For the past decade, we have followed the evolution of the drone industry. We believe the sector is at an inflection point, with surging demand driven by advancements in automation, AI, and legislative support for U.S. domestic manufacturing. This confluence of factors is creating compelling investment opportunities for both public and private investors. In this deep dive, we provide an in-depth overview of the drone industry, exploring key technologies, the shifting competitive landscape, and critical insights into this fast-moving market. Our goal is to equip investors with a comprehensive understanding of the opportunities and challenges shaping the future of drones.

Link to our research disclaimer.

Investment Thesis

We believe the drone industry is entering a transformative supercycle, driven by both military and commercial applications, and our bullish thesis is underpinned by favorable U.S. legislation that will tilt the playing field toward domestic manufacturers. On the defense side, drones are becoming indispensable to modern military strategies globally. Under the Trump Administration, we anticipate a heightened emphasis on drone technology, with public statements indicating his plans to expand the U.S. drone fleet significantly. We believe this will prompt other nations to enhance their own drone capabilities, intensifying global investment in drones. On the commercial front, the market is expanding rapidly as industries such as public safety, security, agriculture, logistics, energy, and infrastructure increasingly adopt drone technology to improve efficiency and reduce costs. While we believe the commercial market still needs a streamlined regulatory framework for commercial applications, we believe more favorable legislation could come in 2025. In addition, this part of the market is ripe for disruption as advancements in AI, payload capacity, and battery life enable new use cases. We also believe the counter-drone market is set to grow in parallel with the rapid expansion of the global drone industry, as governments, defense organizations, and commercial entities seek solutions to address potential security threats posed by unauthorized or hostile drones. Lastly, the U.S. drone space is still fragmented, and we believe the industry is ripe for consolidation as companies expand their portfolios into new drone solutions.

As shown in the chart below, drone stocks have experienced a significant rally in 2024 fueled by favorable legislative developments, increased global defense spending, and growing commercial adoption of drone technologies. While we believe the end of year rally was driven by retail momentum and likely stretched valuations, we still believe the emerging drone supercycle presents a compelling opportunity for long-term, patient investors. In turn, we believe the U.S.-based pure play drone players, including Red Cat RCAT 0.00%↑ , AeroVironment AVAV 0.00%↑ Ondas Holdings ONDS 0.00%↑, Unusual Machines UMAC 0.00%↑ , DraganFly DPRO 0.00%↑, ParaZero PRZO 0.00%↑ and Redwire RDW 0.00%↑ among others are worth adding to your watch lists. However as we explain below, the infancy of the drone market presents inherent risks, including regulatory uncertainties, technological competition, and funding needs. Despite these challenges, we believe these companies represent unique opportunities, as they are poised to play critical roles in the development and scaling of this transformative industry.

(MUST READ) Investment Risks With Drone Stocks

Investing in drone stocks comes with several inherent risks that investors should carefully consider. First and foremost, military defense spending, a key driver for many drone companies, is often lumpy and difficult to predict, which is not ideal for publicly traded companies trying to meet Street expectations. On the commercial side, adoption of drone technology remains uneven, as many applications are still viewed as "nice-to-have" rather than "need-to-have," making them particularly susceptible to economic downturns or shifts in corporate spending. Regulatory uncertainties also pose a significant risk, as changes in legislation or compliance requirements can create hurdles for market growth. Increased competition, both domestically and internationally, adds pressure on margins and market share, particularly as larger, more established players enter the space. Furthermore, many of these public drone companies are small, with annual revenues below $10M, and face the challenge of capital-intensive hardware development that will require them to raise additional funds to sustain operations. These factors make the sector inherently risky, requiring careful due diligence and a long-term perspective from investors.

Favorable US Drone Legislation

A key catalyst to our drone supercycle call is driven by favorable U.S. legislation that is creating a significant tailwind for domestic drone manufacturers, positioning them to gain market share over foreign competitors like DJI. New legislation includes:

The American Security Drones Act: Passed as part of the 2024 National Defense Authorization Act (NDAA), this legislation prohibits government agencies from using drones made by foreign companies, ensuring that U.S.-based manufacturers dominate government contracts.

The Countering CCP Drones Act: Expected to be signed into law as part of the 2025 NDAA, this act will regulate airwaves to ban foreign drones from operating on U.S.-controlled frequencies, effectively removing them from U.S. airspace and providing a significant advantage to domestic producers.

That said, further regulatory progress is needed to unlock the full potential of commercial drone applications. Key areas requiring legislative action include streamlining approvals for Beyond Visual Line of Sight (BVLOS) operations, which are critical for scaling applications like delivery, infrastructure inspection, and agricultural monitoring. The Federal Aviation Administration (FAA) is expected to release a new rule called Part 108, which is expected streamline approvals for these advanced applications but timing is a bit uncertain. We dive deeper into Part 108 in our Commercial Market overview section.

Drone Ecosystem Ripe For Consolidation

We believe the entire U.S. drone ecosystem, spanning hardware, software, and counter-drone technology, is ripe for consolidation as the industry matures and demand accelerates. The rapid adoption of drones across commercial and defense applications has created a fragmented market with numerous players competing for market share. As legislative support grows for domestic production and national security concerns drive the need for secure, integrated solutions, larger companies are increasingly pursuing acquisitions to strengthen their portfolios. Redwire’s (RDW) recent $925M acquisition of Edge Autonomy is a perfect example of this trend, showcasing how industry leaders are leveraging strategic acquisitions to expand capabilities and position themselves for new long-term growth drivers. We believe this consolidation dynamic represents a core thesis for both public and private drone investors.

Investor Gifts

Looking to become a better investor or find that perfect gift for your finance friend? Check out these products from our partner Investor Gifts.

