Tough 1Q25 Guidance Creates Buying Opportunity As Impinj’s Growth Story Isn’t Over

View all Impinj reports and link to our research disclaimer.

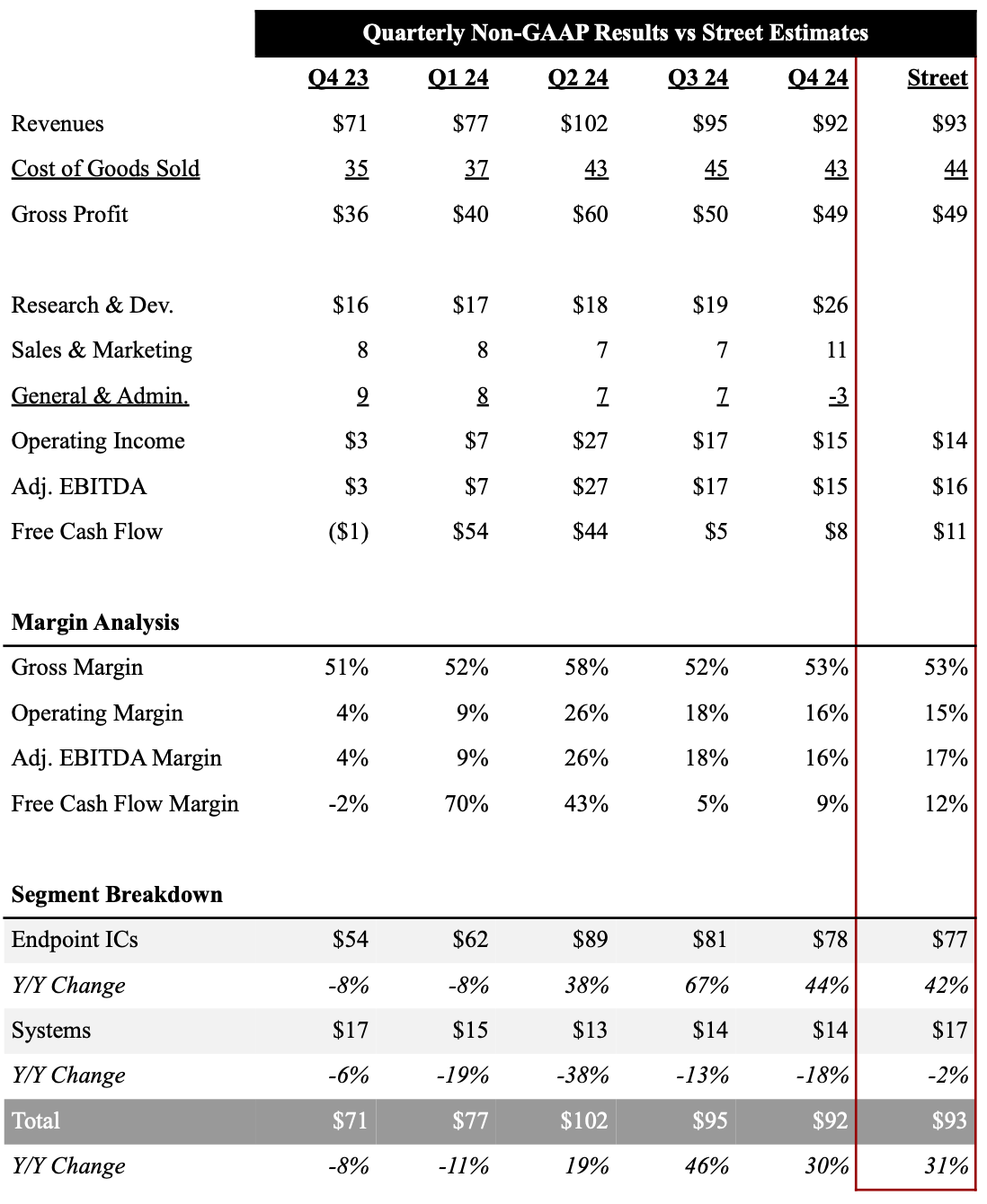

Key Takeaway: Impinj PI 0.00%↑ delivered softer than expected 4Q24 results, missing expectations on both revenue and adjusted EBITDA, while issuing significantly weaker-than-anticipated guidance for 1Q25. The Q4 shortfall that also is leading to weaker Q1 guidance was driven by an inventory buildup fueled by geopolitical uncertainty around tariffs, as well as aggressive inlay price sourcing from customers further down the supply chain, which led to excess stock. In addition, last week one of Impinj’s key logistics customers, UPS, announced it will end its relationship with Amazon, further impacting inventory levels at their key inlay customer Avery Dennison. Shares plunged more than 20%, reflecting growing investor concerns over the company’s near-term outlook.

While we were very surprised by the magnitude of the Q1 shortfall, we view this inventory work-down as an opportunity for investors, as such fluctuations are not uncommon for the company. Impinj faced a similar inventory buildup issue in late 2023, which took approximately three quarters to resolve. However, despite those headwinds, the company still managed to deliver nearly 19% Y/Y growth for the full year, demonstrating the resilience of its business model. We remain confident that Impinj will successfully navigate this temporary challenge, but acknowledge that near-term price action may remain volatile. That said, we recently upgraded Impinj to Buy, as we don’t want investors to overlook the strong demand signals coming from its key customers. Most notably, Avery Dennison, which represents over 30% of Impinj’s revenues, recently guided to accelerating growth in its Intelligent Labels business in 2025. This gives us confidence that the current inventory correction may be short-lived and that Impinj remains well-positioned to return to 20%+ annual revenue growth. With demand expanding across core retail, apparel, and logistics markets, alongside growing adoption in grocery and other new verticals, we continue to see a strong multi-year growth trajectory.

Full financial results and 5 year downloadable model here.

Source: Company Filings, FactSet, Data In Millions

Investor Gifts

