Tekna 2Q24 Material Order & Backlog Growth Robust Despite Industry Challenges; Implementing New Profitability Program

Key Takeaways: Tekna reported mixed 2Q24 results. While sales in 2Q24 were up 29.7% Q/Q and 1.9% Y/Y, which we believe is solid given macro challenges, the Company’s overall results were lower than Management’s expectations. The lower performance in 2Q24 is driven by lower than expected sales into 3D OEMs due to sluggish new printer growth, as well as lower sales to aerospace and medical customers as customers work off high inventory levels. That said, we believe underlying demand trends for their advanced materials remains robust with material bookings up ~18% Y/Y in the quarter, as well as pipeline building for new systems. To mitigate the near term disruption and impact on profitability, they are taking corrective actions by implementing a new profitability program, which will drive an improvement of $2M in EBITDA in 2H24. Although their full year growth expectation is likely now lower, Tekna reiterated their 2024 guidance, which calls for revenue growth and margin improvements on a Y/Y basis.

While Management was discouraged with their Q2 revenue performance, the Company as well as our view on Tekna’s long-term opportunity has not changed. In-line with almost all of our other industrial tech universe, we were not surprised macro headwinds continue to impact near term results. Given their growing pipeline and order book, we remain confident the Company will grow this year, but are now expecting only mid-single digit growth. Despite lower expected revenues, we believe the Company could reach adjusted EBITDA breakeven or better in 2H24 under the new profitability program. That said, we believe Tekna is in the early innings of a multi-year super cycle as demand for their advanced metal materials and plasma systems grow across applications in 3D printing, consumer electronics, aerospace and medical. In turn, we are confident 20%+ revenue growth will return in 2025 and beyond. We continue to view the near term challenges as an attractive buying opportunity for long-term investors. We would also call out Tekna’s Board of Director acquired 17,000 shares post earnings. Assuming Tekna can execute on their aggressive growth trajectory, we believe there is 150%+ upside potential in the stock and remain strong buyers.

View detailed historical results in our full downloadable financial excel model here.

