CALLED IT! Xometry Calls For 2024 Growth To Slow and Profitability To Lag, Stock Down 35%

Xometry XMTR 0.00%↑ announced Q4 results this morning, and as we highlighted in our initiation report two weeks ago (here), the company is expected to come short of the aggressive consensus growth targets set up for them in 2024. Furthermore, investments are expected to grow as the company continues an aggressive international expansion and land and expand strategy, which as we expected, would limit near term profitability. This coupled with restating 4Q22 financials, Xometry shares traded down 35% after earnings!

4Q23 Results vs Expectations

Revenue $128M vs consensus $128.0M

Adj. EBITDA ($2.9M) vs consensus ($1.0M)

1Q24 Guidance vs Expectations

Revenue $118-120M vs consensus $135M

Adj. EBITDA ($7-9M) vs consensus $0.1M

Our Key Earnings Takeaways

Xometry reported 4Q23 revenues growing 30.7% Y/Y to $128.1M, which was in-line with the company’s prior guidance and consensus expectations. Revenue in the quarter was driven by Marketplace revenues growing 41.6% Y/Y growth to $112.1M. Meanwhile, Supplier and Services revenue declined 15.1% Y/Y to $16.1M, which was impacted by discontinuation of the sale of tools and materials. While Xometry saw LTM Active Buyers grow 36.4% Y/Y to 55.458, revenue per Active Buyer declined 10.8% Y/Y. The company is expecting net Active Buyers to be up Q/Q in 1Q24.

Looking ahead, the company acknowledged January started off much slower than expected as several large deals were delayed. Xometry did see an improvement in February, but the company is expecting 1Q24 revenues to grow ~13% Y/Y. This is significantly slower than consensus ~29% Y/Y revenue growth expectation heading into earnings. Xometry has also historically provided full year revenue and adjusted EBITDA guidance, but have decided to not provide formal 2024 guidance. They do expect fiscal 2024 Marketplace revenue growth of at least 20% Y/Y and expect Supplier Services revenue to be down approximately 10% Y/Y driven by the discontinuation of the sale of tools and materials and the wind down of non-core services. This implies mid-teen percent Y/Y growth, which is much slower than the 25%+ annual growth analysts were calling for this year. While we believe the challenging manufacturing environment is impacting growth in 2024, we believe Protolabs competitive network offering is starting to take share from Xometry. Protolabs Network revenues grew ~70.4% Y/Y to $82.6M in 2023, which is faster than Xometry Marketplace revenue growth of 30% in 2023.

Xometry reported 4Q23 adjusted EBITDA loss of $2.9M, which fell below analyst expectations of a loss of $1M as the company incurred higher expenses as they continued their aggressive international expansion and customer land and expand strategy. Xomtery is expected to continue this higher investment cycle which will continue to lag profitability, and guided 1Q24 adjusted EBITDA loss of $7-9M, which was much lower than analyst breakeven estimate. While the company is expecting to be adjusted EBITDA positive in Q3 and onward, we think this could be aggressive given current top-line headwinds and accelerating growth investments. Furthermore, we continue to believe the company will struggle to increase wallet share among customers, which is key to scaling profitability. Xometry announced advertising spend was down 19% in the quarter, but we believe lack of wallet share expansion will likely cause Xometry to accelerate advertising spend to find growth. In turn, pressuring profitability.

Financial Outlook: While not shocked by the revenue slow down, we were surprised by the magnitude of the slowdown. We now believe the combination of macro and competitive headwinds is going to prevent the company from seeing 20%+ annual revenue growth over the next 5 years. In turn we lowered our 2024 revenue estimate from $550.9M to $518.1M, which implies 11.8% Y/Y growth. In addition, we believe current challenges are beginning to prove out our core thesis and fundamental flaw in the manufacturing marketplace business. When customers need prototypes and low-volume part orders, Xometry is an efficient solution. However, as customers need to go from low to high production part orders it will not make financial sense to pay the 30-40% markup (XMTR gross margin) Xometry charges on their marketplace and rather go directly to the manufacturer. We expect the lack of revenue growth per Active Buyer will pressure profitability, and show the company’s 20 - 30% adjusted EBITDA margin target is a pipe dream. Without a meaningful restructure, we believe mid-single digit EBITDA margins are more likely in 2028.