Technology Breakdown

The drone technology ecosystem is a rapidly evolving landscape, encompassing a wide range of innovations across hardware, components, software, and systems integration. Below we explore the critical elements driving advancements in the industry. From drone types, such as quadcopters and fixed-wing systems, to essential components, including motors, batteries, sensors, and AI processors, that power these machines. Beyond hardware, we examine the growing importance of analytics and flight software, which enable advanced capabilities like autonomous navigation and data-driven decision-making. Finally, we explore the transformative potential of the Unmanned Traffic Management (UTM) system, a framework designed to integrate drones safely into shared airspace, setting the stage for the next generation of drone operations.

Hardware

The drone industry features a diverse range of technologies, including quadcopters, vertical-take-off-and-landing (VTOL) drones and fixed-wing drones, which are driving adoption across sectors like defense, surveillance, delivery, and agriculture. Like many industries the hardware market has been historically competitive, particularly in consumer and commercial spaces. In turn, we view the most attractive opportunities are companies like AeroVironment $AVAV and Red Cat $RCAT, with long-term government contracts, as well as Ondas Holdings $ONDS, with Type Certification, are well-positioned to capitalize on growth in this fragmented and rapidly evolving industry. Below we dive into the different diverse drone technologies.

Quadcopters are among the most versatile and widely used drone technologies, valued for their exceptional maneuverability and ability to hover in place. These features make them ideal for commercial applications such as aerial photography, infrastructure inspections, and short-range delivery, as well as short range reconnaissance and surveillance security and defense applications. However, quadcopters typically face limitations in flight range and endurance due to battery life constraints, restricting their use to short-distance missions. Historically, the low-end quadcopter market has been extremely competitive with several players. This market has also been dominated by Chinese based DJI, whose cost-effective and technologically advanced quadcopters have set industry standards. However, recent US legislation that was discussed above, as well as Pentagons Replicator initiative, which is focused on acquiring thousands of small drones for multiple defense agencies has created opportunities for domestic companies like Red Cat (RCAT), Ondas Holdings ONDS and Skydio (private) to gain market share by filling the gap left by restricted foreign competitors. We believe these US-based manufacturers are well-positioned to capitalize on the growing demand for reliable quadcopter solutions. Other public players that are based outside of the US that provide quadcopter solutions and have strong ties to the US include include Parrot and Draganfly (DPRO).

Source: FLIR Systems

Fixed-wing drones are designed for endurance and efficiency, with extended flight times and the ability to cover vast areas. These characteristics make them ideal for applications such as mapping and agricultural analysis in the commercial sector. On the defense side, these drones are widely used for long range intelligence, reconnaissance, and surveillance missions. In addition, being deployed as cost-effective and safer alternatives to traditional fighter jets for precision strikes applications. Key players in the fixed-wing drone market include Red Cat (RCAT), AeroVironment (AVAV), Insitu (Boeing subsidiary), Lockhead Martin LMT 0.00%↑, General Dynamics GD 0.00%↑ who are leaders in tactical military drones. Meanwhile, AgEagle’s (UAVS) SensFly is a provider of fixed-wing commercial applications among other private players.

Source: Aerovironment

Vertical Take-off and Landing (VTOL) drones combine the flexibility of quadcopters' vertical takeoff capabilities with the extended range and efficiency of fixed-wing flight. These solutions are best suited for long-distance missions such as surveillance, mapping, surveying, search and rescue, as well as long distance recon and surveillance defense applications. Leading providers include Wingtra (Private), AeroVironment ($AVAV), and Quantum Systems (Private).

Source: Wingtra

Key Components

Drones are composed of several critical components that enable their operation and functionality across various applications. Key components include propulsion systems, sensors, cameras, navigation and communication systems, and batteries. With U.S. legislation increasingly focused on locally sourcing key drone components to enhance supply chain security and support domestic manufacturing, we see significant investment opportunities emerging in this space. Amid these developments, we believe U.S. companies such as Lumenier (Private), EaglePicher (Private), Amprius (Private), and Unusual Machines (UMAC) are well-positioned to capitalize on the push for a secure and resilient domestic supply chain. These firms, with their advanced capabilities in motors, batteries, and flight controllers, stand to play a significant role in meeting the growing demand for domestically sourced drone components and technologies. We dive into these key components below.

Motors and Propulsion Systems: These provide the thrust and maneuverability needed for flight, enabling drones to hover, navigate, and perform precise movements. Leading manufacturers include Lumenier (Private), known for high-performance motors and propellers used in professional and racing drones, and KDE Direct (Private), which supplies propulsion systems for industrial and commercial applications.

Batteries: Essential for powering drones, batteries often limit flight duration and payload capacity. Advanced battery solutions are provided by Tattu (Private), popular in commercial drones, EaglePicher (Private), specializing in high-reliability aerospace and defense batteries, and Amprius (Private), which develops silicon anode lithium-ion batteries to extend endurance and enhance payload capabilities.

Flight Controllers: Serving as the brain of the drone, flight controllers manage stability, navigation, and autonomous operations, ensuring safe and precise handling. While many companies integrate flight controllers into their systems, DJI and other Chinese-based companies are the dominant players, incorporating advanced controllers into their drones. Unusual Machines (UMAC) is a US based supplier making strides in developing innovative flight control systems, focusing on specialized applications that require advanced integration and autonomy.

Sensors and Cameras: These components are vital for collecting data in applications like mapping, surveillance, and inspections. FLIR Systems (subsidiary of Teledyne TDY) stands out for its thermal imaging sensors, which are widely used in defense and industrial drones.