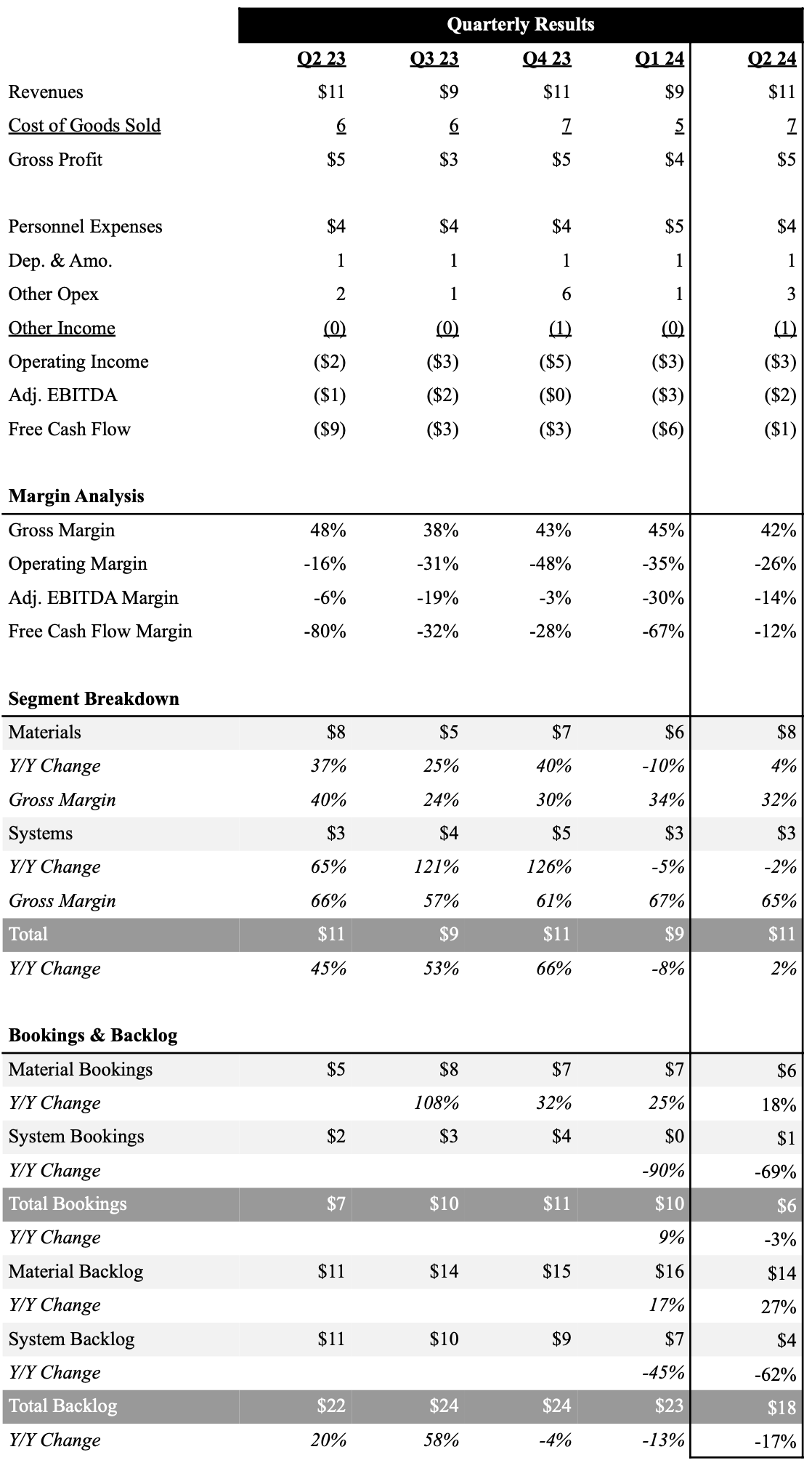

Source: Company Filings, FactSet; Data In Millions

2Q24 Earnings Summary

Tekna reported 2Q24 revenues of $11.2M, which was up 1.9% Y/Y. Material sales were $7.8M, which were up 3.6% Y/Y due to lower sales to 3D printer OEMs as high-interest rates have impacted new system sales. This is not a surprise as almost all public 3D OEMs have consistently reported lower system sales over the last 18 months due to higher interest rates lengthening sales cycles. Sales were also negatively impacted by lower demand from aerospace and medical customers, which we attribute to inventory destocking. That said, material bookings were $5.9M in 2Q24, up 18.0% Y/Y. This drove their materials backlog to $14.0 at the end of 2Q24, which was up 27.3% Y/Y. The Company continues to see strong material demand from new consumer electronics customers (Apple and Samsung). In fact, Tekna highlighted, they provided approval samples to a new consumer electronic customer (we believe Samsung) for large scale manufacturing of smart watch cases produced by Metal Injection Molding. Although still in the early stages, Tekna expects consumer electronics to grow from 5% of revenues in 2023 to ~10% of revenues in 2024. System revenues in 2Q24 were $3.4M, which were down 1.9% Y/Y. The revenue decline was anticipated and driven by timing of deployments. Furthermore, while 2Q24 system bookings were down ~69% Y/Y to $0.5M, we believe Tekna has strong visibility into future orders. We specifically believe the pipeline is driven by the Company’s PlasmicSonic systems, which is used for testing materials in atmospheric re-entry conditions for space tourism and space exploration.

Gross margins were 41.7%, down from 48.2% in 2Q23 and were impacted by $0.5M in one-off costs. Material gross margins were 31.6%, while systems gross margins were 64.7%. Due to the revenue shortfall, Tekna reported an adjusted EBITDA loss of $1.5M. However, driven by working capital efficiencies the Company only burned $0.5M in cash from operations in the quarter. Our biggest concern is liquidity as the Company ended the quarter with $9.3M in cash. However, Tekna’s strong cost controls, coupled with their new profitability program gives us confidence they can navigate this turbulent time with the cash on hand.

Tekna reiterated their 2024 guidance, which calls for revenue growth and margin improvements on a Y/Y basis. However, we believe their revenue growth estimate is lower than previously anticipated. Tekna is expecting lower revenues in Q3 driven by seasonality.

