View all Red Cat reports and downloadable 5-year financial model

Key Takeaways: Red Cat RCAT 0.00%↑ reported FQ2 revenue of $1.5M, falling short of Street expectations of $4.1M due to the strategic decision to halt Teal 2 production temporarily and retool for the upcoming Black Widow drone. While this impacted near-term results, Management issued updated CY25 revenue guidance of $80M - 120M, which—despite the broader range—is significantly higher than CY24 (~$16.5M) and implies a midpoint above consensus estimates of ~$90.4M. The updated guidance reflects significant anticipated revenue derived from the recently awarded massive U.S. Army's Short Range Reconnaissance (SRR) Program of Record contract.

Shares traded down ~15% in aftermarket trading due to the low FQ2 revenue performance, which we believe is extremely overblown given the company’s robust CY25 outlook. We believe our thesis remains firmly intact, bolstered by Red Cat’s strengthening position as a global leader in defense drones following the SRR contract awarded last month. The Black Widow’s approval for military deployment not only provides credibility but is likely to catalyze interest from other branches such as the Navy, Marine Corps, public safety organizations as well as allied defense organizations like NATO. For example, the company highlighted before any demos were even provided to customers they have received RFP quotes in excess of $14M for the Black Widow since that SRR announcement. These domestic and international opportunities, could surpass the size of the SRR contract, which we believe is a ~$250M opportunity over the next 5 years. Additionally, yesterdays partnership announcement with Palantir, equipping the Black Widow with autonomous visual navigation and advanced data processing capabilities, enhances our outlook on profitability. The company did not provide updated targets beyond revenue, but we anticipate to get more color on their path to profitability at the company’s analyst day in 1Q25 after the first SSR kickoff meeting is underway. It is also worth noting the CFO announced she is stepping down, but this is due entirely to family heath reasons and nothing to do with the performance of the company. Following this overblown aftermarket sell-off, we see this as a buying opportunity and reiterate our Buy rating with a $14.10 price target.

View detailed historical results in our full downloadable financial excel model here.

