Optical Networking Earnings Recap: Massive AI Growth Potential Remains and the Top Companies Positioned to Capitalize

Link to our Optical Networking Deep Dive and our research disclaimer.

While there are many signs of sustained demand for optical networking equipment and components, which is largely driven by bullish 2025 capex forecasts from the five hyperscale customers, stocks in this sector have sold off significantly in recent weeks as the market shifts to a more risk-off sentiment. We believe, this divergence presents an opportunity for investors seeking growth in an environment where concerns about economic slowing persist. Notably, and as shown in the chart below, optical component suppliers have seen sharp declines from their recent peaks, with Applied Optoelectronics AAOI down ~47%, Coherent (COHR) dropping 40%, Lumentum (LITE) falling 35% and Fabrinet (FN) declining by 13%. Despite these pullbacks, we believe these companies are well-positioned to benefit from the ongoing AI infrastructure gold rush, which we believe remains intact (for now). The rapid expansion of artificial intelligence applications continues to drive demand for high-performance optical networking solutions within and outside data centers, creating long-term growth opportunities for these suppliers.

In the following sections, we will highlight the key themes emerging from the December 2024 quarter and early 2025 outlook, while also providing our updated take on the positioning and outlook for these four optical component suppliers.

We are also excited to be publishing our first 5-year downloadable financial models on Lumentum (LITE), Coherent (COHR), Fabrinet (FN) and Applied Optoelectronics (AAOI).

