Tekna 3Q24 Sales and Bookings Decline, But Signs Of Green Shoots Showing In 2025

Key Takeaways: Tekna reported what most would perceive as discouraging 3Q24 results. Sales in 3Q24 were down ~16% Y/Y driven by lower than expected advanced material sales into 3D OEMs due to sluggish new printer growth, as well as lower Plasma system sales as projects continued to be delayed. Furthermore, total bookings in the quarter were down 44%, which is very concerning. The company also removed their initial guidance for revenue growth and margin improvements on a Y/Y basis in 2024. As a result, shares traded down ~12% on these results.

Although discouraged with these results, we believe their are signs showing for a recovery in 2025 and our view on Tekna’s long-term opportunity has not changed. In-line with almost all of our other industrial tech universe, we were not surprised macro headwinds continue to impact results, and specifically their additive manufacturing customer segment. We cover the 3D printing space closely, and this market has been in a 2 year industry decline driven by uncertainty and high interest rates. With rates set to come down, and hopes of improving manufacturing environment under the Trump Administration we are cautiously optimistic 2025 could be a much stronger year for their additive segment. Furthermore, we believe the Trump Administration could have a positive impact on Tekna’s Plasma System division, given Trump’s robust relationship with Elon Musk. We believe SpaceX is likely one of the multiple customers evaluating their PlasmicSonic Systems and access to government funding / grants could materially impact Tekna’s business. Lastly, we were encouraged by Tekna’s traction in aerospace and medical material segments, which were up 25% and 35% Y/Y, respectively in what is perceived soft manufacturing environment. After a few weeks into Q4, Management highlighted their Materials segment order book is showing signs of recovery in these segments, and consumer electronics segments, which gives us further confidence in growth returning in 2025.

All that said, we continue to believe Tekna is in the early innings of a multi-year super cycle as demand for their advanced metal materials and plasma systems grow across applications in 3D printing, consumer electronics, aerospace and medical. In turn, we are confident double-digit growth will return in 2025 and beyond. In addition, we believe with a recovery in demand, the company now has a clear path to profitability, which could be reached on a quarterly basis in 2025. We continue to view the near term challenges as an attractive buying opportunity for long-term investors. Assuming Tekna can execute on their aggressive growth trajectory, we believe there is 200%+ upside potential in the stock and remain buyers.

View detailed historical results in our full downloadable financial excel model here.