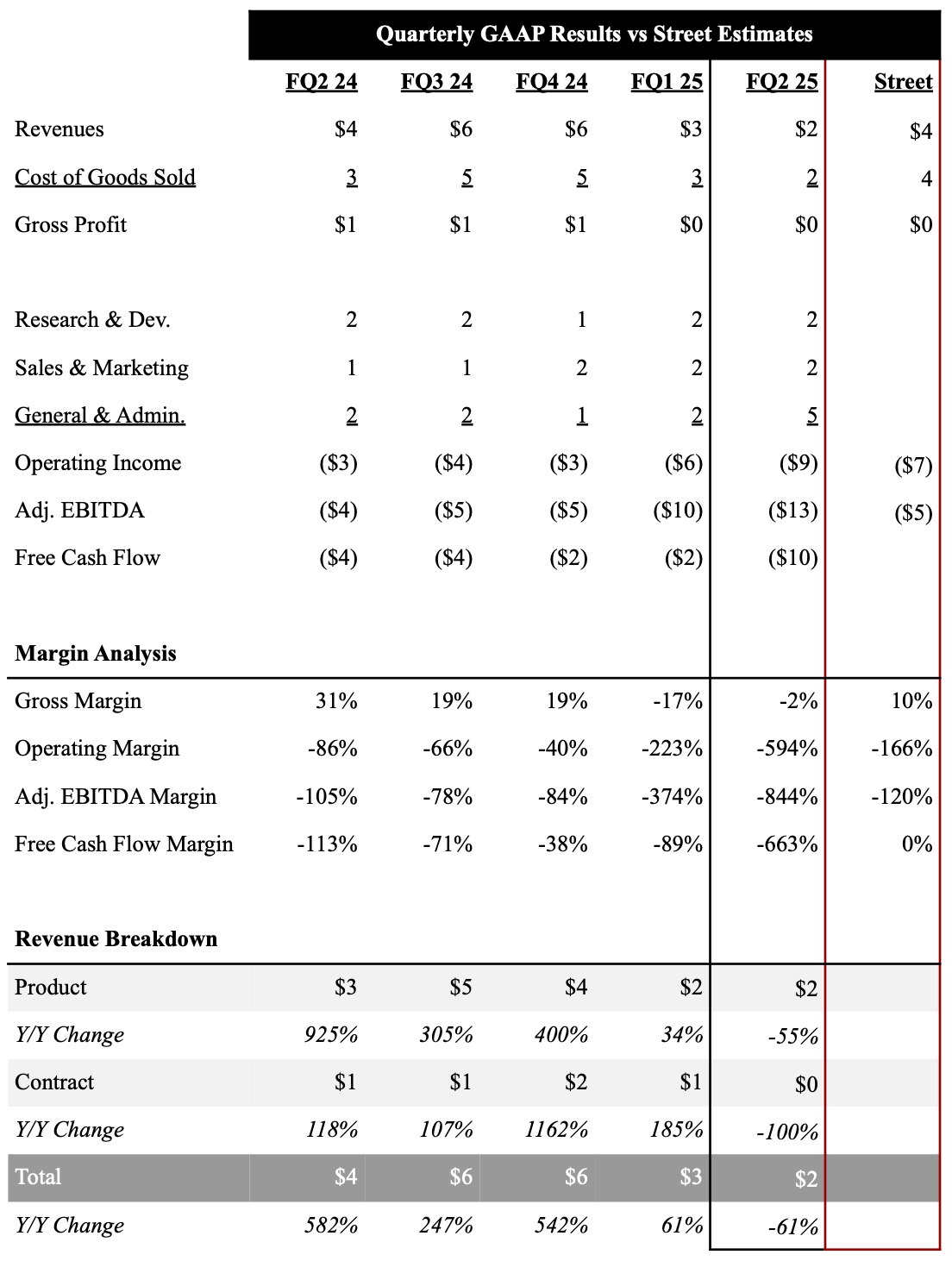

Source: Company Filings, FactSet; Data In Millions

Investor Gifts

Looking to become a better investor or find that perfect gift for your finance friend?

Check out these products from our partner Investor Gifts.

2FQ25 Earnings Summary

Red Cat reported FQ2 revenue of $1.5M, a significant decline from $3.9M in the prior-year quarter, primarily reflecting the company’s decision to halt Teal 2 production in favor of retooling for the Black Widow drone. Despite the short-term impact on sales, management emphasized progress in its strategic focus, including a $1M Edge 130 Blue drone contract and the launch of the ARACHNID ISR/precision strike system. Additionally, the company announced a strategic partnership with Palantir Technologies to integrate Palantir's autonomous visual navigation (VNav) software into the Black Widow drone, enabling advanced capabilities in GPS-compromised environments. This cutting-edge software will enhance mission performance and operational efficiency, making the Black Widow one of the most advanced drones in the defense sector. Following the Black Widow integration, Red Cat plans to incorporate this capability into other drones in its portfolio, broadening the potential applications and revenue opportunities. While management has yet to publish pricing details, this high-margin (>80%) software add-on is expected to significantly improve gross margins, potentially driving them above 50% as adoption scales. Shares traded up ~25% post this announcement.

Gross margin turned negative in the quarter, reflecting elevated costs related to the production transition, compared to a 30.5% margin in the same period last year. Operating expenses rose to $9.1M, driven by higher R&D, sales, and administrative costs as the company scaled operations. Cash used in operations for the quarter was $10.1M, ending with a cash balance of $4.6M. Management secured an additional ~$6M in financing after the quarter’s close, providing liquidity to support growth initiatives. Notably, Management expressed confidence in their cash position, but is waiting to learn about near term funding milestones related to SRR to see what additional capital they may need.

Red Cat introduced CY25 revenue guidance of $80M–120M, with significant contributions expected from the U.S. Army SRR contract and is higher than the company’s prior FY25 calendar guidance of $50-55M, which did not incorporate any revenue from SRR. Note starting January 2025 the company will be switching to a December calendar year end, and is why they provided CY guidance. As a refresher SRR, includes the production of 5,880 systems (2 drones per system) over five years, priced at ~$45K per unit, resulting in what we believe is worth $250M+ over that time frame. We believe the wider than unusual range is driven by uncertainty around timing of funding, but Management highlighted that a kickoff meeting for the SRR program is slated for January and will provide better clarity on future funding and project milestones. This meeting, along with an upcoming analyst day in 1Q25, is expected to provide more insight into operating expense trends and the company’s path to profitability. Management highlighted this guidance does not reflect any big government contracts outside of SRR, as well as incremental revenue from the Palantir partnership. In turn, we believe there could be upside to this revenue guidance.