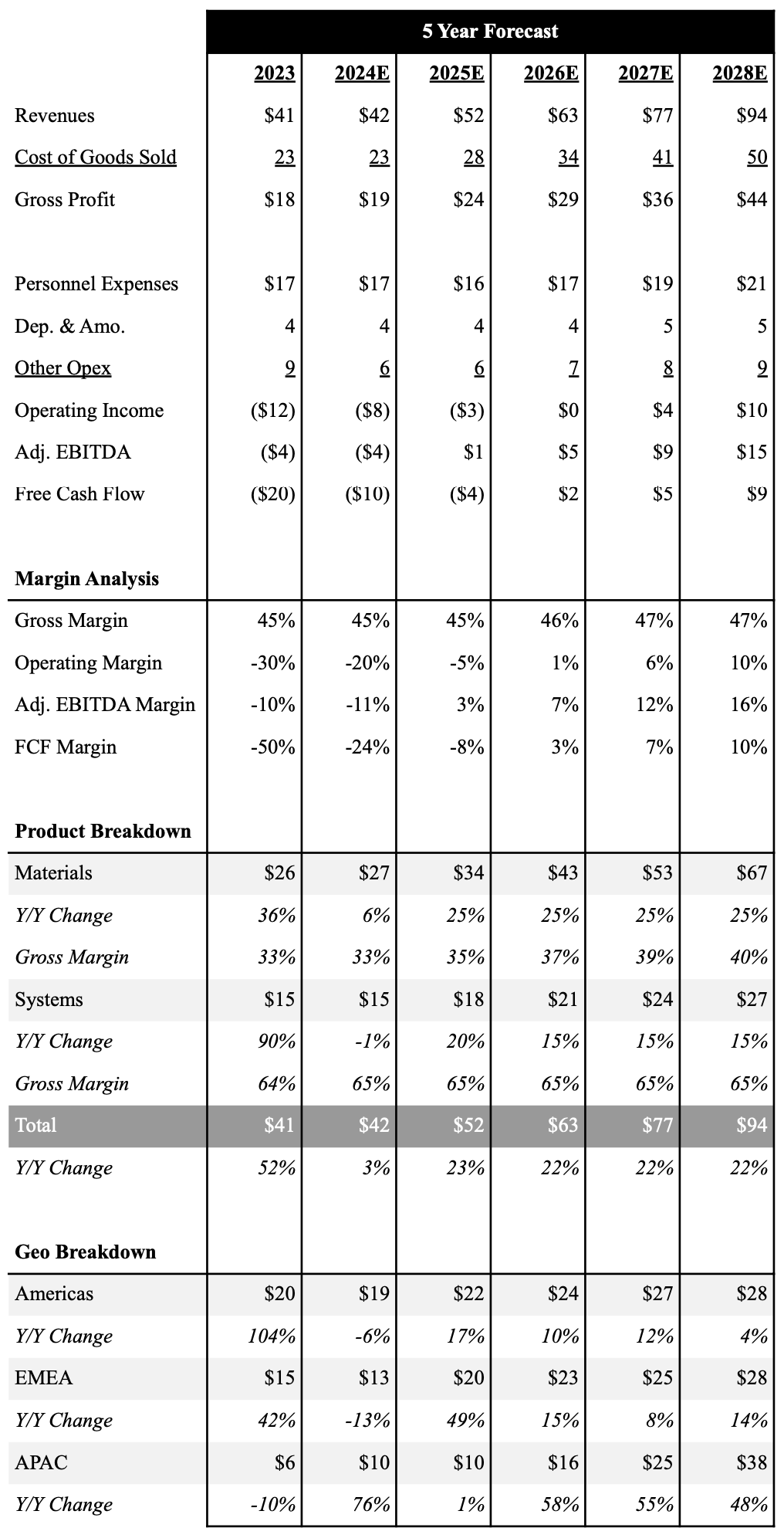

5-Year Financial Outlook

Following 2Q24 results, we have taken down our estimates, but believe there is significant growth ahead once macro conditions improve. We believe the material business will grow 6%+ in 2024. Coupled with essentially flat growth in system sales, we expect the Company to report revenues of $42.3M in 2024, up 3.3% Y/Y. We expect the Company to return to 20%+ growth in 2025, and sustain this growth rate through 2028. We expect production efficiencies and cost controls will continue to drive 20 bps in gross margin expansion in 2024 to 44.8%. As revenues ramp in 2025, and beyond we expect Tekna to continue to see gross margin expansion and reach 47.3% by 2028. However, given the 1H24 revenue shortfall, we expect Tekna to report a small adjusted EBITDA loss of $4.5M in 2024, which is modestly higher than our previous estimate of a loss of $1.5M. However, we believe the Company will turn adjusted EBITDA positive beginning in 2025 and reach ~$15M in adjusted EBITDA by 2028. We expect this will translate into strong cash flow generation with our current estimates forecasting free cash flow of $9M in 2028.Below is an overview of our 5 year outlook with a full downloadable financial excel model here.

Source: Industrial Tech Analyst; Data In Millions

Investment Thesis

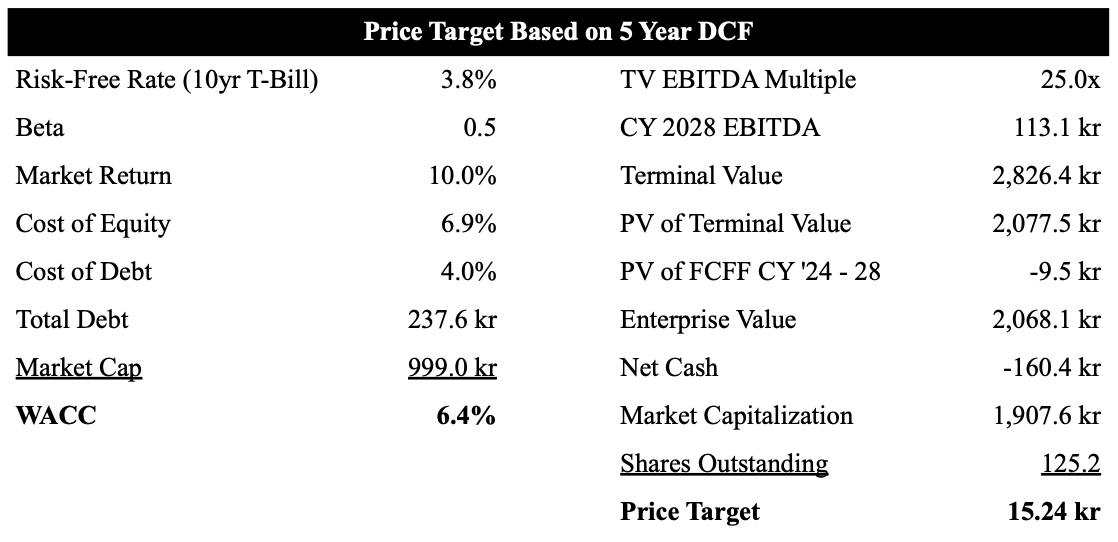

We believe Tekna is in the early innings of a multi-year super cycle as demand for their advanced metal materials grow across applications in 3D printing, consumer electronics, aerospace, and medical. Coupled with a growing pipeline for PlasmicSonic systems from space exploration companies, we expect Tekna to see 25%+ annual revenue growth over the next 5 years with EBITDA margins approaching 20%. These robust catalysts drive our bullish stance and 15.24 NOK price target.

As shown in our table below we use a 5-year DCF model to value Tekna shares. We also value shares in Norwegian Krone (NOK) given they are sold on the Oslo Exchange. Based on our current forecast we value Tekna at 15.24.

Source: Industrial Tech Analyst, Data In Millions Except Price Target

Looking to become a better investor or need to find that perfect gift for your finance friend?

Check out these products from our partner Trading Roadmap.

Research Disclaimer: We actively write about companies in which we invest or may invest. From time to time, we may write about companies that are in our portfolio. Content on this site including opinions on specific themes and companies in technology, market estimates, and estimates and commentary regarding publicly traded or private companies is not intended for use in making any investment decisions and provided solely for informational purposes. We hold no obligation to update any of our projections and the content on this site should not be relied upon. We express no warranties about any estimates or opinions we make.