Communication Systems: These enable real-time control and data transmission between drones and operators, critical for both manual and autonomous operations. Companies like uAvionix (Private) and Garmin (GRMN) lead the market with communication and navigation technologies.

GPS Modules: GPS systems provide precise positioning and navigation, ensuring drones can operate effectively in both routine and complex missions. Key players in GPS integration include Garmin (GRMN) and uAvionix (Private).

Processors: Key chip processors are critical to powering the performance and functionality of drones, enabling advanced capabilities across various applications. Qualcomm (QCOM) and NVIDIA (NVDA) lead in providing processors and AI solutions that drive autonomous navigation and sophisticated analytics. Broadcom (AVGO) supplies RF and connectivity chips essential for reliable communication and navigation, while STMicroelectronics (STM) and Texas Instruments (TXN) deliver microcontrollers, sensors, and power management solutions vital to drone operations. Ambarella (AMBA) focuses on video processing, offering high-definition and ultra-HD SoCs that enhance video quality, electronic image stabilization, and power efficiency. These companies form the backbone of the drone semiconductor ecosystem, driving innovation and advanced functionality. However, given the infancy of the drone space, these markets have yet to drive a material portion of revenues for these global semiconductor companies.

Counter-Drone Tech

The counter-drone technology market is rapidly emerging as a critical segment within the broader drone ecosystem, designed to detect, track, and neutralize unauthorized or hostile drones in sensitive airspaces. These systems employ a range of technologies, including radar, radio frequency (RF) detection, optical sensors, and electronic countermeasures such as jamming or spoofing, to either disable drones or safely divert them. Advanced counter-drone solutions are increasingly vital for protecting military installations, critical infrastructure, and public events from potential security threats posed by drones. As drone usage continues to grow, the counter-drone market is expected to scale proportionally, offering significant opportunities for companies at the forefront of this technology. Leading public players in this market include Ondas Holdings (ONDS), AeroVironment (through its BlueHalo acquisition (AVAV)), DroneShield (ASX: DRO) and Raytheon Technologies (RTX).

Software

The drone software market is a rapidly expanding segment that complements the hardware ecosystem, enabling drones to operate more efficiently and deliver greater value across various applications. A key focus is on data analysis software, which processes and interprets drone-collected data for use in industries such as agriculture, construction, infrastructure inspection, and mapping. These platforms increasingly leverage AI and machine learning to provide actionable insights, transforming decision-making and operational efficiency. Players in this space, include DroneDeploy, Cloneable and Aloft (purchased by UMAC), but we believe the rise of AI is expected to drive transformative advancements, unlocking new capabilities in areas like autonomous flight planning, real-time data analytics, and dynamic airspace management. This convergence of AI and drone software positions the segment for substantial growth as industries continue to integrate drones into their operations.