Updated 5-Year Outlook

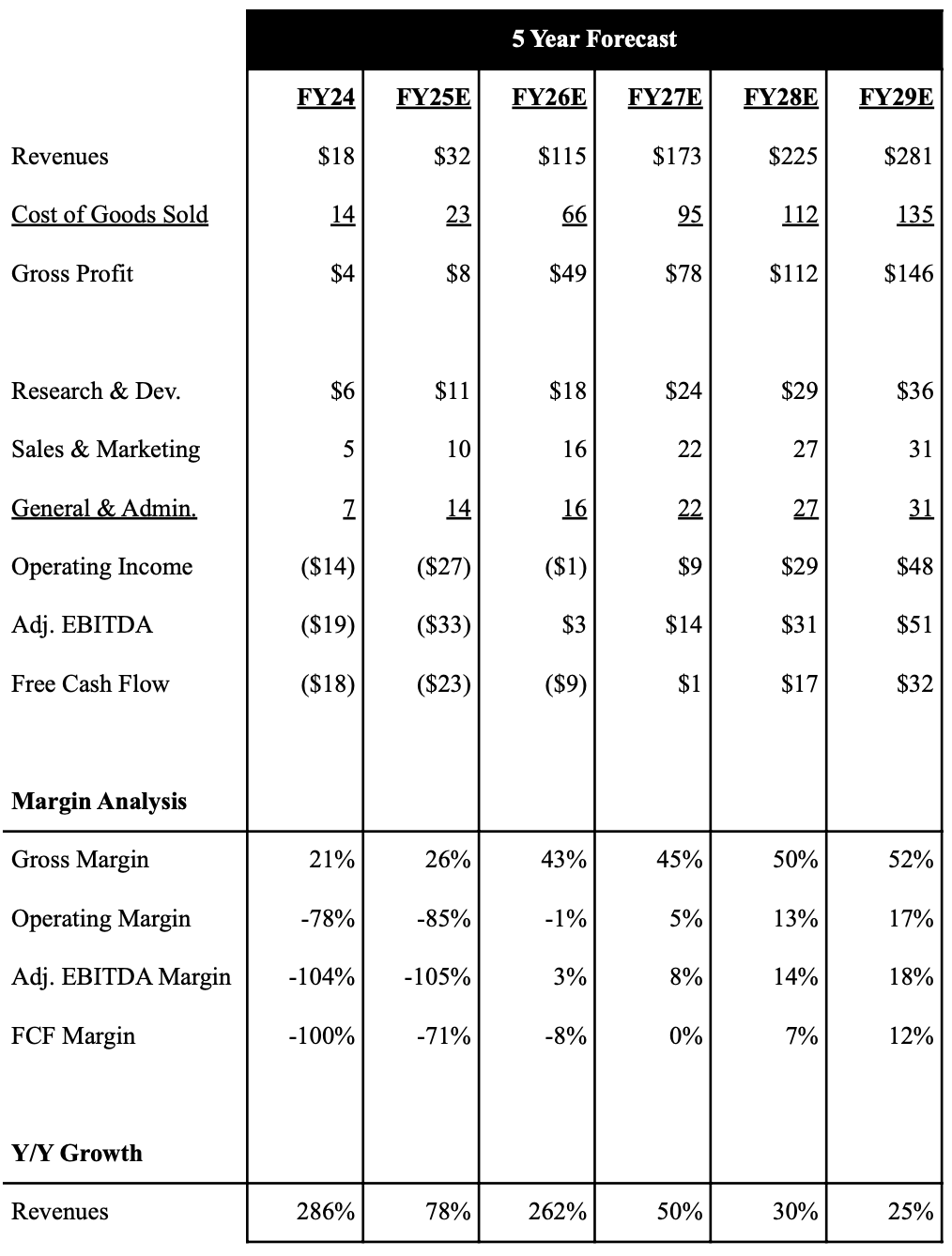

Our CY25 revenue forecast stands at ~$100M, which is in-line with Management’s guidance, though we note that our current model is based on fiscal years and will be updated once the company transitions to a calendar year reporting structure. While Red Cat's massive SRR contract underpins much of this growth, the timing of funding and production ramp remains difficult to predict. We expect to gain greater clarity on this front at the company’s planned Q1 Analyst Day, where Management is expected to provide additional details on SRR funding schedules, production milestones, and broader revenue visibility. That said, we believe there is still upside to these projections, driven by increased sales from other domestic and international defense and government agencies. In turn, we anticipate revenues to grow at least 25%+ through 2028. Furthermore, our concerns around liquidity have significantly decreased, as we believe the company will be able to fund operations through a combination of debt instruments and the substantial prepayment from SRR over the next few months, sustaining operations until reaching cash flow positive in calendar Q4 2025.

Although these estimates could change when we expect the company to provide longer term targets once SSR milestone clarity is provided, we have raised our margin estimates given the margin opportunity following the Palantir partnership. We believe the company will be adjusted EBITDA positive for fiscal year 2026, and see adjusted EBITDA margins approaching ~20% in 2028 as the company continues scales the business. Note we did raise our opex estimates higher as we now expect the company to likely increase funding in R&D given the Palantir partnership.

Below is an overview of our 5 year outlook with a full financial model here.

Source: Industrial Tech Analyst

Investment Thesis

