We Are Upbeat On These 3 Stocks Heading Into Q2 Earnings

Q2 earnings season has started off rocky as a more challenging outlook driven by high-interest rates, political uncertainty and slowing consumer spend has caused 2H24 growth expectations to come down for many in our industrial tech universe. Tekna (TEKNA.OL), Ondas (ONDS) and AutoStore (AUTO.OL) are three stocks that we remain very upbeat about and are slated to report earnings over the next week. While we expect macro challenges to impact results, all three companies have seen bullish data points leading up to earnings, including strong insider buying as well as positive read throughs from key distributors.

Below we dive deeper into these data points and what to expect when heading into Q2 earnings.

Ondas (ONDS)

Ondas is slated to report 2Q24 results on Wednesday, August 14th before markets open. Ondas is coming off a challenging 1Q24 that fell below Management and consensus expectations, as extended timelines related to the Class 1 railroad network upgrade and supply chain disruption in their Autonomous business impacted sales in the quarter. However, given the size of these deployments, we expect these large network upgrades and drone deployments will take time and anticipate revenues can be lumpy quarter-to-quarter. Heading into 2Q24, we are expecting an improvement in revenues Q/Q, but believe deployment timing and supply chain challenges to likely impact Y/Y growth trends. However, analysts are expecting revenues to be down 78% Y/Y to $1.2M, which we believe could be too conservative. We expect Management to sound very upbeat about the pipeline in 2H24 and expect that to materialize, which will drive 25%+ Y/Y revenue growth in 2024.

We would also call out Ondas has seen strong insider buying since reporting 1Q24 results. On June 10th a Director purchased 100,000 shares at a price of $0.67. On June 12th, the CEO acquired 45,049 shares, of which 7,649 shares were purchased at a price of $0.67 and 37,400 shares were purchased at $0.74.

We believe Ondas Networks and Ondas Autonomous are strongly positioned in two robust secular tech trends that are both still in the early innings of adoption. Although the company will need to raise cash, which could include spinning out the Autonomous business, we believe the stock accretion opportunity significantly outweighs future dilution. In turn, we remain buyers of Ondas with a 3 - 5 year horizon.

Link to our 5-year Ondas outlook and downloadable excel financial model here.

AutoStore (AUTO.OL)

AutoStore is scheduled to report 2Q24 earnings before markets open on Thursday, August 15th. In-line with Tekna and Ondas, AutoStore is coming off a challenging quarter where revenue growth slowed, driven by timing and delay of deployments. However, order growth remained strong in the quarter and Management sounded very upbeat on the conference call for the remainder of the year. That said, shares have traded down ~30% since 1Q24 earnings as we believe investors are concerned about the challenging macro environment and high interest rates continuing to push out deployments.

Although we wouldn’t be surprised if macro economic headwinds continue to impact growth in 2Q24, we believe positive data points from Kardex, which is one of AutoStore’s largest global distributors, could indicate a stronger than expected 2Q24. Kardex is publicly traded, and provided 1H24 results on July 24th. While they do not break out AutoStore sales specifically, in their presentation they indicated decision-making delays for larger projects has eased as of Q2 and demand for AutoStore systems continued to be extraordinarily strong. During Q/A they also mentioned their AutoStore business is seeing sustainable growth across Europe, Americas, and APAC with project sizes increasing. Although we have to keep in mind this is just one distributor, we believe these positive comments indicate the future remains bright for AutoStore.

We view AutoStore as a clear market winner within the fast emerging automated storage and retrieval market as secular trends of e-commerce, labor shortages and rising labor costs have made their solution increasingly attractive in fulfillment centers across a growing number of industries. We view the slowdown in demand as an opportunity for investors, as we believe the company will return to 25%+ growth as macro conditions improve. Furthermore, the company has been able to grow profitably, producing adjusted EBITDA margins north of 45%. As macro conditions improve, we believe AutoStore’s strong fundamentals coupled with faster growth will support meaningful multiple expansion. AutoStore is currently trading at 12x EV/EBITDA based on 2025 estimates, which is below our industrial tech comp group (~25x) and their closest public peer Symbotic (~35x). We view current prices off an attractive risk/reward given the Company’s long term opportunity in fulfillment automation.

Link to our 5-year AutoStore outlook and downloadable excel financial model here.

Tekna (TEKNA.OL)

Tekna is slated to report 2Q24 earnings prior to markets open on Friday, August 16th. This will be the first earnings call since the Federal Court of Canada ruled overwhelmingly in favor of Tekna in their lingering IP case against Advanced Powders & Coatings Inc. (AP&C). That said, Tekna is coming off a Q1 where they saw sales decline ~8% Y/Y largely due to timing of new system deployments and lower material sales to 3D OEMs. Driven by the fact material bookings grew ~25% Y/Y in 1Q24, system backlog remained healthy and Management's upbeat tone on the Q1 conference call, we believe the pipeline remains strong and Tekna should see sales improve Q/Q in Q2. However, we believe lower sales into 3D OEMs due to macro challenges may still hamper growth in the June quarter. Regardless, we expect Management to be upbeat on demand for both materials and systems heading into 2H24. We specifically are hoping to hear about additional orders into consumer electronic customers (Apple and Samsung) for next gen smartphone and smartwatch components and casing. Furthermore, we believe the Company will report solid gross margins and strong cost controls, which may allow the company to report positive adjusted EBITDA in 2H24.