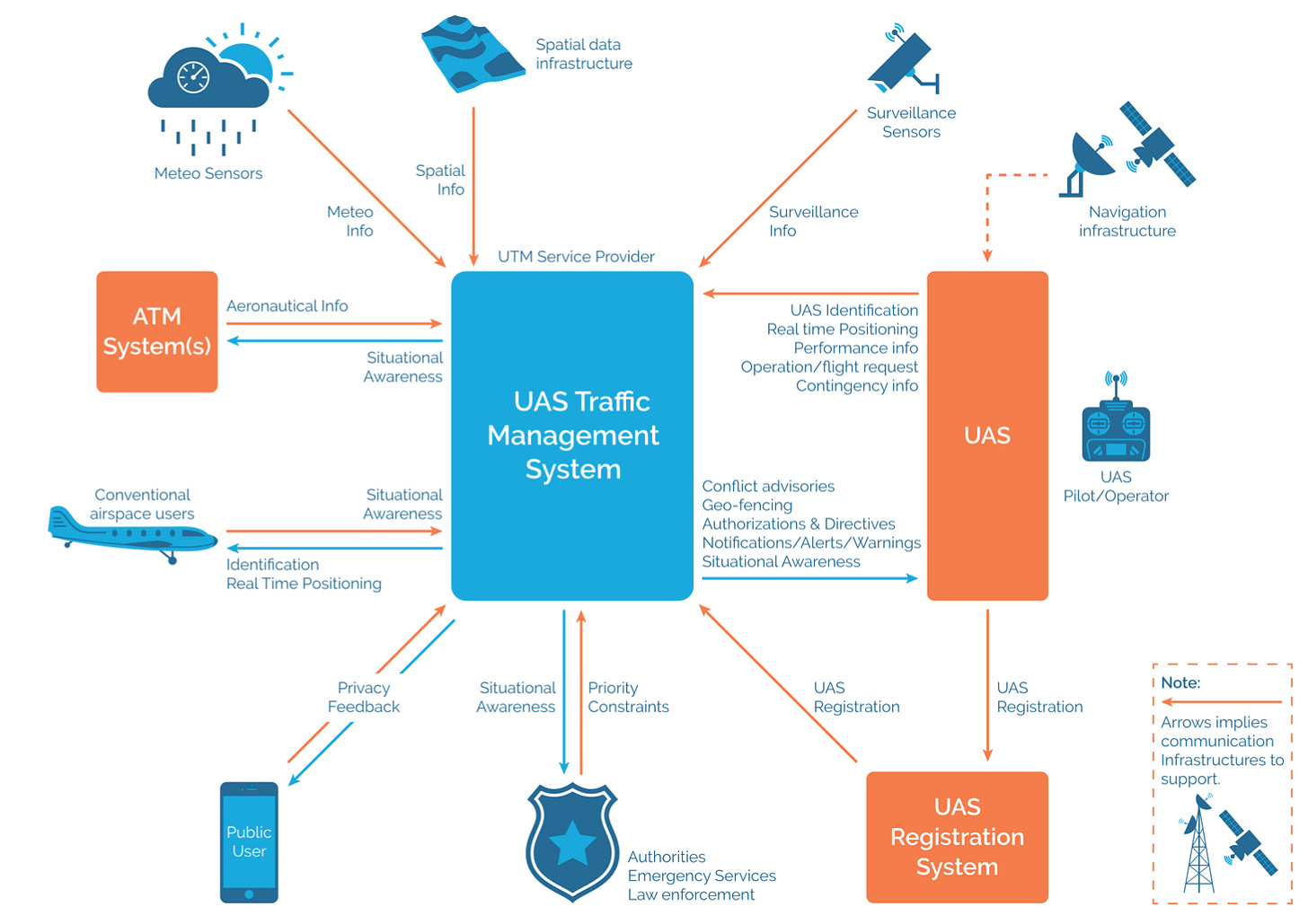

Unmanned Traffic Management (UTM) System

Beyond drone specific technologies, we believe an Unmanned Traffic Management (UTM) system represents a massive opportunity as it is a critical evolution in integrating drones into low-altitude airspace while maintaining safety and efficiency. Originally conceptualized by NASA, UTM is designed to connect drone operators with a centralized coordination service that oversees unmanned operations below 400 feet, which is an area of airspace that is largely uncontrolled by the FAA except near major airports. The goal of UTM is to create a seamless, interoperable system that can manage high-density drone traffic, enabling routine Beyond Visual Line of Sight (BVLOS) flights and other advanced automated operations. By facilitating the safe coexistence of manned and unmanned aircraft, UTM lays the foundation for a future where drones can perform critical roles in industries such as logistics, agriculture, and infrastructure monitoring without compromising airspace safety.

As we highlight in the diagram below, the core functionality of a UTM will be managed by a UTM Service Supplier (USS), which we believe will be multiple commercial entities operating with FAA approval and oversight. The role of the USS is still evolving, but its primary responsibilities are expected to include critical services such as:

Command and Control Communications: Facilitating seamless communication between the UAS pilot and the aircraft to ensure safe and efficient operations.

Manned Aircraft Detection: Utilizing ground-based radar to detect manned aircraft and providing real-time location data to unmanned operators.

High-Density Weather Sensors: Deploying advanced sensors to deliver essential environmental information, improving operational decision-making for drone pilots.

FAA Air Traffic Coordination: Collaborating with FAA air traffic control facilities when unmanned aircraft need to operate in controlled airspace.

Airspace Access and Security: Managing access to airspace for approved operators and identifying unauthorized aircraft for FAA intervention.

Contingency Management: Handling disruptions to routine operations, such as severe weather events, to maintain safety and efficiency.

In addition to the USS, the UTM concept requires numerous functions to ensure safe and efficient integration of drones into low-altitude airspace. The orange arrows in the chart highlight the Supplemental Data Service Providers (SDSPs), which offer specialized data services essential for UTM operations. These services include terrain mapping, real-time weather updates, and surveillance data, all of which enhance the safety and reliability of drone operations. The combination of USS and SDSP functions creates a dynamic ecosystem, offering multiple opportunities for companies to specialize and contribute to the implementation of UTM systems. This collaborative framework underscores the complexity of UTM and the significant potential for industry participants to drive innovation in this space.

Source: Global UTM Architecture

That said, the FAA acknowledges that while progress has been made in the development of UTM, full-scale deployment is still several years away, hindered by a number of complex challenges. One key issue is the establishment of universal interoperability standards that allow seamless communication between various UAS operators, service suppliers, and traditional air traffic control systems. Additionally, ensuring robust cybersecurity measures to protect against potential threats and vulnerabilities remains a critical hurdle. The FAA is working with a consortium of companies to test and implement UTM in real-world scenarios, starting with operations in North Texas. This group has developed industry standards for managing drone-to-drone interactions in shared airspace, particularly for complex operations like package delivery. These efforts aim to create a scalable, national framework for drone operations. The FAA has begun issuing Letters of Acceptance (LOAs) to companies in the consortium, allowing them to conduct BVLOS (Beyond Visual Line of Sight) flights without visual observers, using UTM services for coordination. Over time, as UTM standards mature, these capabilities are expected to expand across the U.S., enabling routine and safe drone operations at scale. The FAA's phased approach is a step in the right direction, but widespread adoption is still years away. However, with AI-driven advancements and the growing demand for automated airspace management, UTM remains a promising area of the broader drone industry.

While no company has been crowned the go-to USS provider, Unusual Machines (UMAC) recently acquired Aloft Technologies, which is a leading FAA-approved provider of UTM services to enterprise, public safety, and government customers. Although still early, we believe this acquisition could prove to be game changer for UMAC, which is currently the only public drone company now exposed to UTM.

Investor Gifts

Looking to become a better investor or find that perfect gift for your finance friend? Check out these products from our partner Investor Gifts, like their one-of-kind Premium Option Trading Desk Mat.

Innovating Across Industries: The Two Pillars of the Drone Market

Defense Market

Drones have become an indispensable tool in modern defense, offering unmatched versatility and efficiency across a range of critical applications. Key uses include intelligence, surveillance, and reconnaissance (ISR) missions, where drones equipped with advanced sensors and cameras provide real-time situational awareness in combat zones or border surveillance. Drones are also increasingly deployed for target acquisition and precision strikes, enabling militaries to neutralize threats with minimal collateral damage. Additionally, they support logistics and supply chain operations, delivering essential supplies to remote or contested areas where traditional transportation methods are impractical. Emerging applications include electronic warfare, where drones are used to jam enemy communications or collect signal intelligence, and swarm tactics, leveraging multiple drones to overwhelm adversaries. With the rise of autonomous capabilities and AI integration, defense drones are becoming even more sophisticated, reducing the risk to human operators and enhancing mission effectiveness. Furthermore, the Trump Administration has been very vocal in wanting to build the largest drone army in the world, which bodes well for drone suppliers over the next 4 years. Key players in this space include AeroVironment (AVAV), General Atomics (GD), Lockhead Martin (LMT) and Northrop Grumman (NOC), as well as emerging companies like Red Cat (RCAT) and Ondas Holding (ONDS( focusing on innovative defense applications.

