Xometry Demand Call Was On Point, As Well As Higher Spend To Limit Profitability

View all Xometry reports. and link to our research disclaimer.

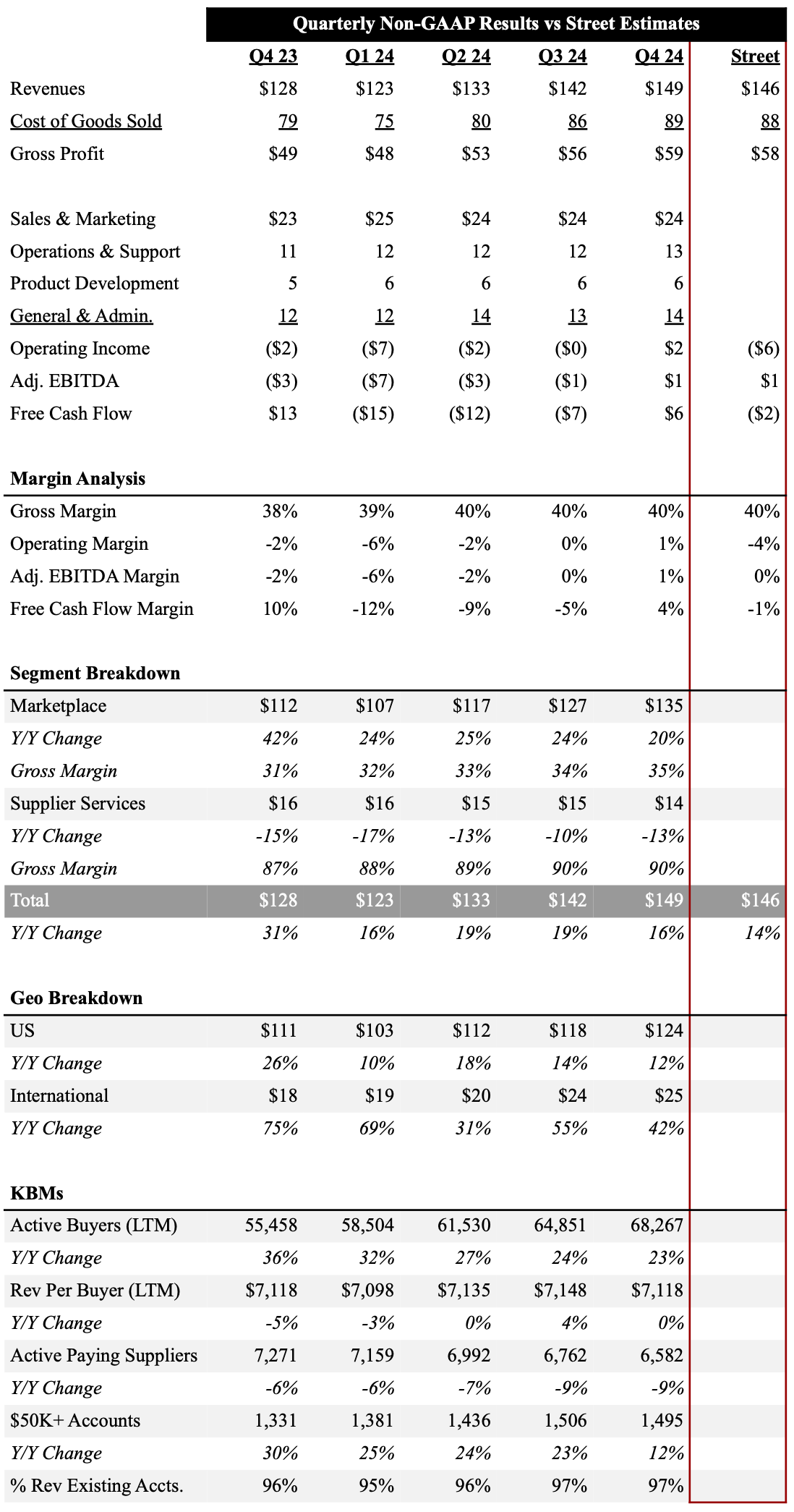

Key Takeaways: Xometry XMTR 0.00%↑ reported strong 4Q24 results, with revenues of $149M coming in above consensus estimates, as well as above the high end of management’s prior guidance. The company demonstrated solid gross margin expansion, and additional operating leverage contributed to a modest adjusted EBITDA beat. However, as we highlighted in our earnings preview, we viewed 2025 estimates as aggressive, and Xometry’s guidance aligned with our expectations, forecasting revenues and adjusted EBITDA below Street estimates. While revenue growth remains resilient despite a challenging manufacturing environment, the company’s guidance for an adjusted EBITDA loss in Q1 remains a key investor concern. As a result, shares traded down mid-single digit following the announcement.