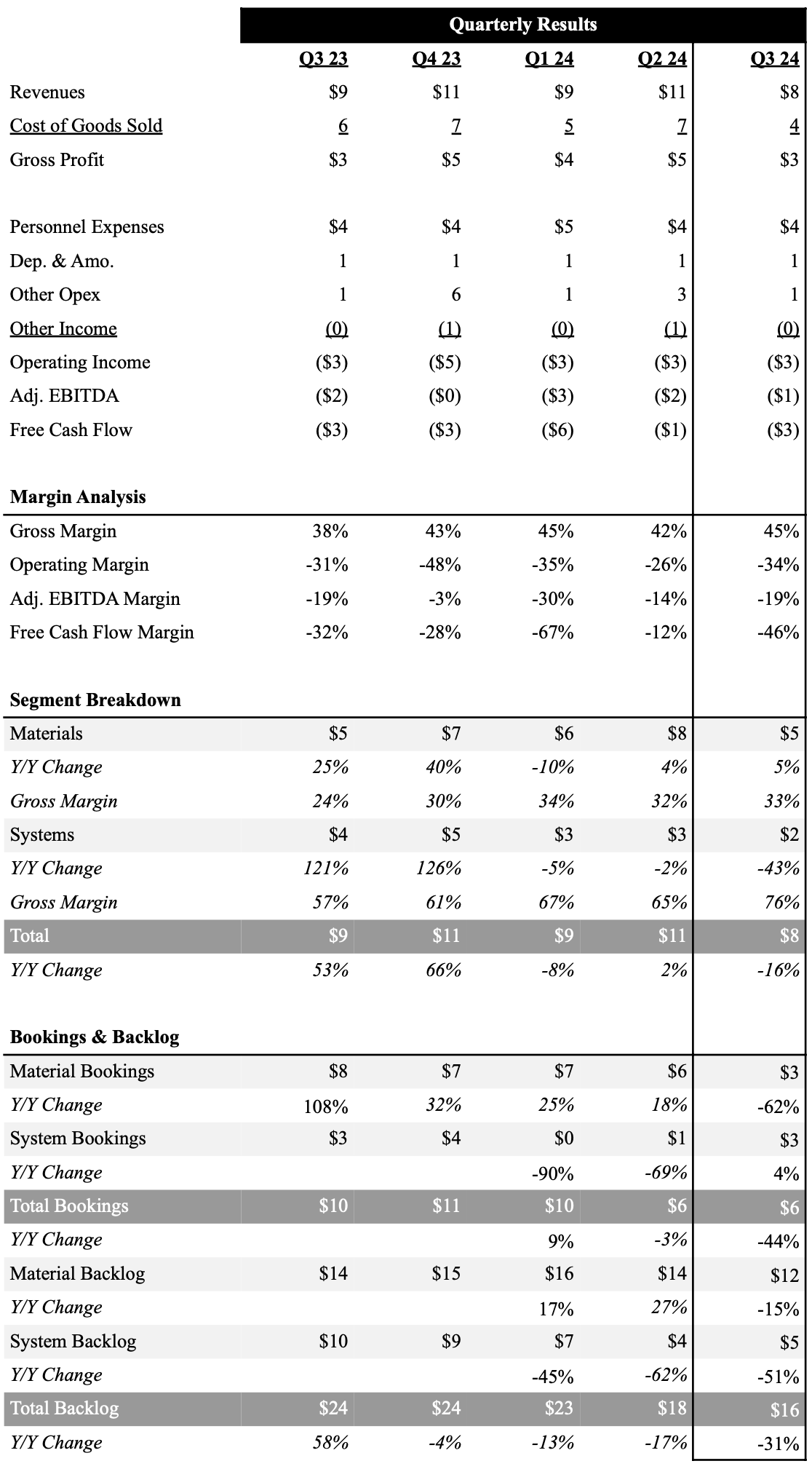

Source: Company Filings, FactSet; Data In Millions

Investor Gifts

Looking to become a better investor or need to find that perfect gift for your finance friend? Check out these products from our partner Investor Gifts like their 2025 Investor Calendar.

✓ US Economic Release Dates

✓ Option Expiration Dates

✓ Market Holidays

✓ Historical Market Returns

SAVE 20% with our exclusive promo SAVE20 at checkout!

3Q24 Earnings Summary

Tekna reported 3Q24 revenues of $7.6M, which was down ~16% Y/Y. While the company anticapted sales to be down Q/Q due to seasonal summer trends, the company experienced lower than expected material sales from 3D OEMs. Material sales were $5.5M, which were still up ~5% Y/Y due to strong sales into aerospace and medical customers, which were up ~25% and ~35% Y/Y respectively in the quarter. Sales in this segment continued to be largely impact by low sales to 3D printer OEMs, which were down ~74% Y/Y in 3Q24 as high-interest rates have impacted new system sales. Furthermore, material sales to consumer electronic customers were down ~7% Y/Y in the quarter. Note consumer electronic material sales are up 60% YTD, and the company is in talks with their two key customers (Apple and Samsung) for 2025 orders. Material bookings were $2.9M in 3Q24, down ~62% Y/Y. This translated into their materials backlog of $11.5M at the end of 3Q24, which was down ~15% Y/Y. System revenues in 3Q24 were $2.2M, which were down ~43% Y/Y. The revenue decline continues to be impacted by project delays and timing of deployments. Meanwhile 3Q24 system bookings were up ~4% Y/Y to $2.9M, but their backlog decreased ~52% Y/Y to $4.9M. That said, we believe Tekna has strong visibility into future orders. We specifically believe the pipeline is driven by the Company’s PlasmicSonic systems, which is used for testing materials in atmospheric re-entry conditions for space tourism and space exploration. As previously stated we believe this division could benefit materially from the Trump Administration given its robust ties to Elon Musk who is the founder of SpaceX and customer of Tekna.

Gross margins were 45.5%, up from 38.3% in 3Q23. The robust gross margin expansion was driven by favorable sales mix of the company’s larger particle materials. Material gross margins were 33.4%, while systems gross margins were 75.7%. Due to the revenue shortfall, Tekna reported an adjusted EBITDA loss of $1.4M. However, the company is taking action to improve profitability with announcing a 15% Y/Y reduction in headcount, and other operational efficiency initiatives. The company burned $1.2M in cash from operations in the quarter, but did increase cash through a loan deposit of $2.2M. Our biggest concern is liquidity as the company ended the quarter with $7.6M in cash. However, Tekna’s strong cost controls, as well as their robust relationship with their largest shareholder who is providing additional financing when needed, we are confident they can navigate this turbulent time.