Program of Record The Holy Grail For Drone Suppliers

A Program of Record (PoR) in the military is an official, long-term procurement initiative established by the Department of Defense to acquire and sustain critical technologies and capabilities for the armed forces. These PoRs are the holy grail among drone defense suppliers because they represent formal commitments by the military to fund, deploy, and support specific systems, often involving multi-year and hundreds of millions of dollars worth of contracts. Recent examples include the U.S. Army’s Short Range Reconnaissance (SRR) program, which awarded a ~$200M+ 5-year contract to Red Cat (RCAT) to supply drones designed for tactical ISR missions. Similarly, AeroVironment (AVAV) was selected under the U.S. Army’s Directed Requirement (DR) for Lethal Unmanned Systems (LUS), which is a 5-year contract with a contract ceiling value of ~$990M. These awards are just a small few that underscores the increasing reliance on unmanned systems in military operations and the value of becoming a trusted supplier within a PoR.

In addition to formal PoRs, we believe drone suppliers have the opportunity for additional wins through the Pentagons Replicator initiative, which is focused on acquiring thousands of cheap, autonomous drones for multiple defense agencies. The Senate Appropriations Committee approved a defense spending bill for fiscal 2025 that would provide full funding for the Pentagon's Replicator Initiative. This DoD funding for drones is going to be the primary vehicle the US government uses to kick-start domestic production. This budget passed the continuing resolution last year and other allocations will result in about $1.5B in funds for Replicator alone going to drone manufacturers from now until September of 2025, which is approximately $100M per month. Furthermore, this demand discussed above is purely related to US based spending. We anticipate countries around the world will follow the US, which will drive demand for drones further internationally.

Blue & Green UAS Certification

Blue and Green UAS certifications are initiatives led by the U.S. Department of Defense to ensure drones meet stringent security, reliability, and operational standards for use in government and defense applications. The Blue UAS program focuses on vetting commercially available drones and components for military use, ensuring they are free from foreign influence, particularly from adversaries like China, and comply with strict cybersecurity requirements. The Green UAS program expands this effort by certifying drones for broader government and public safety use while maintaining high security and performance standards. These certifications are critical as they provide a trusted framework for procuring secure and reliable drones. Companies that have received Blue certification include:

AgEagle

Ascent Aerosystems

Blue Halo’s

Easy Aerial

Flightwave

Freefly Systems

Harris Aerial

Inspired Flight

Parrot

PDW

Skydio

Red Cat

Unusual Machines

Vantage

Wingtra

Commercial Market

The commercial drone market is rapidly expanding, driven by advancements in technology and increasing adoption across industries such as logistics, agriculture, construction, energy, and infrastructure inspection. Key applications include aerial mapping and surveying, crop monitoring, package delivery, and asset inspections, which leverage drones to enhance efficiency, reduce costs, and provide real-time data. Leading players in the commercial drone market include DJI (Private),Ondas Holdings (ONDS), Skydio (Private), Wingtra (Private), and Parrot (EPA: PARRO). However, despite the growth potential, the market still faces legislative hurdles. Regulatory challenges, such as restrictions on Beyond Visual Line of Sight (BVLOS) operations, limitations on airspace integration, and delays in Unmanned Traffic Management (UTM) implementation, continue to slow the full-scale deployment of drones for commercial use. Addressing these barriers is critical to unlocking the next phase of growth and enabling more widespread adoption of drones across commercial sectors.

How To Fly Drones Commercially?

To date, operating drones for commercial purposes in the U.S. is primarily governed by the FAA Part 107 regulations. To comply, operators must obtain a Remote Pilot Certificate by passing a knowledge test, register their drones, and adhere to specific operational limitations, such as maintaining Visual Line of Sight (VLOS), flying only during daylight hours, and not exceeding altitudes of 400 feet. For more complex operations, such as flying BVLOS, over people, or in controlled airspace, operators must apply for waivers, which involve demonstrating robust safety measures and risk mitigation strategies.

One avenue some drone companies have gone to accelerate the waiver process is to receive Type Certification for their drone platform. The Type Certification process for drones, established by the FAA, is a rigorous approval method that evaluates and certifies specific drone models for safety, reliability, and compliance with regulatory standards. Achieving Type Certification is not easy, but simplifies the waiver process for commercial applications, as certified drones are pre-approved for certain advanced operations, such BVLOS or flights over people, reducing the need for additional FAA approvals. This certification accelerates deployment for commercial use cases like delivery, inspection, and mapping. Companies with Type-Certified drones include Ondas Holdings (ONDS), Wing Aviation, Percepto and Matternet. While the current Type Certification process is not very efficient, we believe the FAA is working on a streamline regulatory process to achieve Type Certification.

That said, recognizing the limitations of Part 107, particularly concerning BVLOS operations, the FAA is developing Part 108, a proposed set of regulations aimed at standardizing and facilitating routine BVLOS drone operations. This new framework is expected to establish safety certification standards, technological requirements (such as detect-and-avoid systems), and updated pilot training protocols to enable more complex and expansive drone operations.