We were not surprised by Xometry’s strong Q4 growth, as our 4Q24 Pricing Analysis indicated significant U.S. price acceleration throughout the quarter. However, we also observed international headwinds, which we believe were reflected in the company’s limited Q/Q international revenue growth. While we expected Xometry to guide to robust double-digit growth in 2025, management’s expectation that growth will accelerate beyond 2024 levels continues to stand out. If the manufacturing environment improves, this outlook is plausible, but if headwinds continue we see growth decelerating beyond 2024 levels. That said, as the company scales, we believe investor focus will continue shifting toward profitability, which Xometry has yet to meet. Management has flagged near-term gross margin headwinds due to rapid international expansion, as their pricing algorithm requires time to adapt. Additionally, we believe increased operating expenses associated with global expansion will likely constrain operating leverage. Furthermore, the company’s inability to grow revenue per active buyer in 2024 suggests that Xometry will need to sustain elevated customer acquisition spending, which could underwhelm investor profitability expectations. Given these dynamics, we remain cautious on Xometry shares.

View detailed historical results in our downloadable financial model.

Source: Company Filings, FactSet; Data In Millions

Investor Gifts

Looking to become a better investor or need to find that perfect gift for your finance friend? Check out these products from our partner Investor Gifts like their 2025 Investor Calendar.

4Q24 Earnings Summary

Xometry reported strong fourth-quarter 2024 revenue growth, increasing 16% Y/Y to a record $149M, which was higher than consensus $146M estimate and above managements previous guidance range ($145-147M) . This growth was driven primarily by a 20% Y/Y increase in Marketplace revenue, which reached $135M. Meanwhile, Supplier Services revenue declined by 13% Y/Y to $14M, reflecting the company’s exit from non-core supplier services and a decline in advertising and marketing services. While Marketplace Active buyers increased 23% Y/Y to 68,267, we believe several other key indicators fell short of investor expectations. Specifically, revenue per active buyer was 7,118, which was flat Y/Y. Furthermore, accounts with at least $50,000 in last-twelve-month spending rose 12% Y/Y to 1,495, which was a significant deceleration rom 20%+ growth over the last 12+ quarters. Both these data points further support our rational that the company is struggling to increase wallet share with customers. In addition, active suppliers declined 10% Y/Y to 6,582, marking a 6th consecutive quarter of decline.

Non-GAAP gross margin in Q4 expanded 160 basis points Y/Y to 39.9%, supported by strong Marketplace gross margin expansion. Marketplace gross margin improved 320 basis points Y/Y to a record 34.5%, driven by Xometry’s AI-powered pricing technology and a growing supplier network. Supplier services gross margin also expanded 240 basis points Y/Y to 89.7%. While we were impressed to see Sales and Marketing spend down ~$1M Q/Q, operating expenditures grew in all other categories sequentially, but at a slower rate than revenue growth. In turn adjusted EBITDA showed a meaningful improvement, turning positive at $1.0M for the quarter, up from a $2.9 million loss Y/Y.

Looking ahead, Xometry guided 1Q25 revenue to be between $147 - 149 million, representing ~20% Y/Y growth at the midpoint. However, the company also projected an adjusted EBITDA loss of approximately $1.5M, an improvement from the $7.5 million loss Y/Y. For full-year 2025, Xometry expects revenue growth to exceed 2024 levels, with marketplace revenue growing at least 20% Y/Y, while supplier services revenue is projected to decline by 5-10% Y/Y. Despite these revenue growth expectations, the company acknowledged near-term gross margin pressures due to continued international expansion, as well as increased operating expenses, which could limit operating leverage. Xometry reaffirmed its goal of achieving adjusted EBITDA profitability for the full year but did not provide a quantitative number.

Although not a near term concern, Xometry’s convertible debt note of ~$284M is coming due in 2026 and the Company continues to burn cash bringing their net cash position to a negative $44M.

Below we dive deeper into our updated 5-year outlook, investment thesis and price target.