Strong Execution As AutoStore Expands Margins and Cash Flow Despite Demand Headwinds

View all AutoStore reports and link to our research disclaimer.

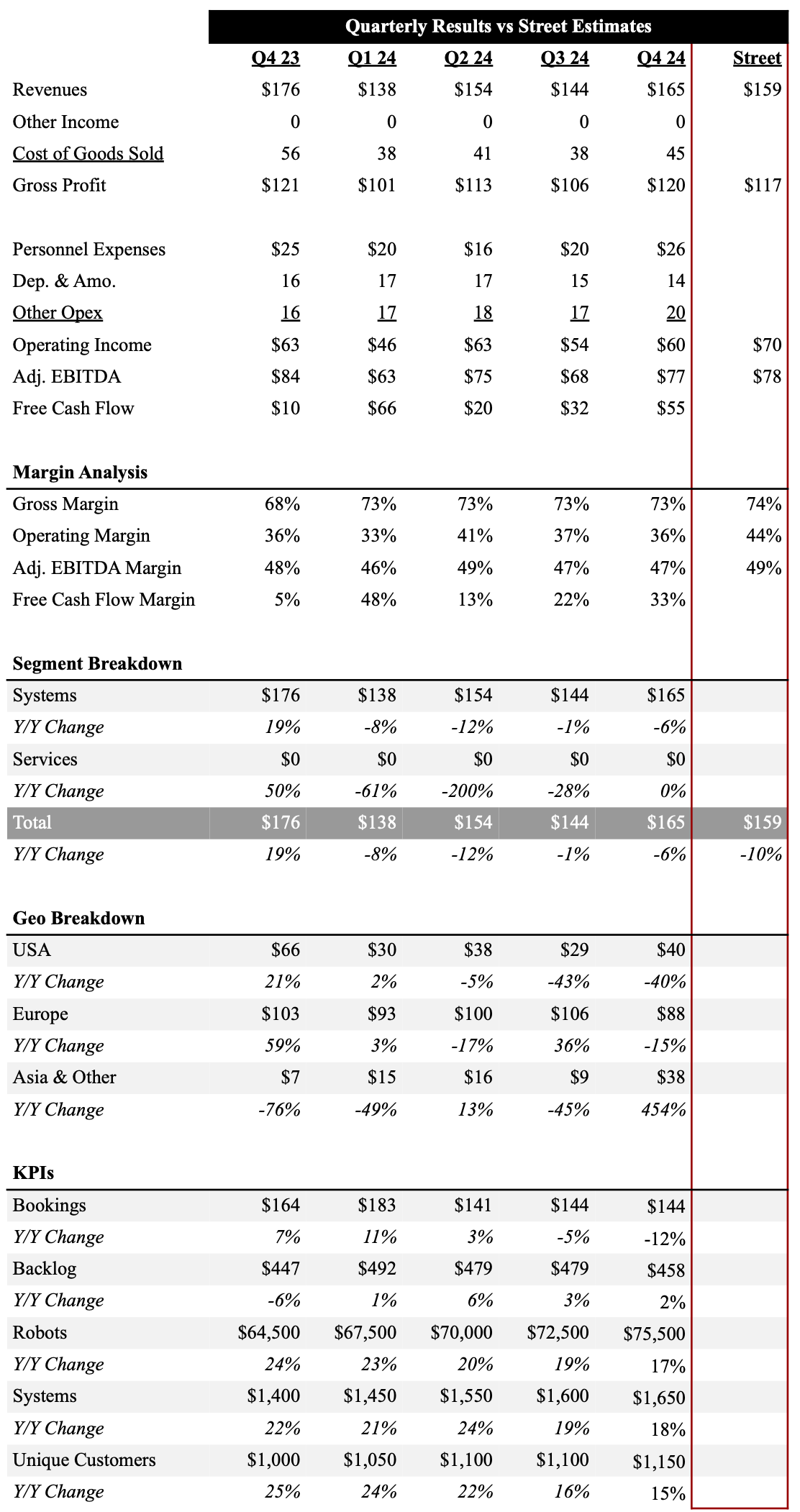

Key Takeaways: AutoStore reported solid 4Q24 results with revenue of $165M beating consensus estimates of $159M, while adjusted EBITDA of $77M was in line with expectations. Despite a ~7% Y/Y decline in revenue, the company delivered a strong gross margin of 73.%, benefiting from operational efficiencies. Adjusted EBITDA margin remained robust at 47% despite continued investments in commercial growth initiatives. AutoStore did not provide quantitative guidance but acknowledged ongoing macroeconomic challenges and extended sales cycles. The stock traded up 2% following the results, reflecting the market's positive reaction to better-than-expected revenue performance.

Although sales have yet to show a sign of recovery, we were very encouraged by the company’s execution, which drove margin expansion and strong free cash flow generation. We continue to believe sluggish sales is purely driven by a timing issue, and not an indication of slowing demand. Given the size of these deployments, we believe it is a normal course of business for sales to be pushed out due to timing and macro factors. However, we believe they will create buying opportunities for long-term focused investors. Although Management did not have a sense of when market conditions will improve, we are cautiously optimistic growth can accelerate in 2025 as a result of pent up demand and improving macro environment. In turn, we remain very upbeat on AutoStore’s long term opportunity as a leader in the quickly emerging warehouse automation space.

View detailed historical results in our downloadable financial model.

Source: Company Filings, FactSet; Data In Millions

Investor Gifts

Looking to become a better investor or need to find that perfect gift for your finance friend? Check out these products from our partner Investor Gifts like their 2025 Investor Calendar.

4Q24 Earnings Summary

AutoStore reported 4Q24 revenue of $165M, reflecting a Y/Y decline of ~7%. Despite this decline, revenue improved ~14% sequentially from Q3, supported by a stronger quarter-end sales push. Order intake for the quarter came in at $144M, down 12% Y/Y, reflecting longer decision-making cycles among customers. The order backlog stood at $458M, representing a slight ~2% increase from the prior year. From a regional perspective, EMEA continued to be the largest contributor to revenue, accounting for 67% of total sales, but sales were down 15% in this region in Q4. Followed by North America at 22%, where sales were down 40% Y/Y. Meanwhile, APAC and Rest of the World accounted for 23% of sales, and were up 450% Y/Y.

Gross margin for the quarter expanded 4.5 percentage points Y/Y to 73%, driven by improved material sourcing, supply chain optimization, and continued operational efficiency. However, adjusted EBITDA declined ~9% Y/Y to $77M as a result of increased investment in commercial growth initiatives, leading to a slightly lower adjusted EBITDA margin of 47% versus 48% in the prior year. The company continued to produce strong cash flow from operations which came in at $48M, which is up from $13M in the prior year quarter. We believe the company’s ability to generate strong cash flow in a down market shows the robust resiliency of their business model.

Looking ahead, AutoStore remains optimistic about the long-term potential of the warehouse automation market but acknowledged that the macroeconomic environment remains challenging. While the company did not provide quantitative guidance, management noted strong underlying demand, supported by a record-high sales pipeline of $7.5B, a ~15% Y/Y increase. However, prolonged decision-making cycles and an increasing focus on larger, more complex projects have extended conversion timelines, making near-term revenue visibility less certain. AutoStore expects the strategic initiatives introduced in 2024 to drive gradual improvements in performance going forward and emphasized its commitment to investing in product innovation, commercial expansion, and operational efficiency.

Below we dive deeper into our updated 5-year outlook, investment thesis and price target.