The FAA was required to release a Notice of Proposed Rulemaking (NPRM) for Part 108 by the end of 2024 outlining proposed regulations for routine BVLOS operations and inviting public feedback, but nothing has been released as of mid-January 2025. Once the NPRM is released it will remain open for comment for 30 to 90 days, during which stakeholders can provide input to shape the final rule. After the comment period, the FAA will review the feedback, a process that may take several months. We believe a final rule will likely be introduced in 2026, but we are cautiously optimistic a new Trump administration could move this process a bit faster.

Drone Investment Opportunities

Below we highlight investment opportunities on pure-play drone companies that are directly driving innovation and growth in the drone industry. Unlike larger corporations such as Amazon, which have growing drone exposure through initiatives like Prime Air, the companies discussed here are fully dedicated to the drone ecosystem across hardware, software, and components. We have initiated coverage on select stocks, such as Red Cat (RCAT) and Ondas Holdings (ONDS), and will continue to launch on individual names as we see new opportunities.

Red Cat RCAT 0.00%↑ is a U.S.-based technology company specializing in advanced drone solutions for defense applications. Their flagship product, the Black Widow, is a military-grade drone designed for short-range reconnaissance missions, featuring cutting-edge capabilities such as night vision and secure communications. Complementing this is the Trichon, a hybrid VTOL drone and FANG, an FPV (first-person view) drone capable of lethal, precise strikes. We currently cover Red Cat and have a bullish view due to its unique positioning to capitalize on a global defense drone supercycle, driven by escalating geopolitical tensions and increasing reliance on unmanned systems. Our bullish investment thesis is driven by Red Cat’s recent transformative SRR contract award that significantly strengthens the company’s financial trajectory, as well as its credibility, opening doors to broader opportunities across military branches, public service agencies, and allied defense organizations such as NATO. In turn, we maintain a bullish outlook on Red Cat’s potential and have set a price target of $14.10.

View all Red Cat reports and downloadable 5-year financial model

Ondas Holdings ONDS 0.00%↑ is another leading U.S. based provider of mission-critical private wireless connectivity and drone solutions, operating through its subsidiaries Ondas Networks and Ondas Autonomous Systems. Ondas Autonomous designs and markets advanced commercial drone platforms, including the Optimus System, a fully automated, AI-powered drone solution with FAA Type Certification. This platform supports public safety, security, smart city deployments, and industrial applications, often provided under a Data-as-a-Service (DaaS) model. Ondas also offers counter-drone systems for protecting critical assets and people from hostile drones, positioning itself as a versatile player in the growing unmanned systems market. We also cover Ondas and have a bullish view on the company driven by their recent FAA Type Certification for its Optimus System, which we believe establishes the company as an early leader in the emerging commercial drone industry. Additionally, the company’s counter drone products are seeing robust initial traction since releasing the product in 2024. We believe accelerated commercial drone deployments position Ondas for significant growth, with the potential to achieve 25%+ annual revenue growth over the next five years. However, as we predicted in our initiation report, sales will likely remain lumpy, creating attractive buying opportunities for long-term investors. Recent funding rounds, which allowed the company to raise ~$30M in late 2024 have alleviated many of our cash concerns. Our price target is set at $1.60, which is below the current stock price, but we plan to reevaluate after the company reports 4Q24 earnings. We anticipate that improving investor sentiment across drone stocks could justify multiple expansion, potentially increasing our target significantly in the near future.

View all ONDS reports and 5-year downloadable financial model

AeroVironment AVAV 0.00%↑ is the largest U.S.-based pure-play drone company, generating over $717M in revenue in its most recent fiscal year. The company operates across three main segments: Uncrewed Systems (UxS), which includes mainly small and medium fixed wing drones for reconnaissance and tactical operations; Loitering Munition Systems (LMS), such as the Switchblade, which deliver precision strike capabilities; and MacCready Works, their innovation hub driving advancements in AI, autonomy, and space technologies. AeroVironment’s strong financial performance is underscored by its growing profitability, with adjusted EBITDA margins of ~18%, demonstrating the scalability of its operations. The company is a trusted partner to the U.S. Department of Defense and allied nations, further solidified by its recent $990M PoR contract for the U.S. Army’s Directed Requirement (DR) for Lethal Unmanned Systems (LUS). A key development for AeroVironment is its recent acquisition of BlueHalo, which expands its footprint into high-growth areas such as counter-UAS technologies. This acquisition is particularly compelling as the counter-UAS market grows in importance due to rising drone threats in both defense and civilian airspace. BlueHalo’s expertise in layered defense systems, including advanced AI-enabled detection and defeat solutions, complements AeroVironment’s existing portfolio and positions the company as a diversified leader in defense technology. With its robust innovation pipeline, strong profitability, and exposure to strategic growth areas, AeroVironment is well-positioned for significant long-term value creation.

Unusual Machines UMAC 0.00%↑ is an emerging U.S.-based drone and drone component manufacturer, positioning itself as a critical supplier in a rapidly evolving drone industry. The company focuses on producing domestic, NDAA-compliant components, including flight controllers and other hardware essential for drone operations. Unusual Machines aims to fill the void left by the U.S.'s reduced dependence on Chinese suppliers, a shift accelerated by recent legislation favoring domestically sourced drone technologies. The company’s growth strategy includes leveraging its retail business, expanding into defense partnerships, and addressing global demand for secure, high-performance drone components. Unusual machines also now have two drone components placed on the Blue UAS Framework. We believe these certifications well-positions the company to benefit from the changing legislative landscape, which prioritizes the U.S.-made drone components, and from the Trump administration's likely emphasis on expanding domestic drone capabilities. We believe the company’s strong relationship with Red Cat (CEO is on UMAC board), which recently secured the massive SRR Army contract, positions Unusual Machines to play a key role in supporting this high-profile program and benefiting from new Red Cat (RCAT) opportunities. Additionally, having Donald Trump Jr. as an investor and board advisor could further strengthen its standing under the current administration. While the company is still small, with less than $5M in annual revenue, we believe its strategic positioning and legislative tailwinds suggest significant growth potential.

