View all Red Cat reports.

Key Takeaways: Although it was widely anticipated after Red Cat RCAT 0.00%↑, announced a special Town Hall meeting last week, but yesterday it became official when the company announced they were awarded the entire U.S. Army's Short Range Reconnaissance (SRR) Program of Record contract. This competitive selection process culminated in Red Cat's Teal Black Widow drone being chosen as the next-generation sUAS for the Army. The contract includes the production of 5,880 systems over five years, priced at $65,000 per unit, resulting in what we believe is worth $500 million over that time frame. This marks a major milestone, showcasing Red Cat's innovation and capability to deliver on the U.S. Army's evolving operational needs.

We believe this significant achievement provides Red Cat global credibility as a leading defense drone player, which is expected to catalyze interest from other military branches, such as the Navy and Marine Corps, as well as government agencies and allied defense organizations, including NATO. We believe one NATO member was awaiting this decision, and could make a purchase soon after. We believe these international and domestic opportunities are of significant size that could exceed the SRR2 contract. Additional wins position Red Cat to gain further traction in the defense sector as it addresses increasing global demand for advanced unmanned systems.

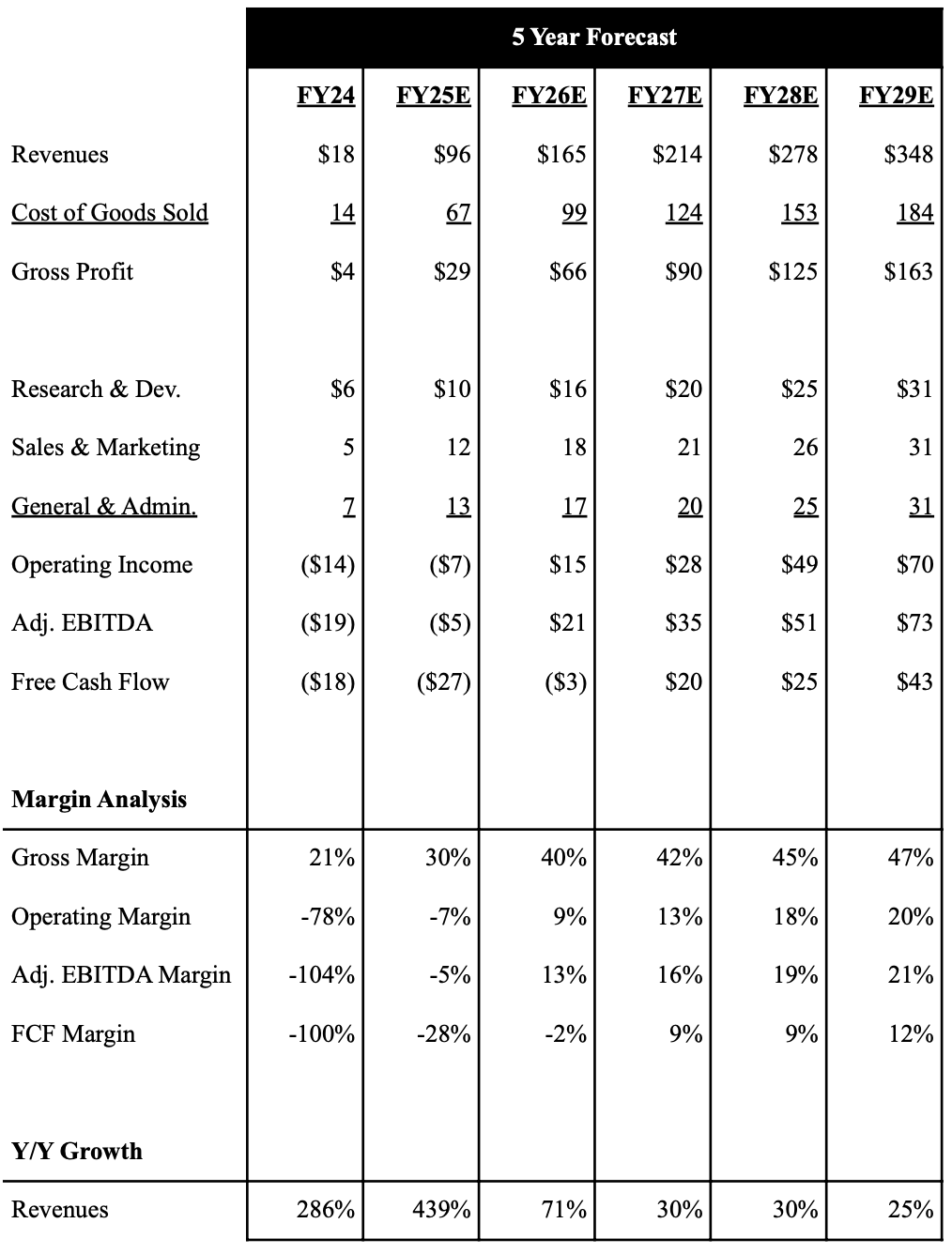

Updated 5-Year Outlook

Financially, Red Cat did not officially revise its FY25 guidance, which previously projected $50-55M in revenue without factoring in any major government contracts. We now anticipate that Red Cat will receive ~$50M in prepayments for this contract in FY25 and have adjusted our revenue estimates upward by ~$100M annually through 2028. We believe there is still upside to these projections, driven by increased sales from other domestic and international agencies. In turn, we anticipate revenues to grow at least 25%+ through 2028. Furthermore, our concerns around liquidity have significantly decreased, as we believe the company will be able to fund operations through a combination of debt instruments and the substantial prepayment from SRR over the next few months, sustaining operations until reaching cash flow positive in calendar Q4 2025.