Key Optical Networking Earnings Takeaways

Despite DeekSeek Worries, Hyperscalers Guide to Massive 2025 Capex Buildouts

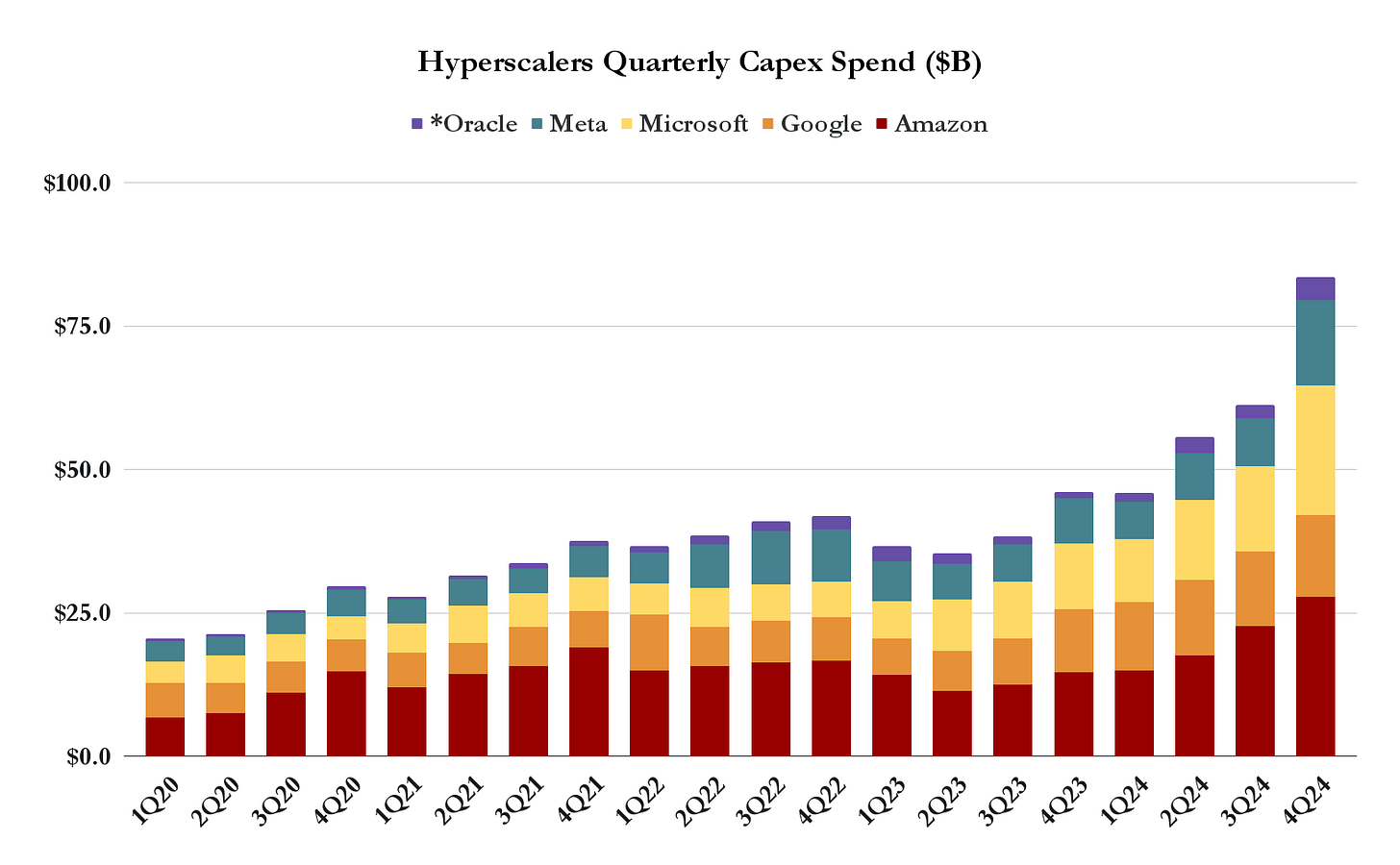

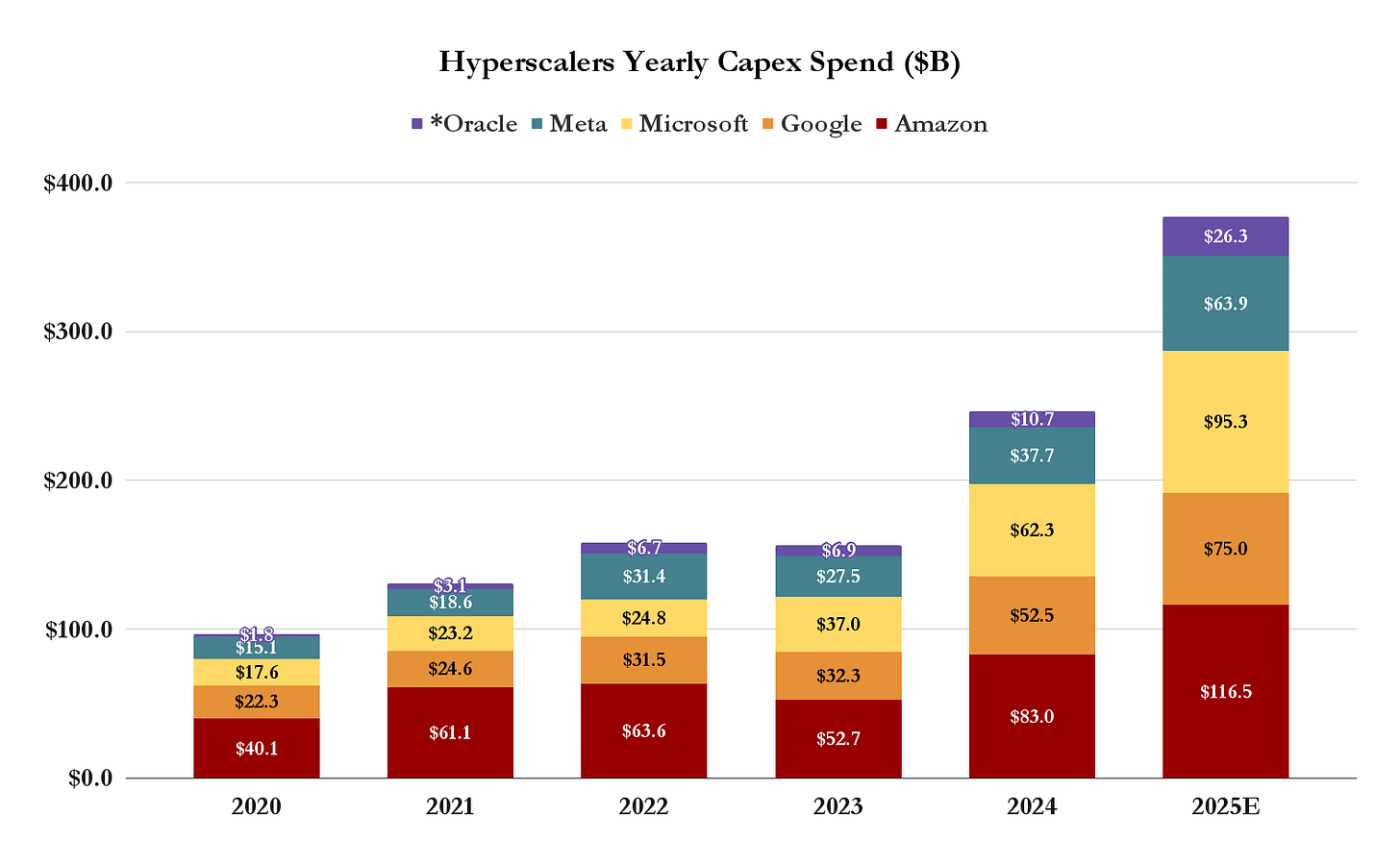

Following the DeepSeek news in late January, investor concerns were high that hyperscalers might reevaluate and potentially cut their capex forecasts, leading to fears of a slowdown in AI infrastructure spending. However, those concerns have now been firmly put to rest, as every major hyperscaler not only maintained their aggressive investment plans but also issued capex guidance that exceeded Street estimates. As shown below, the combined capex of Amazon, Meta, Microsoft, Google, and Oracle surged over 80% Y/Y in Q4, reaching nearly $84B, and in 2025, we believe total spending is projected to grow another 50%+ to exceed $375B for the year. Individually, Meta guided to $60–65B, Microsoft to $80B, Google to $75B, Amazon to over $100B, and Oracle plans to double its data center capacity to over $20B. However, we believe investors may begin to grow concerned about the elevated spending and the lack of near-term ROI, which could weigh on sentiment. While we do not expect hyperscalers to adjust their capex budgets when Q1 earnings are reported, if stocks continue to trade lower on these fears, it may only be a matter of time before hyperscalers start taking a harder look at these budgets. That said, as our chart illustrates, AI infrastructure spending is set to remain robust, and even if modest cuts were to occur, the race to scale AI data centers will continue to be a massive competitive advantage. As a result, we still see strong tailwinds for optical networking players like Lumentum (LITE), Coherent (COHR), Applied Optoelectronics (AAOI), and Fabrinet (FN) as hyperscalers push forward with 800G, 1.6T, and next-gen AI infrastructure deployments.

