Called It Again: Pricing Analysis Accurately Predicts Improving Protolabs Demand

View all Protolabs reports and link to our research disclaimer.

Key Takeaways: Protolabs PRLB 0.00%↑ reported strong 4Q24 results, with both revenue and EPS exceeding consensus estimates. Revenue came in at $121.8M, in-line with the upper end of the guidance range, which implies a solid beat relative to expectations. Adjusted EPS of $0.38 also surpassed consensus of $0.32. Revenue guidance for Q1 of $120 - 128M was in-line with consensus at the midpoint, but the upper-end range signaling improving demand. However, Q1 EPS guidance of $0.26-$0.34 fell short of expectations, due to increased marketing and other investments to fuel future growth in production applications. The company also is guiding to a higher tax rate in Q1, which is weighing on EPS. Despite a slight EPS miss, shares are trying to trade up on the results, which we believe is driven by better demand outlook, but broader market headwinds likely weighing on shares.

We are not surprised by these results, as our 4Q24 Pricing Analysis highlighted stable demand during the quarter. Additionally, in our Protolabs preview earlier this week, we called out positive pricing trends that continued into Q1, which is reflected in the company’s upbeat revenue guidance. (Congrats to our Premium subscribers who received these demand reports ahead of earnings.) We were a bit surprised by the company’s gross margin performance, but given this was led by better-than-expected growth in the Networking business we do not think this is a long-term concern and view this as a net positive. Unfortunately our pricing analysis can not predict opex trends, so the lower-than-expected EPS guidance was a bit discouraging, but we want to highlight that Protolabs has consistently outperformed the high end of its guidance range in recent quarters. Furthermore, we believe the fact Protolabs is accelerating marketing spend to lean into their strategic shift to focus on production orders is a huge long-term positive for the company. We were also pleased to see Y/Y growth in revenue per customer contract, reinforcing our long-term bullish view on the company. We believe that as growth returns, Protolabs will be well-positioned to drive both revenue and earnings growth. The combination of its Factory and Network businesses establishes Protolabs as a clear leader in digital manufacturing, providing a compelling opportunity to acquire new customers and, more importantly, expand wallet share through its internal manufacturing capabilities.

View detailed historical results in our full financial model here.