ParaZero PRZO 0.00%↑ is an Israel-based company specializing in autonomous parachute safety systems for commercial drones, defense drones, and urban air mobility aircraft. Their flagship product, the SafeAir system, integrates advanced technologies such as artificial intelligence to perform real-time data analysis, autonomously identifying and mitigating flight risks. This system enhances safety for bystanders and safeguards valuable drones, equipment, and payloads, facilitating operations over people and beyond visual line of sight. Furthermore, ParaZero have developed the HALO Precision Airdrop System (High-Altitude Low-Opening), which is engineered to transform drone-based logistics by enabling precise and secure delivery of critical supplies in challenging environments. While ParaZero's innovative safety and logistics solutions are compelling, we believe there is a concern that drone manufacturers may develop similar technologies internally, potentially reducing the demand for third-party systems. We believe this possibility positions ParaZero as an attractive acquisition target for larger drone companies seeking to integrate proven safety mechanisms into their platforms. Additionally, ParaZero's relatively modest revenue of ~$600K in 2023 suggests significant growth potential, especially if strategic partnerships or acquisitions materialize.

AgEagle UAVS 0.00%↑ is a U.S.-based drone company specializing in commercial and industrial applications, with a primary focus on aerial mapping and intelligence solutions in a variety of commercial applications such as agriculture, construction, mining and public safety. The company’s portfolio includes the eBee fixed-wing drone series, designed for high-precision mapping and surveying tasks, as well as a range of sensors for data collection and analysis, including multispectral, thermal, and RGB imaging technologies. Additionally, AgEagle offers flight planning and data processing software, enabling seamless integration between hardware and software to deliver actionable insights for industries such as farming, construction, and energy. Despite its innovative product offerings, AgEagle shares have faced significant pricing pressure being down over ~97% over the last 12 months. Stagnant sales, coupled with a cash position of under ~$300K as of 3Q24 with a quarterly cash burn that is north of $1M, are likely drivers to the stock price as investors raise concerns about the company’s ability to sustain operations without additional capital. While the eBee series and its portfolio of mapping and analysis tools hold potential in the growing commercial drone markets, the company’s financial constraints are concerning for potential investors.

Draganfly DPRO 0.00%↑, headquartered in Saskatoon, Saskatchewan, Canada, is one of the more diversified public drone companies with revenue streams spanning hardware, services, software and engineering services. Its portfolio includes advanced drones like the Commander 3XL for industrial applications, precision delivery systems for critical missions, and AI-powered solutions for data collection and analysis. With over 25 years of innovation, Draganfly operates globally across sectors such as agriculture, mining, infrastructure, and public safety, with notable deployments in Ukraine for landmine detection and medical delivery. Despite its strong market positioning and advanced technologies, the company has faced stagnant growth over the past year. This, combined with high cash burn and a dwindling cash position, has likely raised investor concerns about its financial sustainability and ability to capitalize on the rapidly expanding drone market. Given the company’s broader exposure to a wide variety of applications, we do believe if growth can return the company is in a unique position to capitalize on demand for commercial drone solutions.