Source: Oracle, Meta, Microsoft, Google, Amazon

Source: Oracle, Meta, Microsoft, Google, Amazon, Industrial Tech Stock Analyst

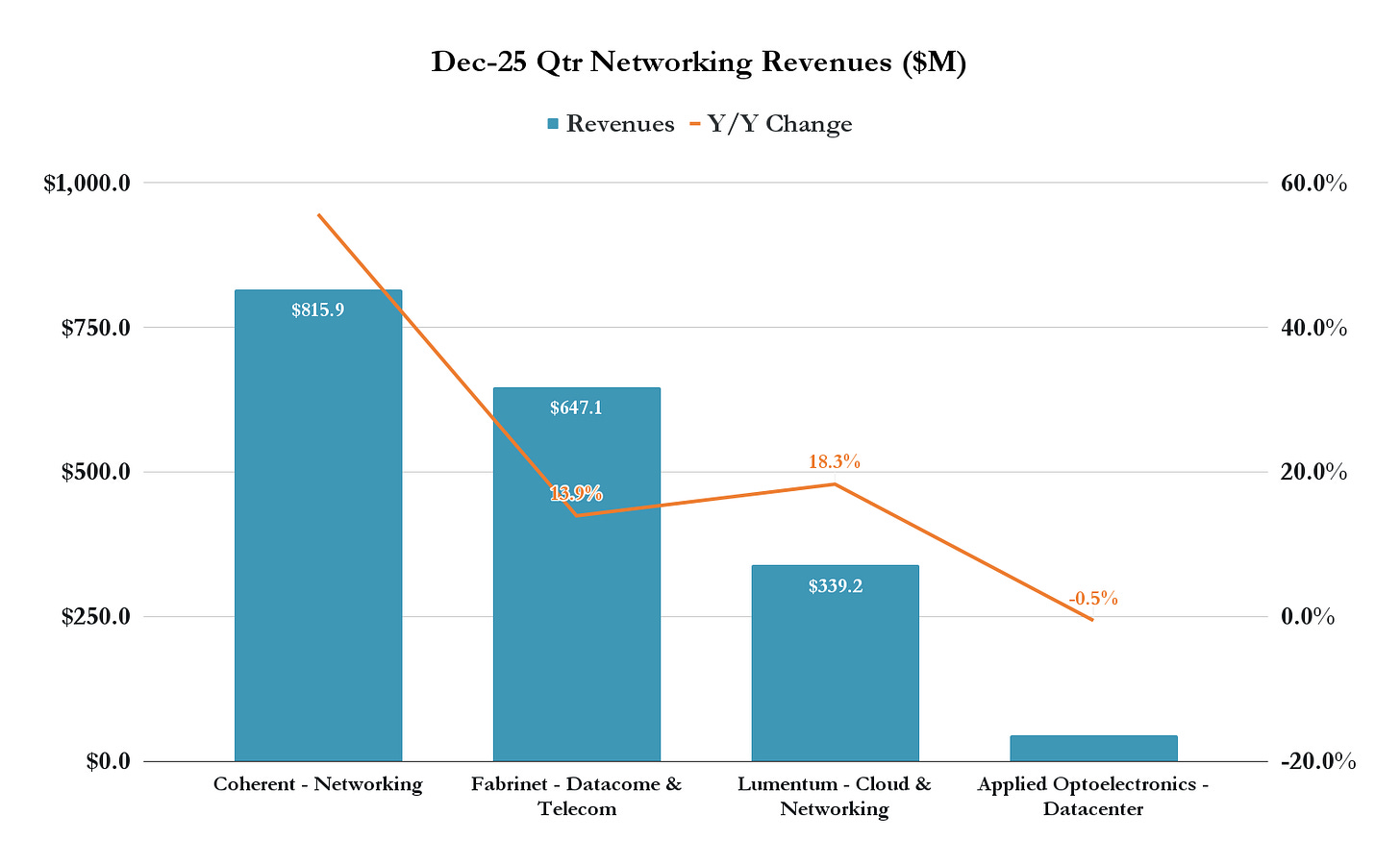

Sustained Hyperscaler Infrastructure Spend Drives Strong Optical Networking Results

Driven by sustained hyperscaler infrastructure investments, optical suppliers reported robust results in their networking businesses in the Dec-24 quarter. While datacenter-related demand (Datacom) remained especially strong, the biggest surprise was the surge in telecom demand, as Data Center Interconnect (DCI) applications, which is historically used for metro and long-haul networks are now being deployed to transport massive amounts of data across hyperscale AI data centers. As we show in the chart below, Coherent led the quarter with networking revenues surging 56% Y/Y, benefiting from strong AI-driven datacenter demand and a telecom rebound. Lumentum followed with cloud and networking revenues up 18% Y/Y, reflecting strength in both segments. AAOI’s datacenter revenues were flat in Q4, but the company guided to an astonishing 140%+ Y/Y growth during the Mar-25 quarter, largely expected to be driven by hyperscaler demand for high-speed optics. Lastly, Fabrinet’s telecom business grew 24% Y/Y, while Datacom increased just 4% Y/Y. The limited growth in Datacom was primarily due to its largest customer, Nvidia, transitioning to next-gen transceivers. As we explain in sections below, we believe this shift stems from hyperscalers increasingly "de-bundling" from Nvidia, opting to source optical components directly rather than purchasing fully integrated GPU platforms. However, this trend represents a major opportunity for Fabrinet, which was recently awarded a strategic agreement with Amazon, a move that could significantly expand its datacenter business in the coming quarters.

Source: Coherent, Fabrinet, Lumentum, Applied Optoelectronics

Telecom Demand Surges as DCI Applications Could Drive a New Optical Supercycle

As we highlighted below, demand for telecom optical products was exceptionally strong this quarter, as the post-COVID inventory overhang that plagued the industry for several years appears to have finally worked itself out. However, what is driving the better-than-expected demand for many optical suppliers is not just a return to normal ordering patterns but rather the accelerated need for these products in Data Center Interconnect (DCI) applications. Specifically, 400G ZR pluggables, ROADMs, amplifiers, and other telco optics, which traditionally used for long-haul and metro networks, are now critical for interconnecting massive AI data centers, which require high-speed, low-latency optical links. Historically, the optical industry has seen an inverse relationship between datacom and telecom demand, with one segment rising while the other falls. However, we may now be entering a supercycle scenario where telecom demand is accelerating at the same time as hyperscalers increasingly need these components, alongside traditional network providers upgrading infrastructure to bring higher bandwidth to consumers. We believe leading coherent optics providers such as Lumentum (LITE), Coherent (COHR), Marvell MRVL 0.00%↑, Cisco CSCO 0.00%↑ (Acacia) and Ciena CIEN 0.00%↑ are well-positioned to benefit from this structural shift, as hyperscalers and service providers both drive a sustained wave of telecom investment.