We would also call out our bullish outlook is driven by the fact Tekna has seen strong insider buying since reporting 1Q24 results. On May 29th, their VP Sales and Marketing purchased 35,000 shares. More recently, on June 28th and two days after the positive verdict, their Chairman of the Board acquired 10,000 shares.

Following the positive patent dispute ruling, we believe this solidifies Tekna as a clear leader in production of metal alloys via plasma-based technology. Most importantly it clears the runway for them to continue the incredible traction they have made with global aerospace, medical and consumer electronic companies globally. We believe Tekna is in the early innings of a multi-year super cycle as demand for their advanced metal materials and plasma systems grow across applications in 3D printing, consumer electronics, aerospace and medical. Assuming Tekna can execute on their aggressive growth trajectory, we believe there is 400%+ upside potential in the stock and remain strong buyers.

Link to our 5-year Tekna outlook and downloadable excel financial model here.

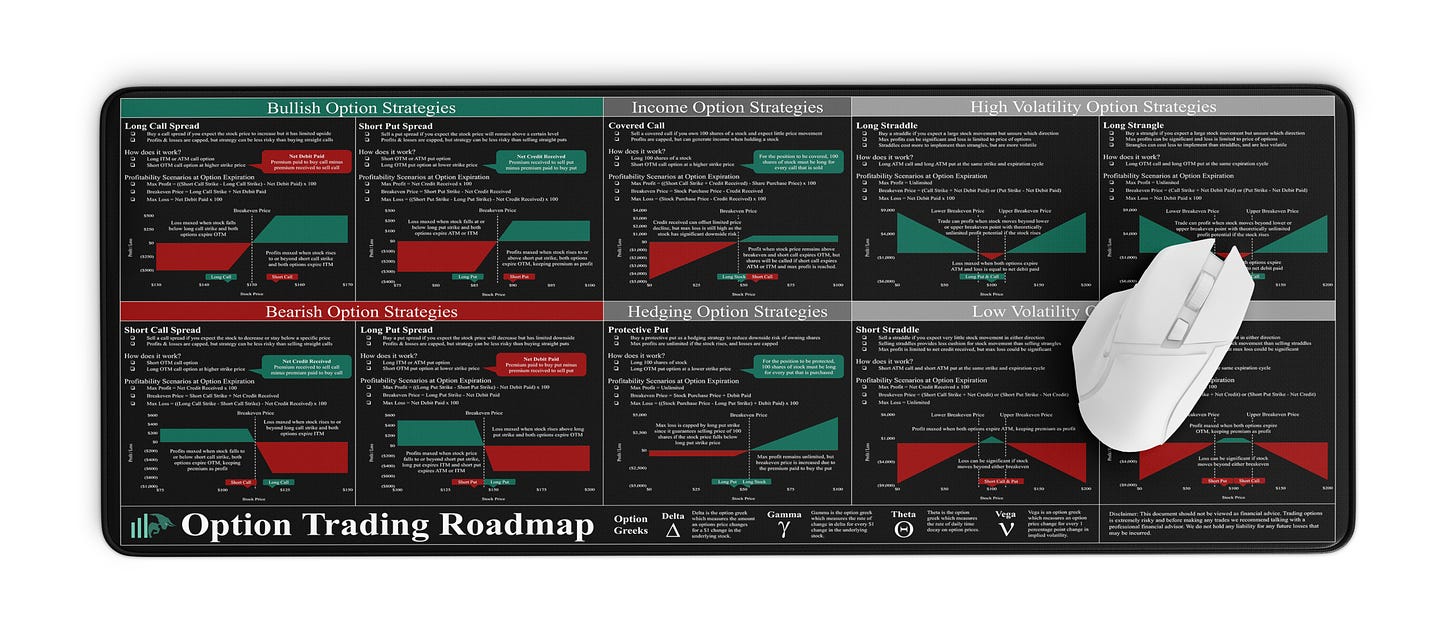

Looking to become a better investor or need to find that perfect gift for your finance friend?

Check out these products from our partner Trading Roadmap.

Research Disclaimer: We actively write about companies in which we invest or may invest. From time to time, we may write about companies that are in our portfolio. Content on this site including opinions on specific themes and companies in technology, market estimates, and estimates and commentary regarding publicly traded or private companies is not intended for use in making any investment decisions and provided solely for informational purposes. We hold no obligation to update any of our projections and the content on this site should not be relied upon. We express no warranties about any estimates or opinions we make.