Tekna removed their original guidance which called for revenue growth in 2024, and now expects growth to be in-line with 2023 levels. However, after a few weeks into Q4, they highlighted their Materials segment order book is showing signs of recovery, particularly in the medical, aerospace, and consumer electronics segments.

As previously announced, Tekna secured a major win in an intellectual property case concerning competing patent rights to produce titanium powder in Canada. Per the Federal Court process, Tekna is working to recoup a potentially significant part of its related legal costs. A Notice of appeal was submitted on September 9 by the other party. It is Tekna’s opinion that the risk resulting from the appeal is low.

5-Year Financial Outlook

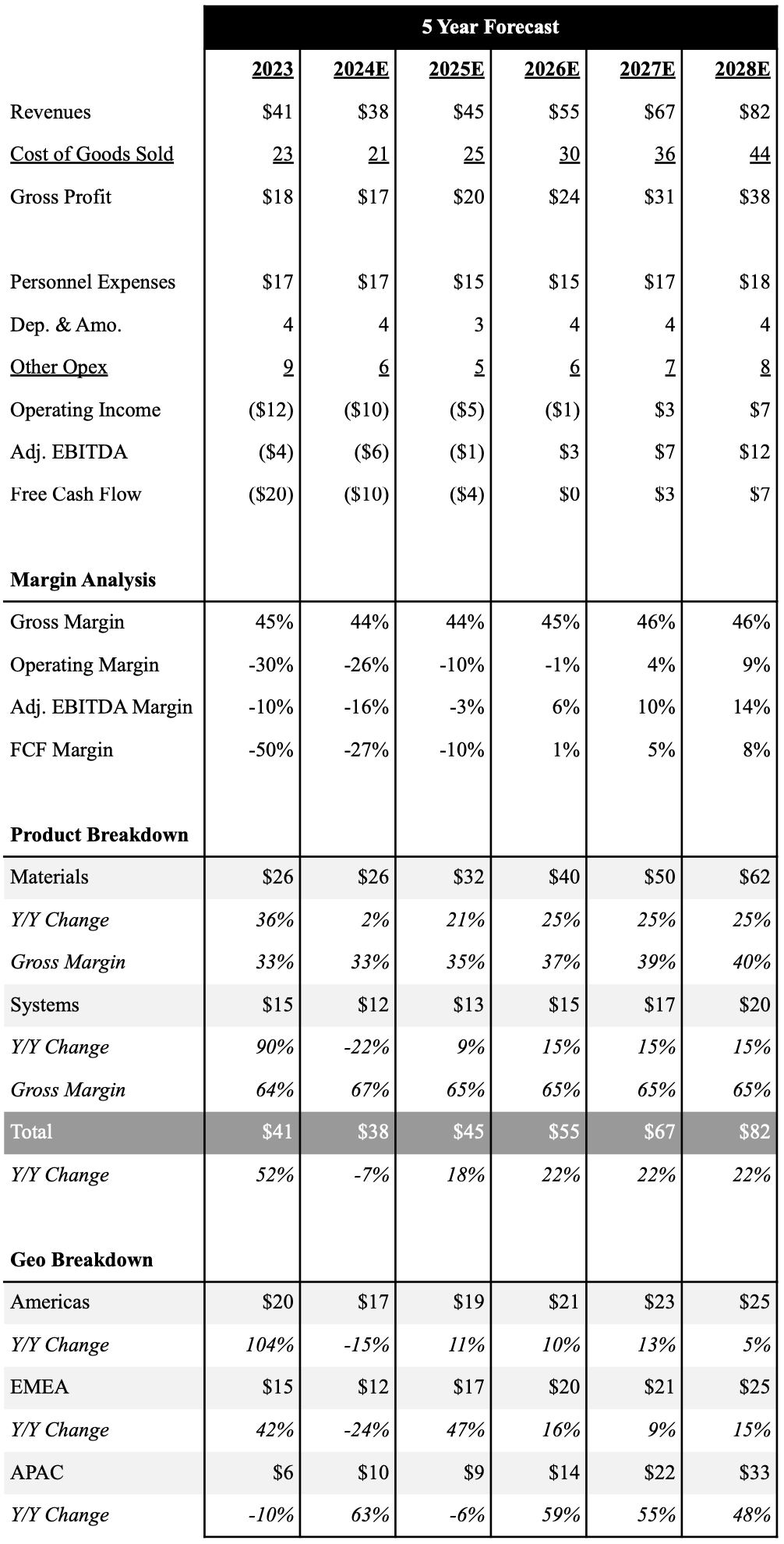

Following 3Q24 results, we have taken down our estimates, but believe there is significant growth ahead once macro conditions improve. We believe the Material business will grow ~2%+ in 2024. However, we expect System sales to be down 22% due to timing of deployments being pushed to 2025 and in turn expect the company to report revenues of $38.1M in 2024, down ~7% Y/Y. We do expect the company to return to growth in 2025 (~18% Y/Y), and sustain 20%+ growth rate through 2028. As revenues ramp in 2025, and beyond we expect Tekna to continue to see gross margin expansion and reach 46% by 2028. We now believe the company will now report a small adjusted EBITDA loss in 2025, but do see a path for the company to be adjusted EBITDA positive for the year if sales recover quicker than expected. However, we expect the company to generate ~$11.8M in adjusted EBITDA by 2028. We expect this will translate into strong cash flow generation with our current estimates forecasting free cash flow of $6.9M in 2028. However, given the company’s System gross margins are north of 65%, we believe if our thesis proves correct about growing opportunities under the Trump Administration, their could be significant upside to these estimates.