Optical Component Vendors Ramping Capacity to Meet Surging Demand

In addition to the bullish signals from hyperscalers’ massive capex plans, multiple optical component vendors have announced their own large-scale capacity expansions, reinforcing our view that the demand runway for next-generation optics remains incredibly strong. These infrastructure investments suggest that the industry is preparing for sustained, long-term growth, further solidifying the case for continued AI-driven spending. Applied Optoelectronics (AAOI) announced the largest capex initiative in its history, planning to spend $120–150M in 2025 alone, an investment that should more than double its output capacity as the company scales 800G and 1.6T transceiver production. Fabrinet is also making a major investment, breaking ground on a new 2-million-square-foot facility, which will increase its capacity by 50%, representing a potential $2.4B in additional annual revenue once fully ramped. Meanwhile, Lumentum is aggressively expanding its laser capacity, increasing 200G EML production by 40% in 2025 and another 40% in 2026, to address a critical bottleneck in the supply chain that has constrained 800G and, more specifically, 1.6T optical transceivers. While these buildouts reinforce our bullish stance, it’s important to recognize the cyclical downside of owning optical stocks. Once demand slows, these companies will lose significant operating leverage due to underutilized capacity, which could heavily weigh on margins. We believe we are still far from this scenario, given the ongoing AI infrastructure boom, but it remains a risk investors should monitor closely.

Applied Optoelectronics and Fabrinet Issue Warrant Deals With Amazon, Solidifying New Massive Partnerships and Domestic Sourcing

In mid-March, Applied Optoelectronics (AAOI) and Fabrinet (FN) issued warrants to Amazon, a major development that signals a shift in hyperscaler procurement strategies. We believe these deals highlight two key trends: (1) a move toward domestic-based optical suppliers and (2) hyperscalers de-bundling from Nvidia by purchasing optical components separately from GPU platforms. Historically, Amazon’s largest optical suppliers have been Chinese-based Innolight and Eoptolink, making this shift toward U.S.-based manufacturers highly bullish for domestic players. The agreement with AAOI is particularly significant, as Amazon's 8-K outlines a potential $4B in purchases over time, a staggering figure relative to AAOI’s $250M in total revenue last year. This validates AAOI as a strategic supplier and could be transformational if Amazon scales its orders. Similarly, Fabrinet’s warrant agreement reinforces the trend of hyperscalers securing dedicated optical supply partnerships. It is worth noting that Amazon has a history of issuing warrants to key suppliers as part of securing long-term partnerships. Given this momentum, we would not be surprised to see similar announcements from Lumentum (LITE) and Coherent (COHR) as hyperscalers continue diversifying their supply chains away from international vendors.

200G EML Supply Shortage: A Critical Bottleneck for 800G and 1.6T Transceivers

One of the biggest supply chain bottlenecks multiple suppliers highlight for 800G and more importantly, 1.6T transceivers is the limited supply of 200G EML (Electro-Absorption Modulated Laser) chips. These lasers are critical for increasing per-lane bandwidth speeds from 100G to 200G, which is essential for enabling the next generation of high-speed optical transceivers. While key transceiver players are still in the early innings of 800G and 1.6T adoption, demand is expected to significantly ramp as Nvidia’s Blackwell chips roll out, given they utilize these higher-speed optical connections. The key question now is whether transceiver vendors will be able to secure enough 200G EML supply to meet this rising demand or if component shortages will become a major headwind for hyperscalers scaling AI infrastructure. On the flip side, suppliers of 200G EML chips, such as Lumentum (LITE), are in a strong position, as high-margin revenue from these components should provide a significant boost to profitability over the next several quarters.