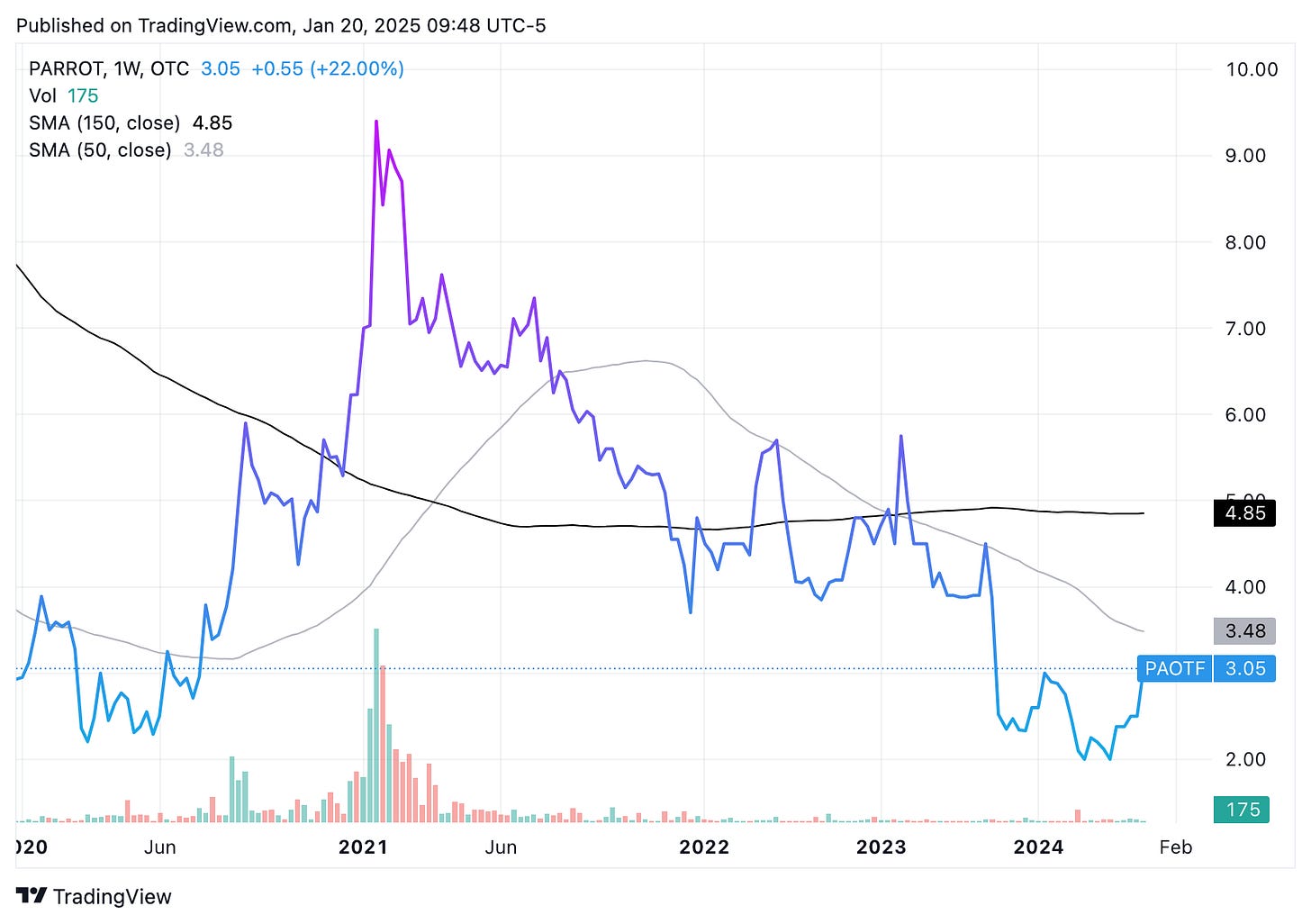

Parrot Drones (EPA: PARRO) is a France-based drone company and a leading European manufacturer specializing in high-performance drones for professional and enterprise applications. The company’s product portfolio includes ANAFI drones, which are compact and lightweight quadcopters designed for use in surveying, inspection, and public safety. Parrot also offers advanced software solutions for drone operations, including mapping, 3D modeling, and real-time analytics, positioning itself as a comprehensive provider of drone hardware and software. The company’s focus on secure, reliable, and feature-rich drones has made it a strong player in the European market and an alternative to Chinese competitors. While Parrot is making significant inroads into the U.S. market, the company could benefit substantially if Europe adopts anti-foreign drone policies similar to those in the U.S. Such policies could provide a tailwind for Parrot, positioning it as a trusted domestic supplier for European governments and enterprises seeking secure drone solutions. Additionally, Parrot’s recent performance highlights its growth potential. In its latest 3Q24 earnings release, the company reported an impressive ~39% Y/Y revenue increase, demonstrating strong market traction in the U.S. With its innovative product lineup, and growing revenue base, Parrot could be well-positioned to capitalize on increasing demand for professional-grade drones in its home market and beyond. Furthermore, Parrot’s inclusion in the Blue sUAS program and its alignment with U.S. allies position it favorably to continue operating in the U.S. market, as new legislation may ban the operation of certain foreign drones in U.S. airwaves.

DroneShield (ASX: DRO) is a global leader in counter-drone (C-UAS) technology, headquartered in Sydney, Australia, with a significant presence in the U.S., where ~70% of its sales are derived. The company specializes in advanced detection and defeat systems designed to protect critical infrastructure, military assets, and civilian environments from unmanned aerial threats. DroneShield’s product portfolio includes portable solutions like the DroneGun Mk4, vehicle-mounted systems like DroneSentry-X, and fixed-site solutions for large-scale operations. Its proprietary AI-powered software integrates radar, radio frequency, and optical systems to provide real-time threat detection and mitigation, making it a leader in multi-sensor counter-drone technology. Droneshield saw an inflection in the business with revenues growing over ~220% Y/Y in 2023 to $54.1M. While sales are expected to be flat in 2024, we believe DroneShield is well-positioned for long-term growth, as their core strategy aligns with the rapidly growing need for counter-drone solutions as unmanned aerial threats become more prevalent. As the only publicly listed pure-play counter-drone company, DroneShield offers a unique investment opportunity in a high-growth, mission-critical sector. We also believe DroneShield could be a compelling acquisition target for drone or defense companies seeking to integrate advanced counter-drone capabilities into their portfolios. However, over the last 12 months we believe the counter drone market has become much more competitive with Ondas Holdings and AeroVironment now entering the market. That said, we believe their entrance further validates the massive opportunity for this technology.

Redwire RDW 0.00%↑ is a U.S.-based leader in space infrastructure, specializing in delivering innovative solutions for civil, commercial and national security space missions. In January 2025, Redwire entered the drone space after announcing the acquisition of Edge Autonomy, a prominent provider of uncrewed airborne systems, for $925M in cash and stock. This strategic acquisition is set to significantly broaden Redwire's portfolio by incorporating Edge Autonomy's combat-proven autonomous airborne platforms. These platforms are optimized for long-endurance, long-range reconnaissance missions and can be rapidly deployed for time-critical operations. By acquiring Edge Autonomy, Redwire aims to leverage synergies between space and airborne operations, creating integrated solutions that meet the evolving needs of defense and national security customers. We believe this strategic expansion into the drone sector positions Redwire to capitalize on the growing demand for autonomous systems across multiple domains.

Research Disclaimer: We actively write about companies in which we invest or may invest. From time to time, we may write about companies that are in our portfolio. Content on this site including opinions on specific themes and companies in technology, market estimates, and estimates and commentary regarding publicly traded or private companies is not intended for use in making any investment decisions and provided solely for informational purposes. We hold no obligation to update any of our projections and the content on this site should not be relied upon. We express no warranties about any estimates or opinions we make.