Below is an overview of our 5 year outlook with a full downloadable financial excel model here.

Source: Industrial Tech Analyst; Data In Millions

Investment Thesis

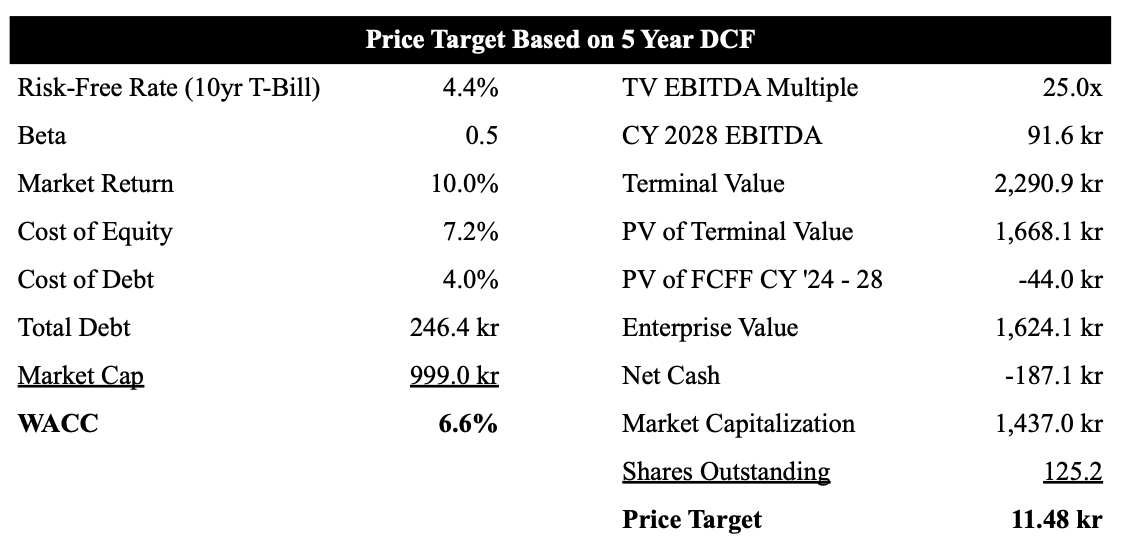

We believe Tekna is in the early innings of a multi-year super cycle as demand for their advanced metal materials grow across applications in 3D printing, consumer electronics, aerospace, and medical. Coupled with a growing pipeline for PlasmicSonic systems from space exploration companies, we expect Tekna to see 25%+ annual revenue growth over the next 5 years with EBITDA margins approaching 20%. These robust catalysts drive our bullish stance and 11.48 NOK price target.

As shown in our table below we use a 5-year DCF model to value Tekna shares. We also value shares in Norwegian Krone (NOK) given they are sold on the Oslo Exchange. Based on our current forecast we value Tekna at 11.48 NOK, which is lower from our prior estimate of 15.24 due to lower revenue and profitability forecasts.

Source: Industrial Tech Analyst, Data In Millions Except Price Target

Research Disclaimer: We actively write about companies in which we invest or may invest. From time to time, we may write about companies that are in our portfolio. Content on this site including opinions on specific themes and companies in technology, market estimates, and estimates and commentary regarding publicly traded or private companies is not intended for use in making any investment decisions and provided solely for informational purposes. We hold no obligation to update any of our projections and the content on this site should not be relied upon. We express no warranties about any estimates or opinions we make.