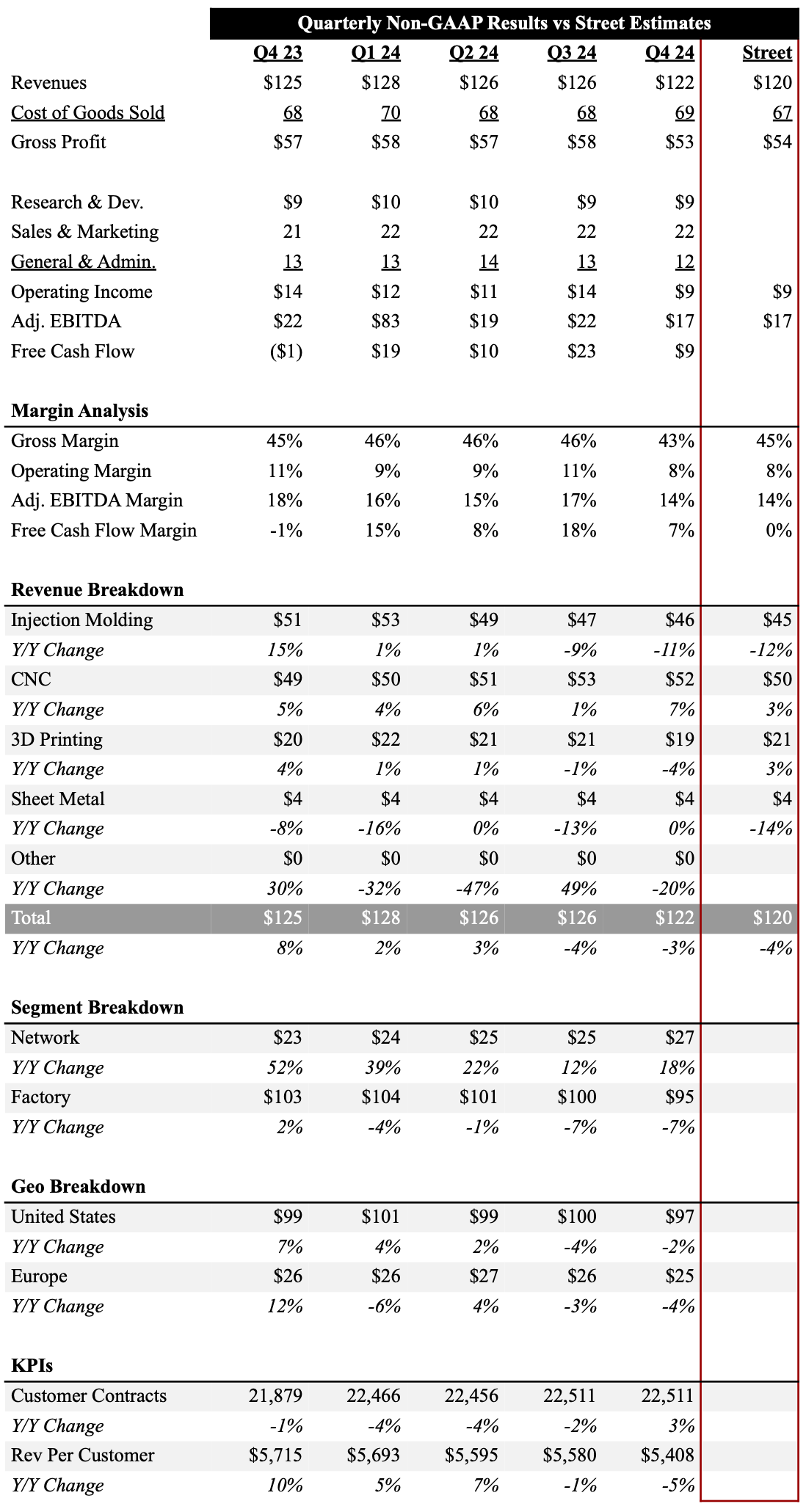

Source: Company Filings, FactSet, Data In Millions

Investor Gifts

Looking to become a better investor or need to find that perfect gift for your finance friend? Check out these products from our partner Investor Gifts like their 2025 Investor Calendar.

4Q24 Earnings Summary

Protolabs delivered 4Q24 revenue of $121.8M, reflecting a slight ~3% decrease Y/Y, but came in at the upper-end of Managements prior guidance ($115-123M) and consensus ($120.2M). Growth was driven by strong performance in the Protolabs Network, which fulfilled $26.5M in revenue, representing a ~18% Y/Y increase. However, revenue in the traditional Factory segment was down ~7% Y/Y as challenging manufacturing environment continues to act as a headwind. CNC revenue increased ~7% Y/Y to $52.4M, while Injection Molding revenue declined ~11% Y/Y to $45.6M and 3D Printing declined ~4% Y/Y to $19.5M. While the company did not breakout Customer Contacts (aka unique customers) in the quarter, Customer Contacts for the year was 51,552, which was down ~4%. That said, revenue per Customer Contacts was up ~3% Y/Y for the year. From a geographic perspective, revenue in the United States declined ~2% Y/Y to $96.6M and Europe declined ~4% Y/Y to $25.2M.

Non-GAAP gross margin in 4Q24 came in at 43.4%, down from 45.3% Y/Y, primarily due to an increasing mix of revenue from the lower-margin Network business, as well as lower volumes in the Factory business. Operating expenses increased Y/Y as the company ramped up investments in sales and marketing to drive future growth. Adjusted EBITDA for the quarter was $16.9M, in line with consensus expectations but adjusted EBITDA margins were down to 13.8% from 17.8% as lower revenue as well as increased spending pressured margins.

For 1Q25, Protolabs provided revenue guidance of $120 - 128M, which at the midpoint implies revenues down 3% Y/Y and in-line with consensus estimates of $124.5M. However, EPS guidance of $0.26-$0.34 was below consensus of $0.34, reflecting higher marketing and growth investments, as well as higher tax rate. Although no quantitative 2025 targets were given, Management is encouraged by the early results of their new marketing initiatives around production opportunities and remains optimistic about growing revenues in 2025. We also want to highlight that ISM Manufacturing was 50.9 in January, which is the first expansion reading since March 2024 and highest reading since Sep 2022. Protolabs stock historically is highly correlated to this index, and if we continue to see ISM trend upwards we expect Protolabs performance and stock price to follow.

Below we dive deeper into our updated five-year outlook, investment thesis and price target.