Nvidia’s Blackwell Ramp Eases Concerns and Strengthens Demand for High-Speed Optics

Heading into Nvidia’s latest earnings, expectations were lower due to concerns over potential ramping issues for its newest Blackwell GPU. However, we believe those fears were largely put to rest as Nvidia reported over $11B in Blackwell chip shipments in the latest quarter, exceeding both company and investor expectations. This ramp is critical for the continued growth in high-speed optics, as Nvidia’s transition from Hopper to Blackwell GPUs doubles optical output bandwidth from 400G to 800G, directly driving optical transceiver bandwidth upgrades from 800G to 1.6T. That said, as we highlighted in the recent Amazon news, a notable trend is emerging where hyperscalers are increasingly "de-bundling" from Nvidia. Instead of purchasing fully integrated GPU platforms with optics included at a markup, key customers like Google and Amazon are now directly sourcing optical components from suppliers to custom-build their systems. We believe this marks a significant industry shift, as other hyperscalers are likely to follow suit in an effort to reduce costs and optimize their infrastructure deployments. This trend is extremely bullish for domestic optical component companies, as it opens up direct supply opportunities for firms like Lumentum (LITE), Coherent (COHR), Fabrinet (FN) and Applied Optoelectronics (AAOI), strengthening their position in the rapidly evolving AI-driven data center ecosystem.

Co-Packaged Optics: A Looming Disruption That Will Reshape the Optical Market

We were somewhat surprised that Co-Packaged Optics (CPO) did not receive more attention on recent earnings calls, given the significant TSMC announcement at the end of 2024. TSMC revealed it has made substantial progress in its silicon photonics strategy and plans to manufacture CPOs, with Nvidia and Broadcom expected to be the initial customers. See our CPO deep dive here. While we believe CPO adoption remains years away from mainstream deployment, TSMC’s roadmap suggests accelerated progress, with sample deliveries in 1H25 and full production beginning in 2H25. Nvidia and Broadcom appear to be pushing to speed up CPO adoption as the industry grapples with mounting thermal and bandwidth challenges, specifically in the transition to 1.6T modules, where traditional pluggable transceivers are facing scaling limitations. While we expect CPO to remain a secondary topic in the near term, we believe it will become a much bigger discussion as the year progresses, especially as it threatens the traditional pluggable optics market. That said, we think CPO adoption will gain even more momentum with Nvidia’s future 3.2T GPU system, which is expected to follow Blackwell and drive the next evolution of high-speed optical interconnects.

Beyond the Big Five: Emerging AI Players Could Ignite the Next Wave of Optical Demand

While the optical networking industry is largely driven by the five major hyperscalers, Amazon, Microsoft, Google, Meta, and Oracle, we believe new entrants could soon be added to this list, further accelerating demand for optical components. Specifically, we see OpenAI as the next company poised to move into the category of spending billions annually on AI infrastructure, as it has already announced initiatives to build its own data centers rather than relying solely on Microsoft’s cloud infrastructure. This shift, if executed at scale, could create a massive incremental demand source for high-speed optics. Additionally, companies like Anthropic and X (formerly Twitter) are expanding their AI and cloud ambitions, further adding to the potential demand surge. With new AI players entering the race to build out massive compute infrastructure, we believe optical suppliers have a significant greenfield opportunity, expanding their total addressable market beyond just the traditional hyperscalers.

Two Upcoming Major Events: Nvidia GTC & OFC 2025

Over the next few weeks, two massive industry events will take place, both of which could have significant implications for AI infrastructure and optical networking. Nvidia’s GTC (March 17–21), the premier AI conference, is expected to showcase new advancements in AI hardware, networking, and datacenter infrastructure, which could further shape investment trends in high-speed optics. Shortly after, the Optical Fiber Communication Conference (OFC) (March 30–April 3), which is the largest annual event for the optical industry will bring together leading companies and researchers to unveil next-generation optical technologies. We believe a major focus at both events will be Co-Packaged Optics (CPO) with hyperscalers racing to push bandwidth limits beyond 800G and toward 1.6T and beyond. Any announcements related to CPO adoption, advancements in coherent optics, or new AI-driven networking requirements could have major implications for optical component suppliers and transceiver manufacturers.

Introducing Platinum Membership – Exclusive 1-on-1 Access

Unlock deeper insights with our new Platinum Membership. In addition to full access to all our research, you’ll receive an exclusive 30-minute 1-on-1 call each month to discuss our latest research, survey findings, or top stock ideas in detail.

Designed for investors, industry professionals, and corporate leaders, this tier offers direct, high-level discussions to refine your strategy and stay ahead in next-gen industrial technologies.

Join now and gain exclusive access to expert insights tailored to your needs!

Key Optical Component Supplier Outlooks

Below we provide our updated take on the positioning and outlook for the leading optical component suppliers, Lumentum (LITE), Coherent (COHR), Applied Optoelectronics (AAOI) and Fabrinet (FN) following the Dec-24 quarter, as well as include links to our most recent downloadable 5-year financial models.