Looking to become a better investor or need to find that perfect gift for your finance friend? Check out these products from our partner Investor Gifts like their 2025 Investor Calendar.

Key 4Q24 Earnings Takeaways

Impinj reported 4Q24 revenue of $91.6M, reflecting a Y/Y growth rate of 29.6% from $70.7M in 4Q23. This result was in-line with the companies previous guidance range ($91-94M), but slightly missed the consensus estimate of $93.1M. The shortfall was primarily due to an inventory buildup driven by geopolitical uncertainties, aggressive inlay price sourcing by Impinj’s customers' customers as well as their key logistics customer UPS ending their partnership with Amazon. It is worth noting UPS publicly said Amazon accounted for ~12% of UPS sales in 2024 and was a high volume customer, so this will impact IC demand near term in this vertical. Despite these challenges, the company highlighted robust traction in retail merchandise, notably with Walmart, and significant growth in the apparel sector. Additionally, Impinj expressed optimism about the food and beverage industry, announcing another large customer win in this category. In the previous quarter, they talked about their first major customer in this category (Kroger) is planning to deploy RFID in the bakery department across 2,800 stores over the next six quarters. We believe further diversifying into new markets will help the company better navigate inventory builds.

Impinj achieved a non-GAAP gross margin of 53.1%, up from 50.9% Y/Y, which was driven by scale efficiencies. Operating expenses increased only $0.6M Y/Y, showing strong operating leverage that translated into 16.4% operating margins. Adjusted EBITDA for the quarter was $15.0M, a significant improvement from $3.0M in the same period last year, but slightly below consensus estimates of $15.4M.

For 1Q25, the company provided guidance with expected revenue between $70.0 - $73.0M, which implies revenues down ~7% at the midpoint. This outlook is significantly below consensus estimates of $93.3M. On the earnings call, management noted that gross margins are expected to decline slightly in Q1. Given the revenue shortfall, adjusted EBITDA guidance in the range of $1.1 - 2.6M missed consensus estimates of $15.1M.

Below we dive deeper into our updated five-year outlook, investment thesis and price target.