Red Cat is uniquely positioned to capitalize on what we believe is a global defense drone supercycle, driven by increasing geopolitical tensions and growing demand for advanced unmanned systems. As a U.S.-based manufacturer and a participant in the U.S. Department of Defense's Blue sUAS program, Red Cat stands to benefit meaningfully from favorable U.S. legislation supporting domestic drone production. We believe the company’s long term opportunity got bolstered by the company’s massive SRR contract award. This milestone not only enhances Red Cat’s credibility but is also likely to catalyze interest from other military branches such as the Navy, Marine Corps, public service agencies, as well as allied defense organizations like NATO. Additionally, we believe the Trump Administration will prioritize building the largest drone army in history, a policy that bodes exceptionally well for U.S.-based drone manufacturers like Red Cat. These factors position Red Cat to capture substantial growth in the defense sector, and drive our bullish outlook on the stock and $14.10 price target.

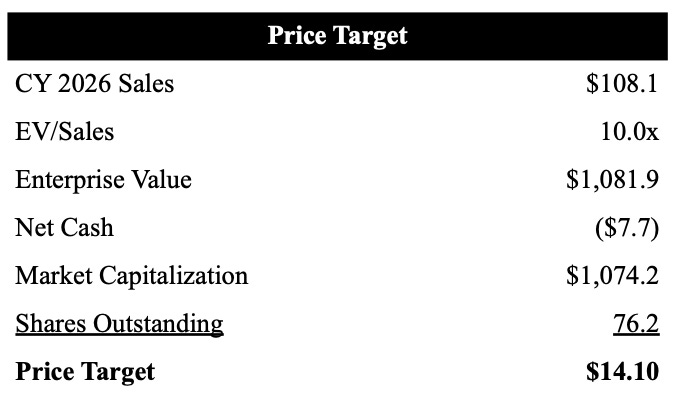

As shown below, based on our 2026 calendar year revenue estimate of $108M and 10x EV/Sales multiple, we value Red Cat shares at $14.10, which equates to ~35%+ upside at current levels. We believe this valuation could be viewed conservative, reflecting a new sales multiple of 10x, which still positions Red Cat at a discount compared drone industry peers like Skydio, which recently raised $170M at a $2B valuation (20x sales). Below we layout our price target calculation.

Source: Industrial Tech Analyst

Research Disclaimer: We actively write about companies in which we invest or may invest. From time to time, we may write about companies that are in our portfolio. Content on this site including opinions on specific themes and companies in technology, market estimates, and estimates and commentary regarding publicly traded or private companies is not intended for use in making any investment decisions and provided solely for informational purposes. We hold no obligation to update any of our projections and the content on this site should not be relied upon. We express no warranties about any estimates or opinions we make.