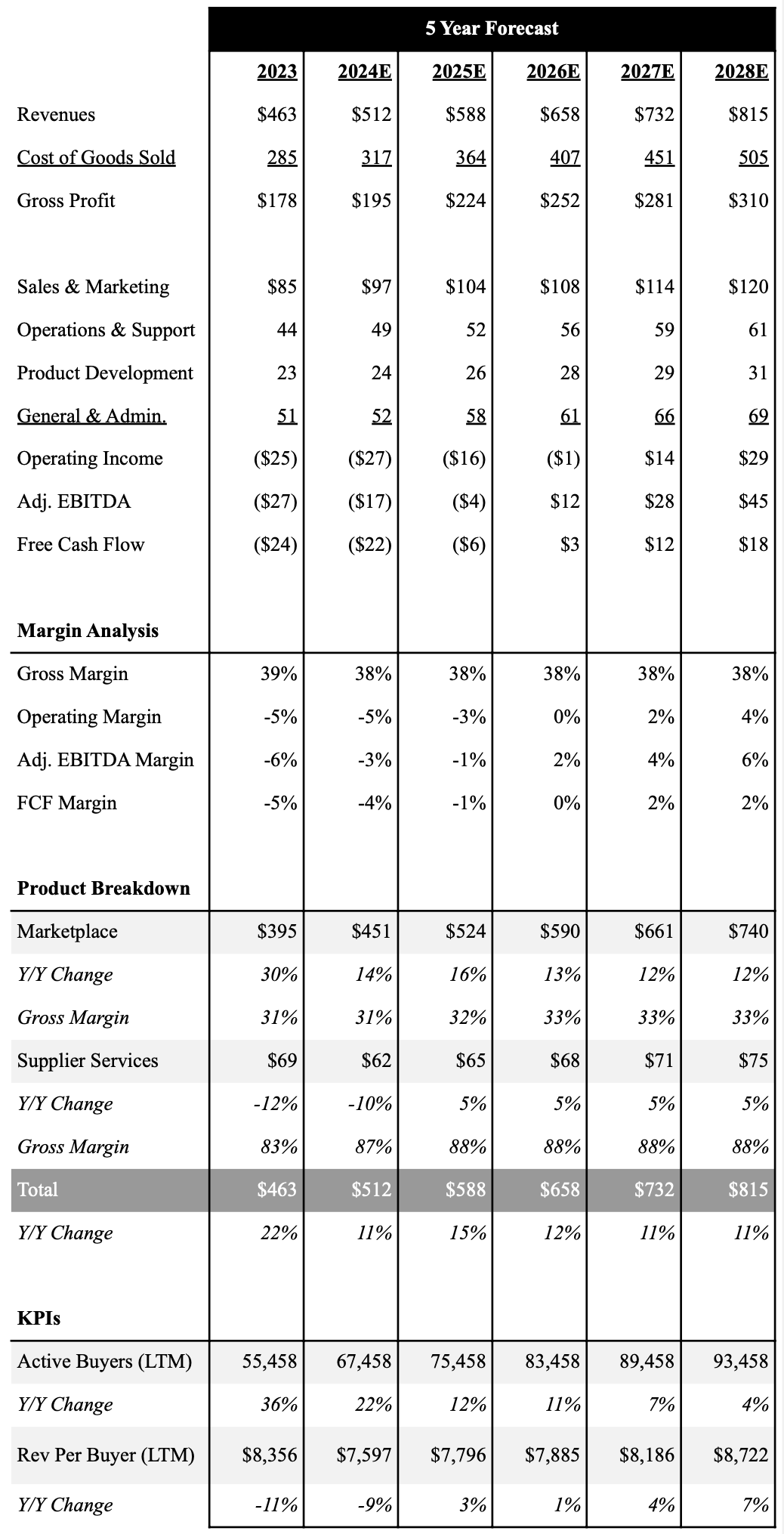

Below is an overview of our 5 year outlook with full financial model here.

Source: Industrial Tech Analyst

Investment Conclusion: We can not deny that Xometry has been a true disrupter to the digital manufacturing space as their Marketplace revenues have grown from ~$80M in 2019 to ~$395M in 2023, and proven the ability to continue to grow double-digits in a tough manufacturing environment. We do believe Xometry will continue to grow, but are cautious on the company’s revenue outlook with the quick emergence of new marketplace players such as Protolabs and continued challenging macro environment. Furthermore, while we believe Xometry is a great tool to secure prototypes and low-volume production parts, we believe Xometry will struggle to increase wallet share among customers. This coupled with higher opex spend, we believe the company will continue to underwhelm investors profitability expectations.

While XMTR share saw a 35% decline following 4Q23 results, a combination of slowing growth and lackluster profitability is not a good combination for a still expensive stock based on an EV/EBITDA multiple. As a result of the much larger slowdown and higher opex spend, we lowered our price target from $17.61 to $8.54, which equates to ~50% downside. As shown below, we use a 5 year DCF model to value Xometry shares.

Source: Industrial Tech Analyst

Research Disclaimer: We actively write about companies in which we invest or may invest. From time to time, we may write about companies that are in our portfolio. Content on this site including opinions on specific themes and companies in technology, market estimates, and estimates and commentary regarding publicly traded or private companies is not intended for use in making any investment decisions and provided solely for informational purposes. We hold no obligation to update any of our projections and the content on this site should not be relied upon. We express no warranties about any estimates or opinions we make.