Although these estimates could change when we expect the company to provide longer term targets on their next earnings call, we have raised our margin estimates materially given the scale efficiencies the SRR2 contract will provide. We believe the company will be adjusted EBITDA and cash flow positive for fiscal year 2026, and see adjusted EBITDA margins surpass ~20% in 2028 as the company continues scales the business.

Below is an overview of our 5 year outlook with a full financial model here.

Source: Industrial Tech Analyst

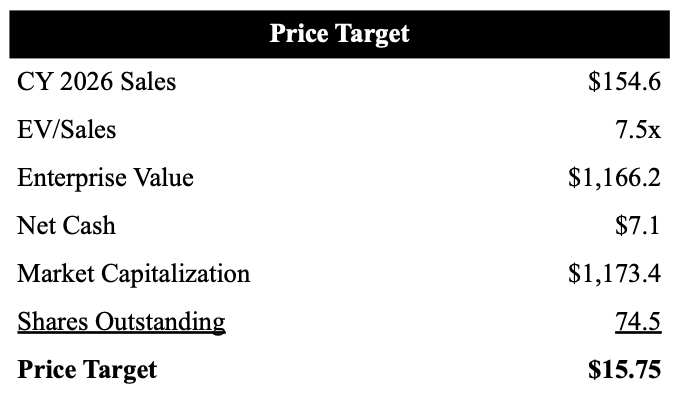

Valuation

Based on our revised financial estimates, we have raised our price target for Red Cat to $15.75, up from $5.80, driven by the material revenue increase expected from the SRR2 contract. We believe this valuation could be viewed conservative, reflecting a sales multiple of 7.5x, which still positions Red Cat at a discount compared drone industry peers like Skydio, which recently raised $170M at a $2B valuation (20x sales). With the SRR2 win underscoring Red Cat's leadership in the sector, the company presents a compelling investment opportunity with over 200%+ upside. Below we layout our price target calculation.

Source: Industrial Tech Analyst

Investor Gifts

Looking to become a better investor or find that perfect gift for your finance friend?

Check out these products from our partner Investor Gifts.

Research Disclaimer: We actively write about companies in which we invest or may invest. From time to time, we may write about companies that are in our portfolio. Content on this site including opinions on specific themes and companies in technology, market estimates, and estimates and commentary regarding publicly traded or private companies is not intended for use in making any investment decisions and provided solely for informational purposes. We hold no obligation to update any of our projections and the content on this site should not be relied upon. We express no warranties about any estimates or opinions we make.