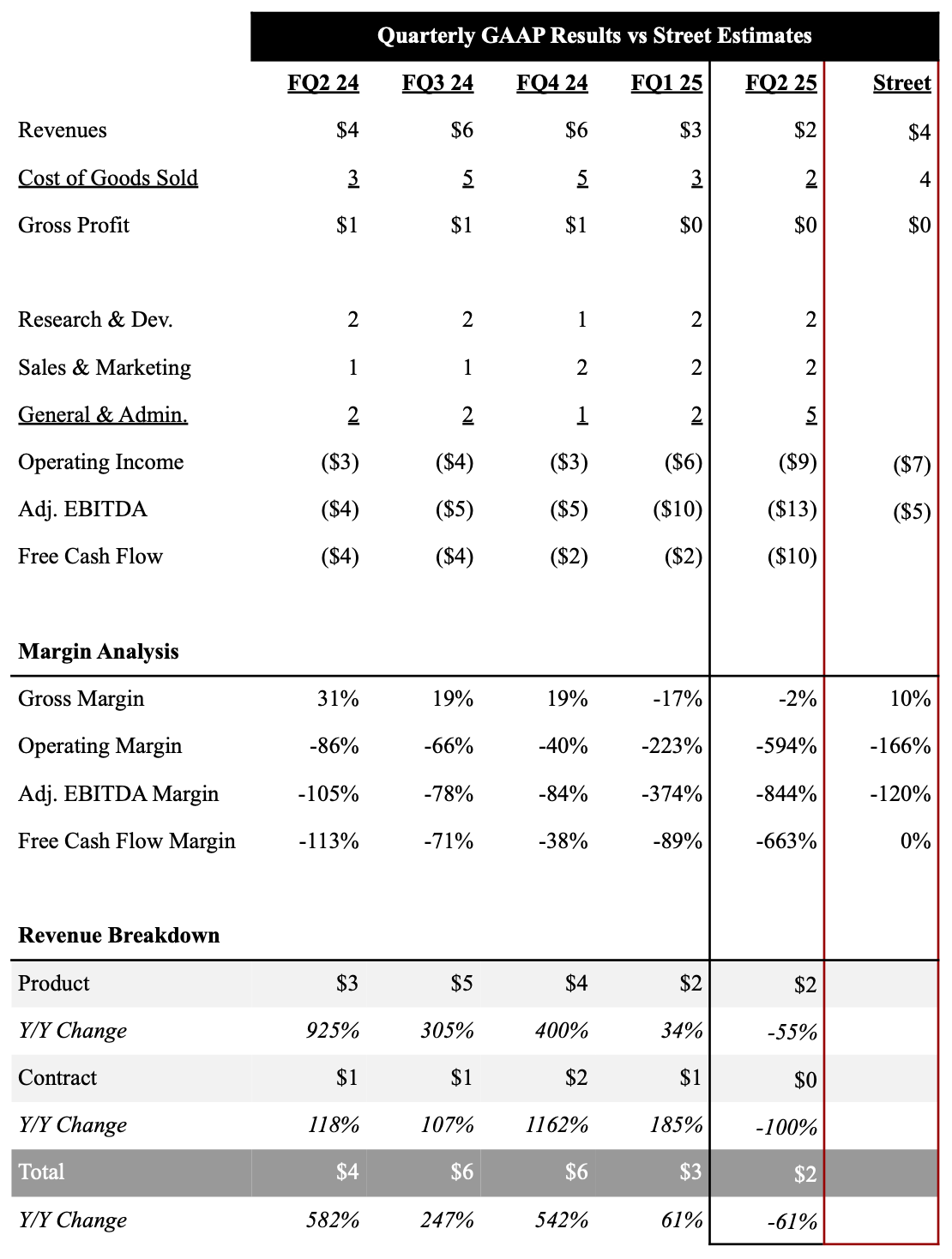

Below we present a snapshot of Red Cat's recent financial performance, as well as other key performance indicators. Additionally, access our financial model below, which provides more historical results for a deeper analysis.

Source: Red Cat; Data In Millions

5-Year Financial Outlook

Our CY25 revenue forecast stands at ~$100M, which is in-line with Management’s guidance, though we note that our current model is based on fiscal years and will be updated once the company transitions to a calendar year reporting structure. While Red Cat's massive SRR contract underpins much of this growth, the timing of funding and production ramp remains difficult to predict. We expect to gain greater clarity on this front at the company’s planned Q1 Analyst Day, where Management is expected to provide additional details on SRR funding schedules, production milestones, and broader revenue visibility. That said, we believe there is still upside to these projections, driven by increased sales from other domestic and international defense and government agencies. In turn, we anticipate revenues to grow at least 25%+ through 2028. Furthermore, our concerns around liquidity have significantly decreased, as we believe the company will be able to fund operations through a combination of debt instruments and the substantial prepayment from SRR over the next few months, sustaining operations until reaching cash flow positive in calendar Q4 2025.

Although these estimates could change when we expect the company to provide longer term targets once SSR milestone clarity is provided, we have raised our margin estimates given the margin opportunity following the Palantir partnership. We believe the company will be adjusted EBITDA positive for fiscal year 2026, and see adjusted EBITDA margins approaching ~20% in 2028 as the company continues scales the business. Note we did raise our opex estimates higher as we now expect the company to likely increase funding in R&D given the Palantir partnership.

Below is an overview of our 5-year outlook and link to our downloadable financial model.

Source: Red Cat, Industrial Tech Analyst; Data In Millions

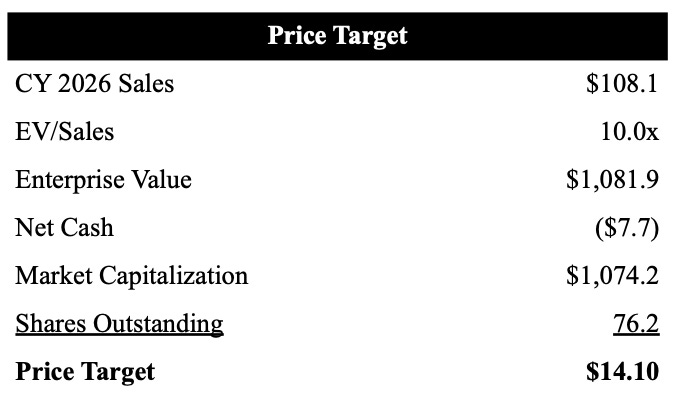

Valuation

As shown below, based on our 2026 calendar year revenue estimate of $108M and 10x EV/Sales multiple, we value Red Cat shares at $14.10, which equates to ~35%+ upside at current levels. We believe this valuation could be viewed conservative, reflecting a new sales multiple of 10x, which still positions Red Cat at a discount compared drone industry peers like Skydio, which recently raised $170M at a $2B valuation (20x sales). Below we layout our price target calculation.

Source: Red Cat, Industrial Tech Analyst; Data In Millions Except Price Target

Research Disclaimer: We actively write about companies in which we invest or may invest. From time to time, we may write about companies that are in our portfolio. Content on this site including opinions on specific themes and companies in technology, market estimates, and estimates and commentary regarding publicly traded or private companies is not intended for use in making any investment decisions and provided solely for informational purposes. We hold no obligation to update any of our projections and the content on this site should not be relied upon. We express no warranties about any estimates or opinions we make.